U.S. oil developers have avoided talk of “production growth” as the consensus in the industry has been that investors would rather see cash returns instead of plowing-back earnings into new wells.

Recently, some industry analysis and articles are pointing out some increased investment into new wells. A good example from Reuters (U.S. shale producers signal more oil coming, as OPEC counts on restraint; Nov 3, 2021) highlights private-company increases in drilling rigs and guidance from BP, Chevron, and ExxonMobil. Services firm Schlumberger said in its latest earnings-release call that industry capital expenditures would be up 20% in 2022.

But 2022 may need more capital expenditures, just to maintain production.

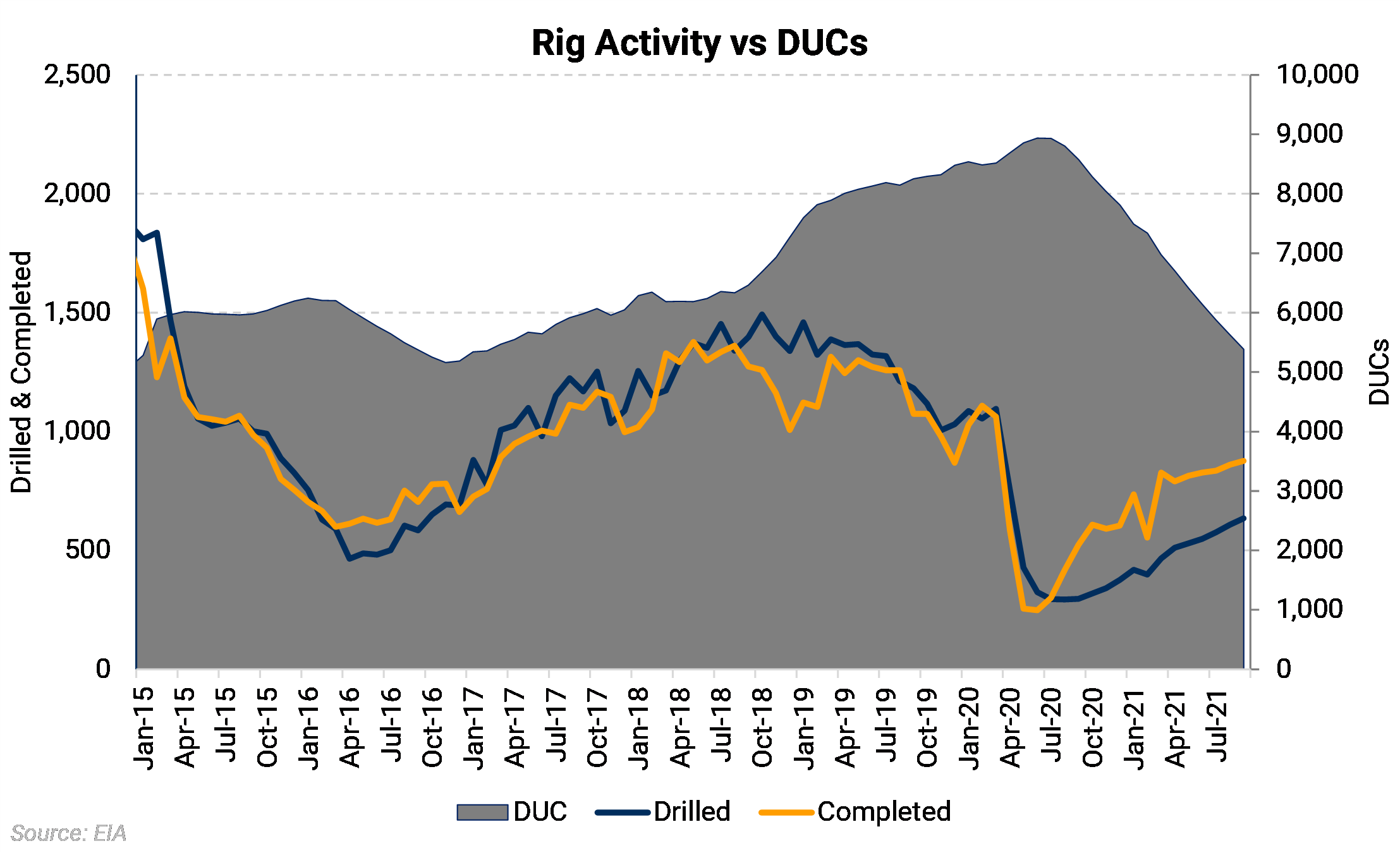

Below, we show how a smaller backlog of drilled-but-“uncompleted” wells (DUCs) and higher steel costs make each new producing well more expensive.

The DUC inventory, reported by the EIA, is an estimation of the number of wells that have been drilled, but no completed. When the number is falling, it means wells that were drilled in the past (maybe last month; maybe years ago) are finally turned to sales.

In other words, the drilling portion of the cost had already been borne in a past accounting period. The cash expenditure that remained was the completion. This means the marginal cost to bring a DUC well online is much lower than one that must be started from scratch – one where both the wellbore must be drilled and completed.

The chart below shows the nationwide DUC inventory peaked in spring of 2020, just as prices dived at the onset of the coronavirus pandemic. Since then, the number of well completions has exceeded the number of new wells drilled

AEGIS heard from its own clients, and we observed in market data, that E&Ps were using DUC inventory to support production and avoid declines during late 2020 and 2021. They were the cheapest way to bring on a new well and generate the cash the companies needed.

However, things are changing.

At some point the number of viable DUC wells will be no more. Then, each new well will carry the burden of both the drilling and completion cost.

Therefore, the cost of a new well in 2022 could rise.

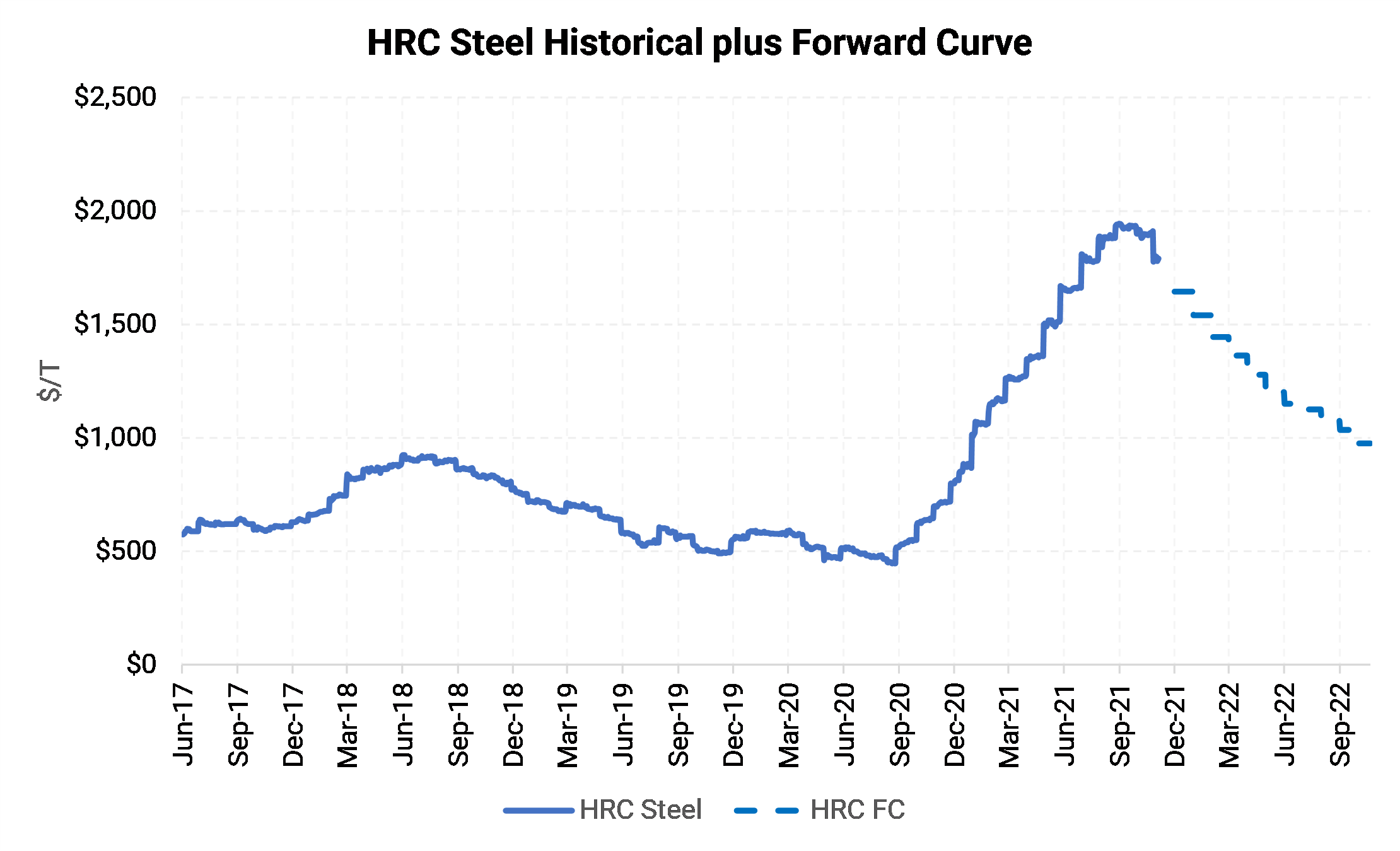

Part of that increased drilling and completion cost will be increases in steel well casing (and any other steel input cost). Steel prices are twice as high now as they had been any time during 2015-2020.

The chart below shows the prompt-month price of Hot-Rolled Coil Steel (HRC). The price has relaxed only a little since reaching its highs of almost $2,000/Ton. Steel is in high demand across industries, supply chains are facing difficulties, and energy costs in China have threatened to reduce supply.

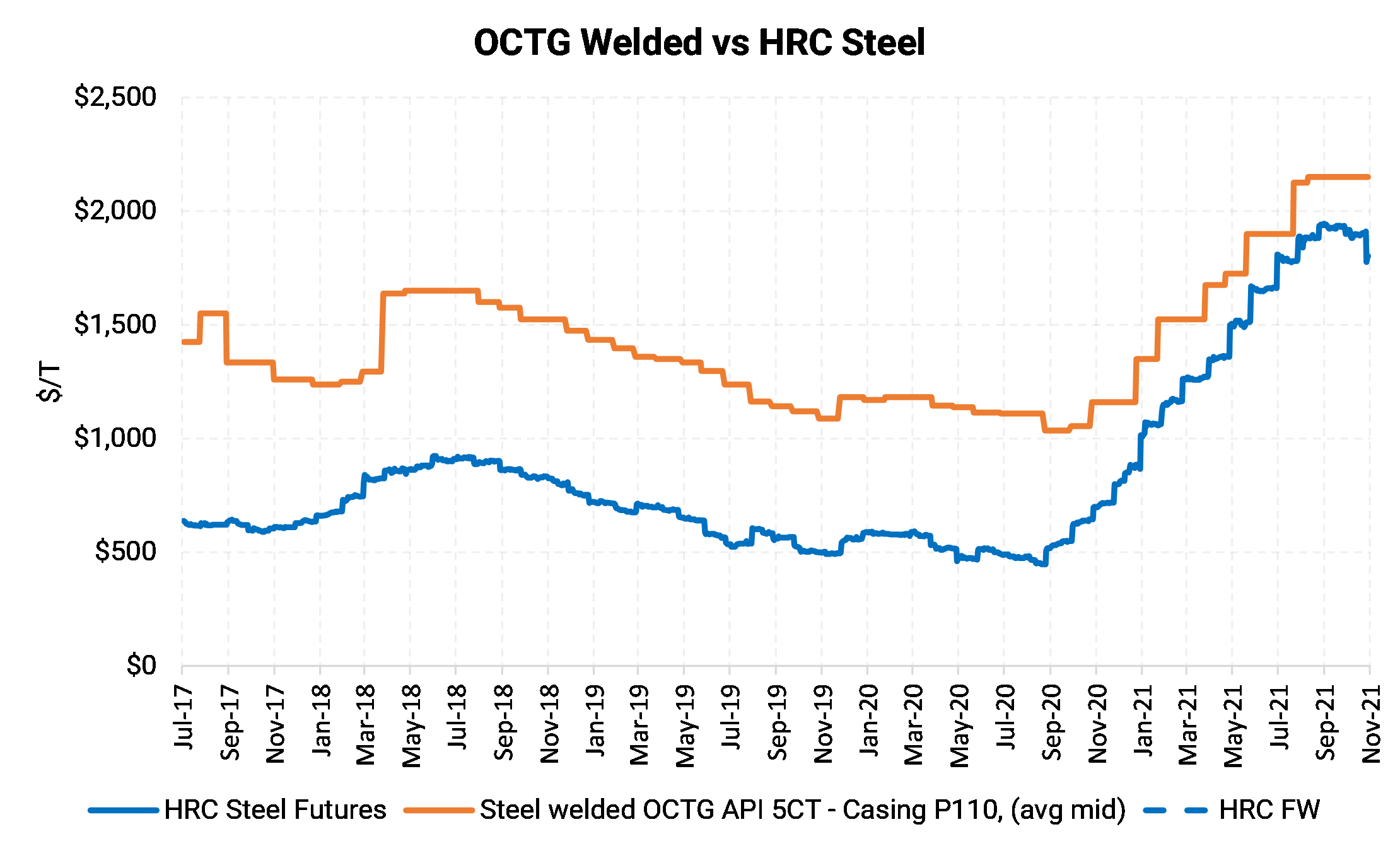

The largest exposure of E&Ps to steel costs is in the tubular products that make up well casing. These tubulars come in different varieties, so some use HRC as the raw material, while others come from a scrap-market source. Either way, prices are up for both steel and end-product tubulars.

The chart below demonstrates how HRC and a popular type of welded tubulars (they come in seamless varieties, too) are somewhat correlated, as steel is the major input cost.

This means that in 2022, the cost of that new well comes with increased steel costs, too. AEGIS expects the per-foot cost will be more than twice as high to start 2022 than it had been in 2019, just before Covid.

As an aside, we will mention that HRC steel can be hedged, but the tubular costs are not done as easily. It’s still possible. Let us know if you need to discuss it.

If you are interested in tracking steel and other metals costs, consider signing up for AEGIS daily and weekly updates here.

Will there be enough money spent in development in 2022 to generate production growth in oil and gas? As budgets are set for 2022, we expect to hear new guidance from the public companies. But it seems likely that capex will need to rise if only to keep production flat. Two contributors are increased tubular costs and fewer DUCs available.

---------------------

Trying to make your cash flows certain in 2022? Not only can oil and gas prices be hedged, but also consider diesel, interest rates, steel, carbon, and power! Talk to a strategist at AEGIS at info@aegis-hedging.com.