Crude oil markets have been upended by high levels of volatility, resulting in lower liquidity. Open interest in benchmark crude markets has sunk to the lowest levels since 2016 as traders remove risk and margin requirements increase.

Lower liquidity helps explain the wild gyrations oil prices have experienced lately. As volatility increases, traders re-evaluate risk and often reduce positions to lessen exposure. Then, with fewer trades and fewer participants, there is less of a buffer to prevent big swings in prices.

WTI crude oil is the most actively traded commodity in the world. The high level of participation allows for efficient trade fills and minimal bid-ask spreads. However, the reduction in open interest has caused hedgers to observe wider over-the-counter (OTC) markets than normal. By “wide,” we mean the bid price and ask price have separated from each other.

Hedging counterparties sell derivatives to (or, buy from) hedgers, so they generate exposures of their own as the provide this service. Thus, they are subject to the recent rise in price volatility and likely need to carry more cash (reserves) or post more margin to trade. As volatility increased, many traders’ margin requirements increased as well.

Wild Price Swings and Volatility

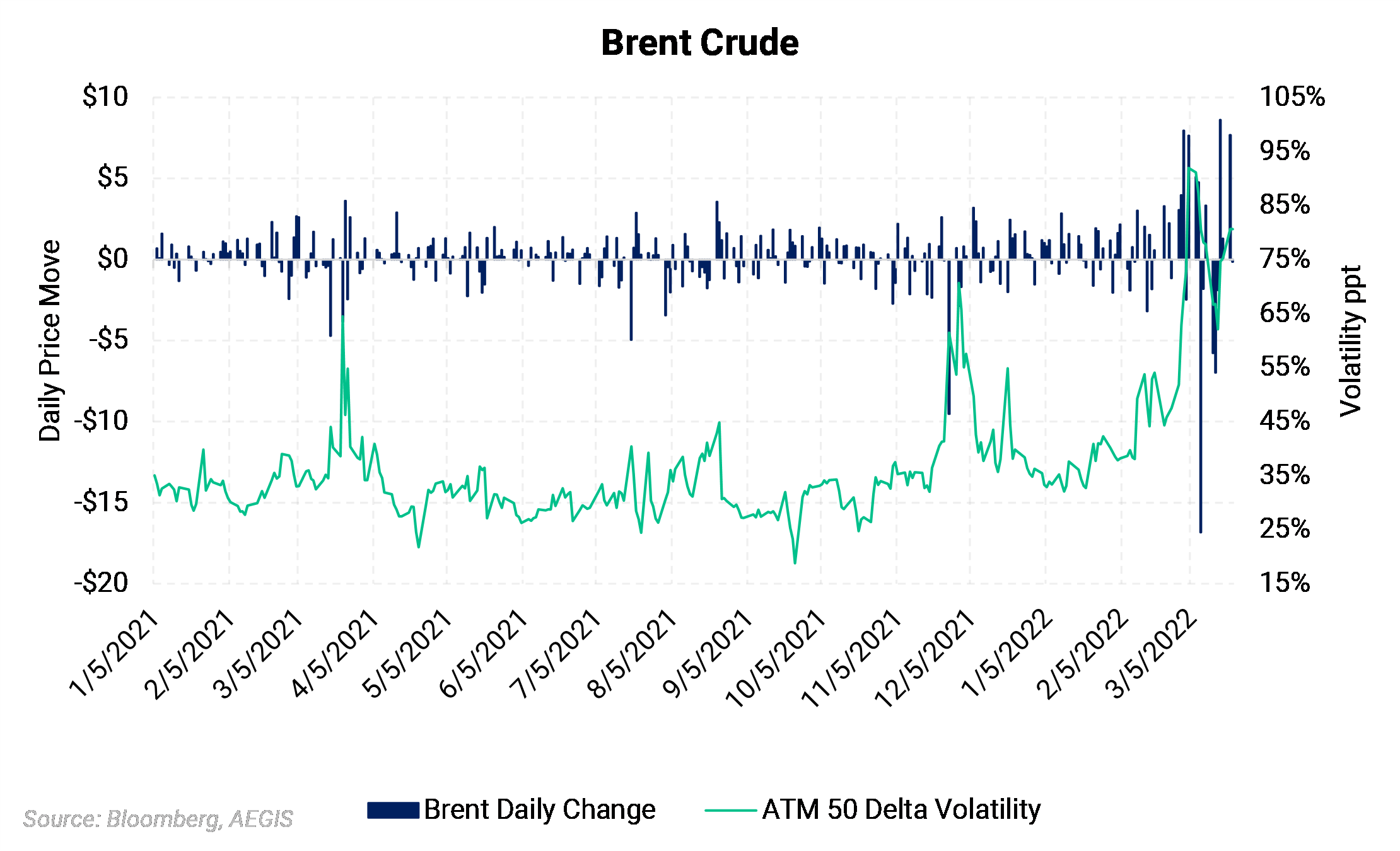

Brent prices have moved more than $5/Bbl intraday for 16 out of the 20 trading days so far in March. The chart below shows the large daily swings as blue bars. It also shows how at-the-money (ATM) volatility (green line) skyrocketed this month. This “volatility” measure is derived from option values, and it is a measure of the market’s expectation of future oil-price changes. Clearly, the market expects more of these wild price movements in the future.

Open Interest Falls

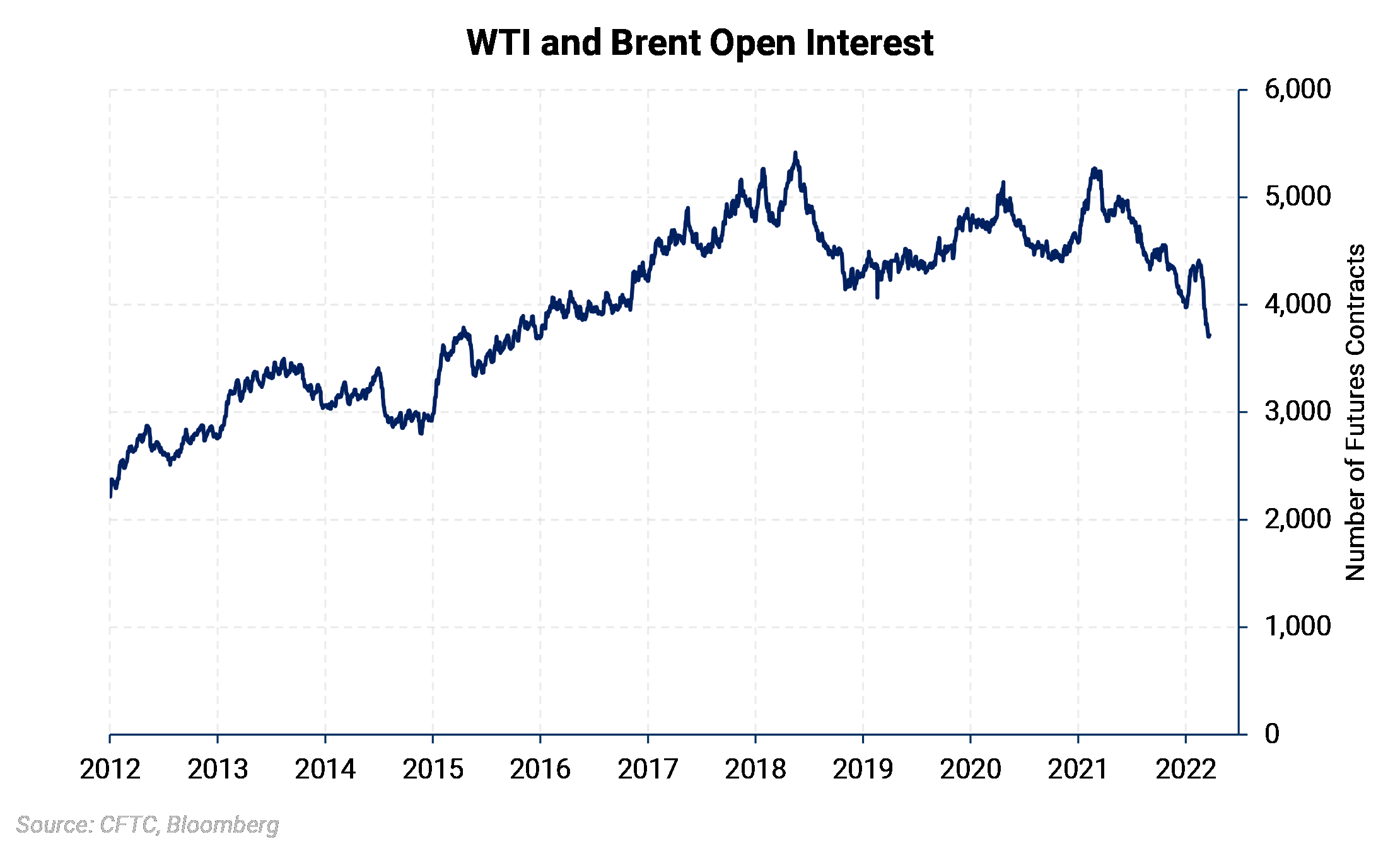

Oil's open interest (OI), or the number of outstanding contracts, has fallen to its lowest level since 2016 (see the chart below). According to Bloomberg, the combined crude oil, diesel, and gasoline OI represent the equivalent of nearly a billion barrels worth of contracts liquidated.

Margin Calls and Trading Difficulty

Volatility puts the exchanges at risk, too, and they have responded by tightening their rules. The Intercontinental Exchange Inc. (ICE) and CME Group Inc. have increased their margin requirements in an effort to mitigate market instability. For example, CME Group increased margin requirements for its U.S. crude and heating oil futures contracts four times since February 23. According to Bloomberg, the increases will act as a deterrent to speculative trading and will likely lower activity.

Not even the largest, most successful trading companies are immune. Singapore-based Trafigura Group, the world's second-largest oil trader, is raising a $1.2 billion credit facility to help it continue regular operations in "unprecedented market conditions and extreme volatility," Chief Financial Officer Christophe Salmon said in a notice on Tuesday. Other large commodity traders were also looking for funds to cover increased margin requirements.

Hedgers Face Some Challenges

Producers and consumers looking to execute hedges may find markets slightly wider than usual. A wider market is an increase between the mid-market (what you see published) and the counterparty’s bid. Simply stated, a wide market means a worse price, whether you are hedging oil production or consumption.

Some counterparties are faring better than others, but expect less aggressive pricing in general. Since volatility spiked in late February, our trading desk has observed a 25% to 50% increase in execution spreads. For example, a recent Cal '24 WTI three-way collar was indicated with a mid-to-bid of $1.25/Bbl from a counterparty. A "normal" spread would have been $0.65/Bbl a few months ago.

The wider mid-to-bids aren't only in crude oil hedges. A Henry Hub costless collar inside the next 18 months typically has about 2-3c of "credit," or transaction charge, built-in. That can now be a little larger, depending on the counterparty.

Hedging counterparties include banks and merchant traders, and they are not all equally affected by recent volatility and margin or reserve requirements. Further, we observe that secured (collateralized) and unsecured trading relationships produce different results, with secured trading showing smaller bid-ask changes. The mid-to-bid is also dependent on creditworthiness and other idiosyncrasies of the producer or consumer.

AEGIS can help navigate the hedging landscape in a time of turbulent markets. Our business is providing the most transparent and educated advice for client hedging transactions. We face over 40 counterparties daily. We likely have insight into trading partners’ recent competitiveness in your markets and among your peers.