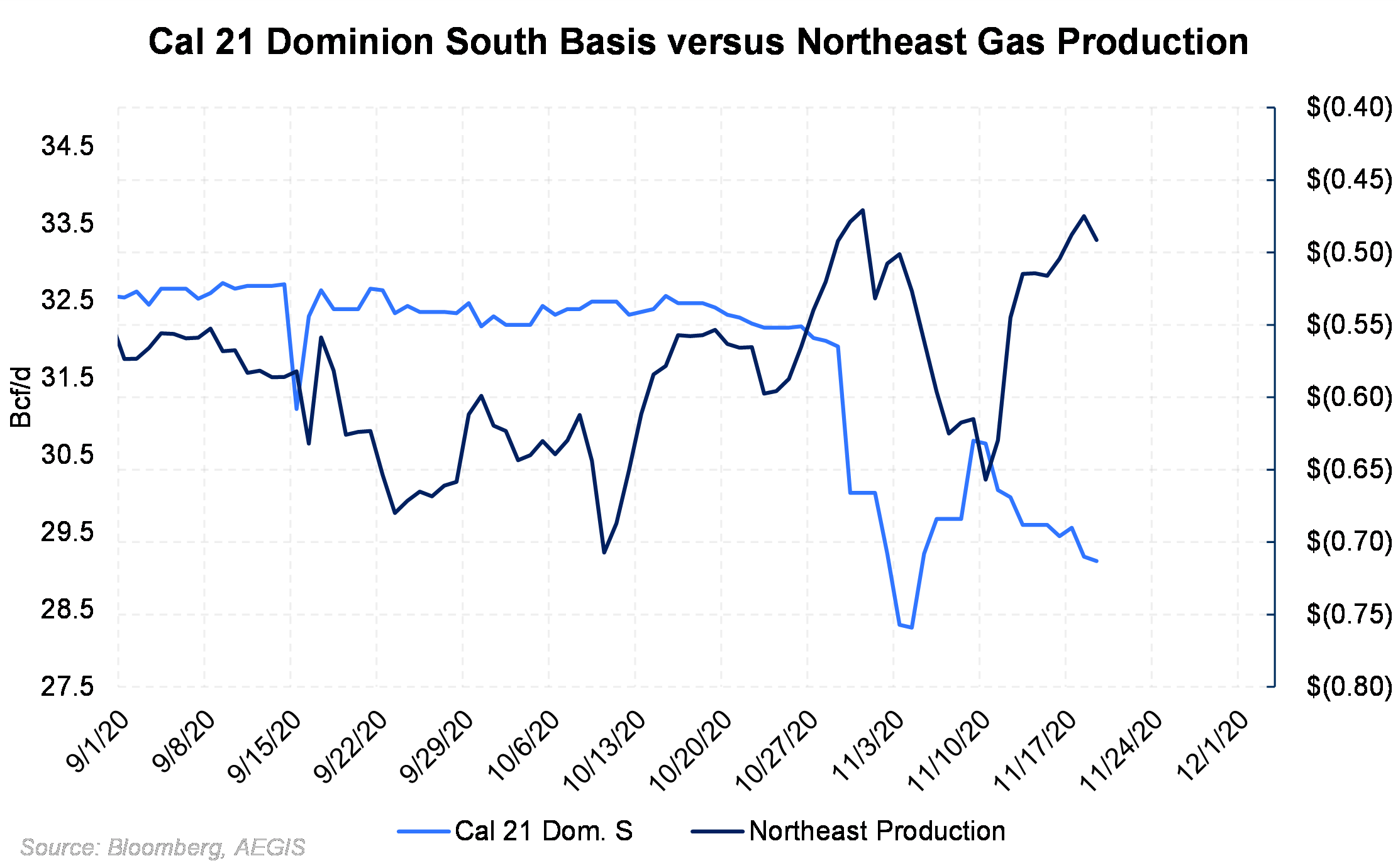

The chart above plots the changes in Northeast production and its effect on more longer-dated tenors (Cal 2021) of the Dominion South (DomS) price point. It is apparent that there has been a strong correlation between elevated production, mostly coming from the Marcellus shale play, weaker local prices.

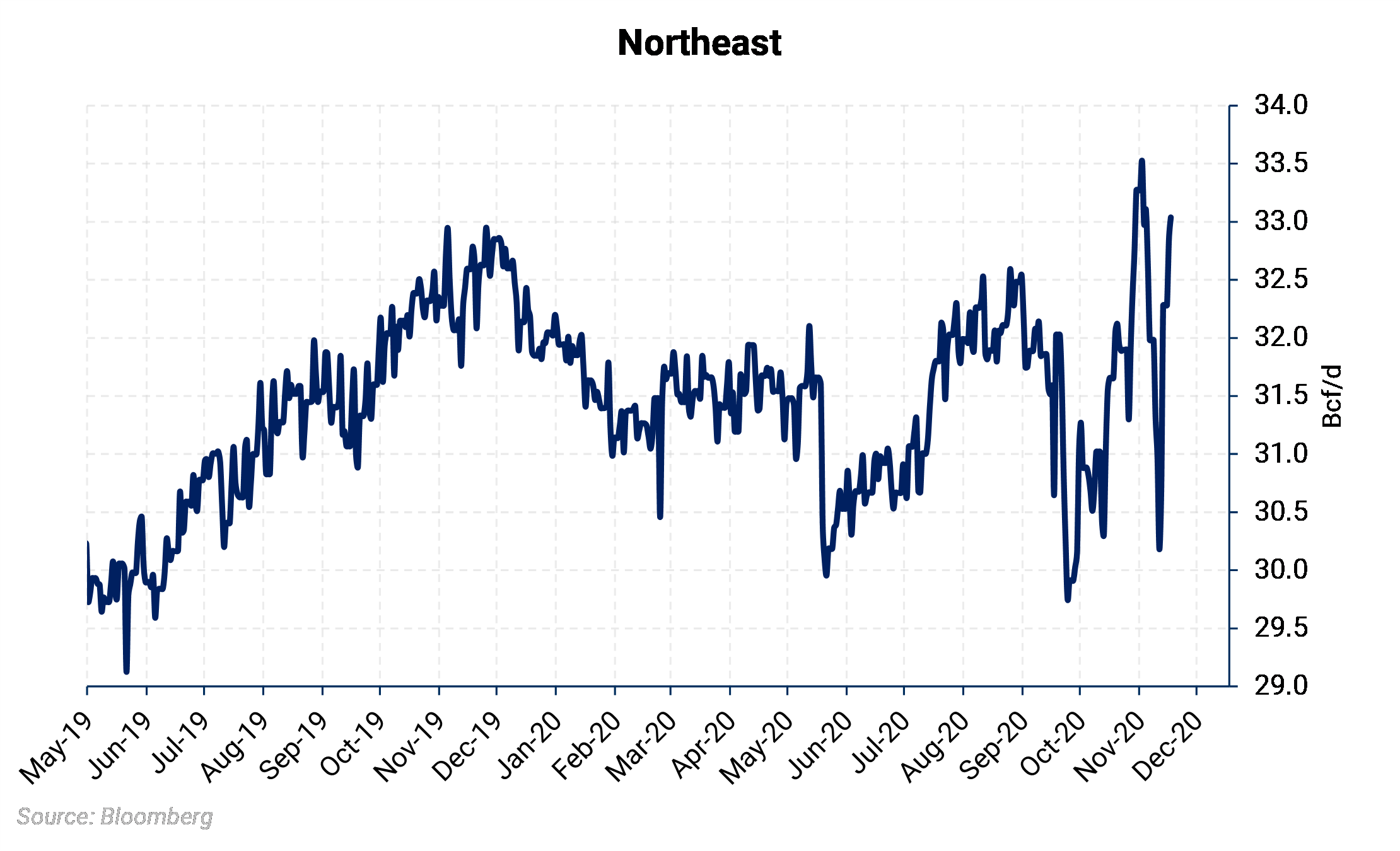

The record amount of gas produced has most directly affected cash prices. The combination of low local demand (weather related) and insufficient outbound pipeline capacity has pushed cash basis at DomS to a discount of -$2.29/MMBtu to Henry Hub, as recently as Nov. 9. Cash basis had "recovered" to a -$1.23/MMBtu discount as of November 17.

The chart above plots the changes in Northeast production and its effect on more longer-dated tenors (Cal 2021) of the Dominion South (DomS) price point. It is apparent that there has been a strong correlation between elevated production, mostly coming from the Marcellus shale play, weaker local prices.

The record amount of gas produced has most directly affected cash prices. The combination of low local demand (weather related) and insufficient outbound pipeline capacity has pushed cash basis at DomS to a discount of -$2.29/MMBtu to Henry Hub, as recently as Nov. 9. Cash basis had "recovered" to a -$1.23/MMBtu discount as of November 17.

At 33 Bcf/d, the Appalachia gas market in the winter typically has enough outbound capacity. This is because local wintertime demand absorbs the excess supply. Yet, 33 Bcf/d in shoulder and summer months will likely strain most outbound corridors from the Northeast supply region. For this reason, forward Appalachian basis prices have come under significant pressure over the past three weeks. The market apparently is assuming those elevated production volumes would continue after winter has passed.