U.S. Energy Information Administration (EIA) forecasts much higher natural gas prices will be required to keep the market in balance.Let's take "stock" of where we are with the gas storage outlook going into 2021. The EIA put out its monthly Short-Term Energy Outlook (STEO) on Tuesday, January 12. Their STEO report is a great way to gauge baseline expectations for the coming year, as the EIA predicts supply, demand, stocks, and prices for gas out two years.

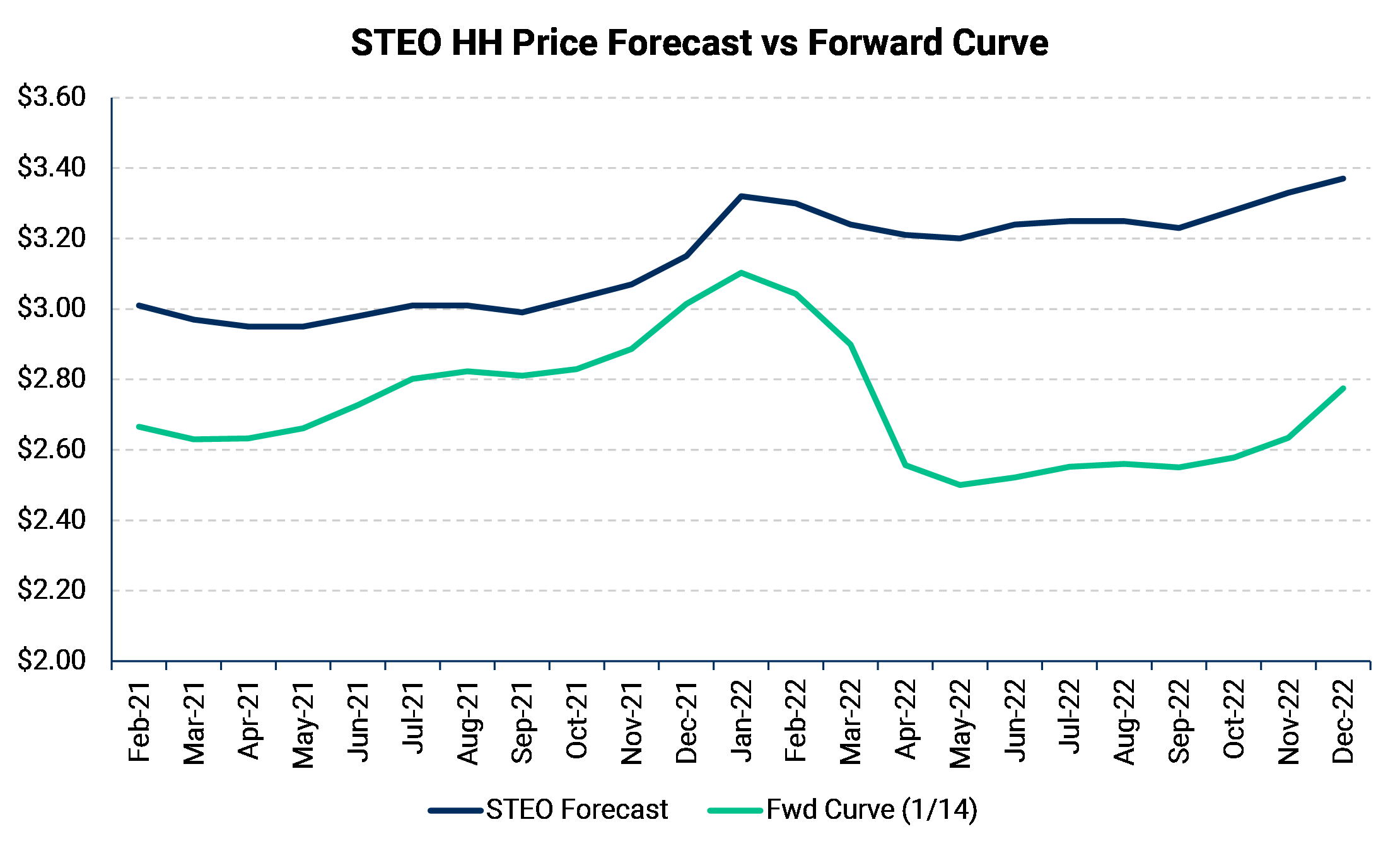

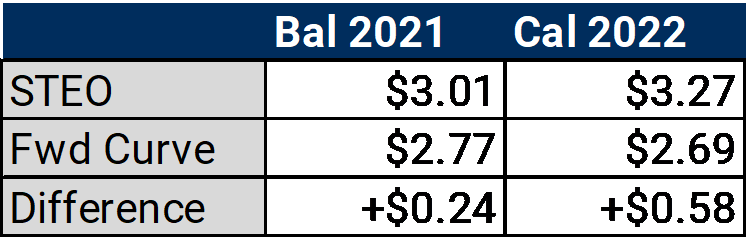

Let's cut to the chase and look at the EIA's natural gas price forecast relative to the forward curve. The EIA projects prices that are substantially higher than where the market is trading; by about $0.24/MMBtu in 2021 and $0.58/MMBtu in 2022!

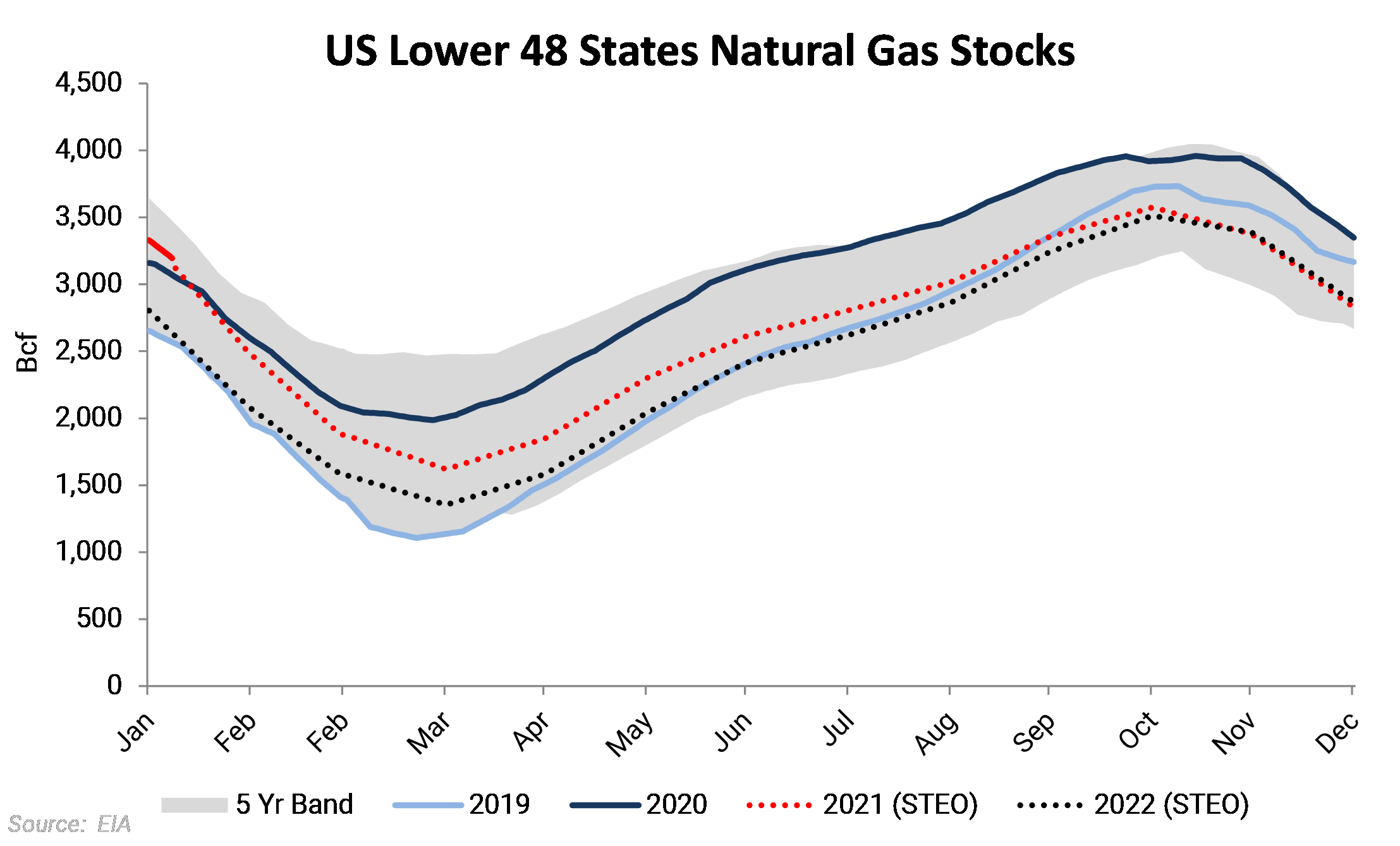

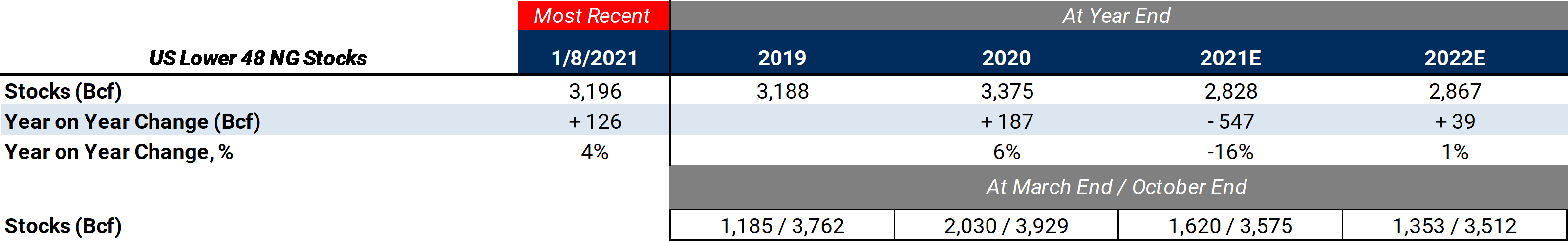

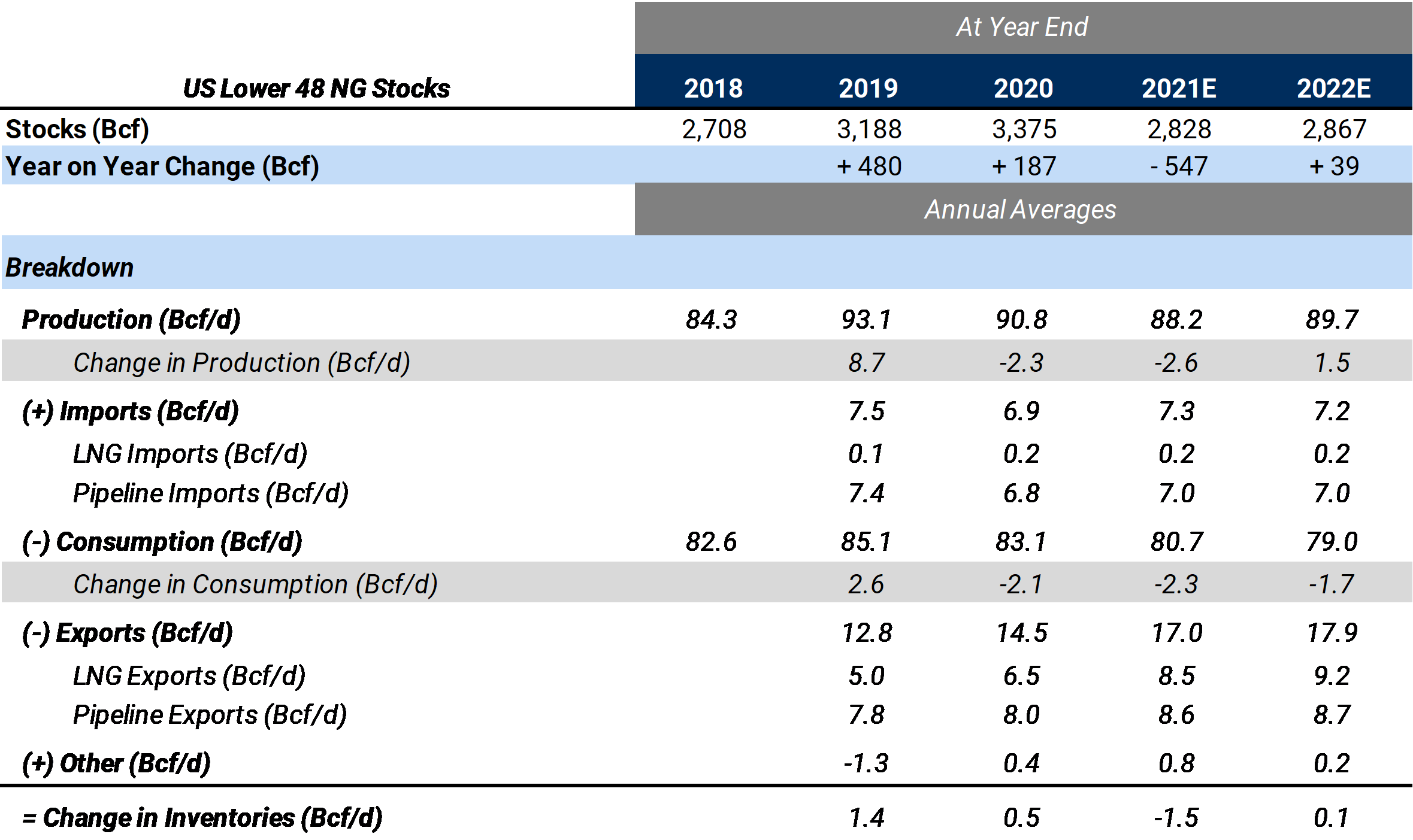

With such a bullish price forecast relative to strip, the next logical question one might ask is what the EIA's view of the supply-demand balance is going forward. Even with their bullish price forecast, the EIA still expects a substantial draw in 2021 (547 Bcf), and a roughly balanced market in 2022.

With such a bullish price forecast relative to strip, the next logical question one might ask is what the EIA's view of the supply-demand balance is going forward. Even with their bullish price forecast, the EIA still expects a substantial draw in 2021 (547 Bcf), and a roughly balanced market in 2022.

In short, the EIA believes that much higher gas prices may be needed to balance supply and demand.

In short, the EIA believes that much higher gas prices may be needed to balance supply and demand.

The EIA's supply-demand balance numbers underlying the storage forecast above is summarized in the table below. Let's look at the EIA's domestic production and demand forecasts more closely.

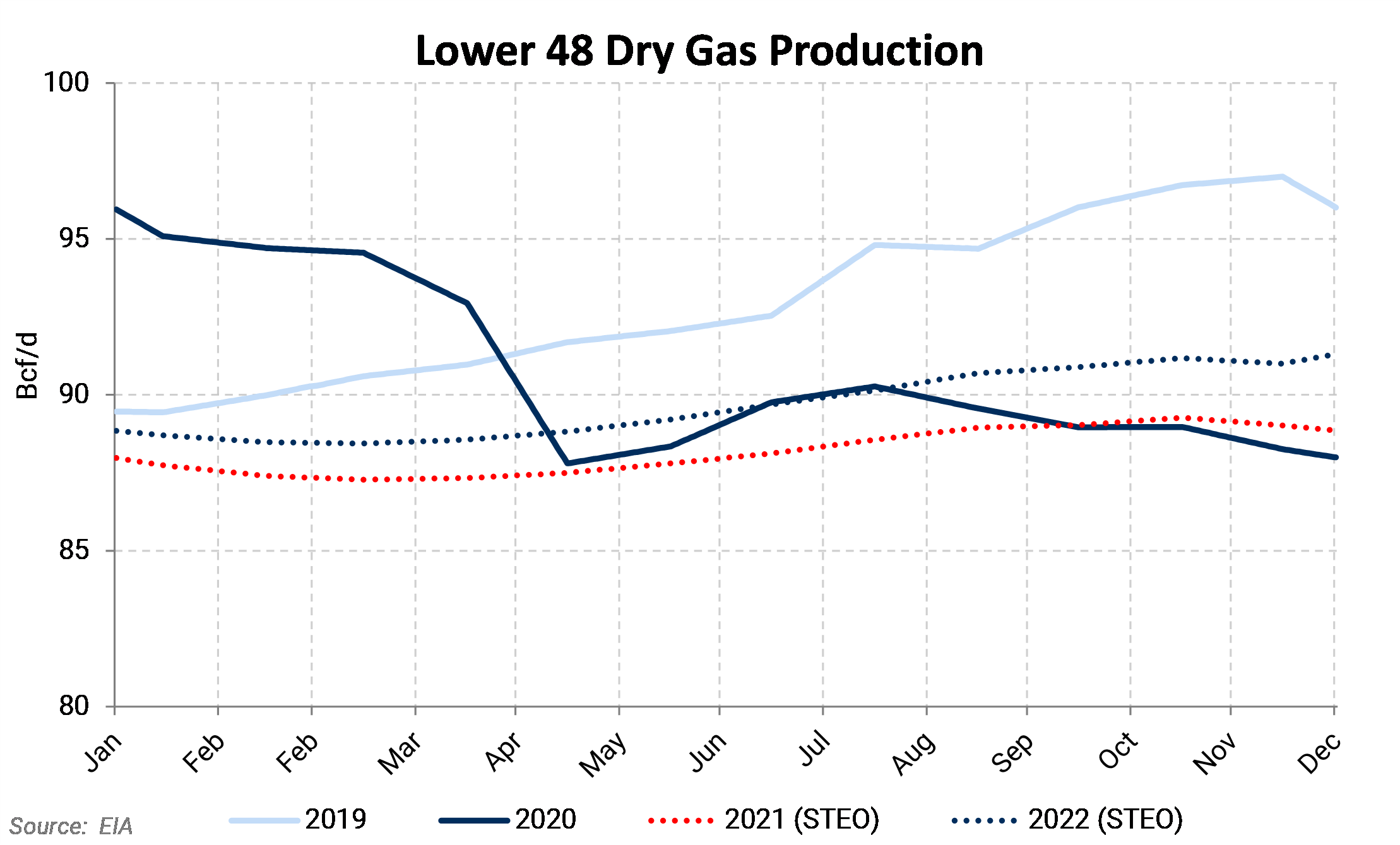

Let's look at the EIA's domestic production and demand forecasts more closely.

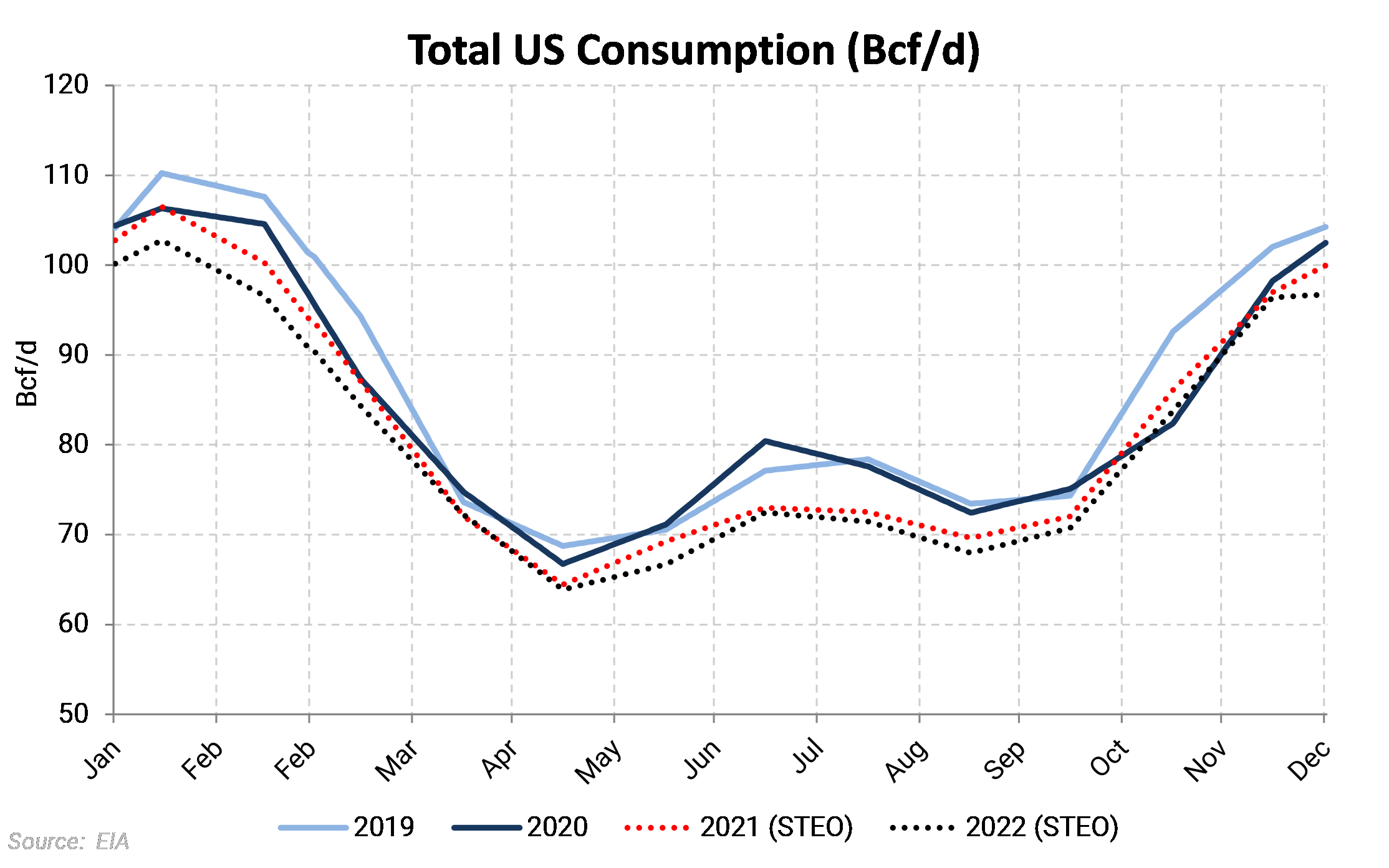

Production will likely struggle to stay flat, as evidenced by the declining trend in recent months. AEGIS agrees with the EIA's assessment that marginally higher gas prices will not be enough for production growth to resume in the next 12 months. The EIA has 2021 demand at about 2.3 Bcf/d lower than 2020. Most of the demand decline it projects will come from the power sector. The EIA projects that natural gas's share of fuel for power generation will decline from 39% in 2020 to 36% in 2021 to 34% in 2022. This share will mostly be ceded to coal. The EIA expects coal's share of powergen demand to rise from 20% in 2020 to 22% in 2021 and 24% in 2022.

The EIA has 2021 demand at about 2.3 Bcf/d lower than 2020. Most of the demand decline it projects will come from the power sector. The EIA projects that natural gas's share of fuel for power generation will decline from 39% in 2020 to 36% in 2021 to 34% in 2022. This share will mostly be ceded to coal. The EIA expects coal's share of powergen demand to rise from 20% in 2020 to 22% in 2021 and 24% in 2022. In summary, the EIA believes that higher natural gas prices are needed to cause the power sector to switch to coal from gas (i.e. destroy demand). This is the likely path for the natural gas markets to balance in 2021. Or rather to attempt being balanced. As noted earlier, the EIA still sees a draw of 547 Bcf this year. Balance won't come until perhaps 2022.

In summary, the EIA believes that higher natural gas prices are needed to cause the power sector to switch to coal from gas (i.e. destroy demand). This is the likely path for the natural gas markets to balance in 2021. Or rather to attempt being balanced. As noted earlier, the EIA still sees a draw of 547 Bcf this year. Balance won't come until perhaps 2022.

A warm winter in the U.S. may have hampered weather demand, but the STEO indicates a supply pinch is coming soon. AEGIS agrees with that assessment. With anemic supply growth, the stage is set for a tighter market going forward.

For producer hedge programs, AEGIS prefers collars to swaps for capturing potential upside in prices on the back of a tightening supply-demand balance.