More Appalachian gas egress may not be as bearish to Henry Hub as initially thought. The long-delayed 2 Bcf/d Mountain Valley Pipeline (MVP) was singled out in the recent debt ceiling deal in Congress that will allow the pipe to be completed by the end of this year, according to owner Equitrans.

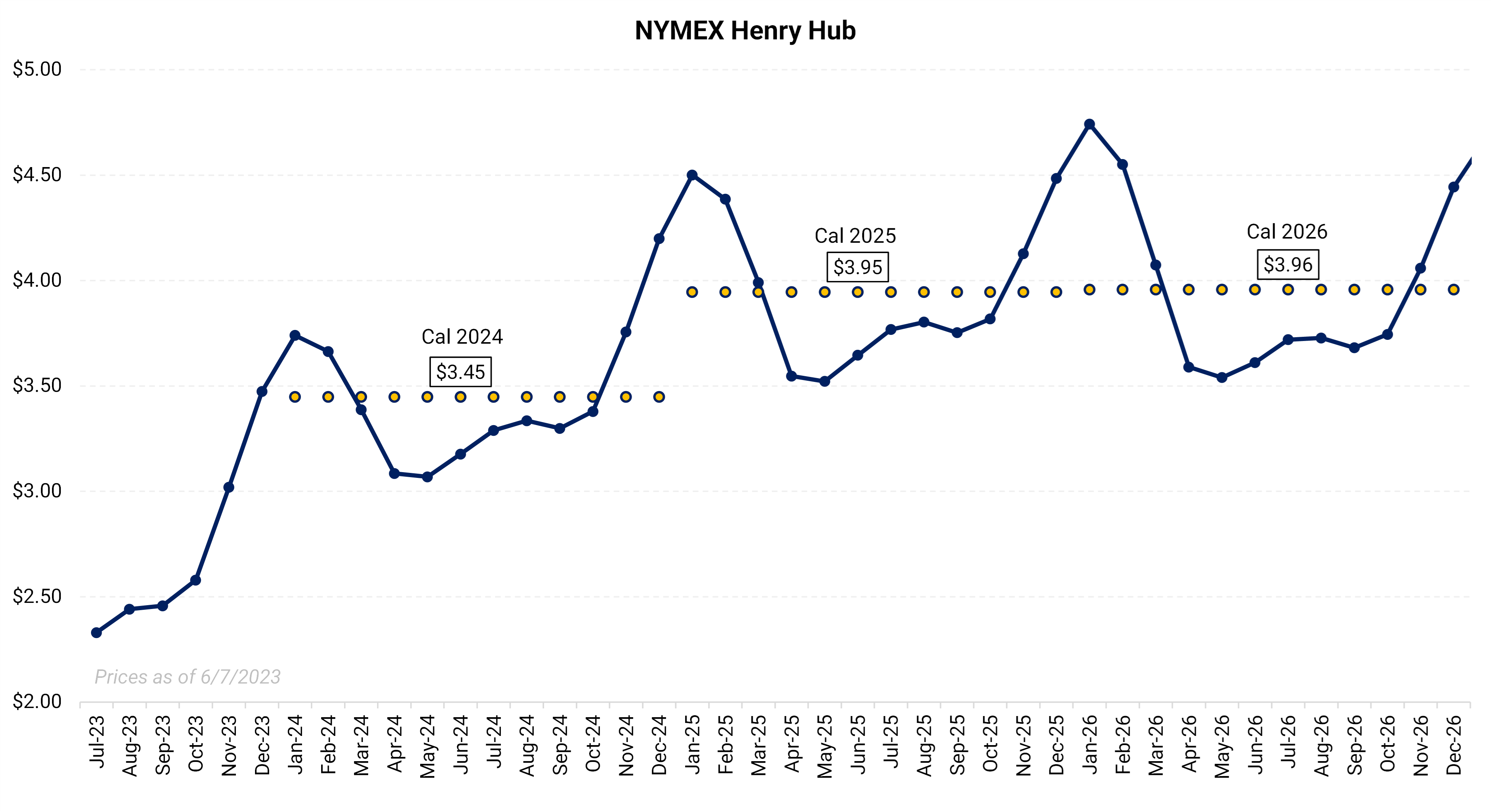

Our immediate reaction to the news that MVP would be completed when nearly every analyst was giving it no credit was that an extra 2 Bcf/d of supply would push Henry Hub prices lower. Added supply into a system tied to the Hub area would undoubtedly be bearish for the current forward strip seen in the chart below. However, upon further investigation, there are potential constraints on the Transco mainline where MVP connects that would keep MVP from flowing at full capability.

Yes, you read that right. The $6 billion pipe that will come online five years delayed can no longer flow at capacity until Transco makes expansions.

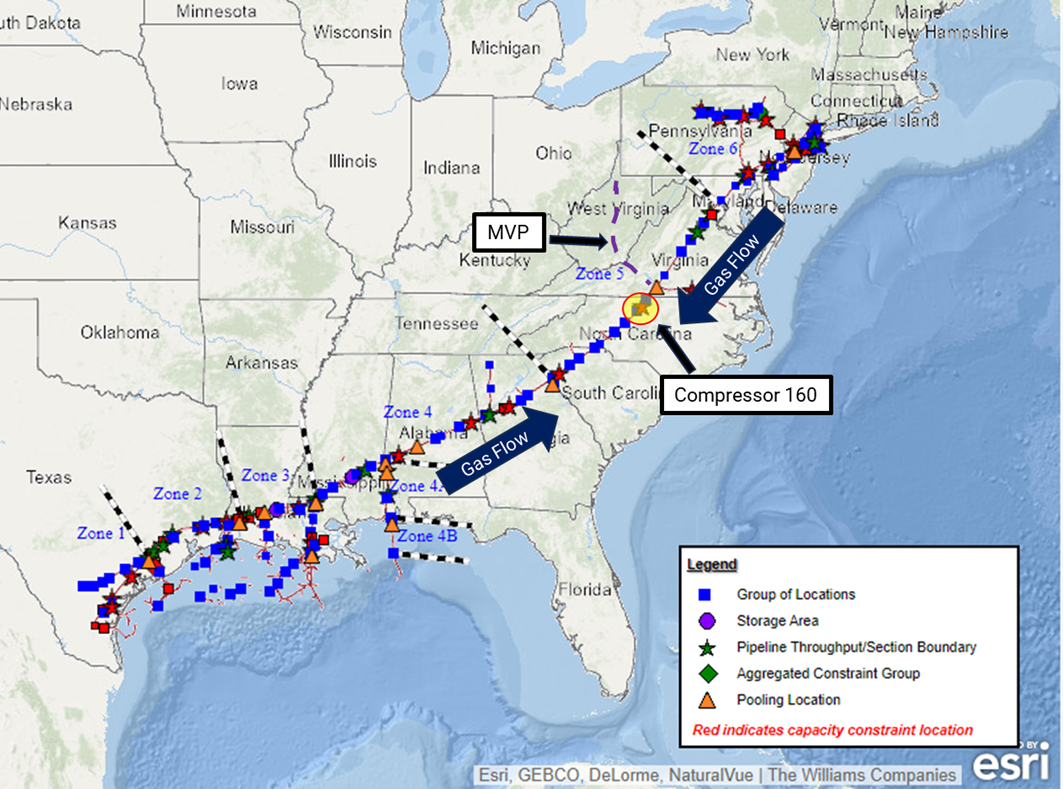

We need to dissect historical gas flows and capacity limitations on the Transco mainline to understand what space will be available when MVP enters service. The map below shows the Transco pipeline stretching from south Texas to New Jersey and Pennsylvania. The pipe sent gas north toward the Atlantic and NE demand centers, but gas started to flow south following the Marcellus shale's proliferation.

Gas flows headed south on Transco meet gas flowing north from Texas and Louisiana between Georgia and the Carolinas. This forms the null point, a place where flows are zero that fluctuates seasonally between South Carolina and North Carolina.

Transcontinental Pipeline (Transco)

When we initially heard that MVP would be coming online, the assumption was 2 Bcf/d would be pushed back to the Hub, causing downward pressure on the Nymex benchmark. Looking at compressor station 160 south of the MVP interconnect, we found that this is not the case, at least for now.

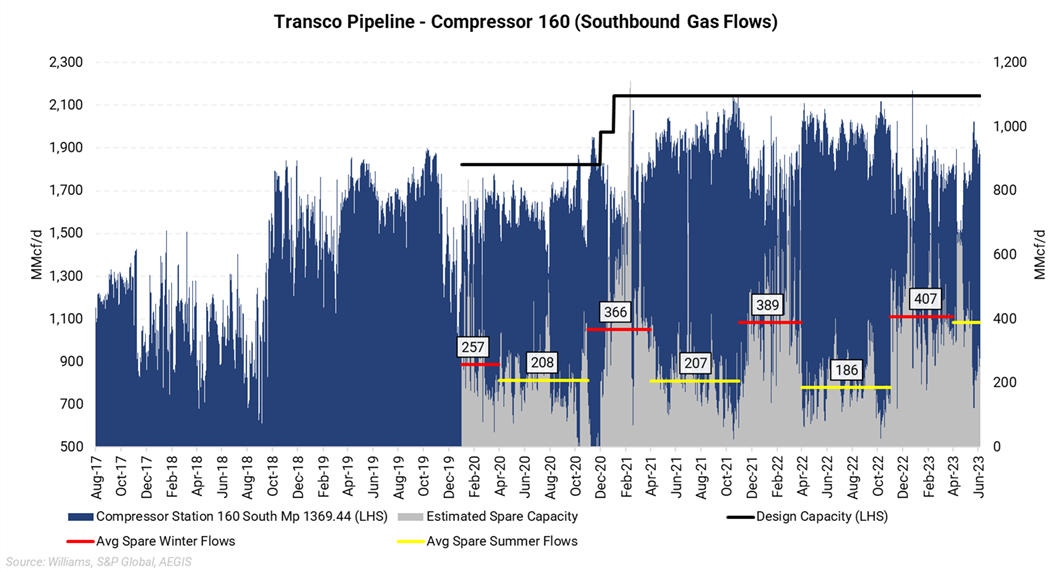

The following chart shows historical gas flows through compressor 160 (blue area). In the past two summers, average flows through this point were near design capacity. The yellow lines show implied spare capacity through the compressor in summer. If this accurately represents the amount of extra gas that can flow through this compressor, then MVP cannot dump more than that spare capacity (gray line) onto the Transco mainline.

Over the past five years, Transco has found ways to nearly fill its pipeline as MVP has been in limbo.

So, what should we expect once MVP comes online? Assuming Equitrans completes MVP at year-end and producers are willing to fill available space quickly, about 400 MMcf/d would be able to push south this winter and about 200 MMcf/d next summer. The added southbound flows would slightly pressure Gulf pricing; it’s not as bearish as 2 Bcf/d.

Looking past next summer, MVP will likely grow into its 2 Bcf/d capacity as Transco has over 1.5 Bcf/d of system expansions slated to come online through 2025. On balance, MVP will probably help take the edge off the upside price risk for Henry Hub in 2025 and 2026, when a “wall” of LNG is expected to come into service.