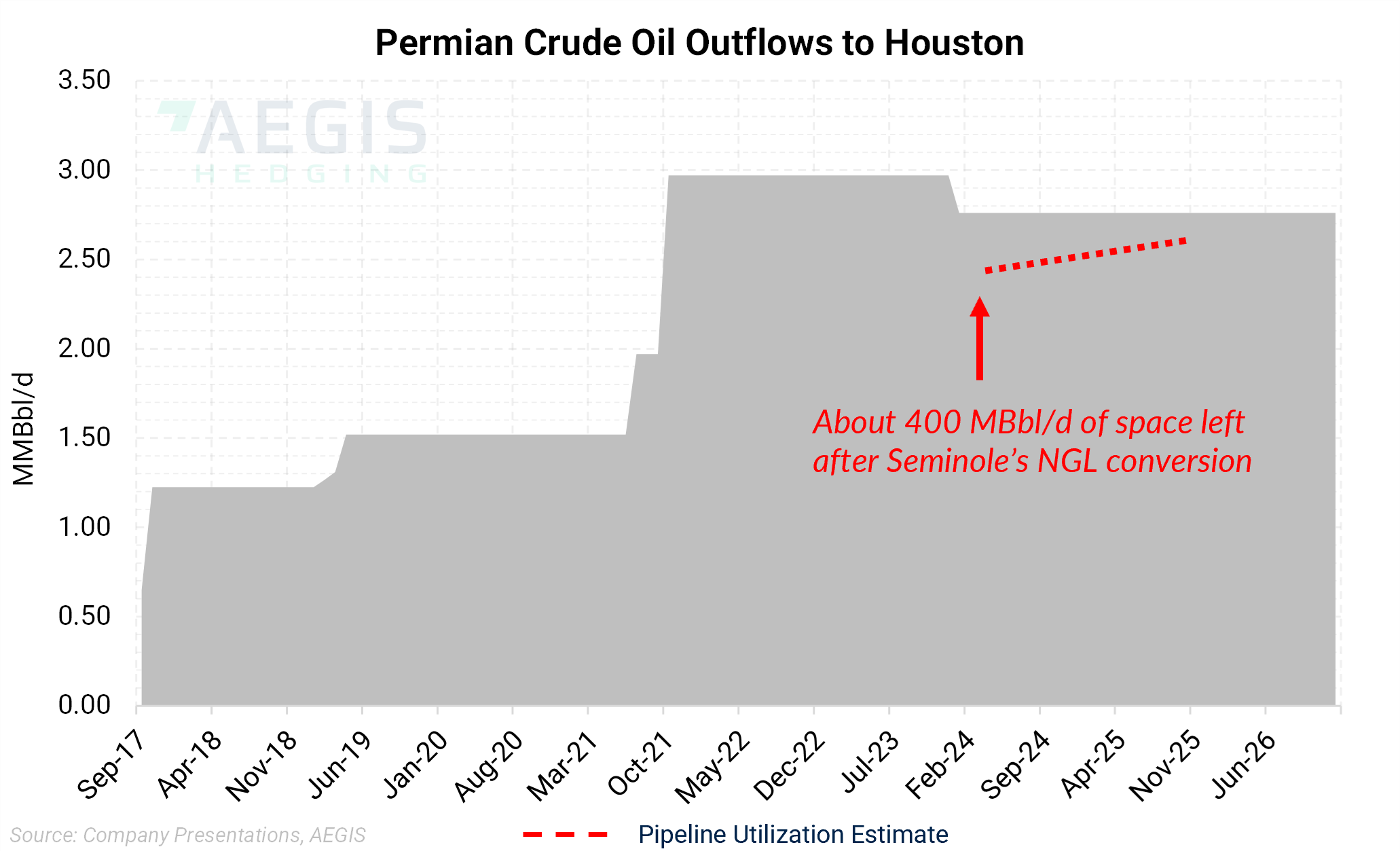

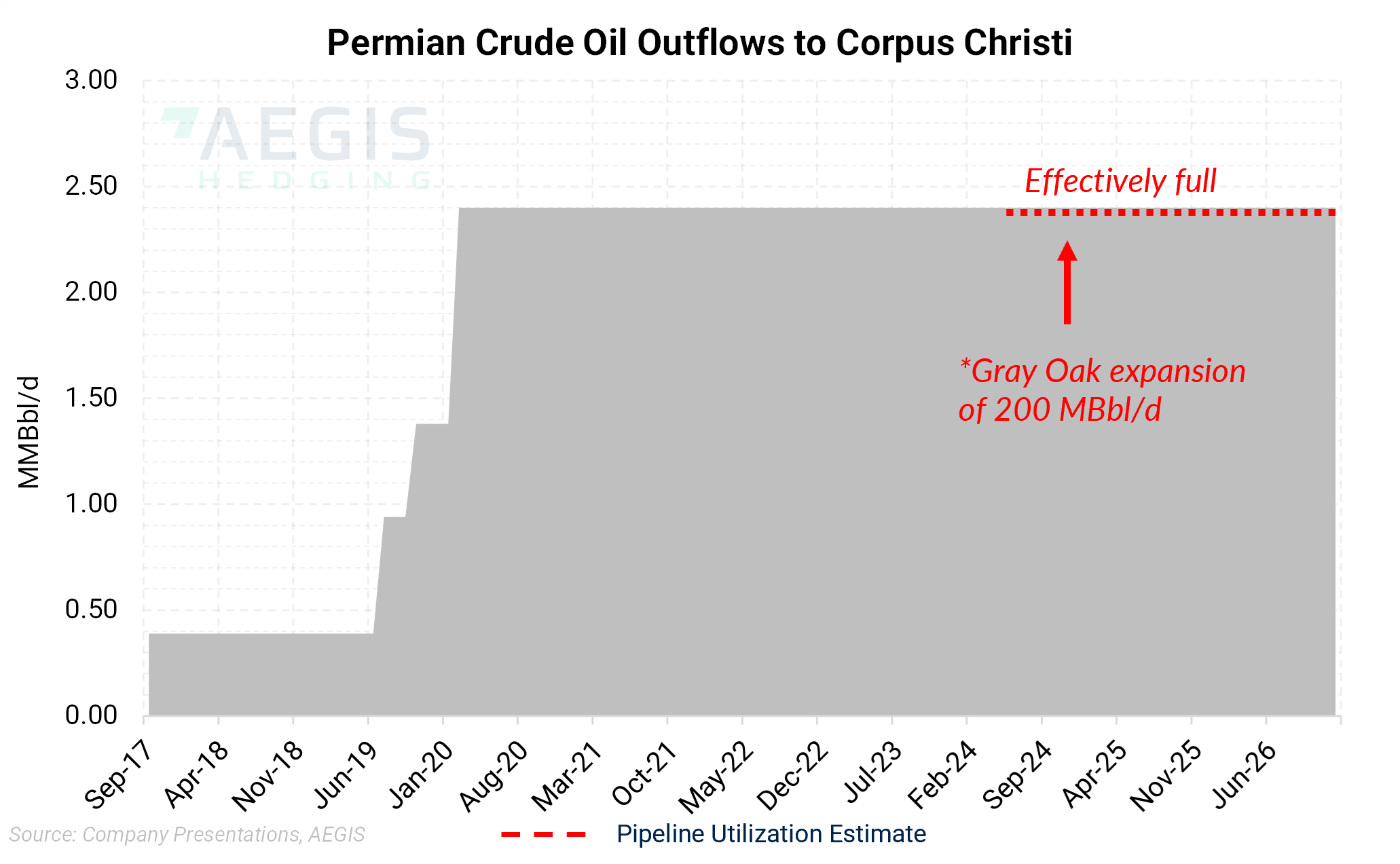

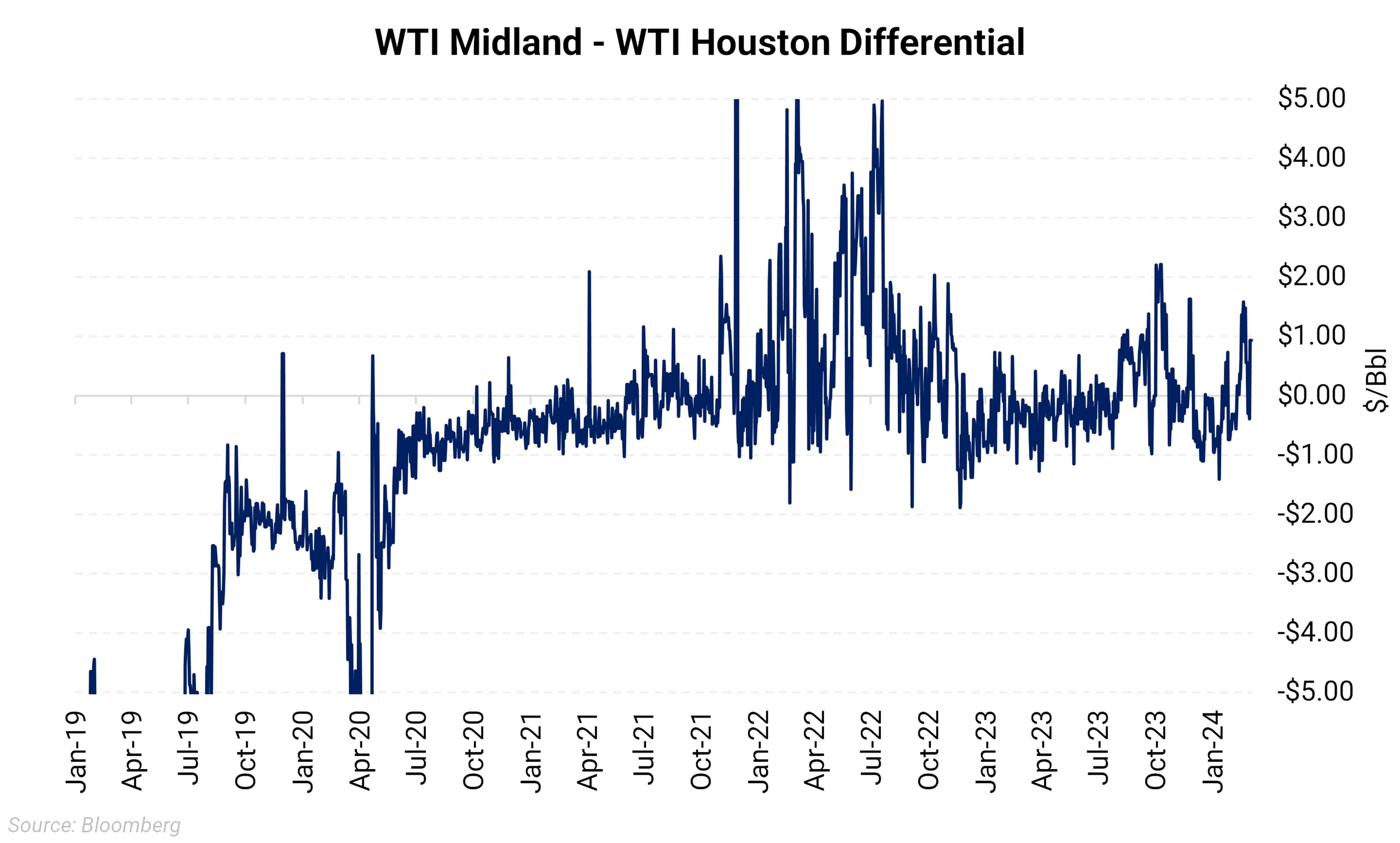

More attention is focused on the Permian as its supply is growing, pushing the utilization rates of pipelines to the Gulf Coast higher, with expectations to reach full capacity by year-end. The rise in Permian oil production, expected to grow by about 340 MBbl/d this year, according to Rystad estimates, is quickly nearing the limits of current infrastructure. This bottleneck highlights the pressing need for additional infrastructure to accommodate the increasing oil output. Although the Gray Oak pipeline expansion provides a near-term buffer, its additional capacity of just 200 MBbl/d may soon be filled by the pace of production growth. Prices reflect this, too; as the pipelines began to fill, the Midland-Houston (MEH) differential improved from averaging around -$3.08 (2018-2022) to average at about -$0.30 in February. |

|

|

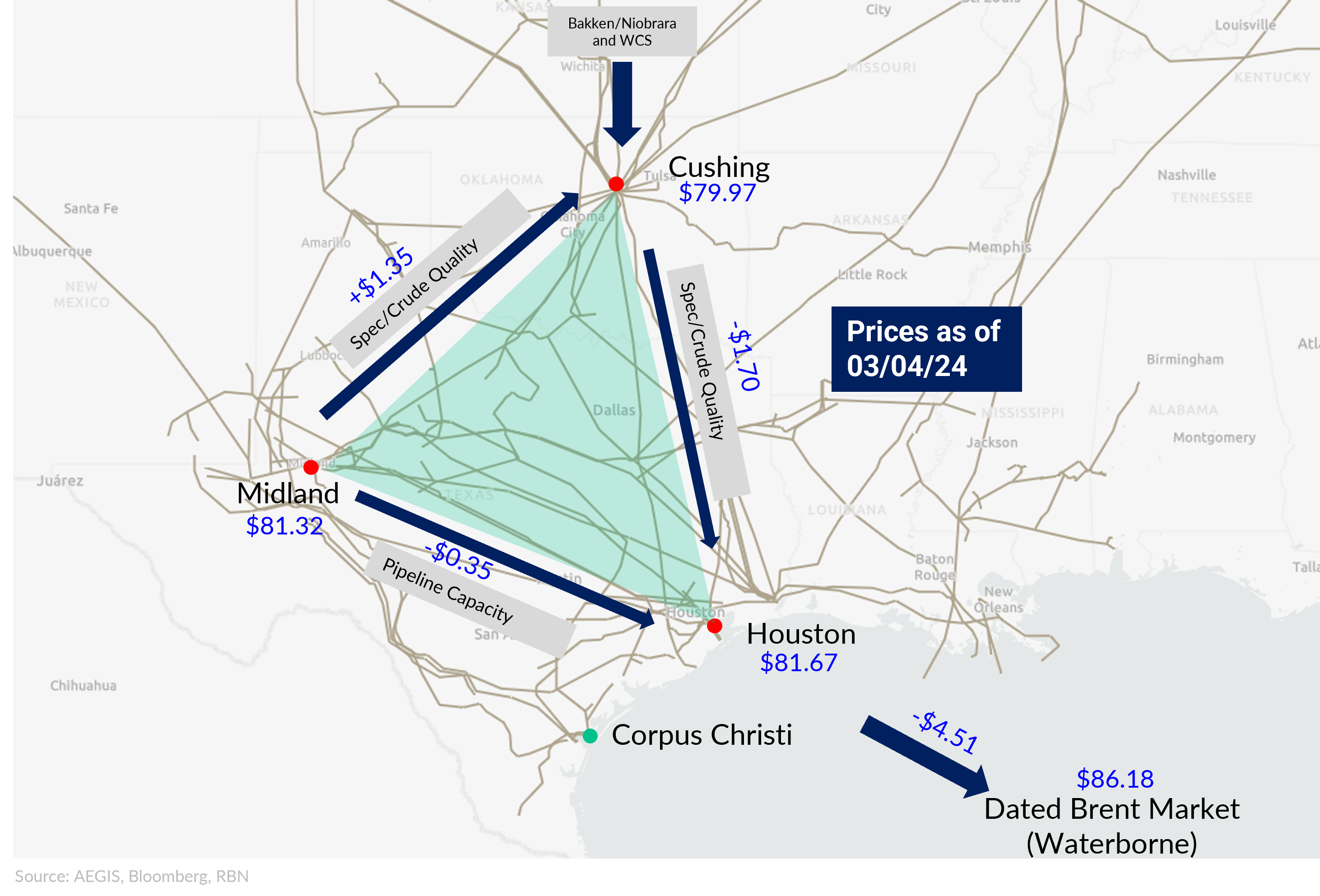

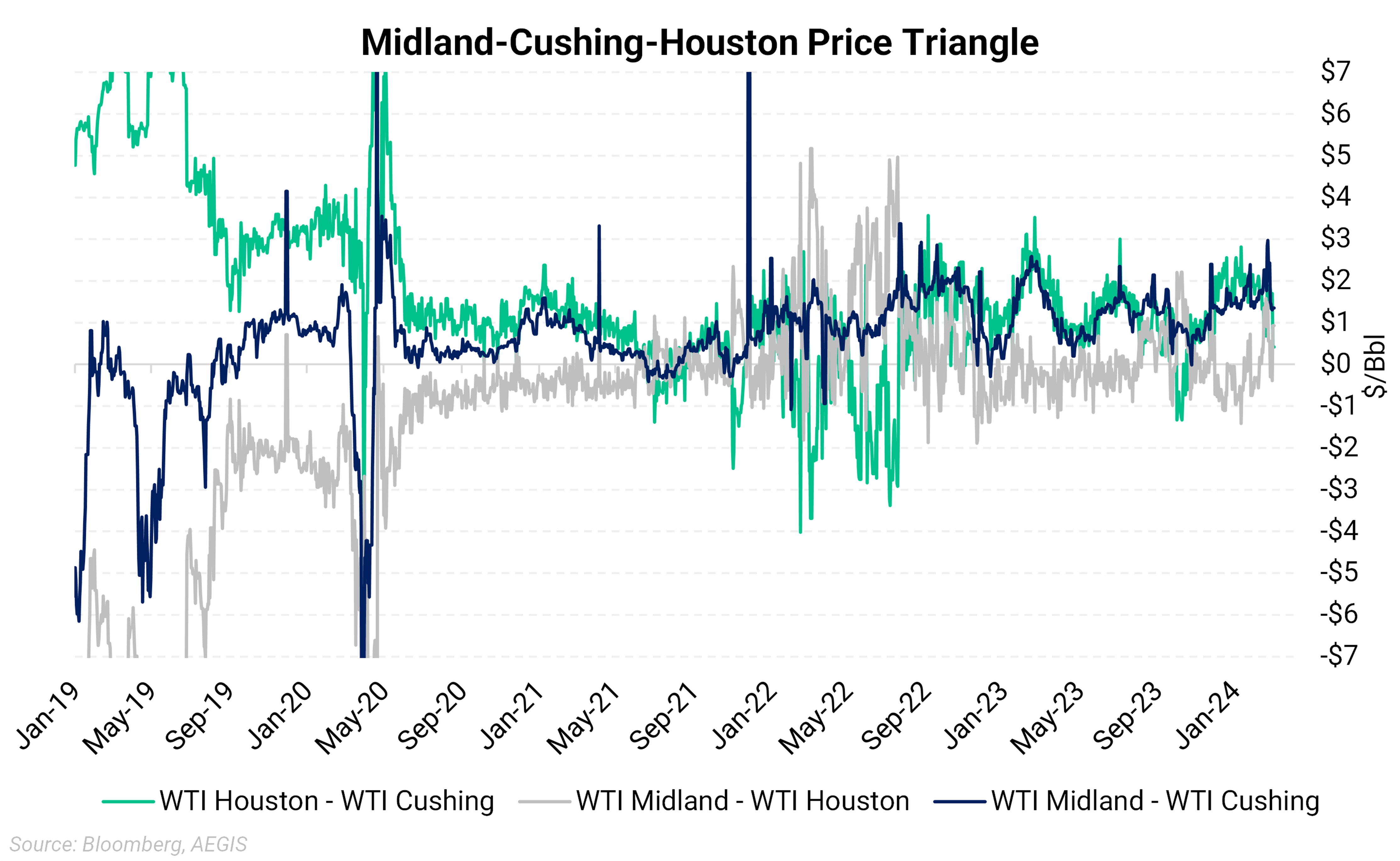

The Midland-Cushing-Gulf Coast “triangle,” as we refer to it, plays an important role in the U.S. oil market. It illustrates the complex interplay between production, storage, and transportation, which ultimately influences global oil prices. Crude oil from Midland, a key production area in the Permian Basin, was traditionally transported to Cushing, Oklahoma, known for its extensive pipeline network for storage, blending, and further distribution. Cushing serves as a pricing point for NYMEX WTI. Oil from Cushing could then be moved to the Gulf Coast, a major refining and export hub. The economics of these movements are dictated by price differentials, which are influenced by crude specifications, transportation costs, export economics, and international demand, driving the flow of oil based on its market value and the cost-effectiveness of delivery to domestic and international buyers. However, with the construction of new pipelines directly connecting Midland to the Gulf Coast, the dynamic within this triangle has evolved. This direct route bypasses Cushing, giving quicker access to international markets, where U.S. crude, especially the light, sweet grade from the Permian Basin, is in high demand. The chart below tracks the change in spreads along the Midland-Cushing-Houston triangle. Both WTI at Midland and WTI at Houston have been trading at a premium versus the benchmark at Cushing. |

|

|

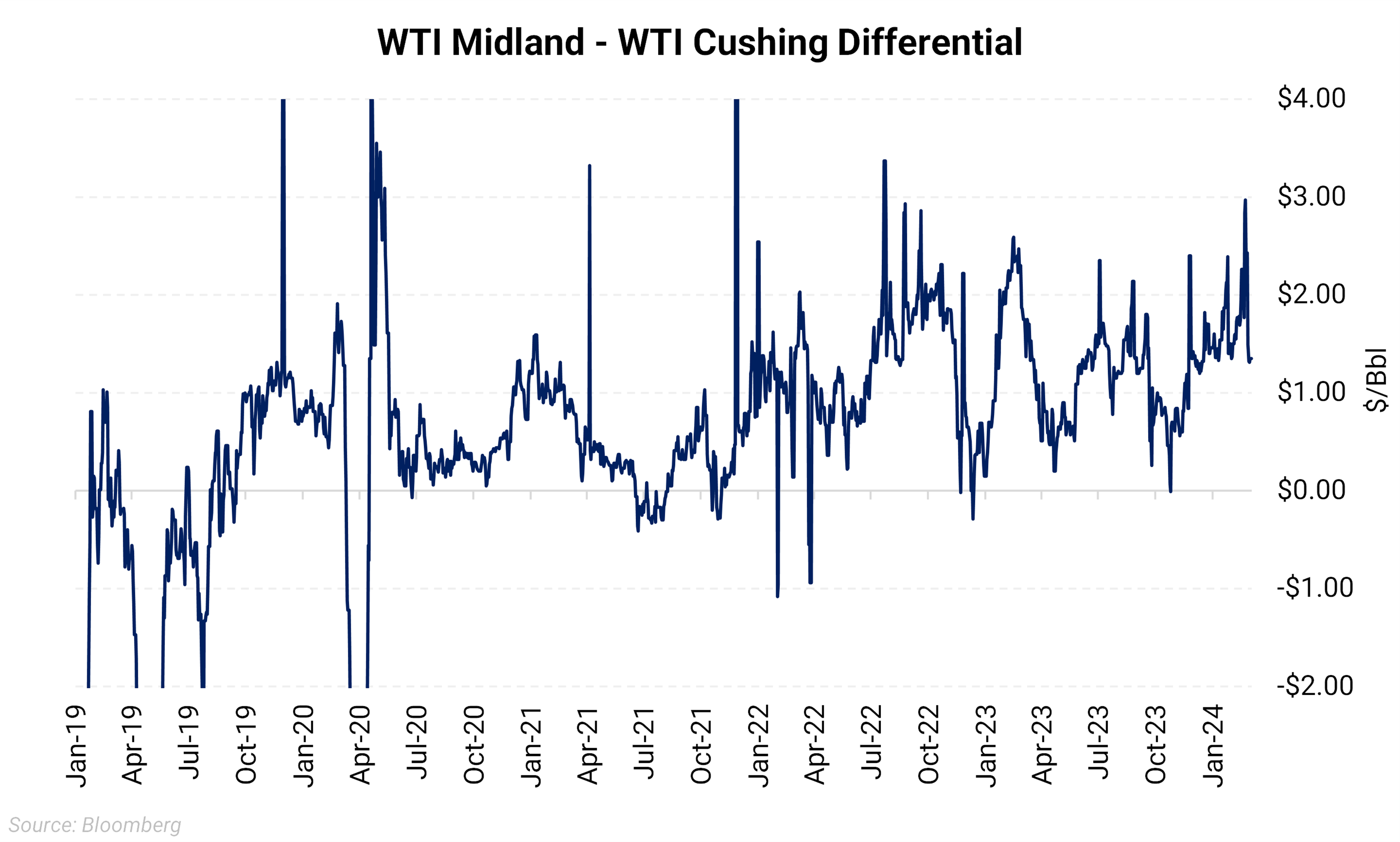

Prior to the Permian-to-Gulf pipeline buildout, barrels priced in Midland traded at a discount to Cushing. In the past, when supply from Midland got tight, the differential narrowed (less of a discount). For the past four years, Midland has traded at a premium to Cushing. This is because of the build-up of the Midland-Gulf coast route in addition to blending economics. In the past, the Mid-Cush differential was -$2.74/Bbl (2017-2019), but it has risen to an average of $1.21/Bbl in 2023. |

|

|

Furthermore, WTI Midland generally trades at a premium to WTI Cushing because Cushing needs the Midland barrels for blending purposes. WTI at Cushing, also known as Domestic Sweet (DSW), is a blend that conforms to the NYMEX WTI futures contract delivery standards with an API gravity between 37-42o and sulfur content of up to 0.42%. Meanwhile, WTI in Midland is considered "neat" crude and is not significantly blended with other crudes. WTI Cushing's blend usually includes a variety of crudes such as Bakken, Niobrara, and lower-quality crudes like WCS, which is already heavily discounted due to its low API gravity and high sulfur content. This results in WTI Cushing (DSW) being discounted to the higher quality WTI Midland. Two major pipelines transport oil from the Midland to Cushing - the Basin Pipeline (450 MBbl/d) and the Centurion Pipeline (250 MBbl/d). These pipelines are currently operating at about 60% capacity, with the majority of WTI volumes from the Midland to Cushing flowing through the Basin pipeline, according to RBN Energy. |

The charts below show takeaway capacity from the Permian basin to Houston and Corpus Christi.

|

|

|

Before the large infrastructure buildout out of Permian from 2018-22, the Midland-Houston (MEH) differential averaged about -$3.08/Bbl (2018-22). However, this differential has improved to an average of -$0.30/Bbl in February 2024. It shows signs of recovery as pipeline capacity begins to fill, especially with the pipelines to Corpus Christi operating at maximum capacity driven by the rising demand for loading large VLCCs at the Ingleside terminals, offering lower shipping costs. |

|

|

Additionally, the prospects for increasing crude flows from the Permian-to-Cushing appear limited beyond the Gulf Coast export corridor, positioning Houston as the viable destination for Permian crude. According to estimates from RBN, nearly 400-450 MBbl/d of capacity is available on the Houston corridor even after accounting for the Enterprise Seminole’s (210 MBbl/d) conversion back to NGL service. With Permian crude production expected to rise by at least 340 MBbl /d (Rystad) in 2024, this will leave roughly 110 MBbl /d of capacity, pushing barrels toward less attractive markets outside of Houston. Additionally, as mentioned in mid-cush, Midland's ‘neat’ barrels are in high demand for international markets because of their lower sulfur content and lighter nature. This quality makes it a preferred input for refineries producing high-value, low-sulfur refined products. In summary, more attention is being focused on the triangle differentials as the growing supply out of the Permian is filling takeaway capacities on the existing pipelines to the Gulf Coast. Should this bottleneck continue, Midland prices may be pressured, incentivizing additional infrastructure development from the Permian Basin. |