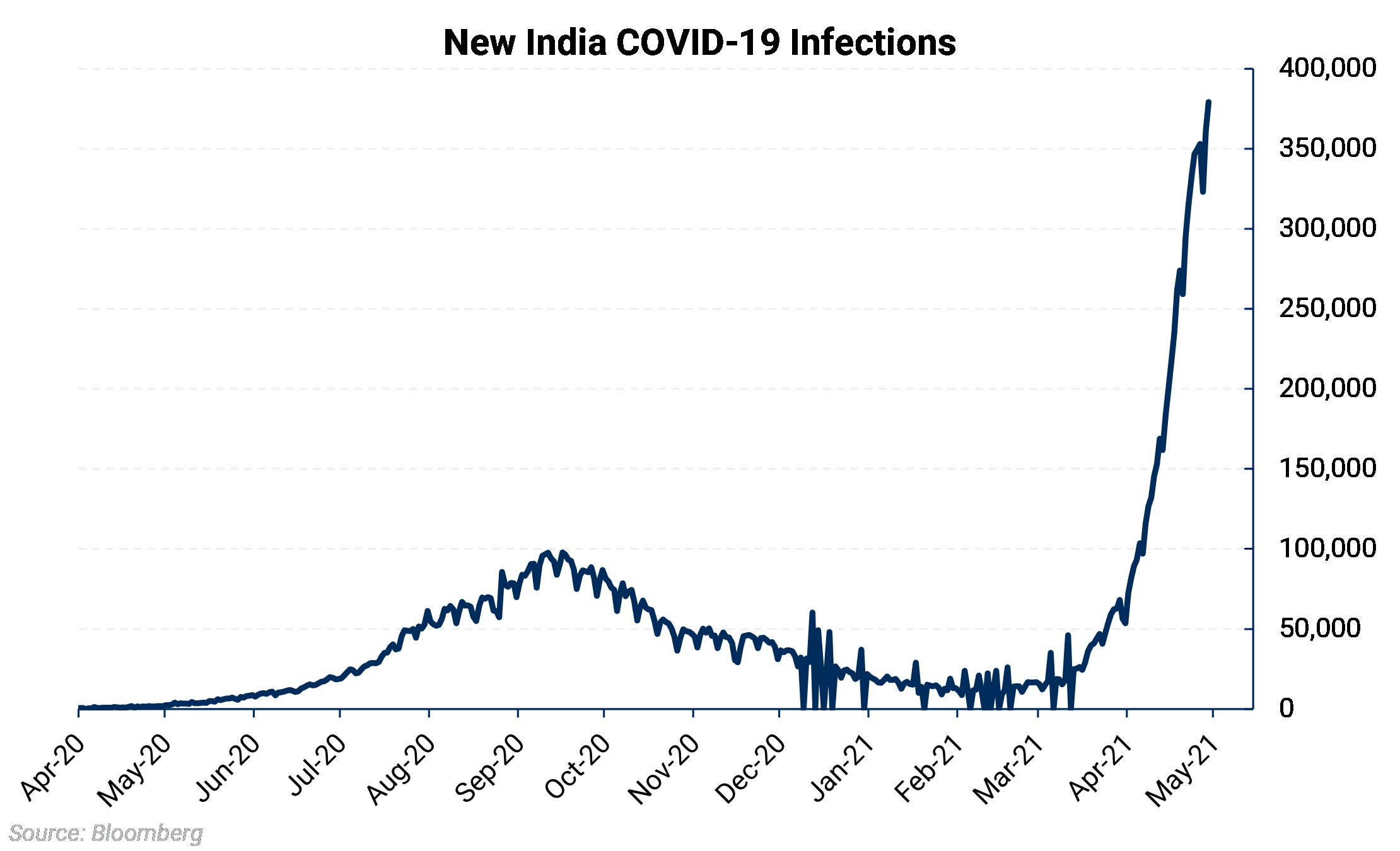

India reported 379,257 new COVID-19 cases on Thursday, April 28, with 3,645 new deaths, making it the deadliest day for any country since the start of the pandemic. The Indian government has not yet ordered a lockdown; however, new restrictive measures may become inevitable if the situation continues to worsen. Indian demand for petroleum has already decreased, which could pressure prices and affect OPEC's decision to resume production.

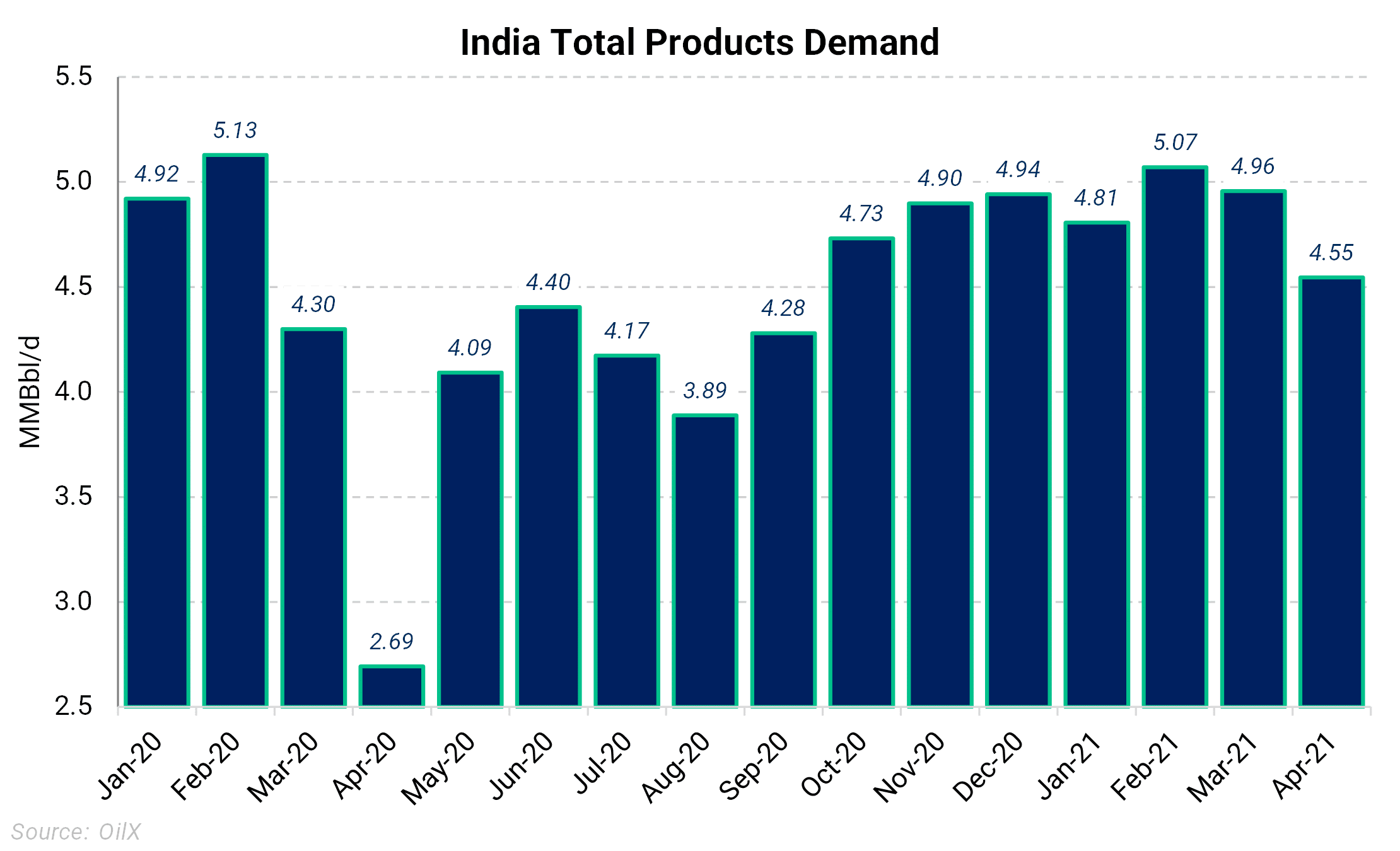

Preliminary estimates by OilX suggest that demand for petroleum products in India could be 4,550 MBbl/d this month, nearly 406 MBbl/d lower than March's level of 4,956 MBbl/d (Please see chart below). This would be the lowest mark since the country's last COVID surge in September. In April 2020, India imposed a national lockdown, which caused demand for oil products to fall by 1.62 MMBbl/d (OilX).

Rystad Energy estimates that liquids demand in India could fall by as much as 575 MBbl/d in April and 915 MBbl/d in May. If Rystad's forecast is correct, they estimate that the market could be in a 900 MBbl/d surplus this month and a 1.4 MMBbl/d surplus next month.

Even more concerning is that India has yet to announce a national lockdown, which experts say will be needed if the country wants to stem the COVID outbreak. According to Bloomberg, over 150 districts are already being considered for new restrictive measures. Such lockdowns in India will limit domestic gasoline and motor fuels demand. Jet fuel demand would also plummet as other countries could bar flights from the country.

Throughout this pandemic, India had remained a bright spot in an otherwise gloomy demand situation. The country helped keep oil demand elevated as European countries and the U.S. dealt with lockdowns in their respective countries. India, the world's third-largest crude importer, plays a prominent role in the global oil market. Crude prices could come under pressure if Indian refiners are forced to reduce purchases.

The COVID outbreak in India threatens the oil demand recovery and has OPEC's attention. According to Reuters, members of the group's Joint Technical Committee have expressed concern about the growing COVID cases in India, Japan, and Brazil. While OPEC says it is moving forward with its planned supply hikes, it will be keeping a finger on the pulse of the oil market to see how it should respond to faltering demand in India. If the global market flips to a surplus, it could delay OPEC plans to return production to the market.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.