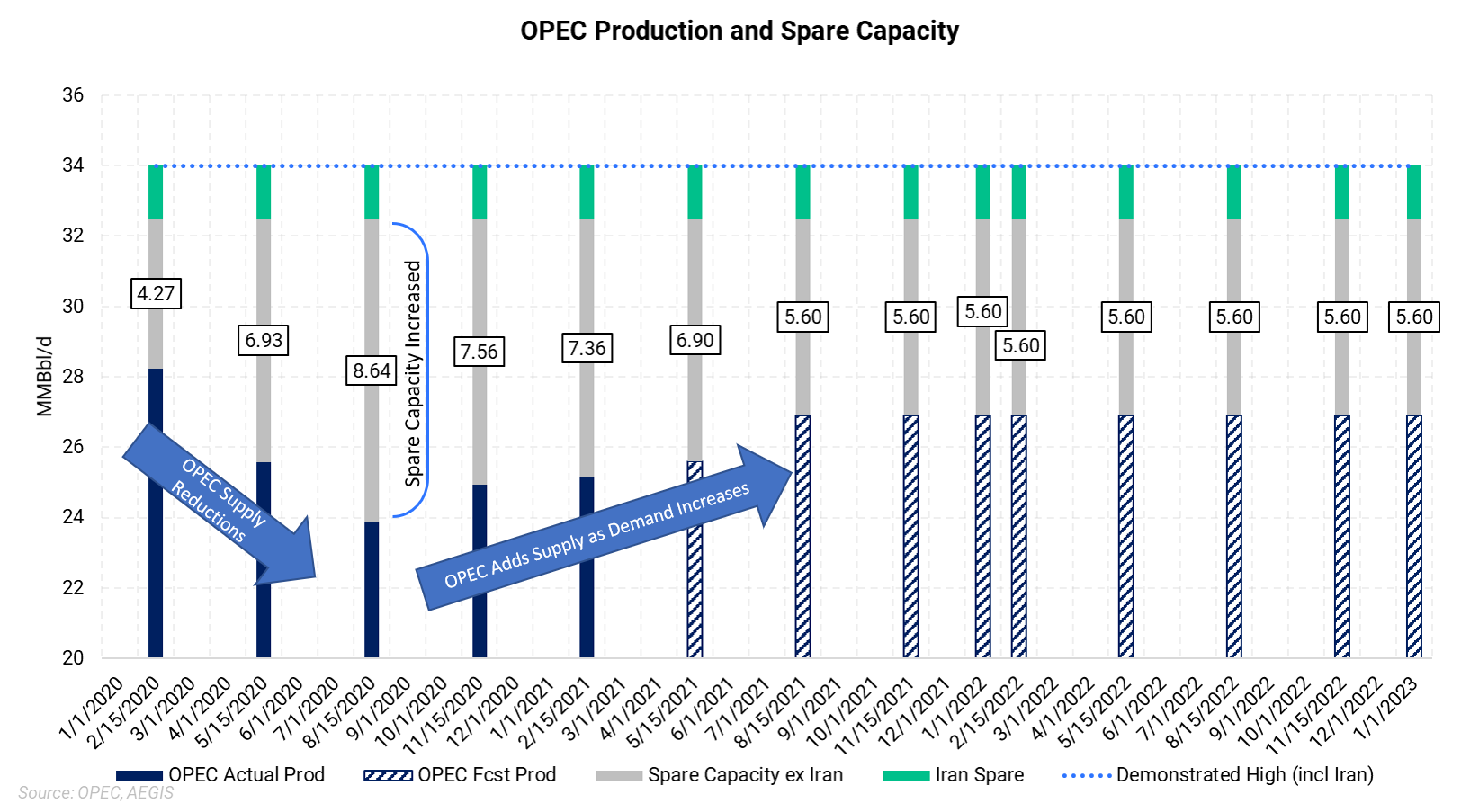

Spare capacity could be exhausted in under 12 months if OPEC’s new global demand and supply estimates come true in 2021.In its latest monthly Oil Market Report (MOMR), OPEC forecasts 2021 demand growth to average 6 MMBbl/d. OPEC also raised its expected demand for its crude, known as the “call on OPEC” coinciding with a lower forecast for non-OPEC supply growth, now at 0.7 MMBbl/d for 2021. The call on OPEC has continued to climb as the group has become more bullish on demand. The amount of spare capacity from OPEC ballooned last year as the cartel drastically reduced supply in 2020 due to the pandemic-induced crash in crude demand and prices. According to Bloomberg, the highest level of demonstrated production (dotted blue line) reached by current OPEC members is 34 MMBbl/d. In 1Q of this year, the group produced around 25 MMBbl/d, leaving about 7.36 MMBbl/d of spare capacity, if Iran is omitted, as shown in the chart below. Spare capacity had increased to 8.64 MMBbl/d in 3Q 2020, when OPEC reduced production to under 24 MMBbl/d. |

|

|

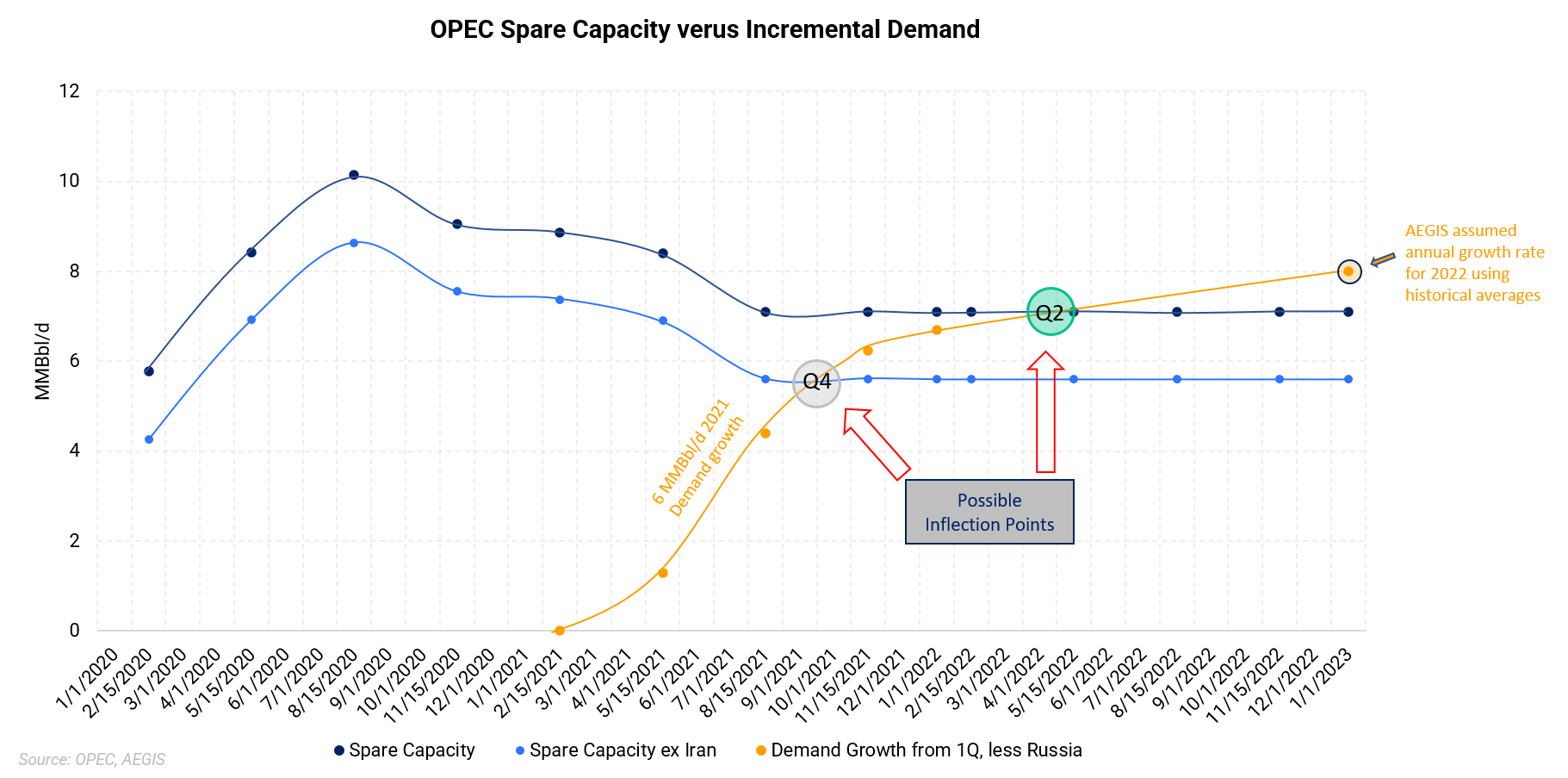

OPEC has indicated they intend to release about 2 MMBbl/d of supply back onto the market between May and July. The takeaway here is that by mid-summer, OPEC ex Iran should have about 5.6 MMBbl/d of spare capacity, and OPEC including Iran will have 7.1 MMBbl/d of spare capacity. For analysis purposes, let’s assume OPEC production is unchanged beyond July as the group has not indicated how they intend to increase production further as demand returns. Per OPEC’s own estimates, they would not have enough spare capacity beyond 3Q2021 to serve global demand growth. The chart below shows when OPEC forecasted demand would exhaust existing spare capacity. OPEC spare capacity, without an increase in Iran output, could be exhausted by 4Q 2021. The inflection point, shown by the gray circle, shows demand eclipsing available productive capacity from the cartel. If Iran can rid itself of U.S. sanctions, the inflection point is closer to 2Q 2022. |

|

|

The set of assumptions laid out by OPEC’s forecast above is much more bullish than their more reserved conclusions earlier this year. OPEC is now implying the oil market will need more supply beginning in the second half of this year. However, it is important to note that the chart above does not include supply growth from non-OPEC. In their latest monthly report, OPEC forecasts non-OPEC supply to grow by only 700 MBbl/d. Of that 700 MBbl/d increase, U.S. oil output is expected to fall about 100 MBbl/d in 2021, but supply from Canada and Brazil will grow, according to OPEC’s MOMR. Bottom line – the global oil market does look more bullish as we continue to move further away from pandemic-induced demand destruction. Progress with the vaccines and the further reopening of the global economy is encouraging demand growth. However, the argument illustrated above doesn’t come without risks. Demand growth could fall short of expectations for the rest of the year. In addition, non-OPEC supply from the U.S. could surprise on the upside. Despite the near-term risks, we believe oil fundamentals have become much more constructive, especially looking to Cal ’22 and beyond. |

| Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|