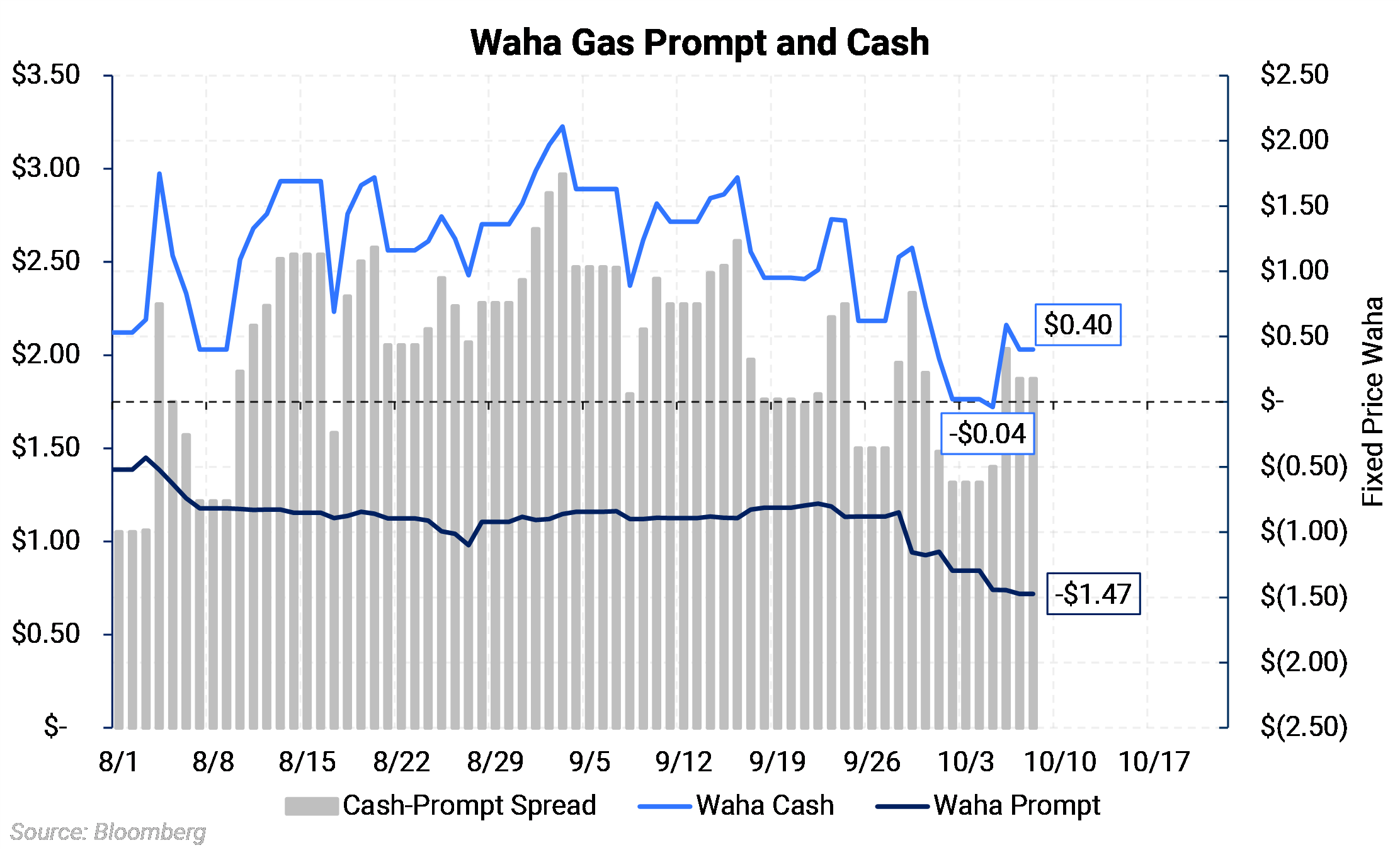

Unplanned maintenance on El Paso Natural Gas (EPNG) and Transwestern Pipeline have pressured cash and prompt Permian gas prices.

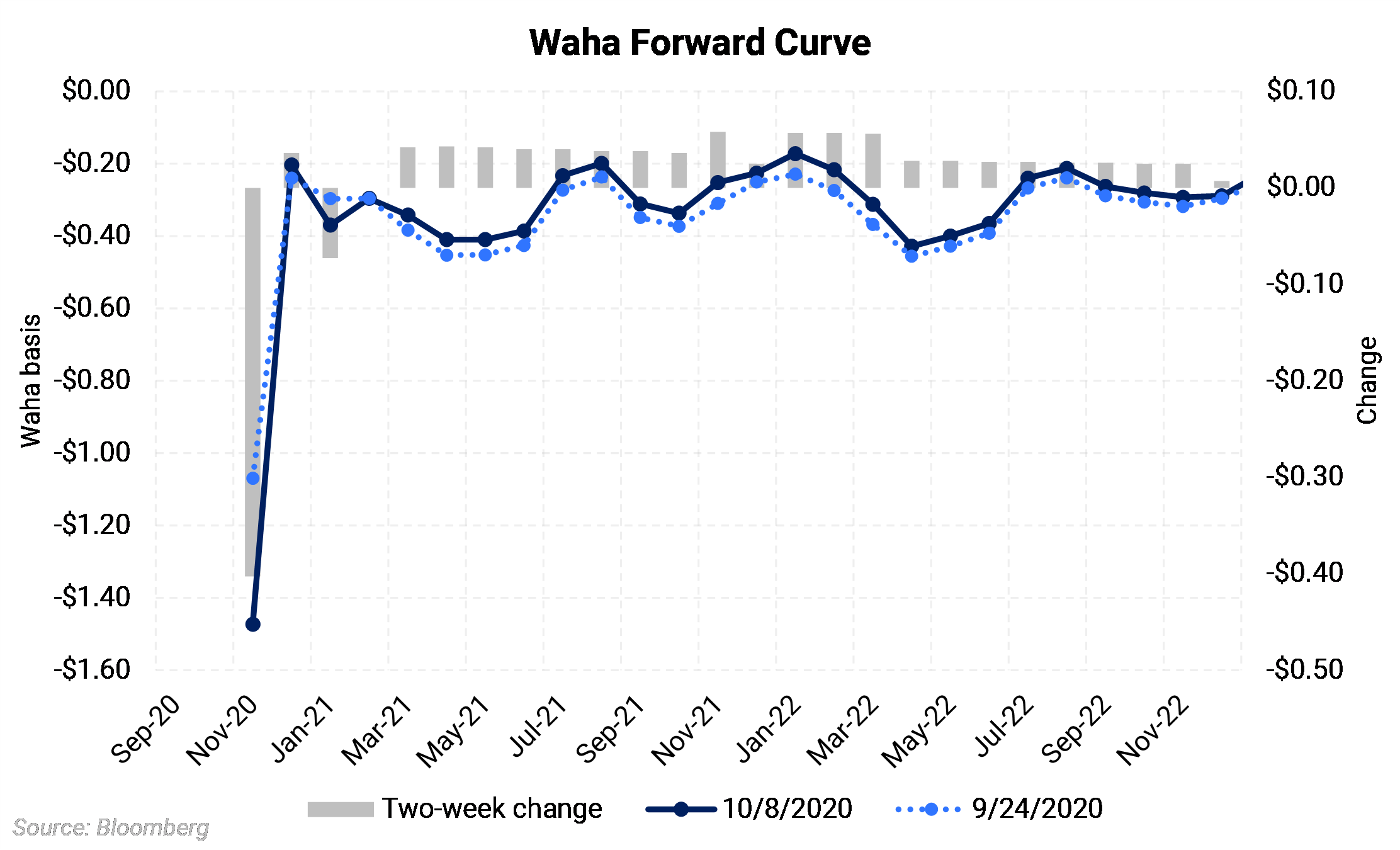

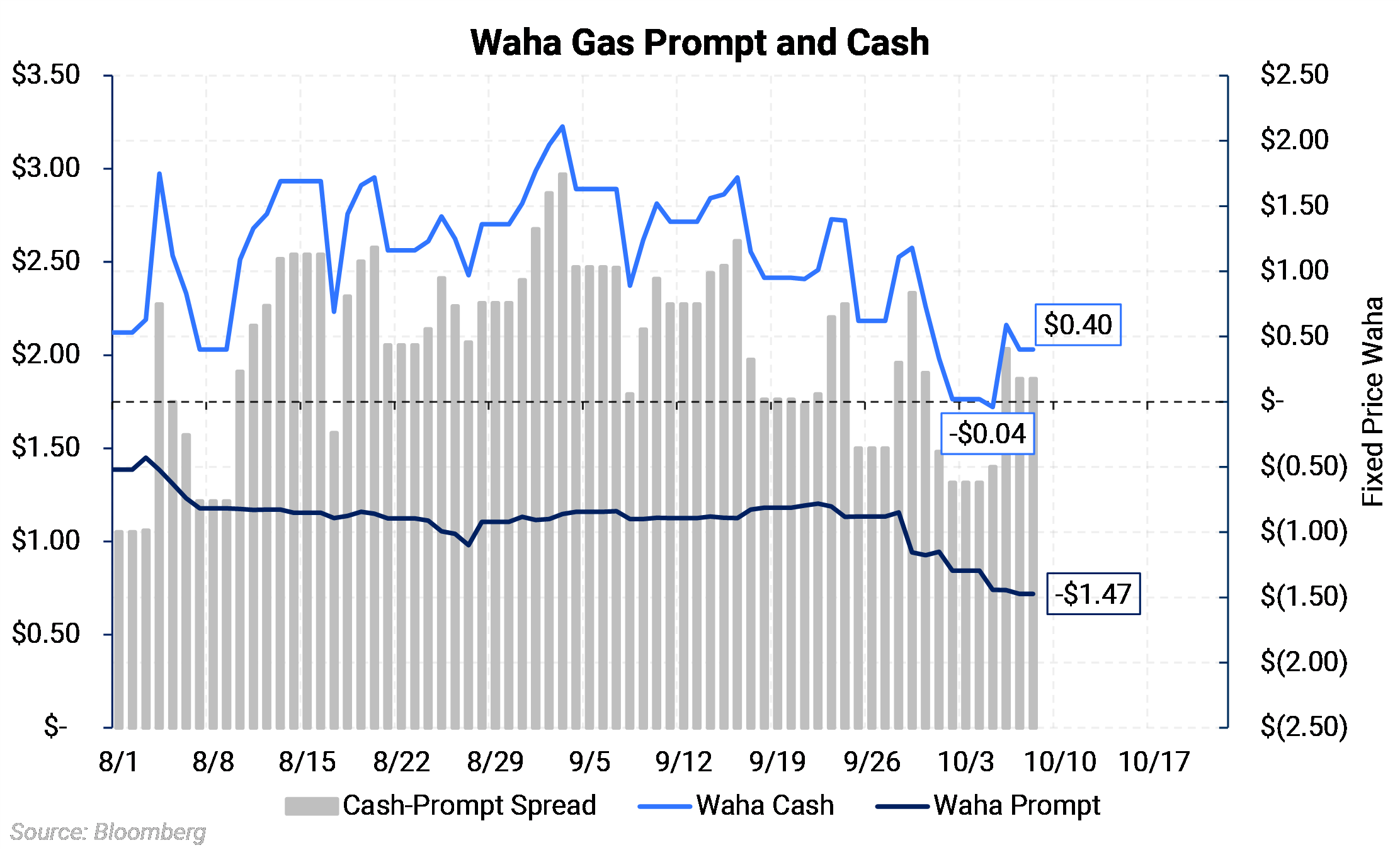

Waha cash prices plummeted into negative territory on October 5, the first time since April of this year amid the depths of the pandemic. Restricted gas flows on the north side of the Permian have pressured more near-term prices as shown below in the chart. Most of the Waha curve has seen little change in the past two weeks; the November and January contracts were the exception, having fallen 40c and 7.6c respectively.

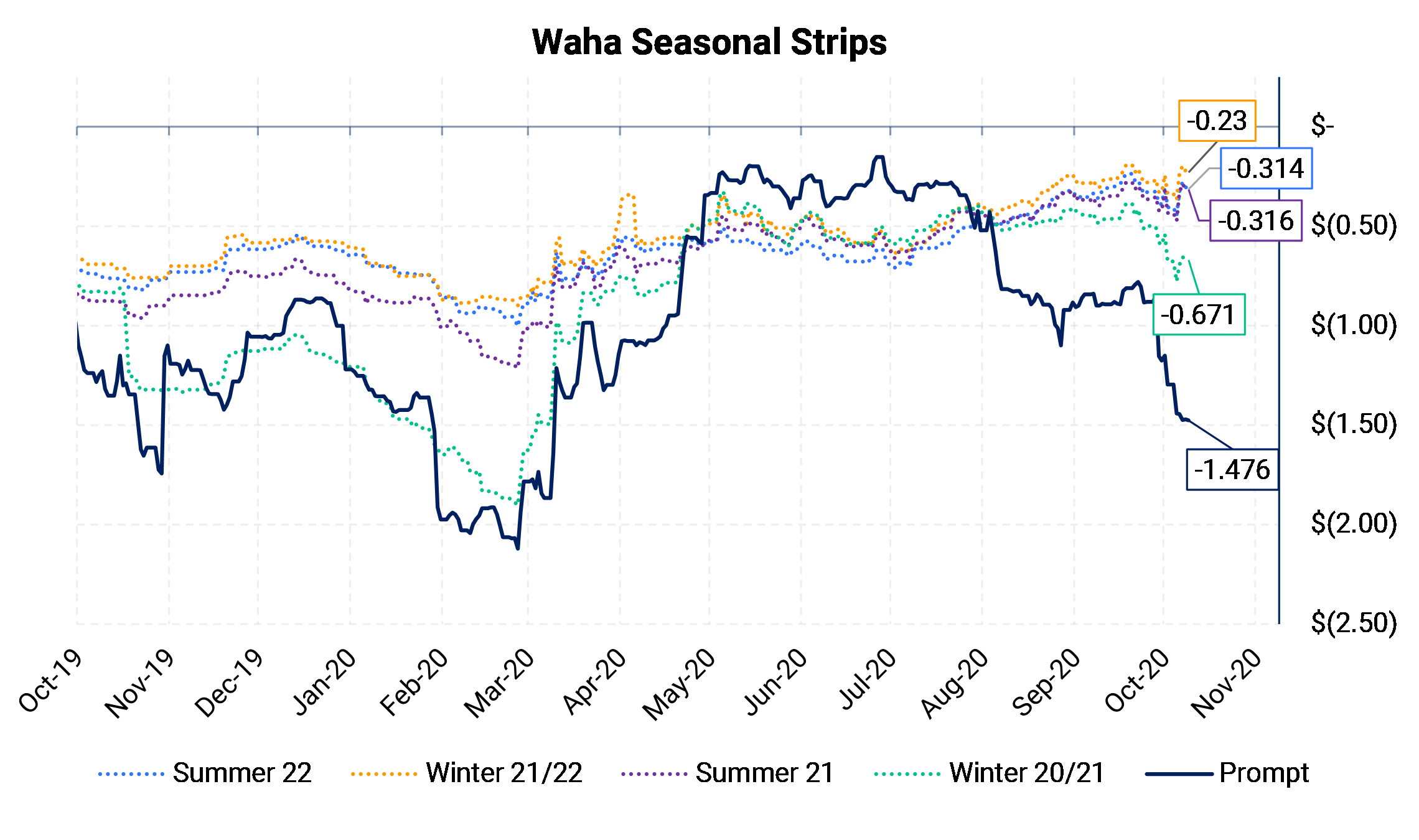

Further along the curve for Waha, prices have only jostled a few cents here and there. In fact, from late 1Q2020 onward, Waha has been relatively insulated from more near-term price fluctuations. Some of this stability may be because Kinder Morgan's 2 Bcf/d Permian Highway pipeline (PHP) is slated to enter service in early 2021.

| The chart on the right shows historical rolling Waha cash and prompt-month pricing. Cash (medium blue), also known as physical pricing, hit negative territory early this month. Demand is low during the fall season, and some pipelines have been under maintenance. Waha cash markets — that is, fixed price, not basis — have since recovered from -$0.04, trading at $0.40 as of October 8. |  |

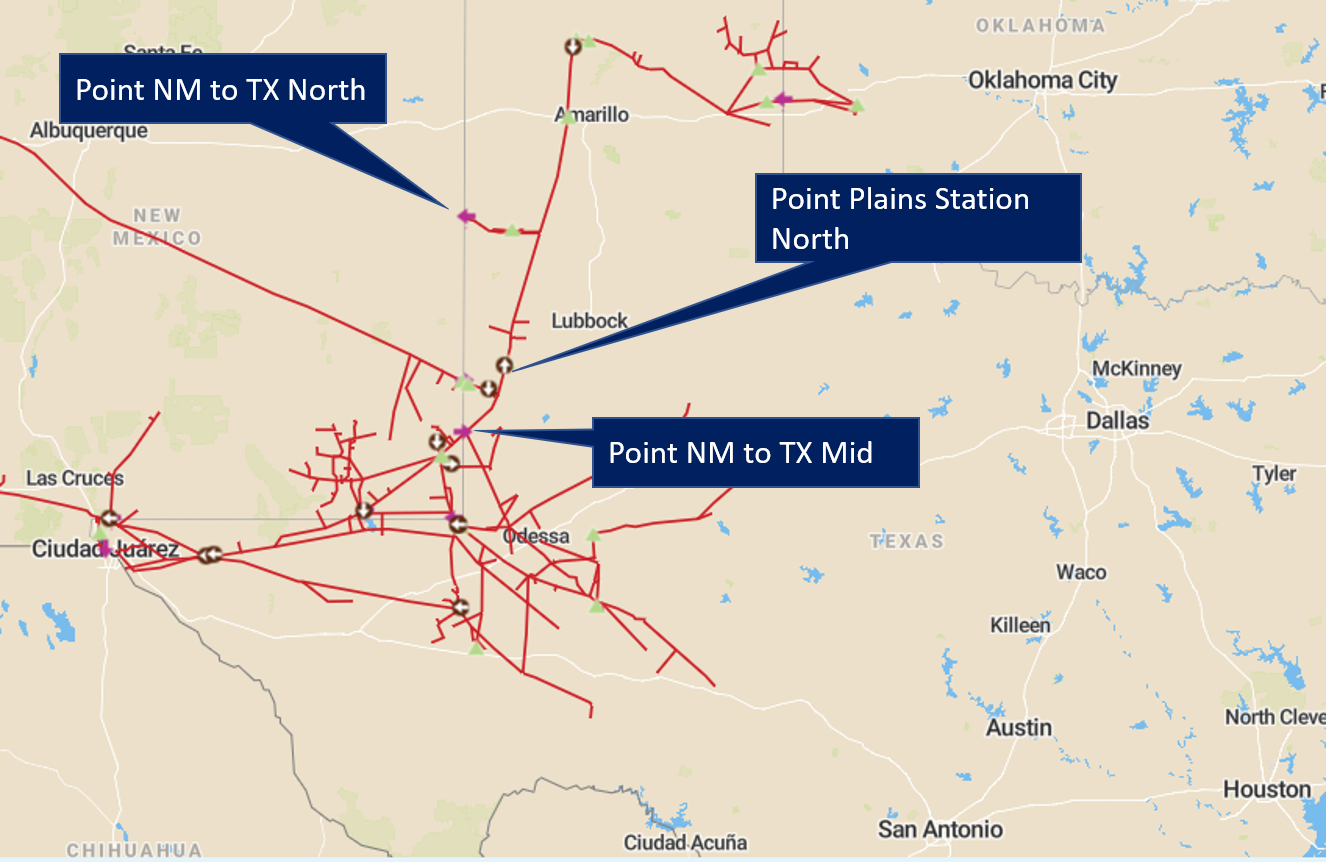

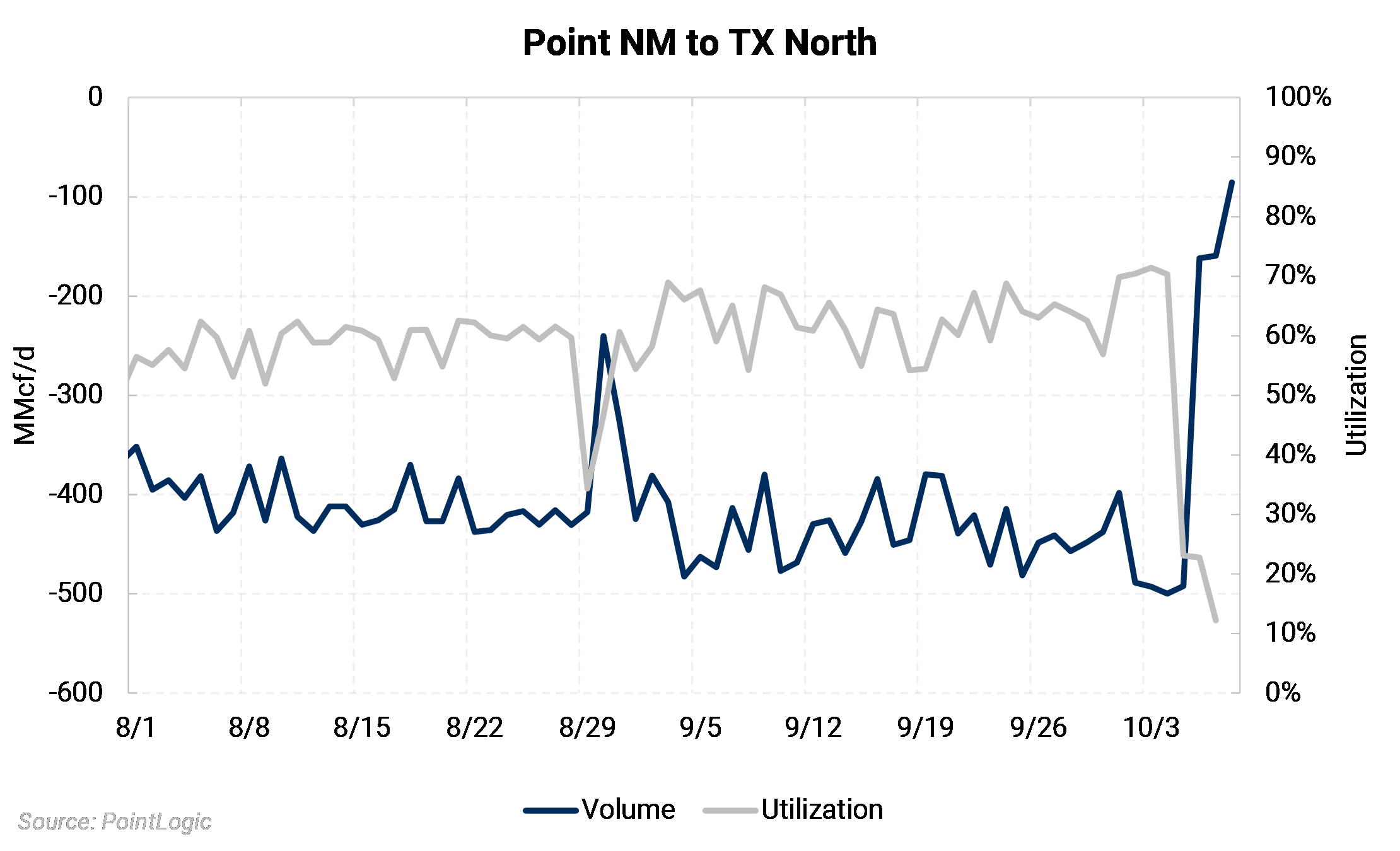

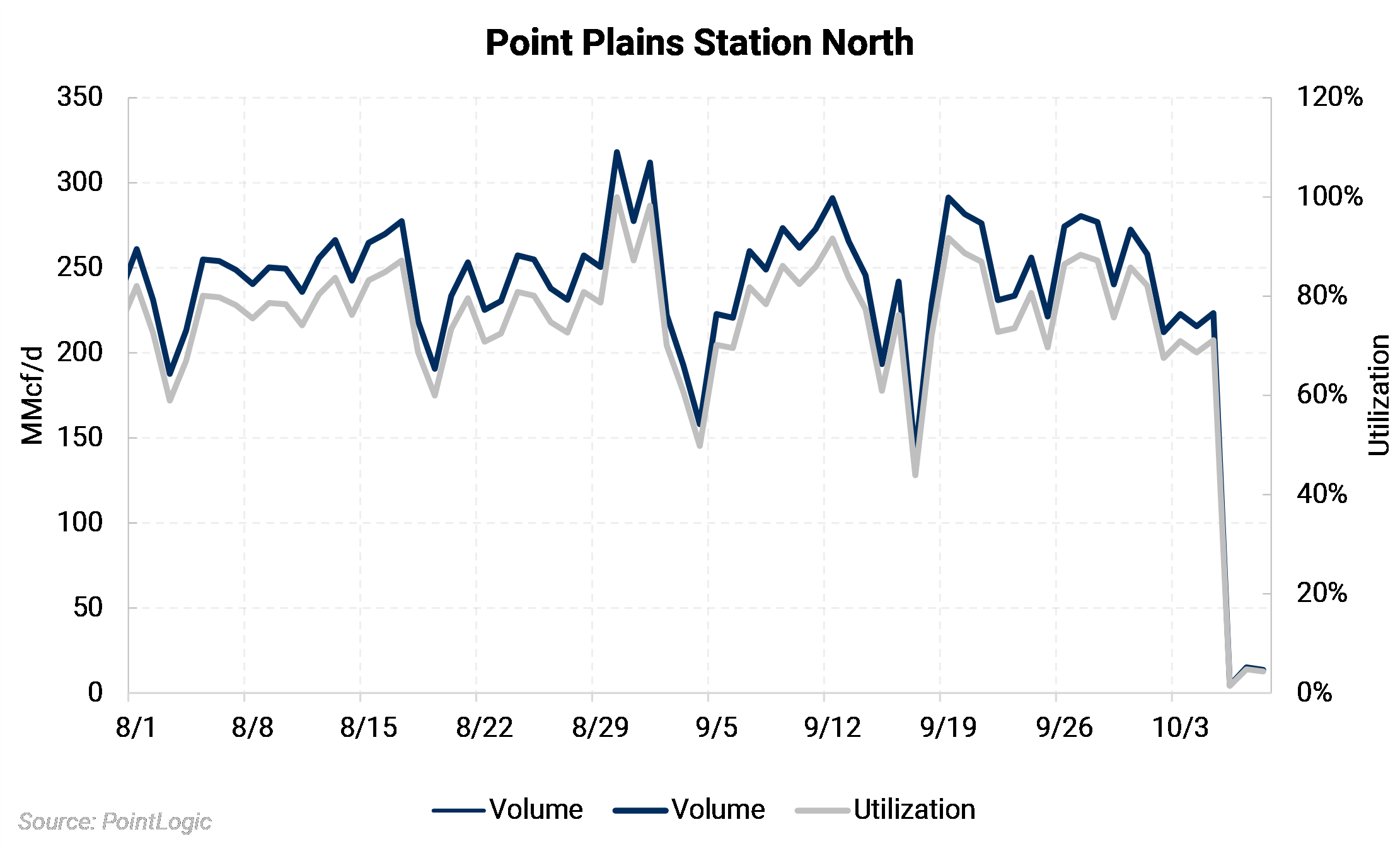

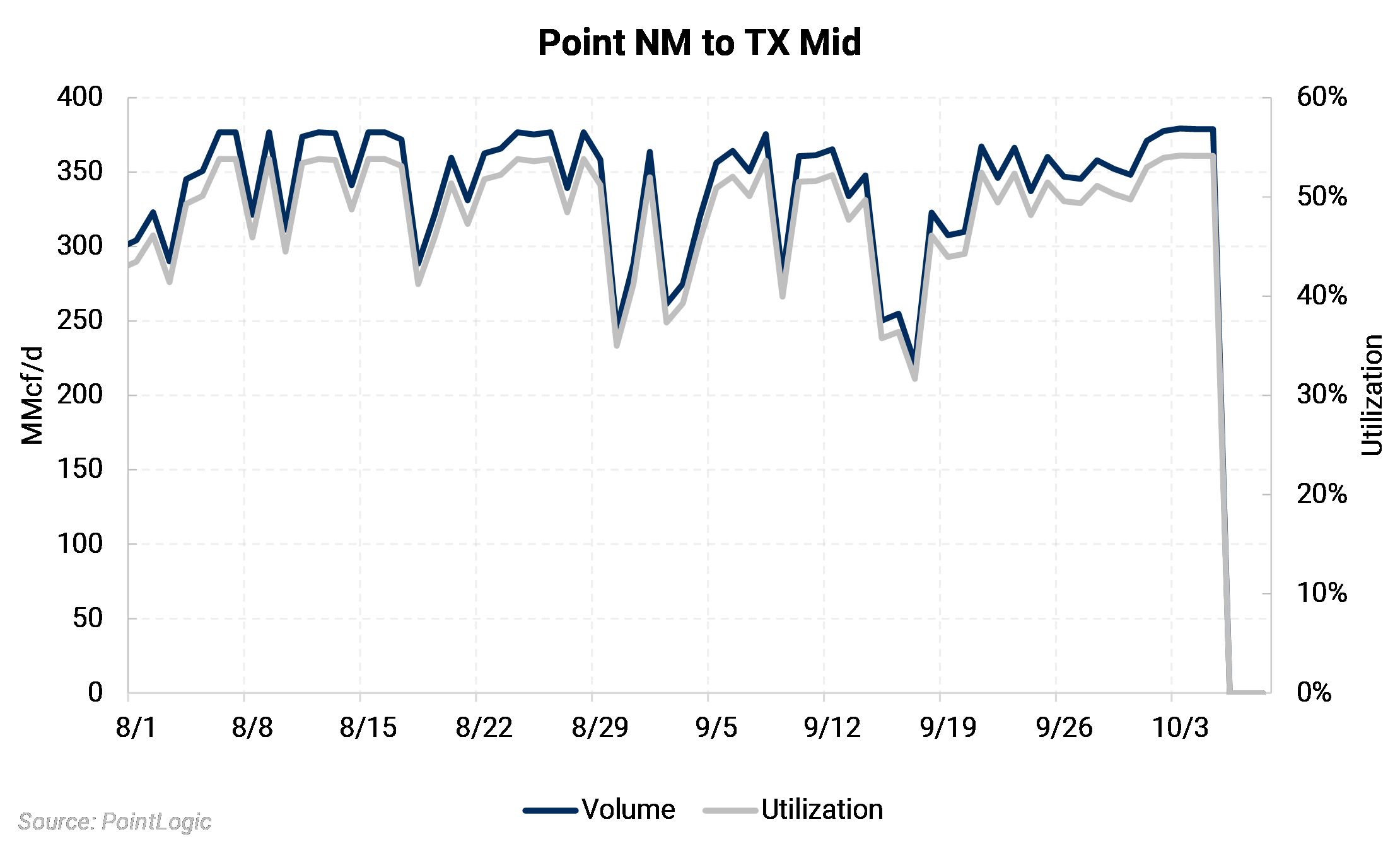

Regional pipeline maintenance in the Permian has been the largest contributor to the recent price collapse. El Paso Natural Gas (EPNG) system declared a force majeure on September 30 on Line 1201 downstream of the Hackberry compressor station, effective October 1, according to the company. Maintenance at the Hackberry compressor in Arizona is far downstream of the Permian basin, as gas flows west to demand centers. The company also conducted maintenance further upstream that reduced flows on the northern end of the Permian basin as shown by select meters in the graphic below.