|

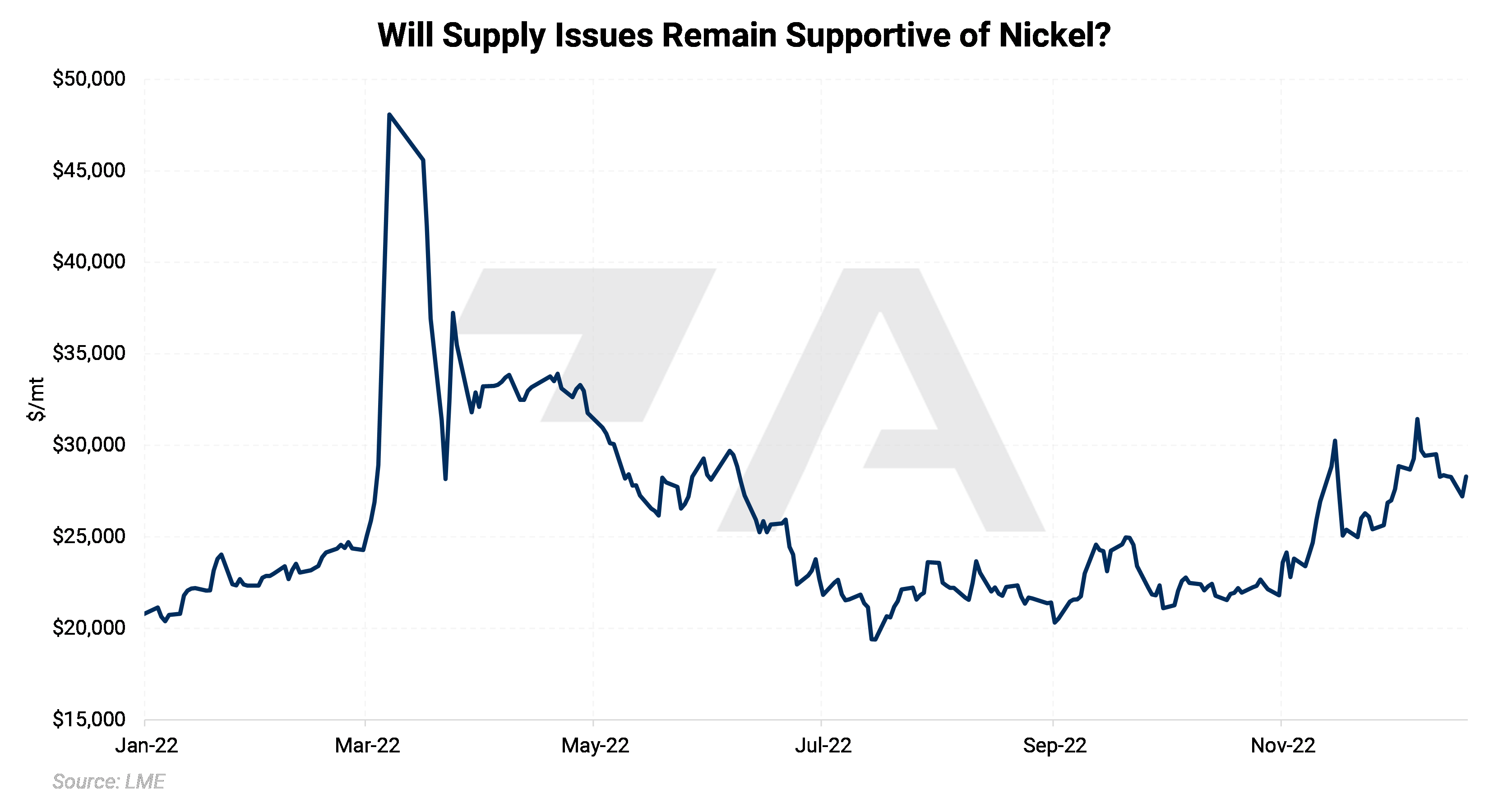

The LME Nickel 3M Select contract last settled at $28,130/mt (12/20/2022 close). Can the rally continue into 2023? |

|

|

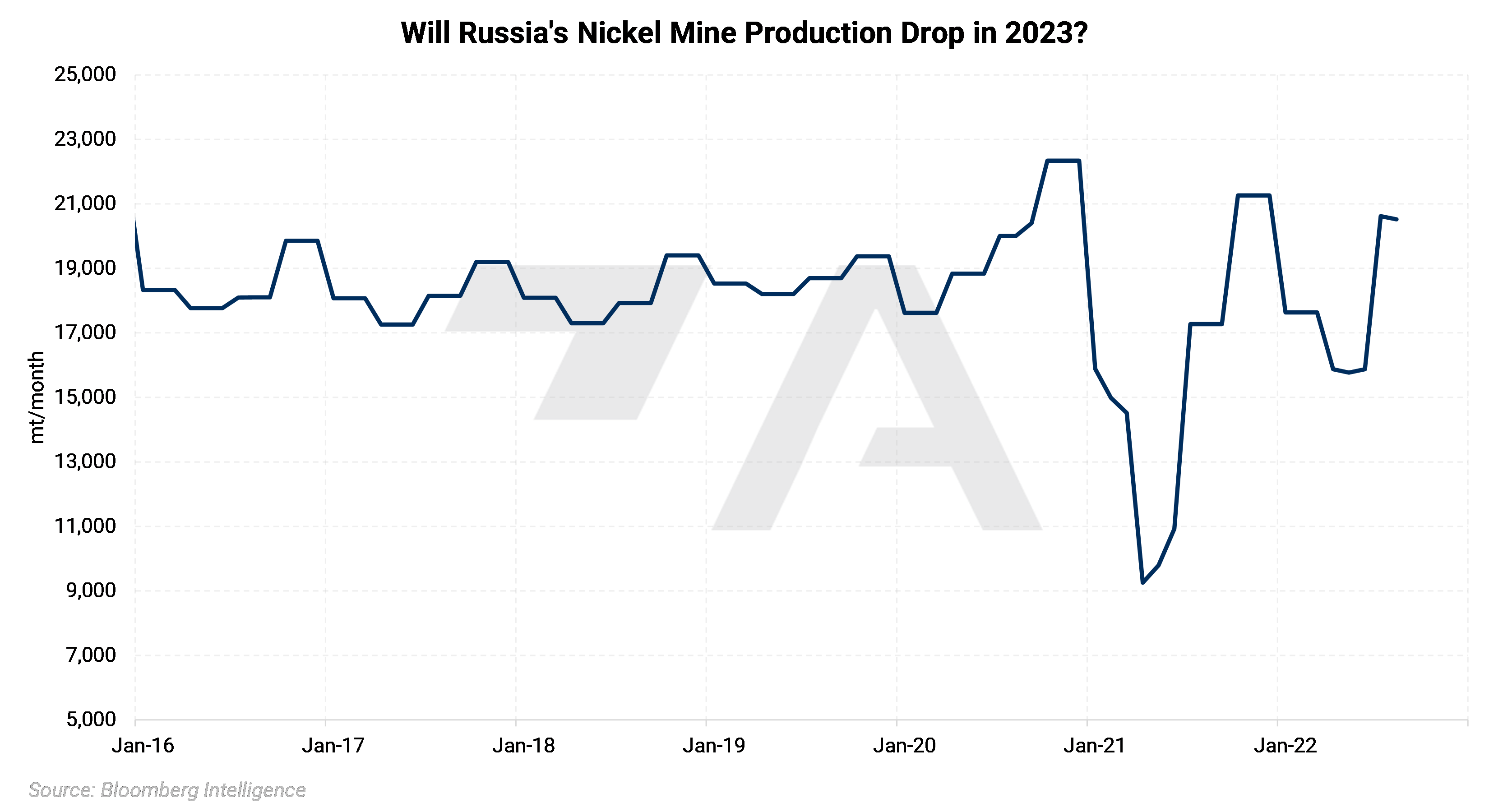

Russian miner Norilsk Nickel is considering lowering their output by 10% next year. The company estimates 2022 production will be 205,000 to 215,000 mt, thus, output in 2023 could range between 184,500 to 193,500 mt. Norilsk claims the potential drop in production is due to falling European demand for Russian metals. Based on USGS data, Russia is the world’s third largest nickel miner, responsible for approximately 9.3% of global nickel mine production. (Source: Bloomberg, USGS) |

|

|

However, production elsewhere could be on the rise. Tsingshan Holding Group Co., which is the world’s largest nickel producer, plans to open a 50,000 mt/yr plant in Sulawesi, Indonesia by July 2023. According to unnamed sources recently interviewed by Bloomberg; Tsingshan may decide to double the size of the plant to 100,000 mt/yr. Refined nickel production in the region could grow further, as two other Chinese producers, CNGR Advanced Material Co., and Zhejiang Huayou Cobalt Co. are proposing similar operations in Indonesia and China, respectively. Indonesia is the world’s largest nickel producer, according to USGS data. (Source: Bloomberg, USGS) |

|

|

|

Are you a nickel end-user (such as a stainless-steel producer) and looking to hedge your future needs? Consumers can hedge nickel in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum nickel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.