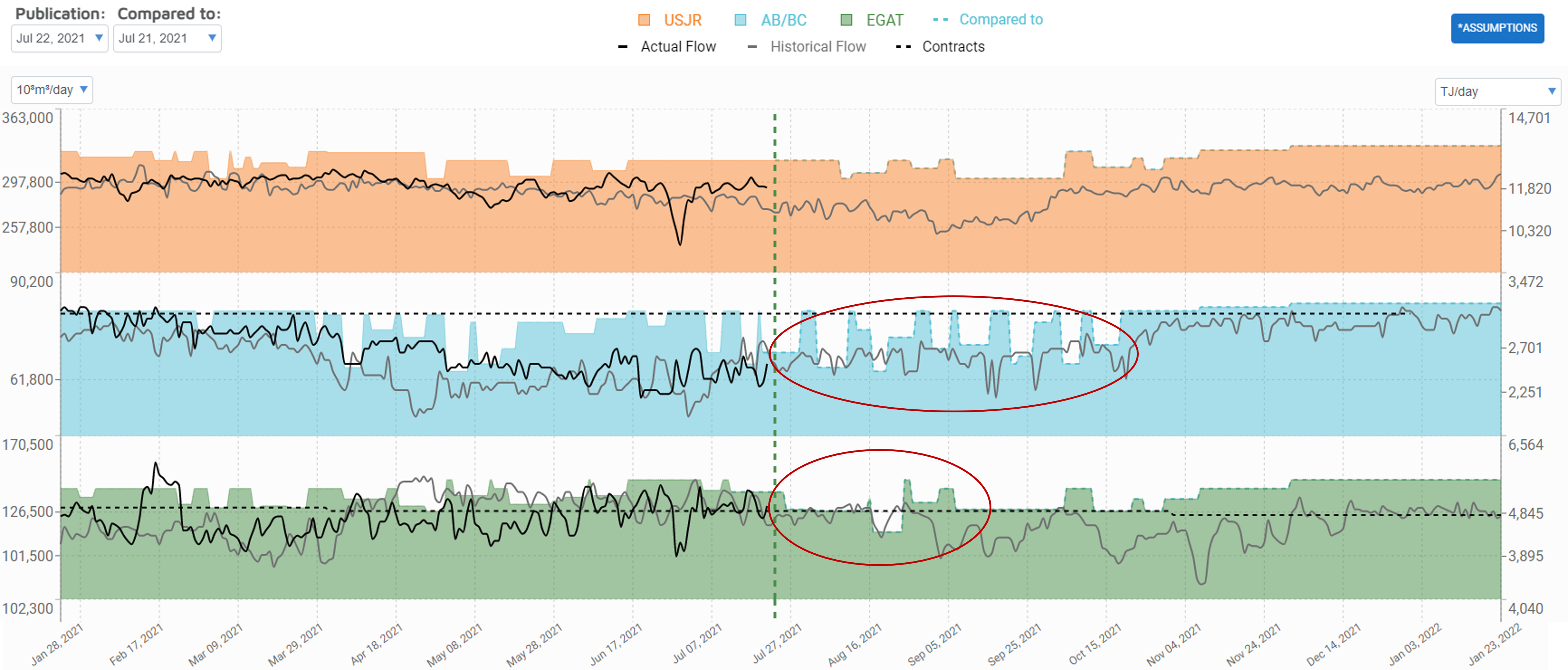

Just as gas prices continue the party, the helicopter parent named TC Energy has set an early curfew for Western Canadian basis. AECO has taken it on the chin with an announcement out of TC Energy that IT-D in the EGAT will be partially restricted starting July 26 due to planned maintenance. The maintenance schedule has been anticipated to be quite heavy for the end of the summer, but whether material restrictions would be needed has been anyone’s guess.

The latest outage schedule provided by NGTL doesn’t give us a lot of confidence that TC Energy will be able to balance the system without material restrictions. The market seems to agree. The magnitude of the restrictions is yet to be discovered, but the markets unfortunately have experience with this type of news and have acted accordingly.

Source: NGTL

Source: NGTL

Given that NGTL’s Temporary Service Protocol (TSP) was not renewed for the summer, the limits on deliveries either through EGAT or into storage will create bottlenecks USJR driving near-term AECO lower. Essentially, price becomes the balancing item in the market. This means that the economic incentive will be there to inject gas but the limitations on IT-D is the wildcard.

The strength in AECO has largely been driven by robust summer demand fundamentals even as supply has kept pace. The heat in the western US has had WCSB export demand competing with local storage for most of the summer. Even as the heat moderates, downstream storage will continue to compete with local storage as well as WCSB demand. We see the pull on gas out of Canada growing into the fall with the additional contracting on TCPL Mainline to Emerson, the ramp up of GTN Xpress and Westcoast Reliability and Expansion Program. These combined capacity additions should keep AECO supported into the winter even if we see contracts turned back on Alliance. Additionally, oil sands production is expected to continue it’s impressive growth into the fall, perhaps setting new records. This has been a large contributor to the strong intraprovincial demand over the summer and is expected to continue into the fall.

The Canadian gas market looks to remain extremely tight heading into winter. Winter AECO looks to be stuck in maintenance mode, widening as Nymex climbs higher. We are optimistic that the fundamentals are supportive AECO for the winter and should see basis tighten providing overall better fixed price as we move through the fall.