Inflation and political bargaining over new legislation may finally be what leads to the completion of the long-awaited Mountain Valley pipeline.

The Inflation Reduction Act (IRA) currently has language to fast-track MVP’s permitting, giving sudden life to the long-delayed, 2-Bcf/d pipeline that connects Appalachia producing areas to the Mid-Atlantic demand region. IRA has passed the Senate, and the House version may get a vote Friday.

Background on the pipeline

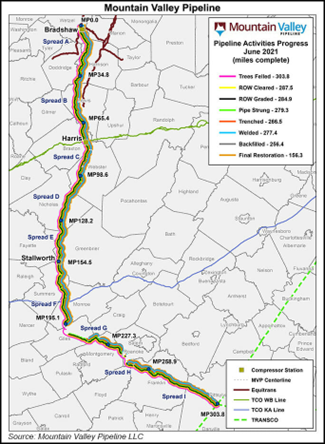

The Mountain Valley Pipeline is a joint venture between Equitrans Midstream, NextEra, Con Edison, WGL Midstream, and RGC Midstream. The 300-mile pipeline will extend from West Virginia to Virginia and will have a capacity of 2.0 Bcf/d. The pipeline will transport gas from the Marcellus and Utica shale formations to markets in the Mid and South Atlantic. While the pipeline was first proposed in 2014, legal battles over permits, and environmental concerns have kept the project from being finished. Construction began in 2018, and by 2021 the project was 92% complete. However, since the beginning of construction, environmental groups have sought to stop the pipeline. Opponents sued to keep permits from being approved, especially permits needed to cross wetlands and bodies of water. Despite this, a new deal between Senator Joe Manchin and other Senate Democrats could finally lead to the pipeline being completed.

Mountain Valley faced strong opposition in the courts for years while government agencies and environmental groups debated the potential effects of the pipeline

Shortly after construction began on the pipeline in 2018 a panel of federal judges rescinded permits, saying that the project had not been fully vetted. The three-judge panel of the U.S. Court of Appeals for the Fourth Circuit ruled unanimously that the U.S. Forest Service and the Bureau of Land Management had not carefully reviewed the impact the pipeline would have on the forest. In January 2022, the same court ruled again to deny the necessary permits for the project due to federal agencies inadequately measuring the environmental impact. In February 2022, the Fourth Circuit court overturned another permit citing protection of endangered fish species.

The success of new legislation intended to fight inflation may depend on the pipeline's approval being streamlined

In exchange for his support of the bill, Senator Joe Manchin, demanded the inclusion of certain stipulations, one of which being the approval of the Mountain Valley Pipeline. While the new bill is intended to invest $300 billion on climate and healthcare action, it now also includes language relating to fossil-fuel energy.

Manchin’s addition to the bill requires federal agencies to:

While the IRA was not originally intended to change the way new pipelines are approved, the inclusion of Joe Manchin’s requirements involving “excessive litigation delays” may ease the process of constructing energy infrastructure, especially the permitting process.

Other market effects of the IRA

The bill also mentions changes to regulations involving oil-and-gas lease sales. It would require the Interior Department to offer at least two million acres (about twice the area of Rhode Island) of public lands and 60 million acres (about the area of Colorado) of offshore waters for oil and gas leasing each year for a decade as a prerequisite to installing any new solar or wind energy. The act also modifies rules relating to tax credits for carbon capture and storage, known as “45Q” tax credits. The modifications involve increasing the value of tax credits to $85/ton (up from the current $50/ton), adding a tax credit for direct air capture, and decreasing the size requirement for qualifying projects.

Basis differential moves higher following the passage of the bill

Dominion South basis quickly moved higher following news that the construction of the pipeline would be included in the Inflation Reduction Act. As many market participants expect the pipeline to be completed in 2023, it was the 2023 prices that saw the most movement. Once the pipeline is operational it should significantly reduce constraint on the gas-pipeline network in Appalachia. With more pipeline capacity in the region, basis prices should rise as more gas can be moved to the Gulf Coast from the Northeast.