Oil prices have made a dramatic comeback this year, climbing $25/Bbl to $73/Bbl for WTI as of September 23. Will oil’s strength continue into 2022, or will supply and demand soften due to a pick-up in oil production and OPEC’s plan to bring back all of its previously held back supply?

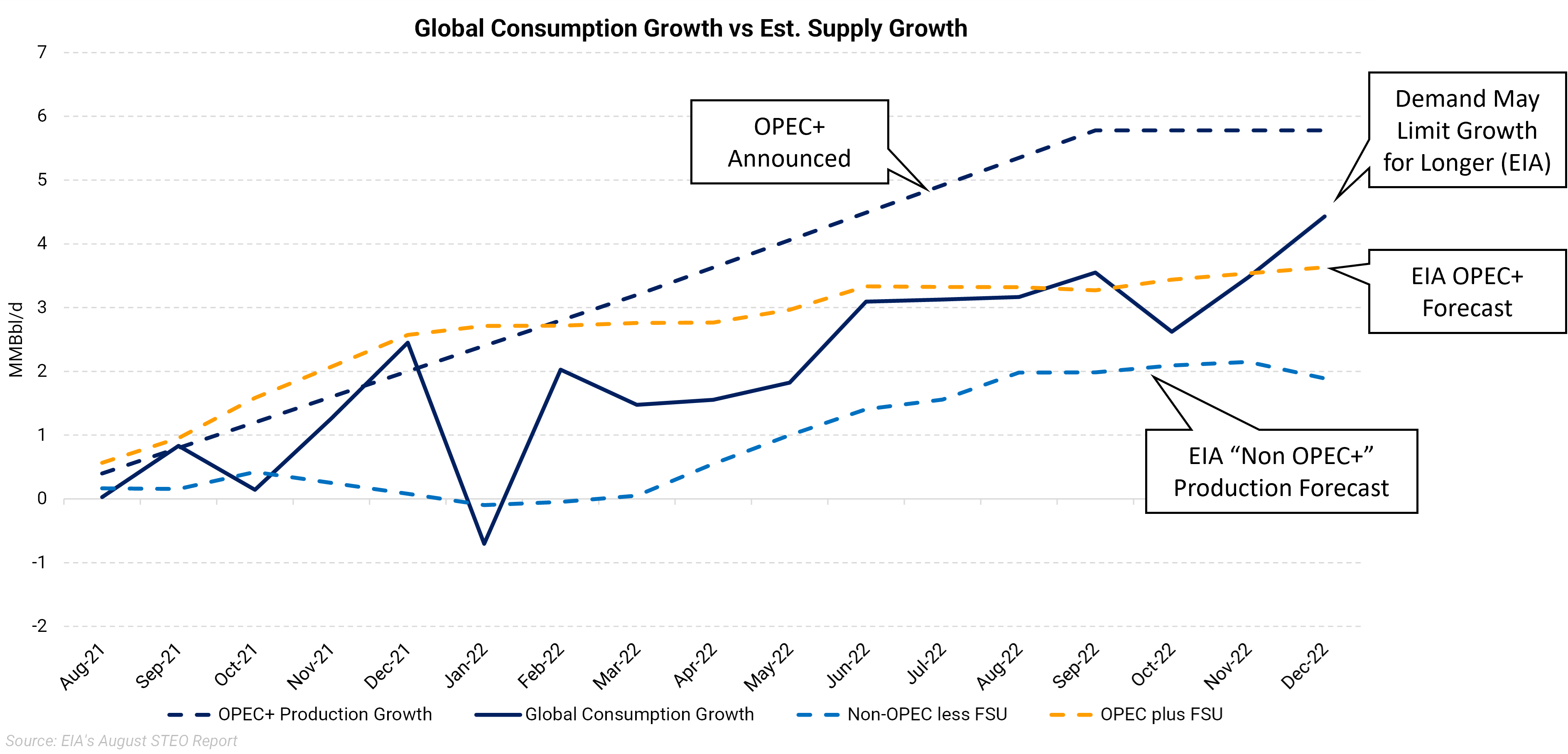

First, consider a forecast independent of OPEC’s expectations. The chart below shows how 2022 could unfold according to the EIA’s latest monthly Short-Term Energy Outlook (STEO) report. AEGIS grouped the STEO forecast into three main components: oil demand, non-OPEC production, and OPEC production. The dark blue line shows what the EIA expects of global oil consumption growth. The governmental agency then forecasts output from non-OPEC producers, including the U.S., Canada, and Brazil. The amount of crude oil demand remaining, also known as the “call on OPEC” is what the EIA will assume OPEC can produce and keep the global market near balanced. For our purposes, we include the FSU (Russia) in with OPEC+ to better compare what OPEC+ has previously announced.

Based on EIA’s current demand and non-OPEC supply forecasts, OPEC+ cannot continue adding supply, as it has previously announced, through next year and keep the oil market balanced. Oversupply would be the result.

The EIA OPEC+ forecast (dashed gold line in the chart below) shows what the cartel can produce and make supply equal to demand. But notice how the OPEC+ Production Growth (dashed dark-blue line) produces a large gap between what OPEC+ has announced and what the EIA says the group can do.

Under these circumstances, OPEC+ would not be able to release 400 MBbl/d per month back onto the market as planned, if their goal is to keep the market from being oversupplied in 2022. That is, they would have to alter their plans if they do not want to pressure prices lower. OPEC and its allies have mentioned they reserve the right to change said policy if the market needs it.

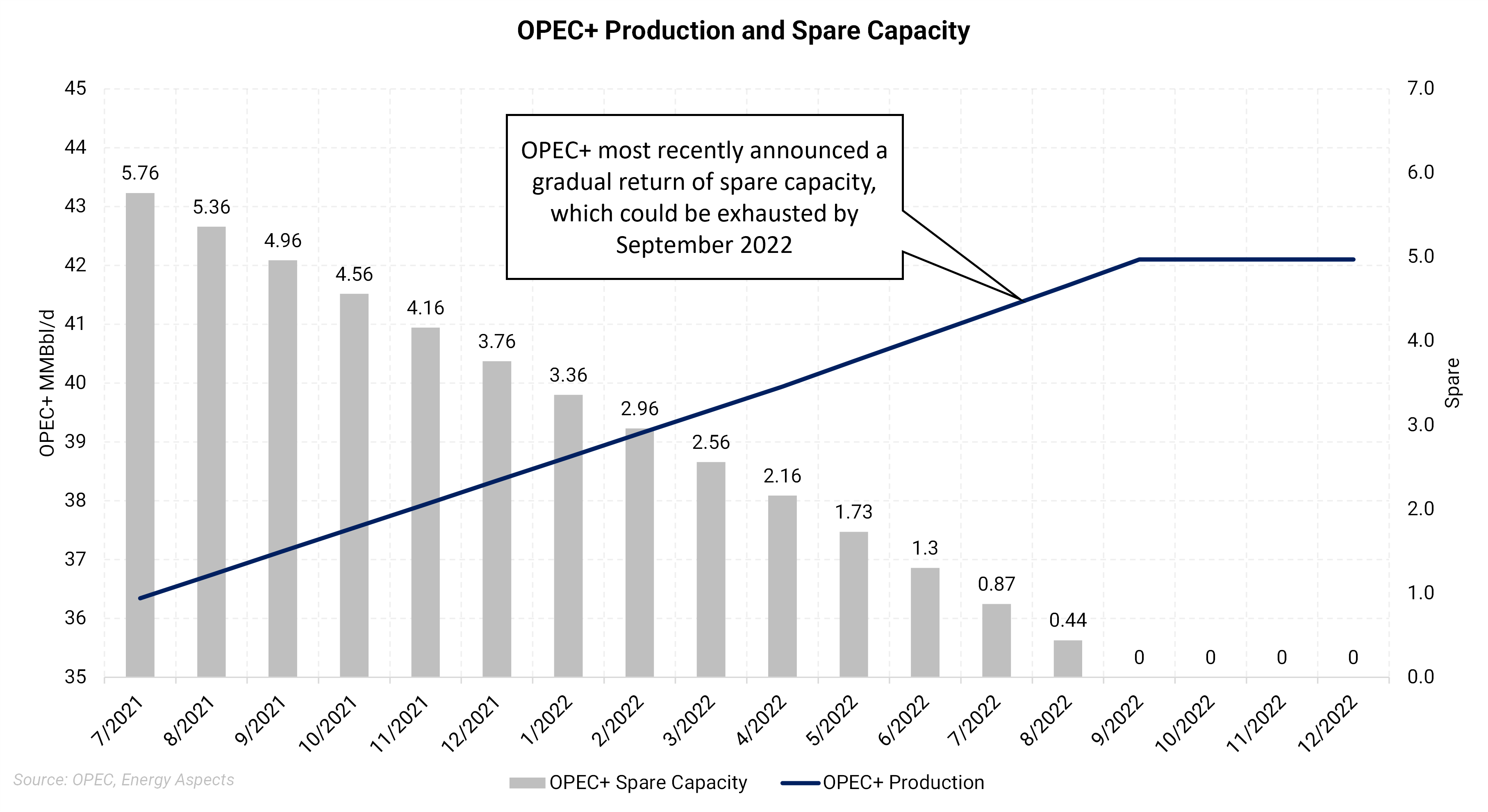

The chart below is a visualization of what OPEC+ agreed to this summer for their go-forward policy.

If the EIA's demand and non-OPEC supply forecasts are correct, then it's likely OPEC+ will have to reduce how much supply they return to the market in 2022 to keep prices near current levels.