|

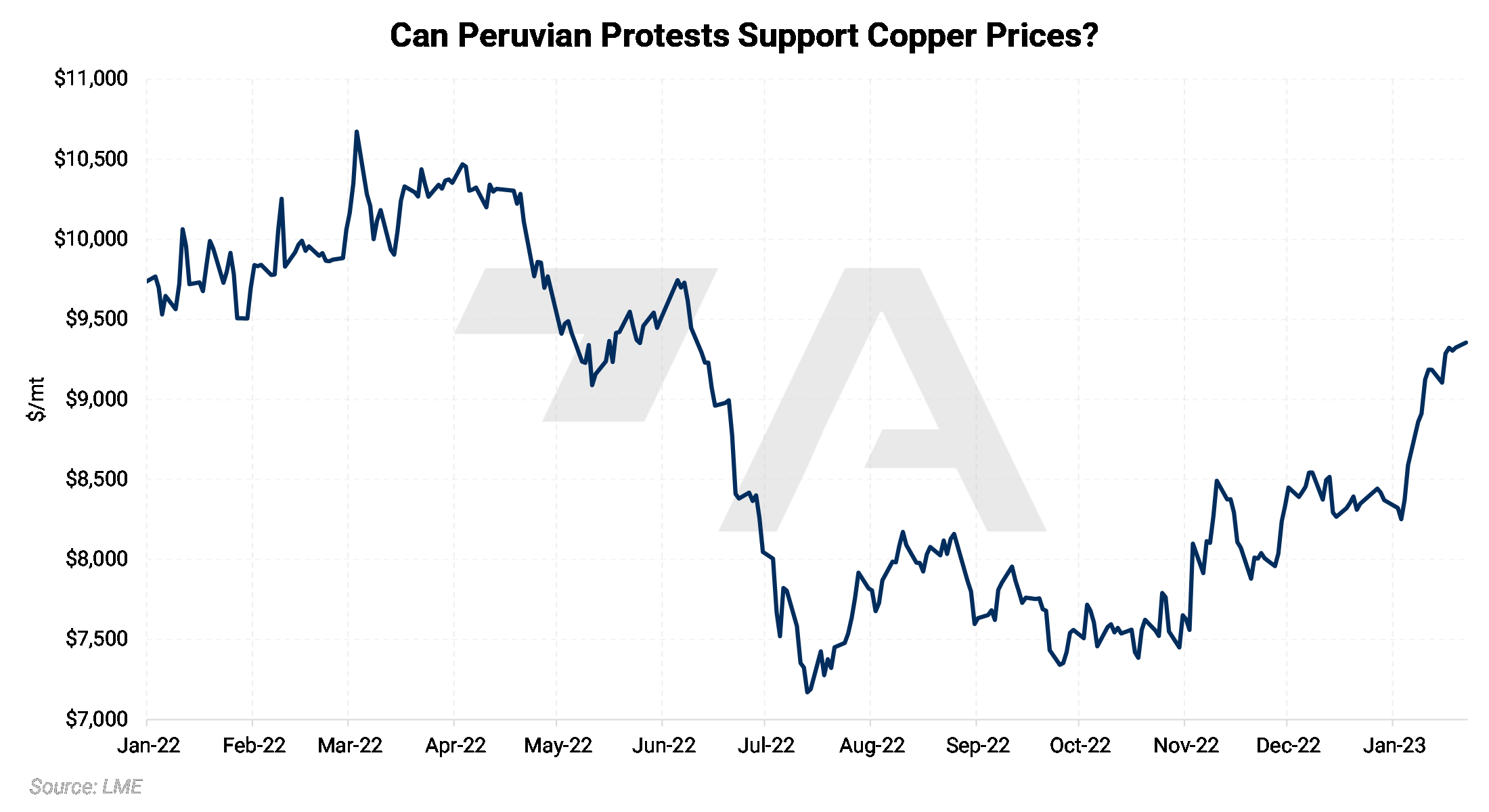

The LME Copper 3M Select contract last settled at $9,335/mt (1/24/2023 close). This contract could be on pace for the highest monthly close since June 2022. |

|

|

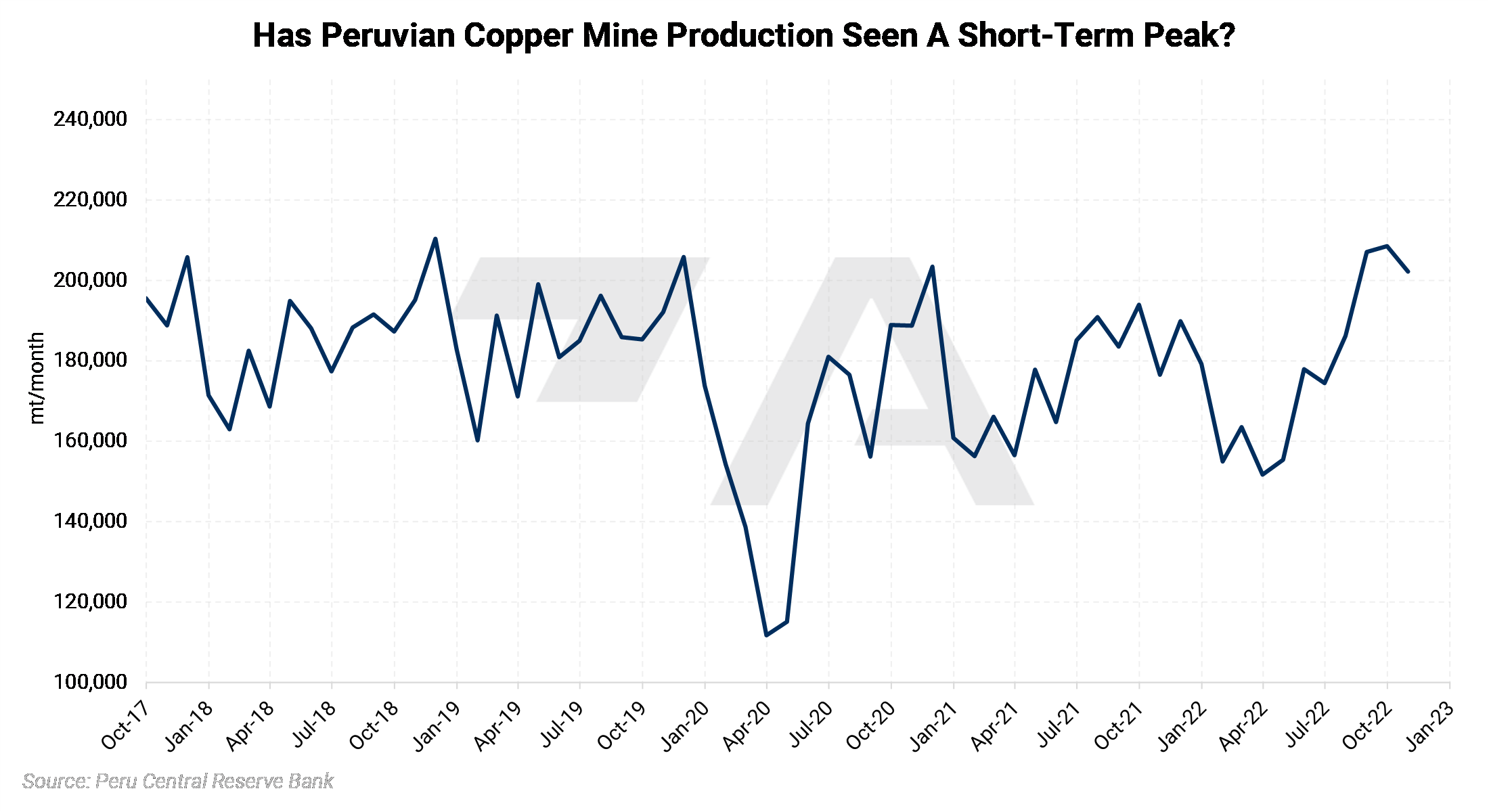

Protests throughout Peru have worsened in recent weeks, potentially restricting access to the country’s copper supply, according to Bloomberg. The Las Bambas mine, which is responsible for approximately 2% of the world’s copper mine supply, has seen transport of copper concentrates impacted by road blockades, according to Reuters. Last Friday, January 20, Glencore announced that they had suspended operations at the Antapaccay copper mine after the 3rd attack on the facility in a month. Moreover, transport officials recently told Reuters that protestors have blocked roads in 18 of 25 of the country’s regions. The ongoing protests began in early December when then-President Pedro Castillo was impeached and arrested on corruption charges. At 2.2 million mt, Peru was the world’s second-largest copper miner in 2021, according to USGS data. (Source: Reuters, Bloomberg, USGS) |

|

|

The following map was taken from the Peru Ministry of Energy and Mines’ 2021 annual report. All copper mines that were in production at that time are designated with a red box. As we can see, most of the copper mines are in the southern half of the country. Any significant road blockages or protests are likely to impede copper production in that region. |

|

|

|

So why are Peru’s issues “potentially bullish” even though the new and ongoing protests have not impeded zinc or copper production? According to Bloomberg reports, nearly $1 billion of copper is “trapped” in storage at the Las Bambas mine due to road blockages. If protests persist or worsen, the production or transport of zinc or copper could be affected. Thus, given that zinc and copper prices are down for the year, this could be a good time for end-users of either metal to hedge future needs. This would allow such an end-user to be “ahead of the game,” should protests interrupt the production or transport of zinc or copper. Consumers can hedge zinc in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum zinc price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.