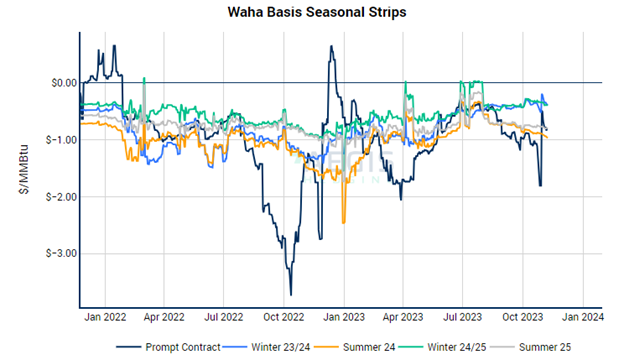

Permian dry gas production has continued to grow, contributing to the Lower 48 supply hitting new records. At the same time, Waha prices have been weaker in the past few months, both in the rolling prompt-month contract and future summer strips.

Source: Bloomberg. Please note that some historical price marks can show inconsistent values. Prices as of 11/8/2023

Source: Bloomberg. Please note that some historical price marks can show inconsistent values. Prices as of 11/8/2023

During the past summer, prompt Waha gas prices were close to Henry Hub, trading within 27 cents in June. However, as fall approached, these prices deteriorated, reaching over a $1.00/MMBtu discount compared to the Hub. Concurrently, the prices for Summer 2024 and Summer 2025 strips also decreased by approximately 20 cents and 10 cents, respectively. By early November, the Summer 2024 Waha gas strip was trading at around -$0.95/MMBtu.

Waha basis often sees significant price discounts compared to the Henry Hub benchmark, as gas production frequently exceeds or nearly matches the available pipeline capacity. There are rumors that the Whistler pipeline expansion, which would increase pipeline egress, is operational. However, there is also speculation of an increase in gas supply with this added capacity. The operational status of the Whistler expansion, which adds 500 MMcf/d, is primarily inferred from indirect evidence, as it is an intrastate pipeline with different reporting requirements than those crossing state lines. Additionally, White Water Midstream, the pipeline's owner, has not publicly commented on the status of the expansion.

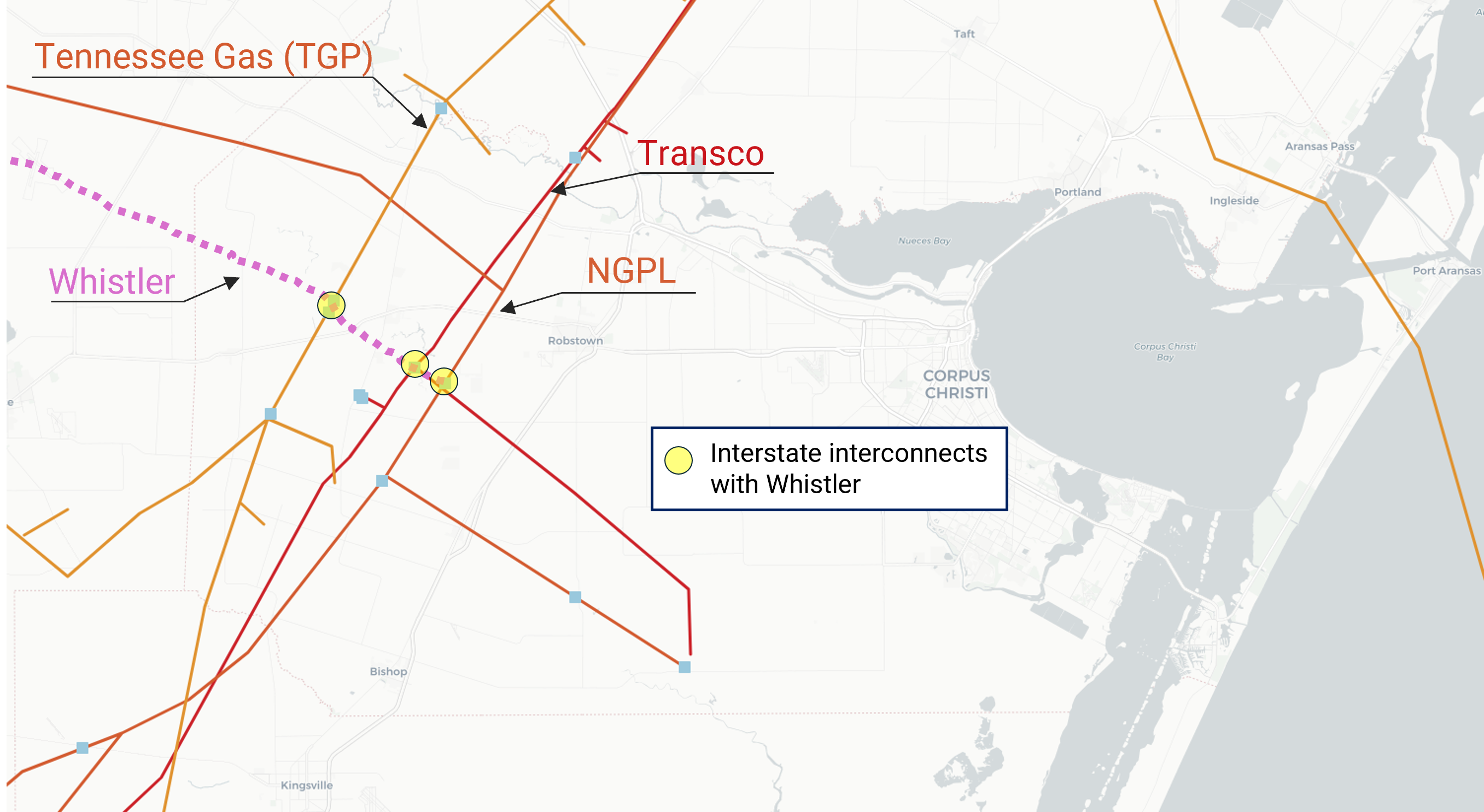

Below is a map showing three interstate pipelines connecting with the Whistler pipeline. Whistler carries gas from West Texas to the Agua Dulce hub near Corpus Christi, Texas. Whistler connects with Transco, TGP, and NGPL near the South Texas gas hub.

Source: S&P, AEGIS, WhiteWater Midstream

Source: S&P, AEGIS, WhiteWater Midstream

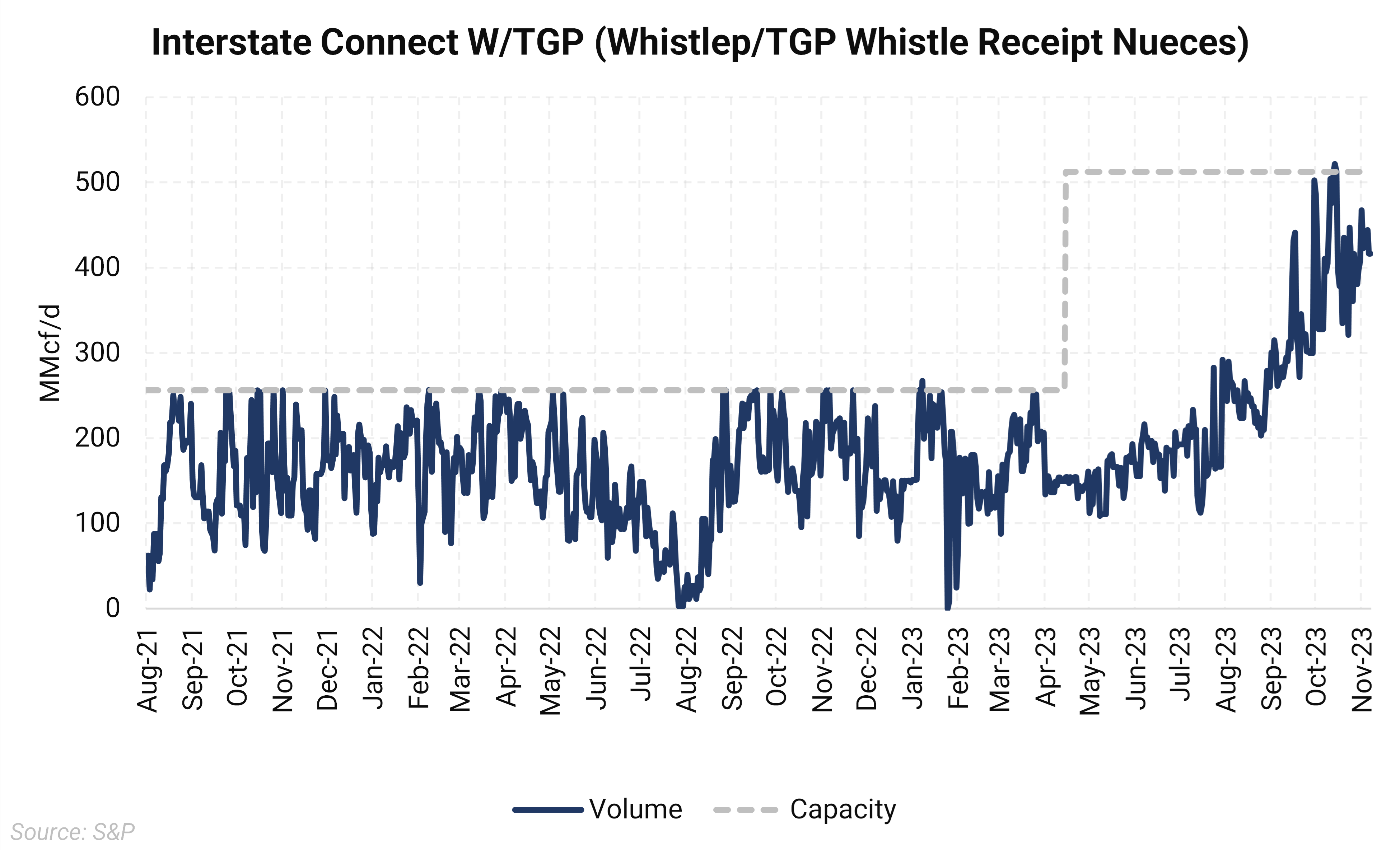

The Tennessee Gas Pipeline (TGP) meter increased its operational capacity in the spring to 512 MMcf/d. Gas flows on Whistler started rising in late July and were recently near the new capacity limit.

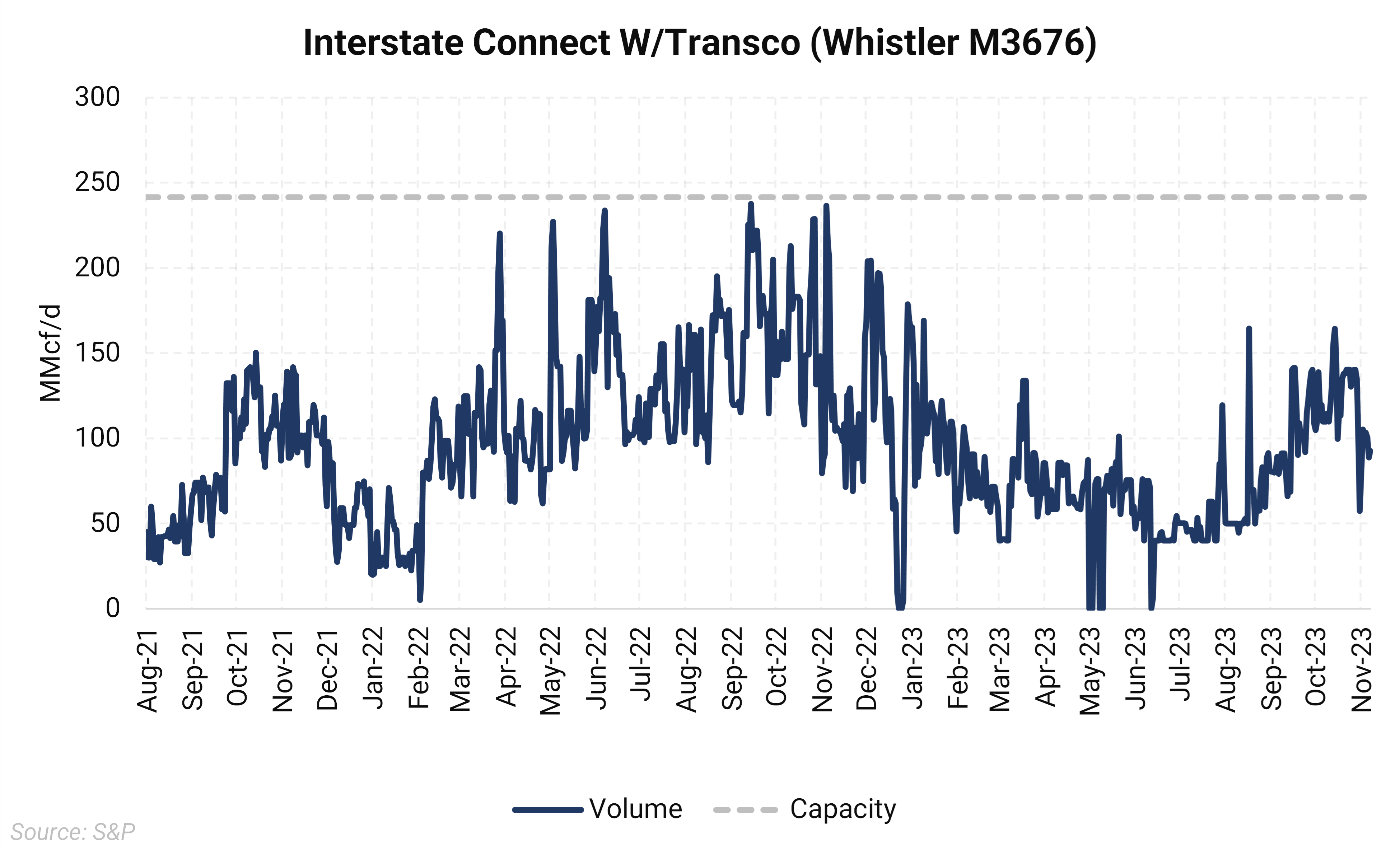

Flows onto Transco from Whistler were more muted as volumes peaked at just over 150 MMcf/d.

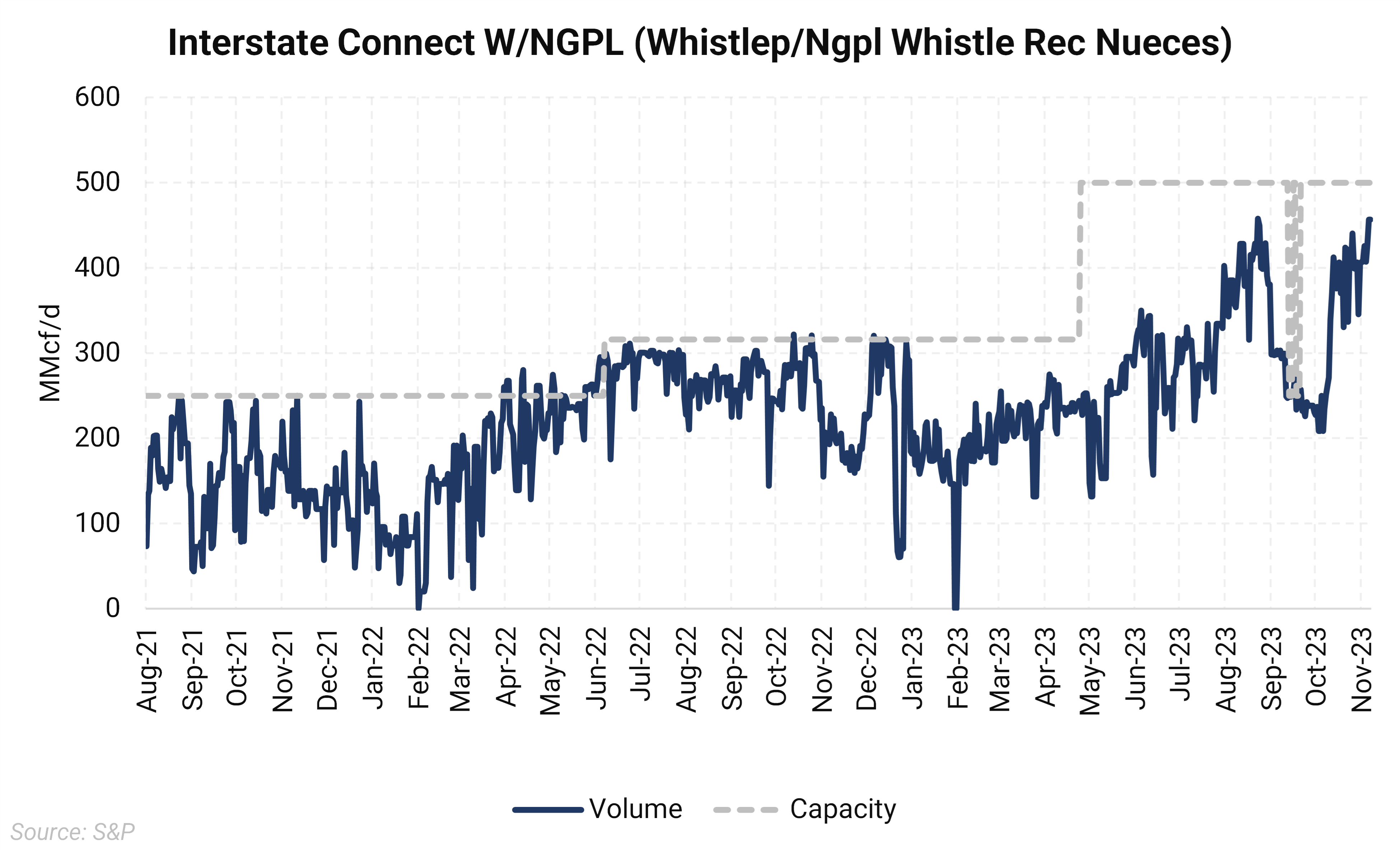

Like TGP, Whistler's connection to NGPL showed record volumes flowing recently. The meter for NGPL increased its capacity in April to 500 MMcf/d, and in recent days, it has been flowing over 400 MMcf/d.

The flow increase on these three interconnects near the Agua Dulce hub provides evidence that Whistler's 500 MMcf/d expansion has started to come online.

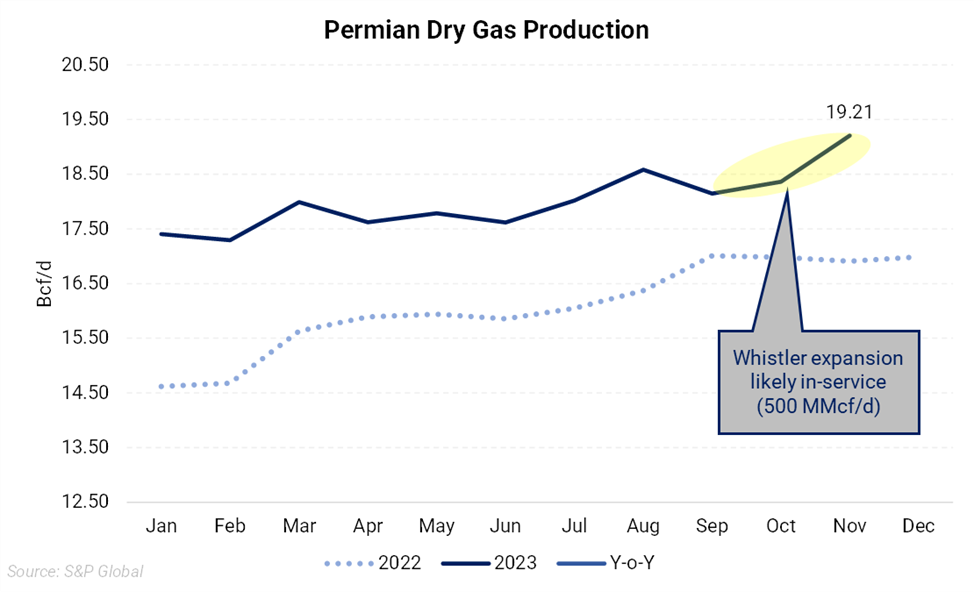

The addition of Whistler's expansion allows Permian operators to send more gas to the Gulf Coast. On November 8, modeled dry gas production in the Permian was 19.21 Bcf/d, according to S&P data. The current Permian supply contributes to the record level of Lower 48 production of 105.4 Bcf/d.

Typically, new pipeline egress for a supply region can mean an improvement in basis relative to Hub. The estimated increase of flows coming from Whistler could indicate that there is plenty of supply to go around, and all that is needed is a way for it to leave the basin. Although it's uncertain whether the Whistler pipeline is operational and whether any additional gas it might be carrying is incremental or redirected from other pipes, past experiences show that Permian operators are adept at quickly utilizing new pipelines to increase gas supply.