A potential supply crisis is on the horizon as fewer domestic refineries produce a greater portion of the country's refined products

United States' energy market is alarming travelers and the broader economy, as evidenced by record fuel prices, rising airfares, and low fuel inventories. There is simply not enough refining capacity to convert crude into usable fuels.

How much refinery capacity does the U.S. have?

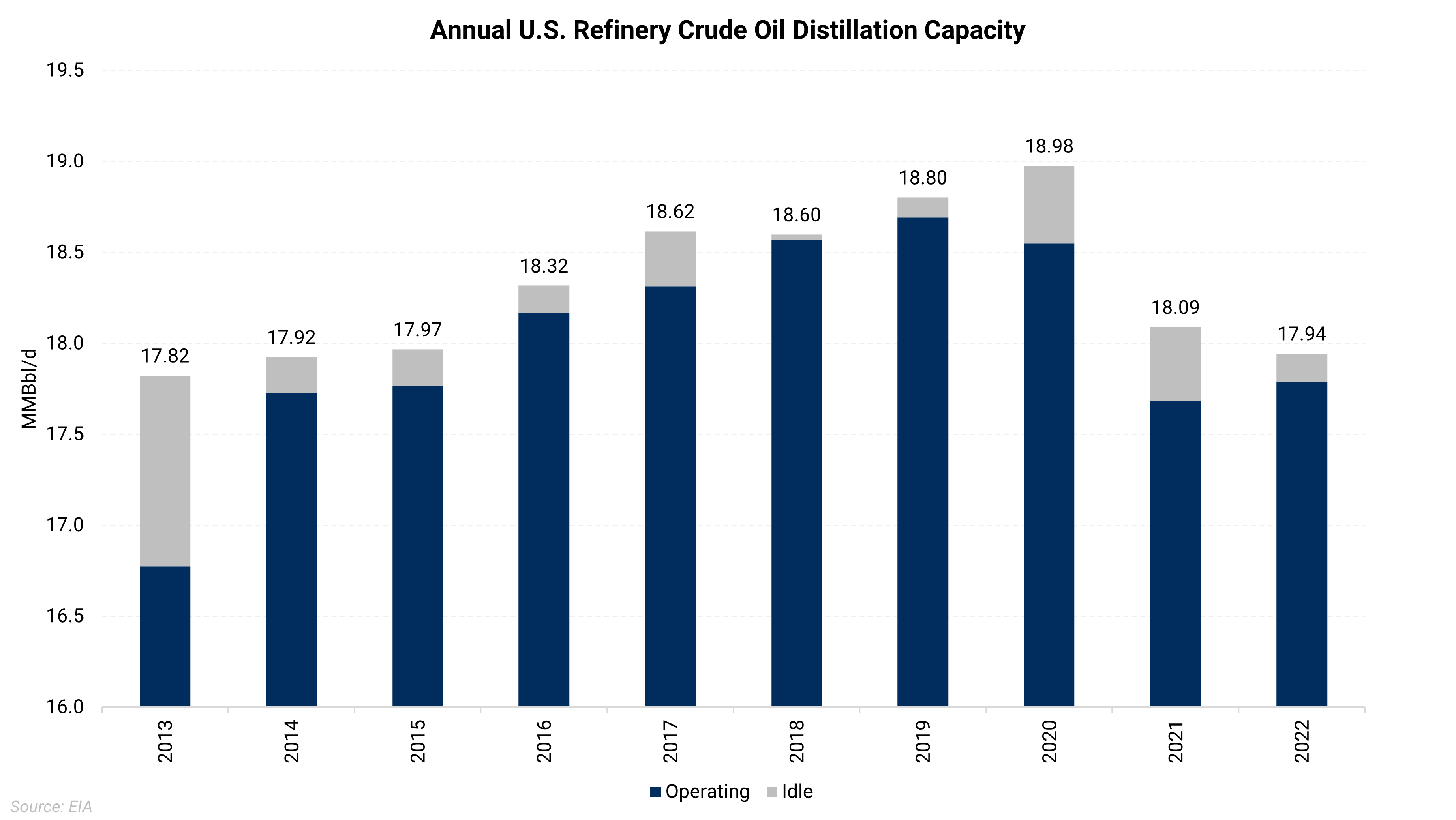

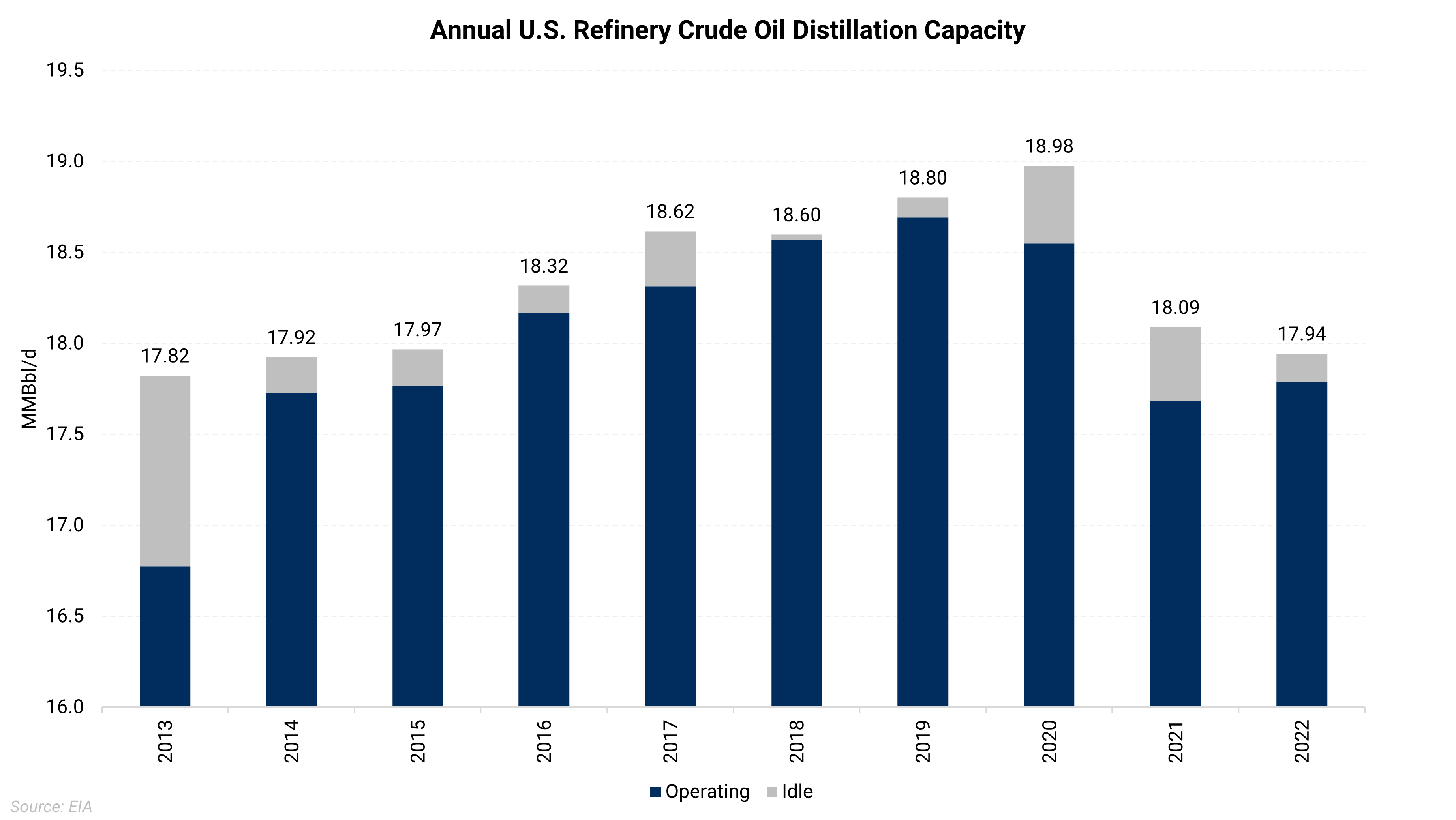

- At the beginning of 2020, the United States had the largest refining industry in the world, with 135 operating petroleum refineries and a total refining capacity of 18.98 MMBbl/d

- Since then, the U.S. has lost nearly 1.1 MMBbl/d of refining capacity since then and now has 125 operating refineries with a total crude distillation capacity of 17.90 MMBbl/d

Is pandemic the only factor causing the U.S. to lose refining capacity?

- No, the drop in American refining capacity is the result of a combination of factors, some of which preceded Covid

- Demand for gasoline and jet fuel practically disappeared during the pandemic's peak, forcing companies to close some of their least profitable refineries permanently

- While the steep decline in fuel demand caused by the pandemic sped up the process of refinery cutbacks, closures, and transitions, many of these steps were already planned or underway

- Some of those plants were simply too expensive to repair after being damaged by hurricanes, fires, explosions, and other natural disasters

- This is especially true given that a future shift to cleaner energy sources makes investors and operators believe their long-term business models would be unprofitable and less likely to draw customers

- The decision to convert or shutter refineries is made by factoring in the present and projected future fuel demand, facility locations, and market access

Plant Closures

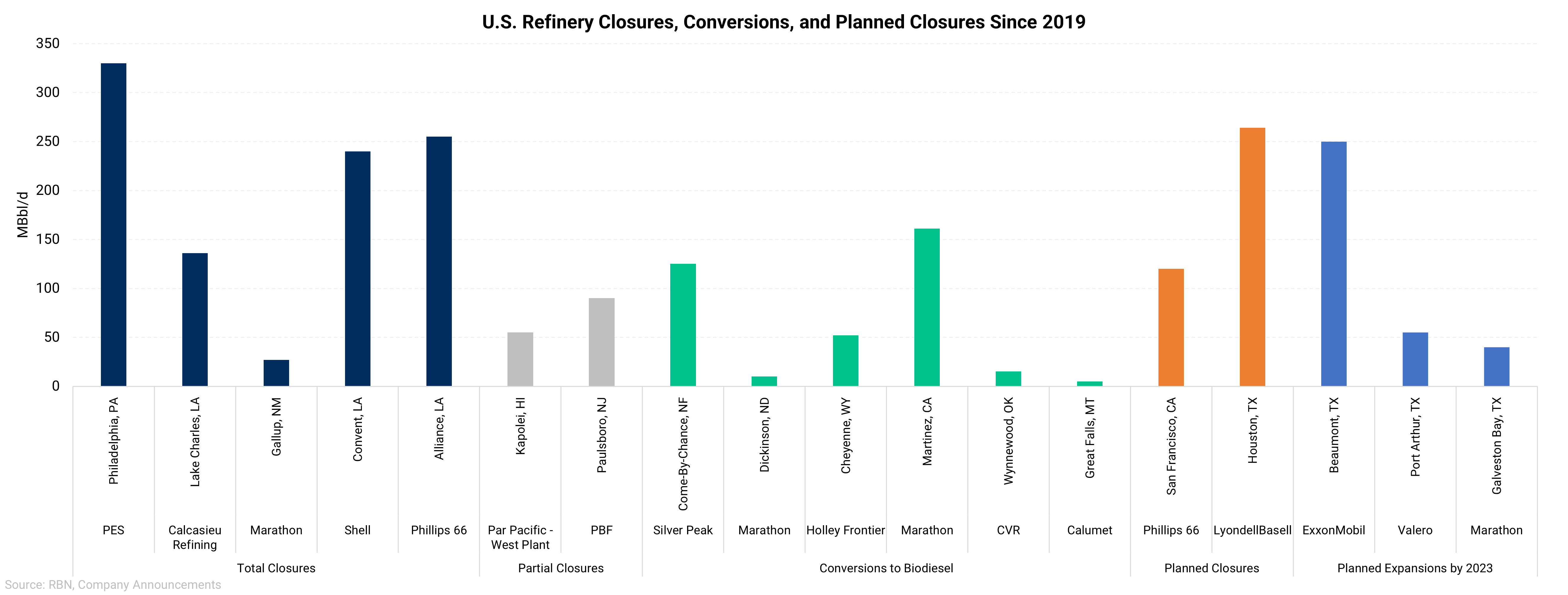

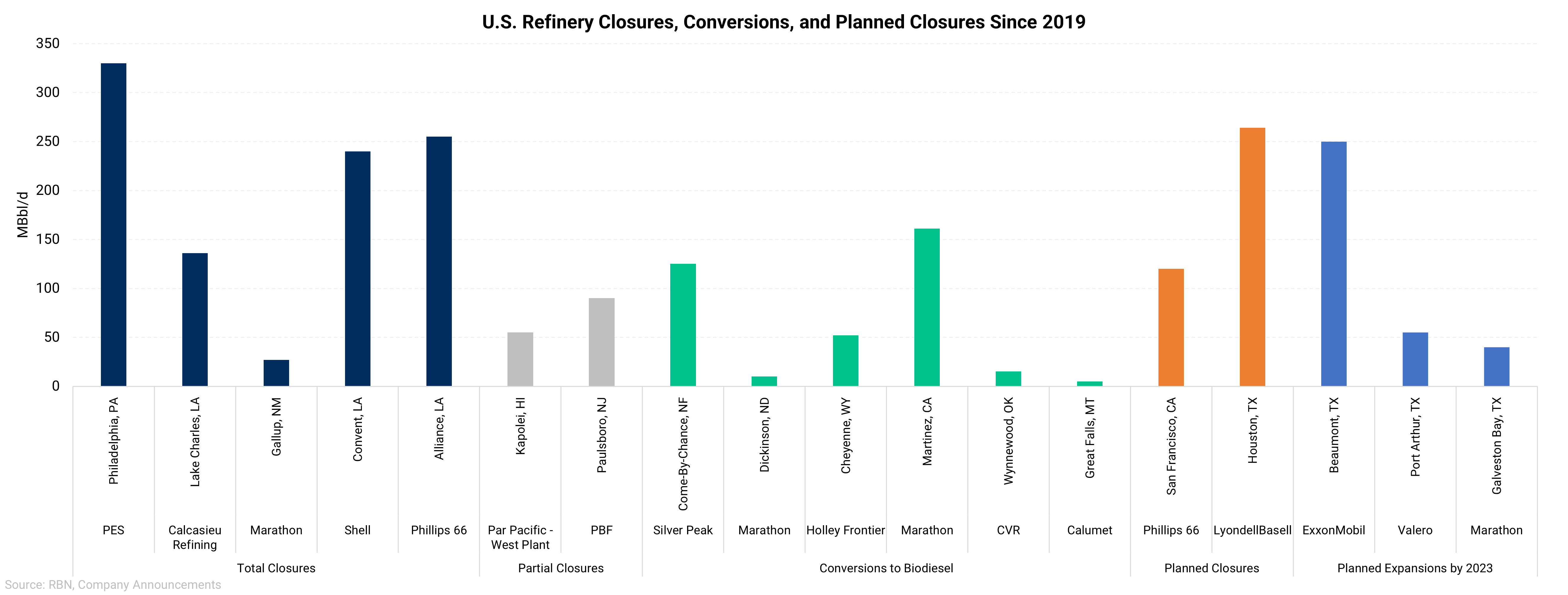

The chart above shows closures and conversions in the last three years. Compared to 2019 levels, the nation's refiners have shut down or announced plans to shut up to 1.8 MMBbl/d of refining capacity.

Is it possible to restart facilities quickly?

- No, it is not possible to instantly restore lost capacity

- More than half of the refining capacity that has been lost in the U.S. over the last few years is either being retired or is in the process of being converted to the production of renewable fuels

- At a time when labor and construction costs are rising in the U.S., even restarting idled plants might be expensive

- New refineries take a long time to build. Even if any company considered constructing a refinery today, it would only affect the market in perhaps five years, not the crisis we are currently facing

How is lost refining capacity affecting fuel prices and production?

- Lower refining capacity results in lower fuel output levels. As a result of limited supply, buyers of fuel must pay more for refined products

- Further, prices of fuels have raced much higher than crude prices have. The higher profit margin encourages all available refining capacity to be dispatched

- Even with less refining capacity, U.S. refineries are running at high utilization rates of almost 95%, which is currently at its highest level since the end of 2019

What does lost capacity mean for the future of liquid fuels?

- The demand for fuels has nearly returned to pre-pandemic levels, whereas the capacity for refining has not

- There is a shortage of refined products due to this mismatch

- Capacity expansions at existing refineries - ExxonMobil, Valero, and Marathon Petroleum are now expanding three sizable refineries in Texas that will provide a combined 350 MBbl/d more capacity for crude distillation in the United States, according to Argus