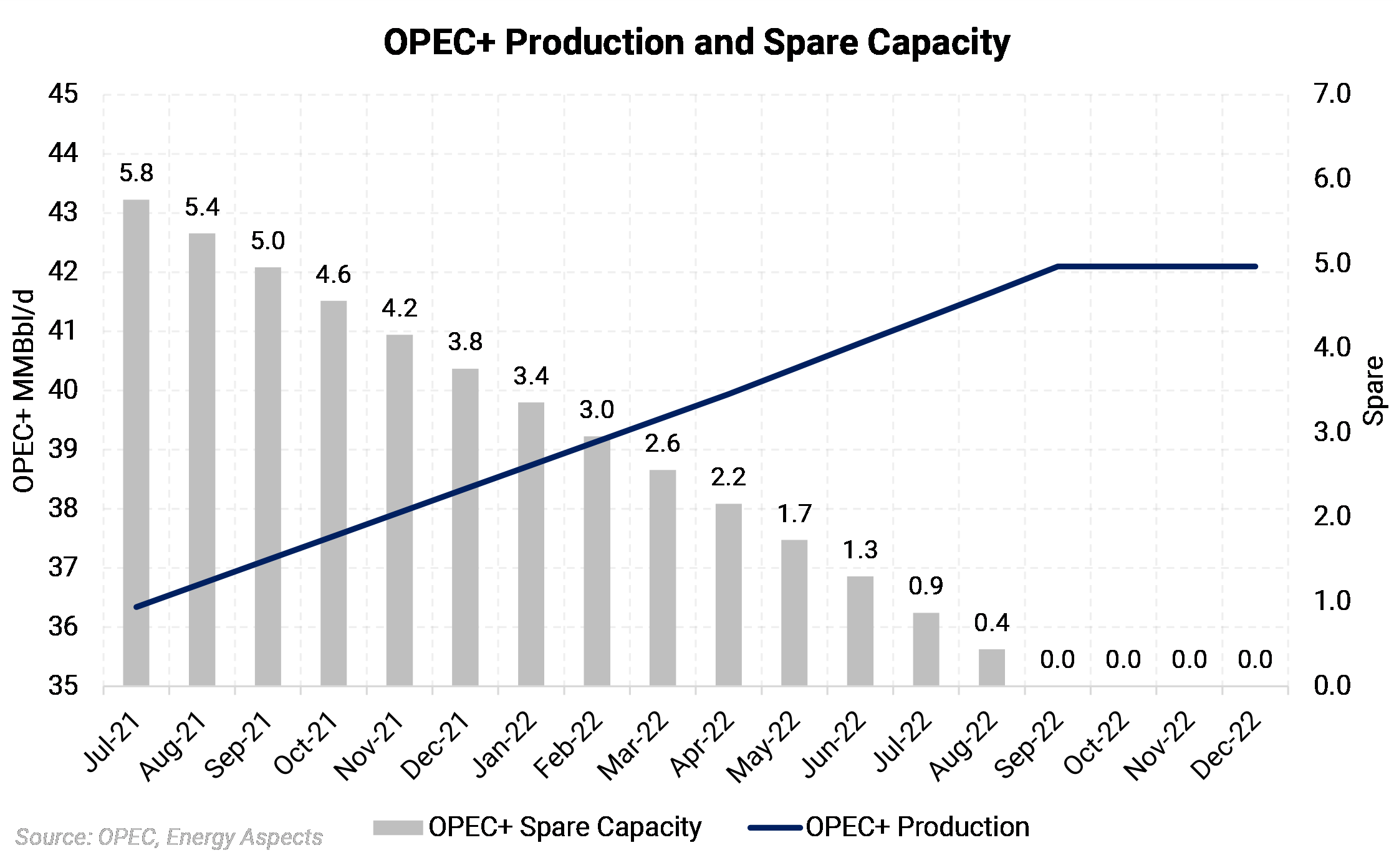

OPEC+’s stated spare capacity is near 5.8 MMBbl/d when accounting for Iran sanctions.

The group’s planned supply hikes may leave it without spare capacity by September 2022. For perspective, from 2011 – 2020, OPEC spare capacity averaged 2.43 MMBbl/d, which would be reached by April 2022 under the current plan. (See the chart below)

“Spare capacity” in this context is the difference between current OPEC+ production according to its September quotas, and the new OPEC reference production levels reached during the group’s last meeting, or the total amount of production forecast to come online.

|

Iran was excluded from the spare-capacity figures, as talks to end U.S. sanctions have stalled. Iran refused to extend a nuclear-monitoring pact that served as a stopgap measure allowing negotiations to continue. U.S. National Security Adviser Jake Sullivan publicly urged OPEC+ to increase output recently, which is important because he is also heading the Iran nuclear talks. The public call for more oil may signal those talks are failing, and Iranian crude will not be returning to market anytime soon.

|

|

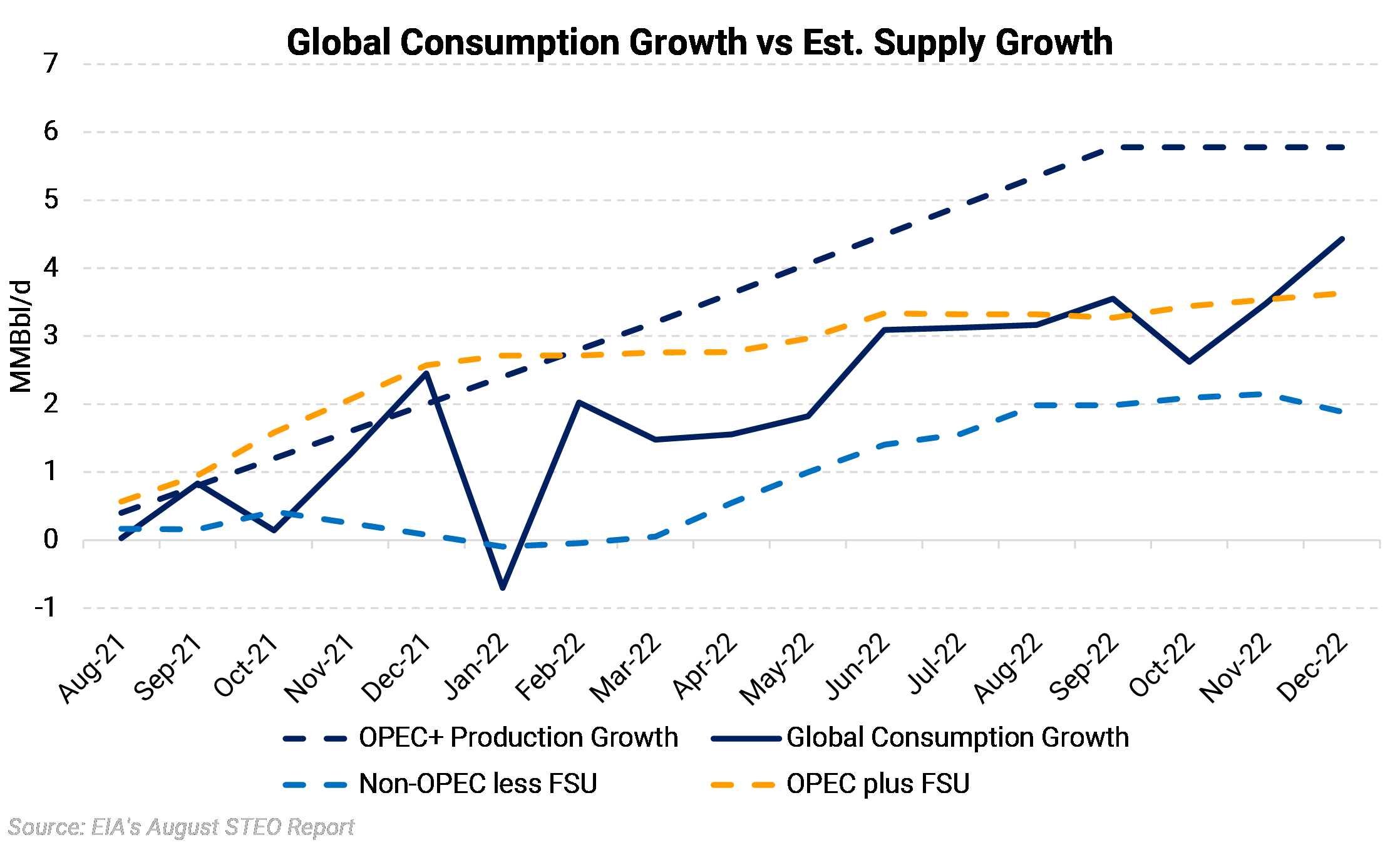

OPEC+ may have plans to bring back production, but other analysts conclude (or at least imply) that the pace is too aggressive if you do not assume oil demand will recover quickly in 2021-2022.

Many agencies have become more pessimistic about demand over the last month as COVID cases have risen in China and the United States. If the demand recovery slows, OPEC+ will not be able to adhere to its current production schedule without putting the market in a glut.

The chart above shows the growth in global consumption (from EIA’s latest Short-Term Energy Outlook, or STEO) using July 2021 as the baseline. Also, it shows the total amount of crude OPEC+ is expected to bring online under the current agreement. If the cartel adheres to its agreement, then the market would start loosening by January 2022 as new OPEC supply outpaces the demand gains. In conclusion, OPEC+ could match global demand growth on a 1:1 basis and still maintain spare capacity through 2022.

Therefore, in the most recent STEO, the EIA forecasts that total oil production must be lower, and OPEC+ would need to adjust production lower, if non-OPEC+ production rises.

|

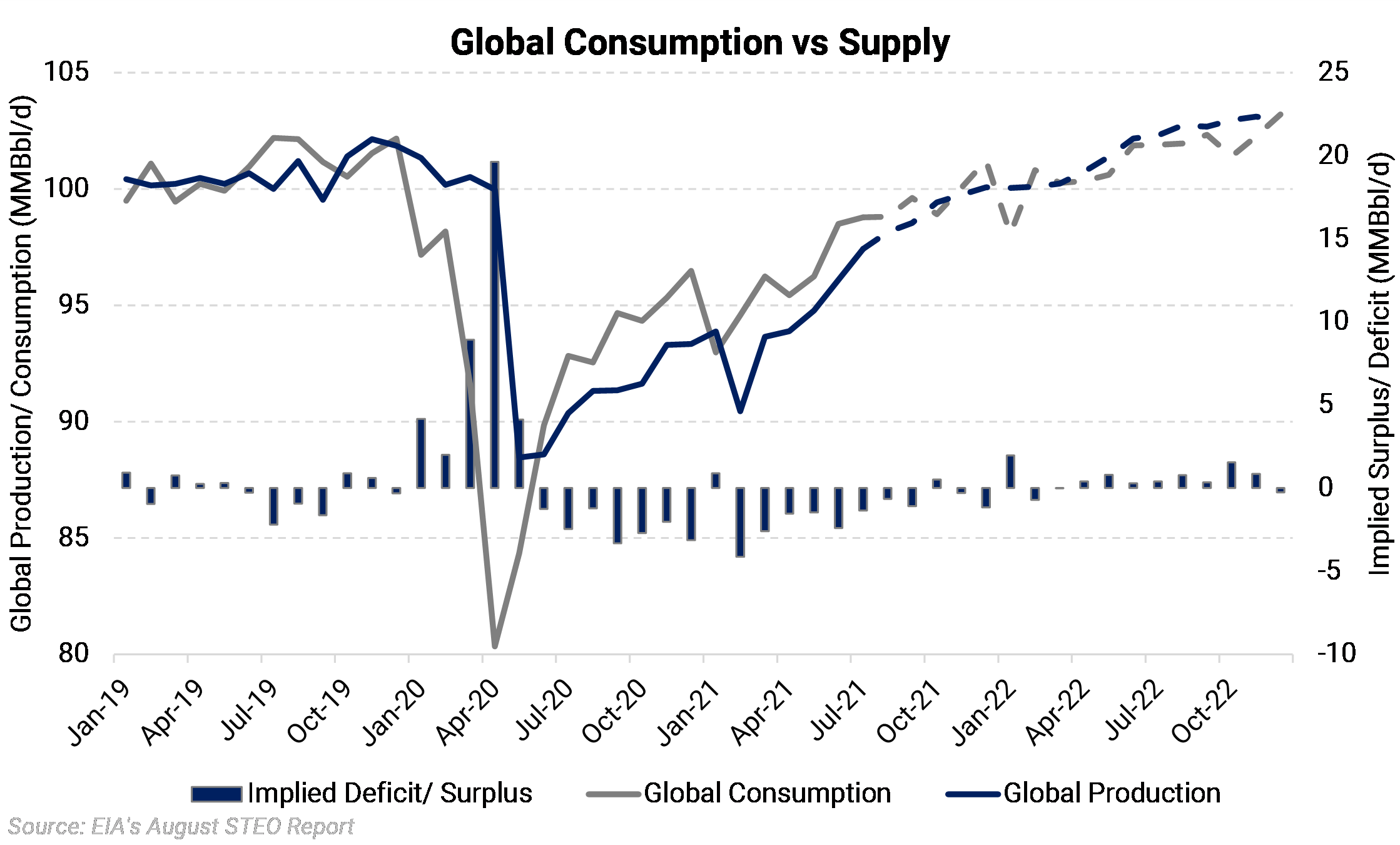

The chart on the left reflects the EIA’s August STEO report. The blue columns show the implied deficit or surplus (Global Production - Global Consumption), and the lines show the EIA’s global consumption and supply estimates. The EIA forecasts that the global market will flip to a small surplus by early 2022. The EIA also forecasts a strong rebound in non-OPEC supply in 2022, particularly from the U.S. The agency shows U.S. production increasing by 1.5 MMBbl/d in 2022, which coupled with the planned OPEC supply hikes would be very concerning for oil prices.

|