|

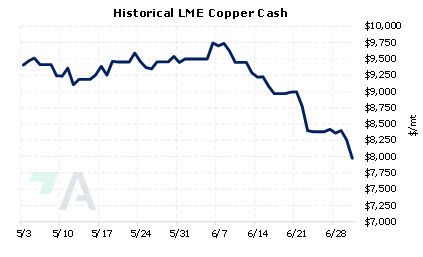

LME Copper 3M Select plunged by 20.5% in 2Q, the biggest drawdown since 2011, as slumping demand due to COVID lockdowns in China, and fears over a potential global recession weighed on prices. This percentage drop in 2Q beats the 19.8% tumble in 1Q 2020 during the onset of the pandemic. Some industry analysts are concerned that metals prices still have further to fall. For example, yesterday, Commerzbank analyst Daniel Briesemann stated "We still see metals falling as a recession in the U.S. is fully priced in." This is an about-face from bullish estimates earlier this year, as analysts quoted by mining-journal.com in January predicted $10,500/mt or higher due to a forecasted pre-Beijing Olympics demand boom and supply-chain bottlenecks that would impact supply. |

|

|

|

Even though the copper market seems to be pricing in a potential recession, copper producers might consider hedges that provide downside protection. These might include applying simple hedges involving swaps to lock-in a price or put options to establish a minimum price. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum price for a copper producer, as they would simultaneously buy a put option (creating a floor, or minimum) and sell a call option (creating a cap, or maximum). The call and put premiums offset, making the construction costless. It is popular because of the downside price protection, but you sacrifice access to much higher prices if prices should rise. Such positions are standard for producer hedging, but they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. *Please note that our offices will be closed on Monday, July 4 due to the Independence Day holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * (7/1/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

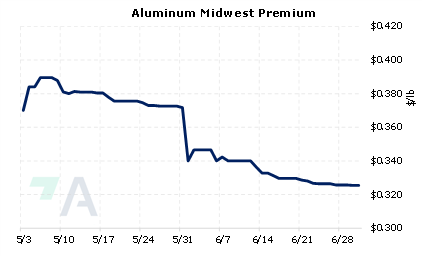

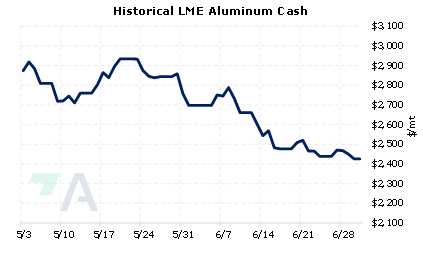

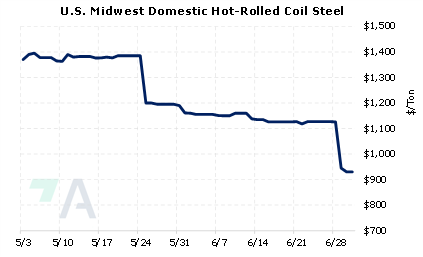

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/29/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 06/23/2022: What is Green Steel Anyways? |

||

|

|

||

| Important Headlines | ||

|

6/30/2022: Copper heads for its biggest quarterly plunge since 2011 6/30/2022: Recession fears creep into ECB thinking at summer conference 6/29/2022: Britain sanctions Russian oligarch Vladimir Potanin 6/29/2022: UK sanctions Russia’s second richest man 6/28/2022: US to raise to 35% tariffs on certain steel, aluminum imports from Russia 6/27/2022: FEATURE: Pandemic fades, recession looms for H2 US ferrous scrap market 6/27/2022: Copper steadies, but recession fears dominate mood 6/24/2022: Copper heads for worst weekly loss in a year, nickel and tin plunge 6/24/2022: China's May bauxite imports hit record high; alumina exports soar on Russian demand 6/23/2022: European stainless steel longs demand to rebound to 1.2 million mt in 2022: CAS |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||