Permian gas prices received relief when a new pipeline came online in late September, but future maintenance will again reduce egress.

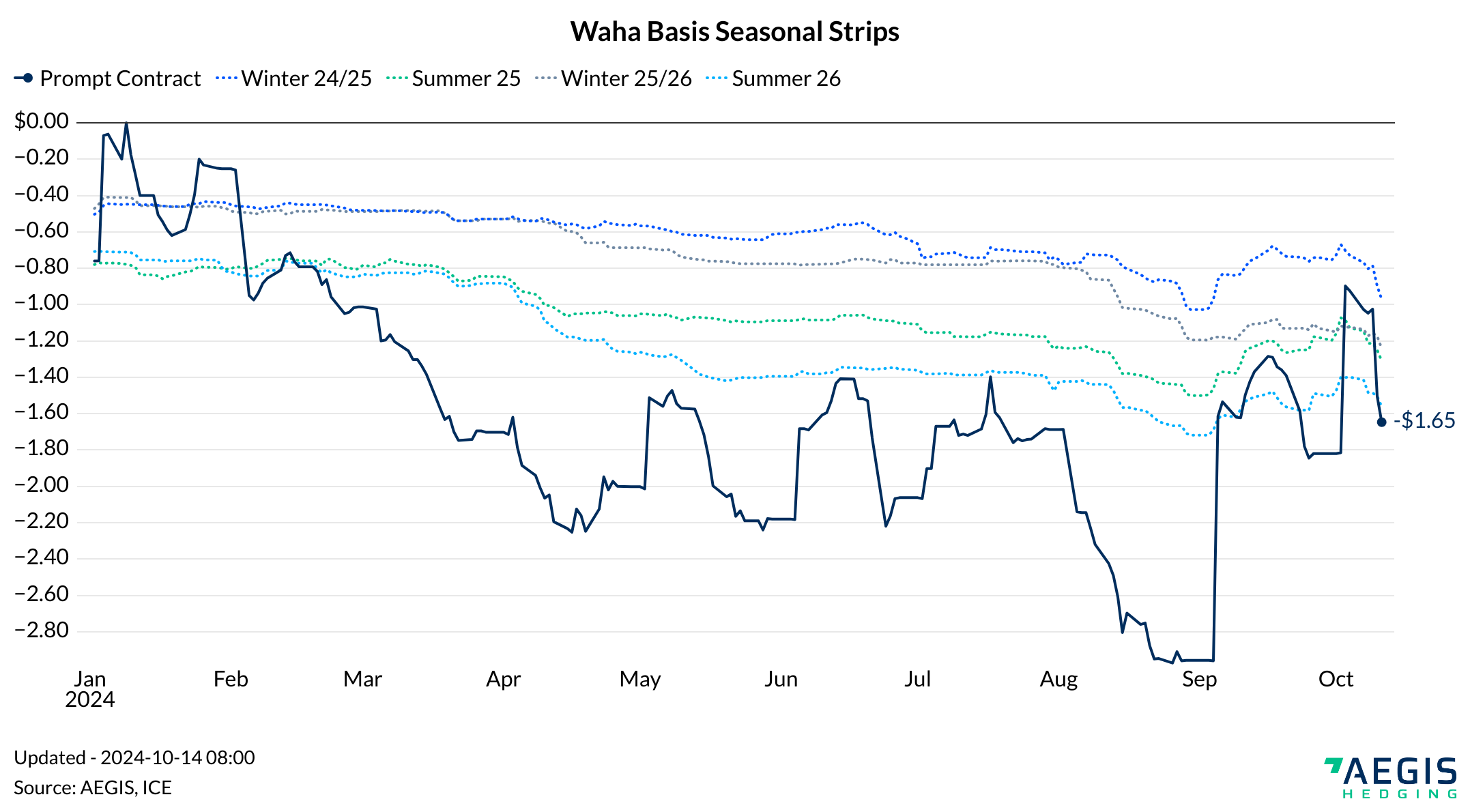

Waha basis improved greatly in late third quarter once the new 2.5 Bcf/d Matterhorn pipeline came online. The Permian had been strained for takeaway capacity for much of 2024, causing nearly 40% of the year to print negative Waha cash prices. Now with an additional outlet, gas could leave west Texas a little bit easier. Prompt-month Waha basis improved from nearly -$3.00/MMbtu to -$1.00 back from Henry hub when the then prompt contract October rolled to the more premium November contract and Matterhorn’s in-service took pressure off the marginal molecule.

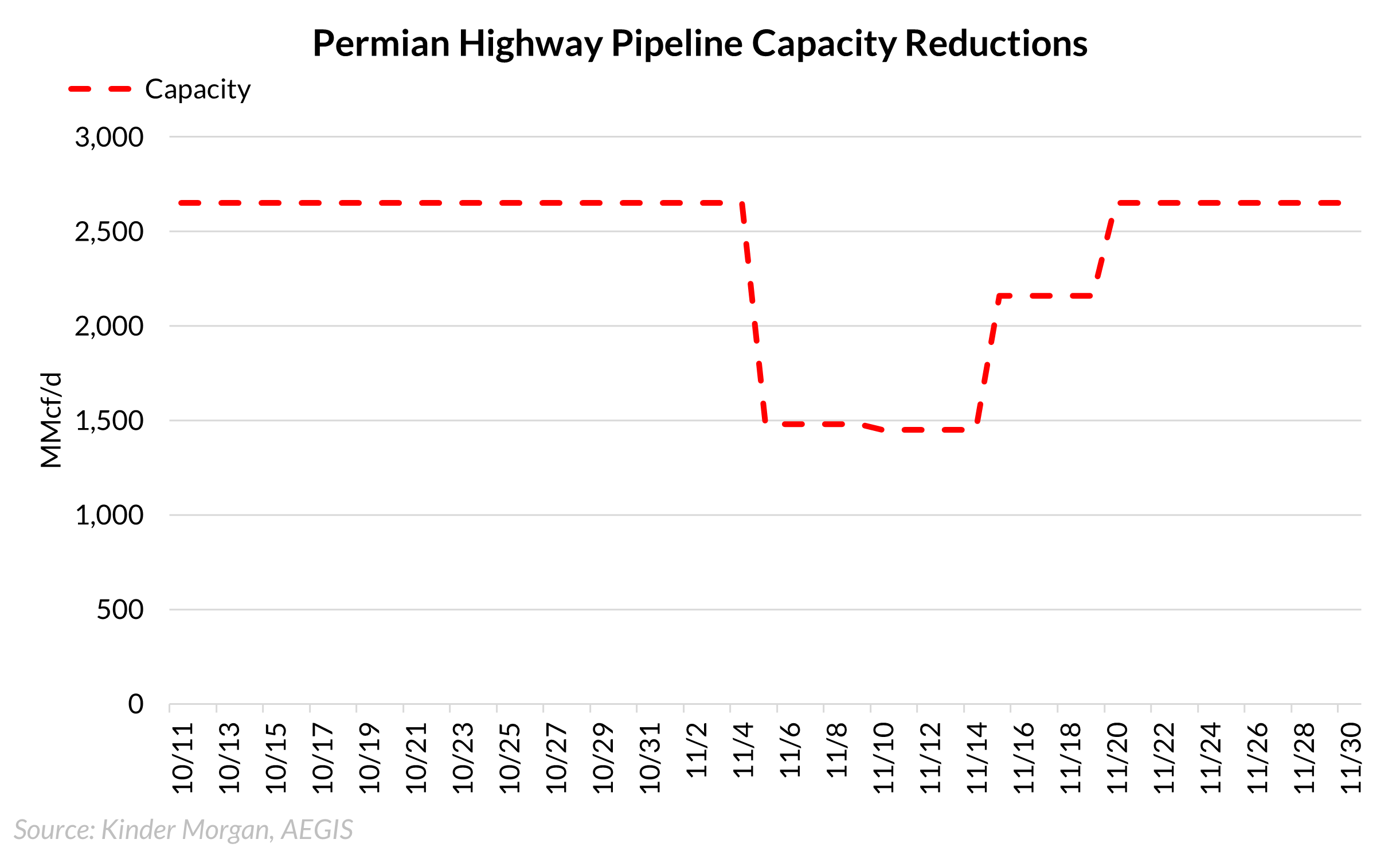

However, some of the price strength has been short-lived as Kinder Morgan announced a 15-day maintenance on its Permian Highway Pipeline (PHP). The notice on October 10 provided by Kinder shows reductions in capacity on PHP by as much as 1.2 Bcf/d. The chart below highlights Kinder’s announced net outages for November. There is also a five-day outage planned By Kinder on Gulf Coast Express (GCX) in late October.

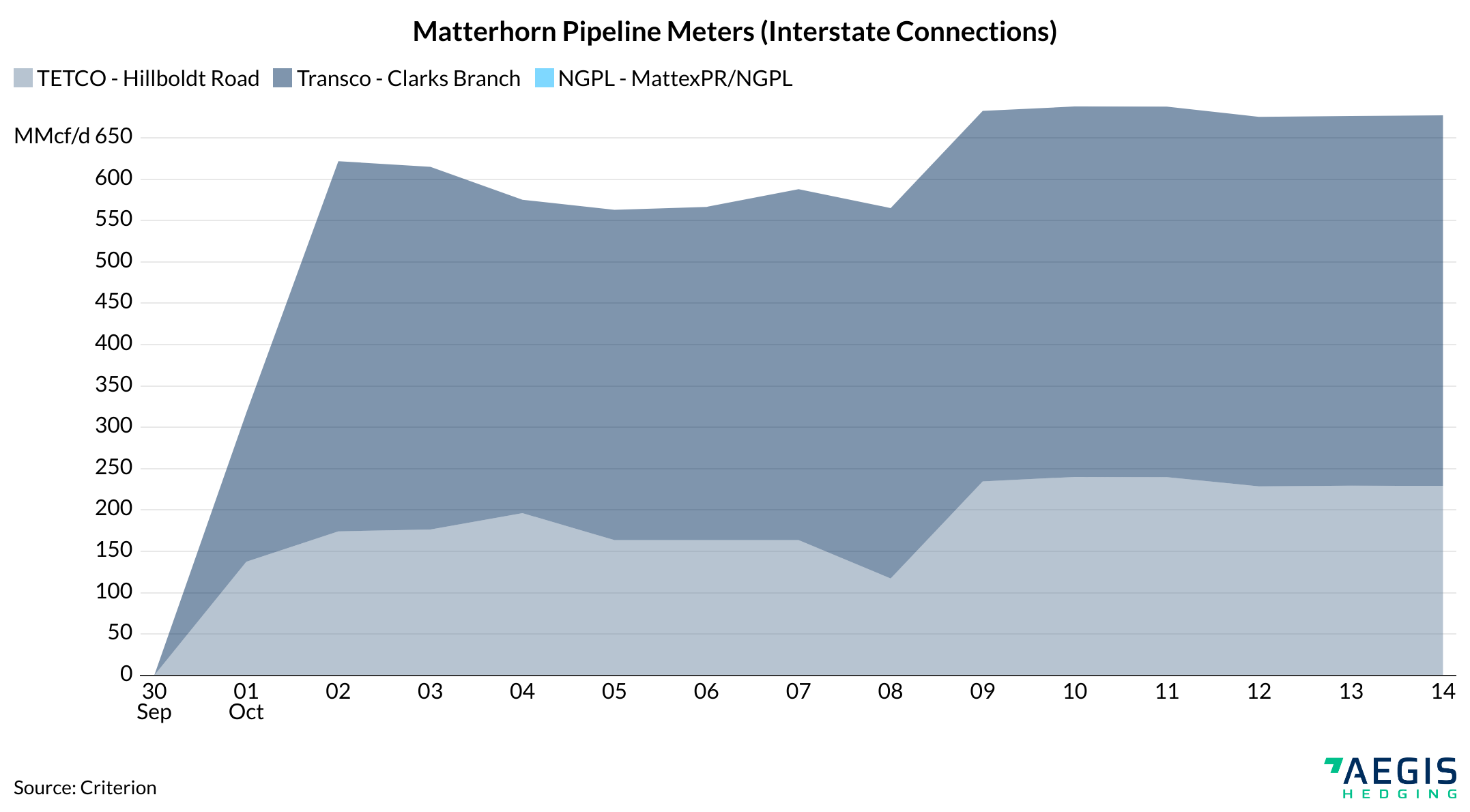

Since coming online, Whitewater Midstream’ s Matterhorn has been measured as flowing at least 650 MMcf/d now as shown below. Matterhorn is an intrastate pipeline so there are no requirements to post flows, unlike interstate pipes that come under the FERC jurisdiction. We are able to measure Matterhorn flows at three interstate connections, those being on Transco, TETCO, and NGPL. Whitewater’s new pipe could be flowing more than shown in the chart below as additional flows are opaque.

Expectations are that Matterhorn likely ‘stole’ initial volume from pipes heading north out of the Permian as that gas would see a better net-back heading into the Texas Gulf Coast. Analysts across the market anticipate Matterhorn to fill around April 2025, causing Permian operators to utilize the northern corridor into the midcontinent to a higher degree after that time. While Waha basis prices have improved materially, pipeline maintenance whether planned or unplanned will have a short but meaningful impact on basis price moving forward.