|

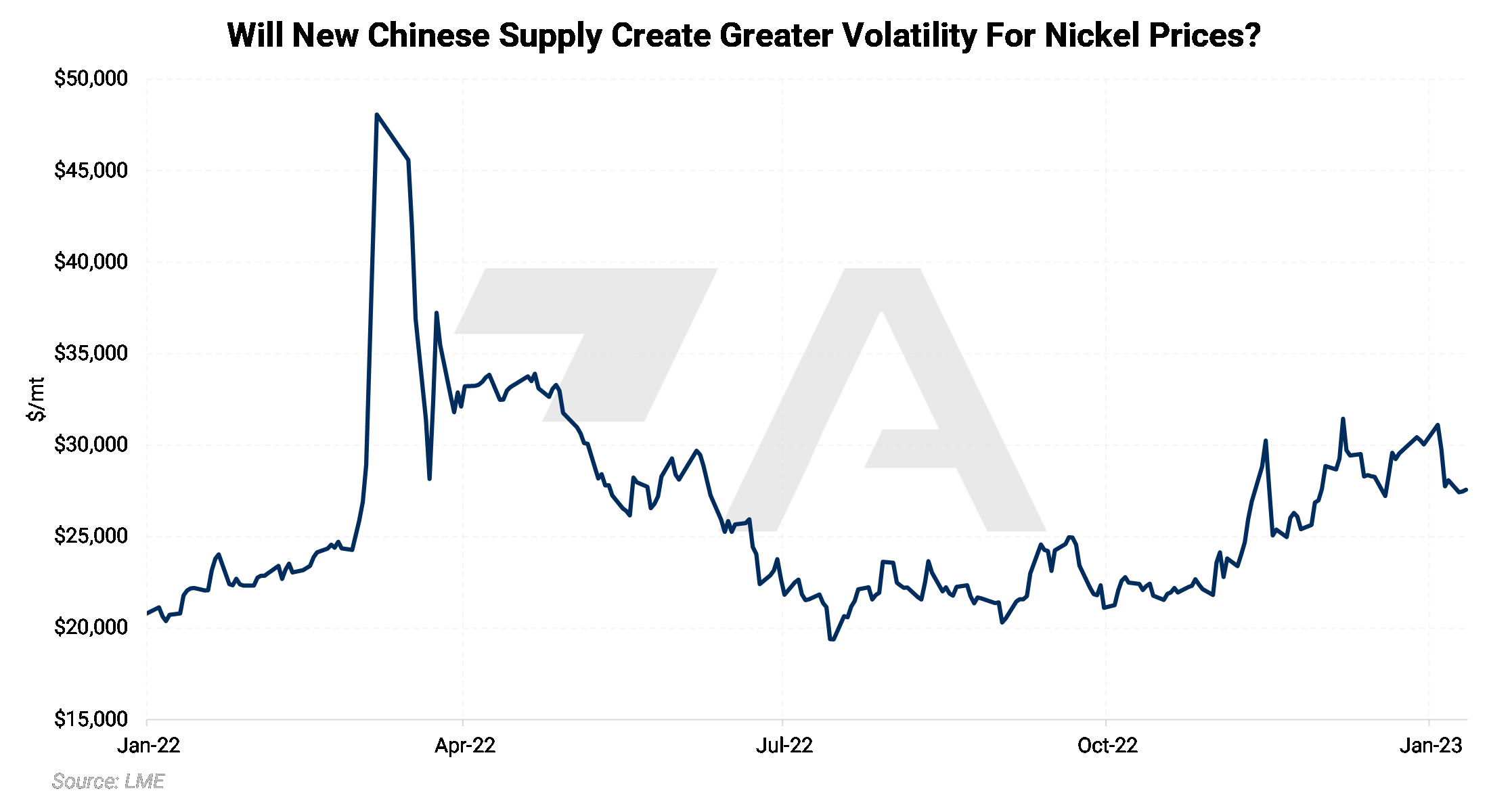

AEGIS notes that the recent downtick in prices could be tied to a potentially significant increase in Asian refined nickel supplies. Tsingshan Holding Group Co., which is the world’s largest nickel producer, is reportedly in talks with several struggling Chinese copper smelters about switching to nickel processing, according to Bloomberg. This move, if successful, would essentially double China’s refined nickel to approximately 360,000 mt/yr. As Bloomberg recently suggested, Tsingshan’s moves “could reshape global supply dynamics and inject fresh volatility into the battered nickel market.” |

|

|

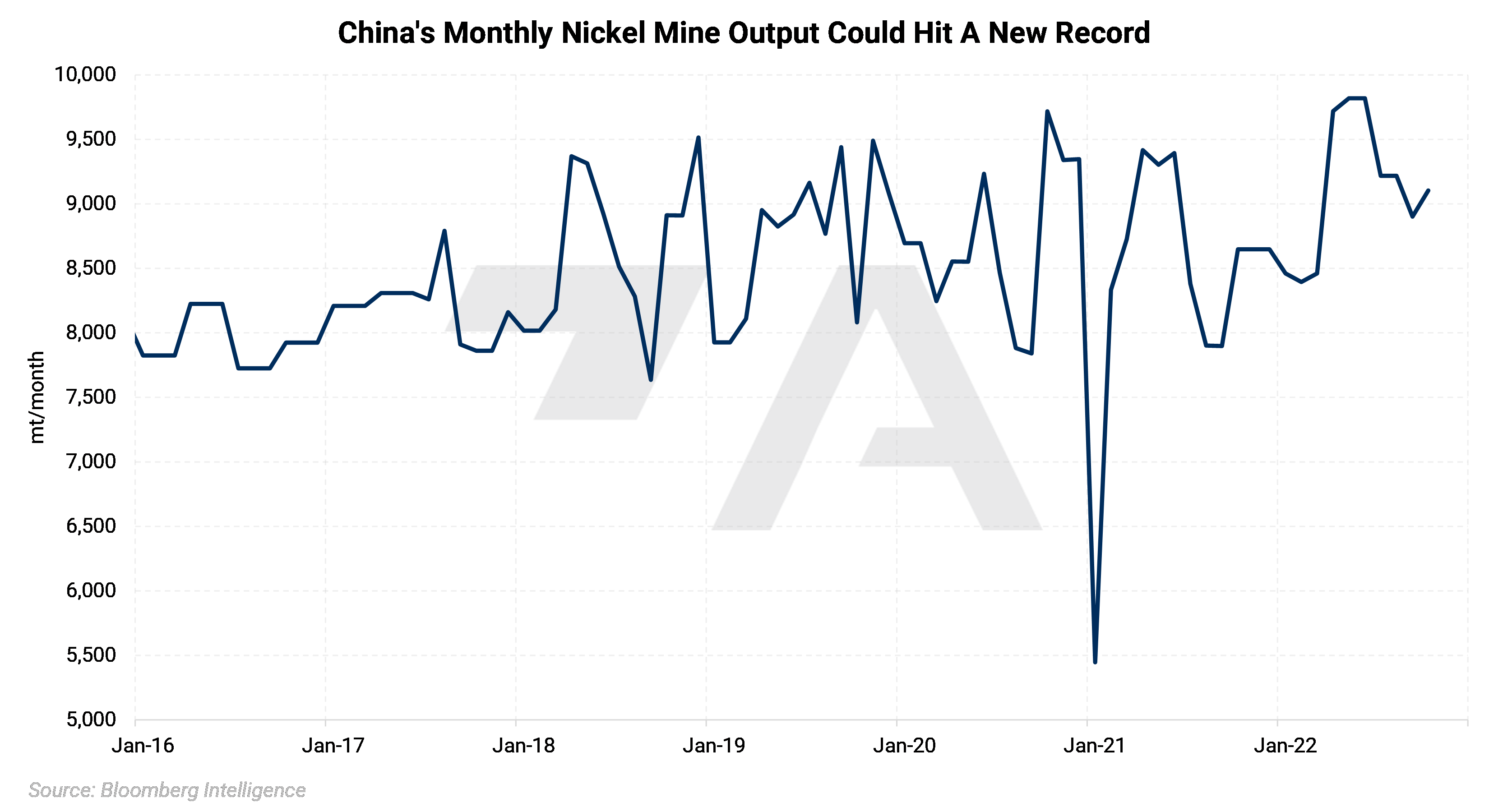

Except for a brief dip during the early part of the pandemic, China’s nickel mine production has been quite steady for some time. If Tsingshan’s ambitions come true, then China’s domestic nickel mine production will likely need to increase rapidly. Can they do it…or do they need to increase imports? |

|

|

China’s imports of nickel ore are quite seasonal. However, increased refining capacity could lead to both higher import volumes and greater month-over-month stability. |

|

|

|

Although it is less apparent, China’s refined nickel imports are seasonal as well. AEGIS notes that monthly quantities are much more volatile than that of nickel ore imports. Moreover, volumes have increased dramatically recently, as they imported approximately nearly 261,000 mt in 2021, nearly double that of 2020. Will Tsingshan’s expansion efforts lead to a dramatic decrease in refined nickel imports into China? Or will imports stay the same? |

|

|

|

Are you a nickel end-user (such as a stainless-steel producer) and looking to hedge your future needs? Consumers can hedge nickel in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum nickel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.