|

The UK government sanctioned Norilsk Nickel PJSC president Vladimir Potanin yesterday, sparking fears that refined nickel supplies from Russia could plunge. According to Bloomberg, UK government sanctions on individuals automatically extend to any company that individual owns or controls, including companies where an individual owns more than 50% of the shares, but also those where they have the right to appoint a majority of the board of directors, and those where “it is reasonable to expect that the person would be able to ensure the affairs of the entity are conducted in accordance with the person’s wishes.” However, Norilsk Nickel wasn’t directly mentioned in yesterday’s press release UK’s Foreign, Commonwealth & Development Office. Following the government announcement, the LME stated that they “are looking into the detail of the sanctions and what it may mean for the LME, its participants, and Norilsk brands.” Norilsk Nickel is the world’s largest producer of refined nickel, according to Reuters. |

|

|

|

LME Nickel prices jumped on this news yesterday, as the 3M Select closed at $23,890/mt, up $745/mt on the day. This is the first bullish catalyst the nickel market has seen in some time. This could be an opportunity for end-users such as stainless-steel producers to hedge future needs. End-users might consider applying simple hedges involving swaps to lock-in a price or call options to establish a maximum price. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum nickel price for a stainless-steel producer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (6/30/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

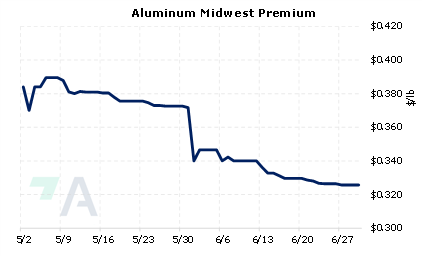

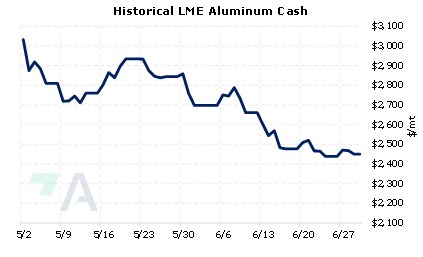

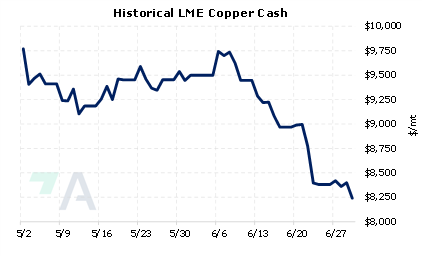

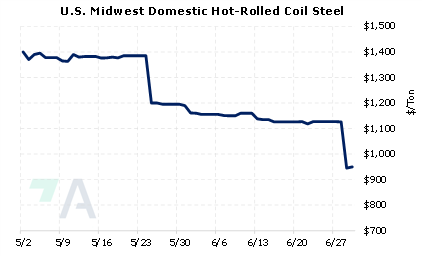

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/29/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 06/23/2022: What is Green Steel Anyways? |

||

|

|

||

| Important Headlines | ||

|

6/29/2022: Britain sanctions Russian oligarch Vladimir Potanin 6/29/2022: UK sanctions Russia’s second richest man 6/28/2022: US to raise to 35% tariffs on certain steel, aluminum imports from Russia 6/27/2022: FEATURE: Pandemic fades, recession looms for H2 US ferrous scrap market 6/27/2022: Copper steadies, but recession fears dominate mood 6/24/2022: Copper heads for worst weekly loss in a year, nickel and tin plunge 6/24/2022: China's May bauxite imports hit record high; alumina exports soar on Russian demand 6/23/2022: European stainless steel longs demand to rebound to 1.2 million mt in 2022: CAS |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||