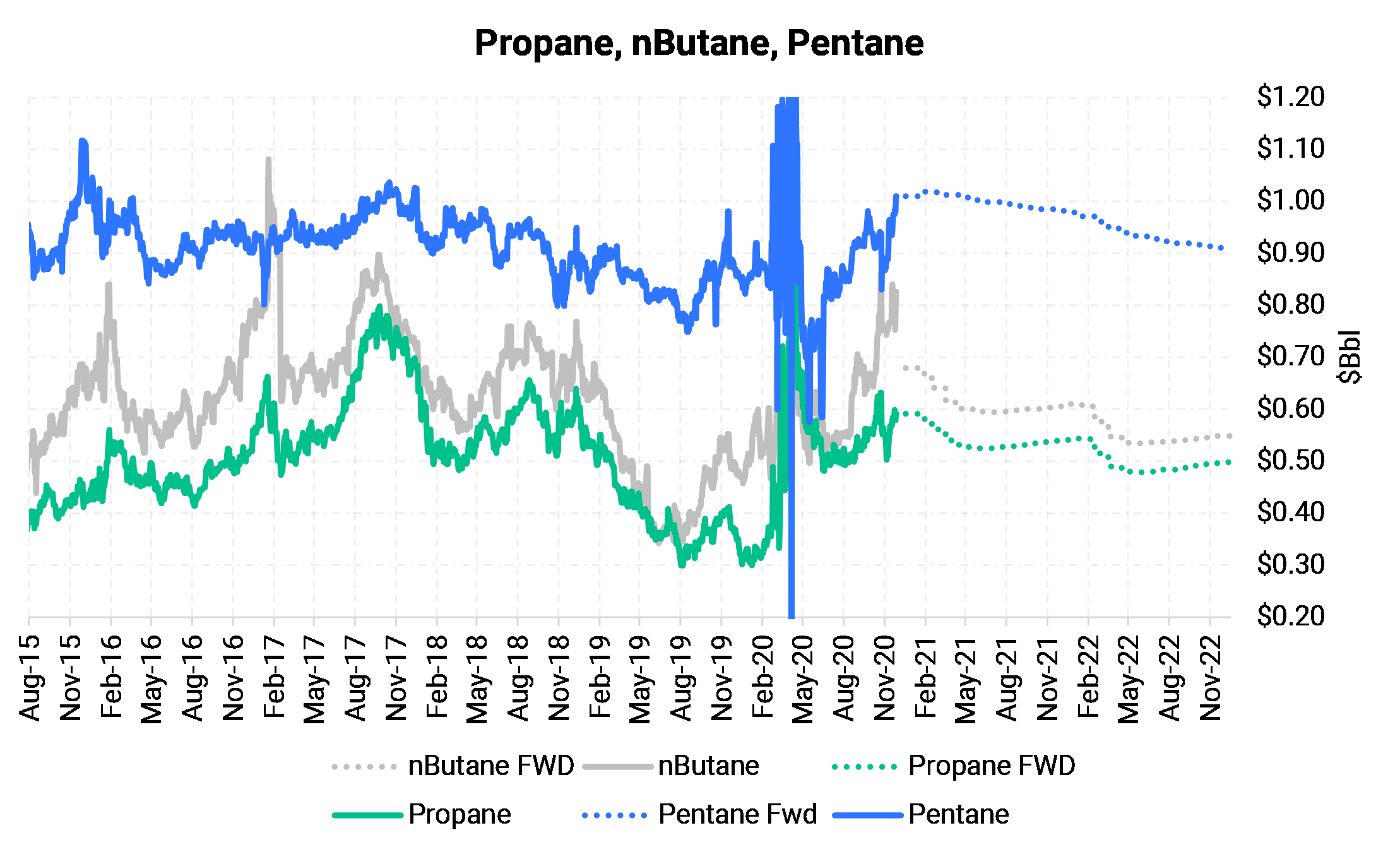

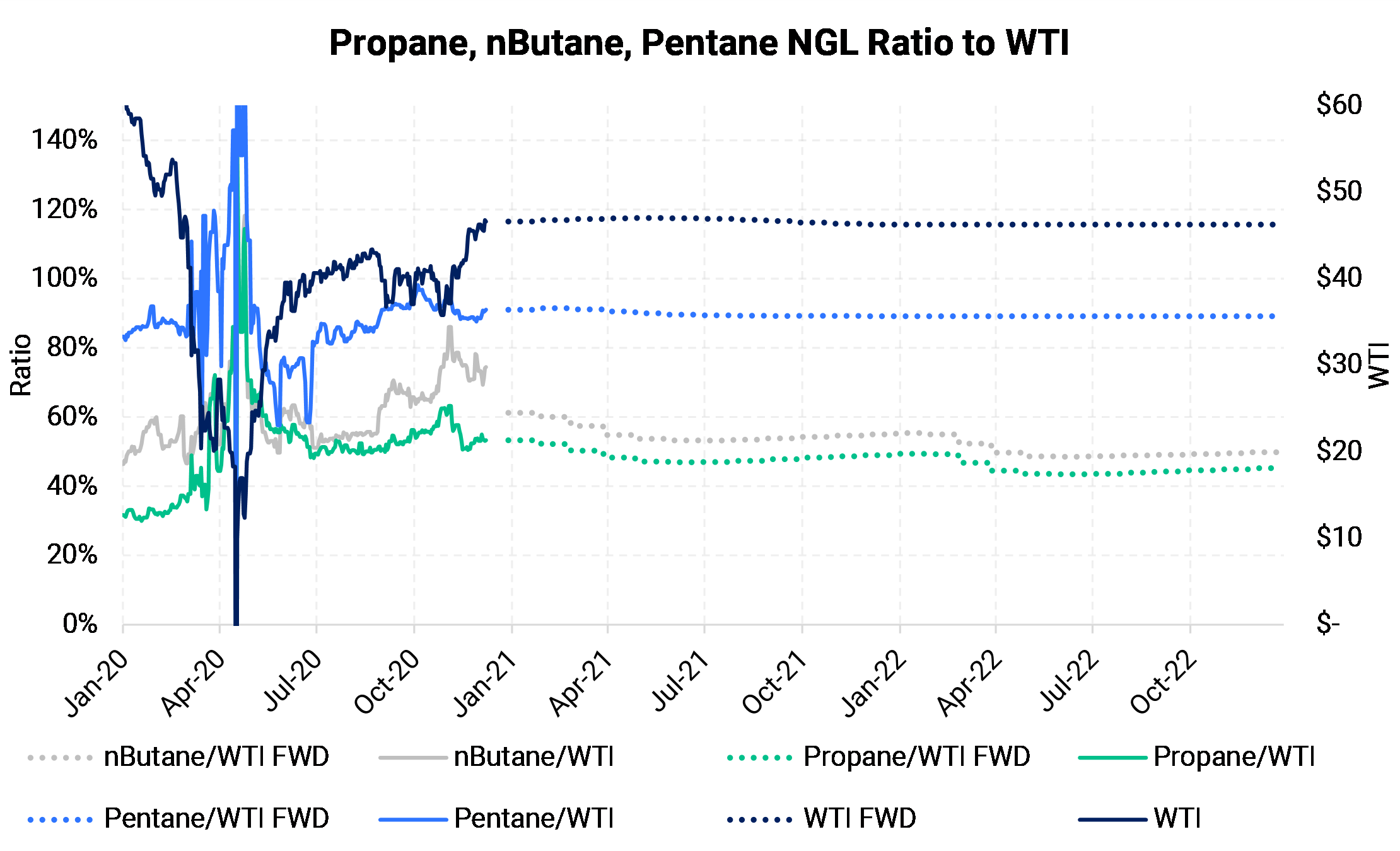

Prices of Mont Belvieu natural gas liquids, C3, C4, and C5 (propane, butane, pentane), have benefited as WTI prices have reached multi-month highs. Pentane (C5) has recovered to above $1/Bbl. All things being equal, the NGLs discussed here (sorry, ethane) move in some correlation with oil prices. The chart on the bottom right shows the historical and forward-curve relationship between C3-C5 and WTI. Each component does have its own supply and demand; therefore, each may drift between different ratios to WTI over time.

|  |

One of the largest markets in North America for C5 is usage as a diluent for heavy Canadian crude. The oil sands' bitumen in Alberta, Canada, require a blending with lighter carbon products to allow transport on pipelines back to the U.S. For example, C5 will travel north to Alberta, blend with Canada's heavy crude, then travel back to the U.S. to be consumed by refineries. Pentane's demand and ratio to WTI can increase when Canadian production rises. It's probably fair to say that the recent rise over $1/Bbl for Pentane has been more due to the rise in WTI.