The theme of large oil independents and supermajors for 2021 is to keep production flat, pay down debt, and create more free-cash flow. For a sample of large producers who had issued guidance as of February 25, most expected 2021 oil production to be generally flat or only slightly higher than last year's.

Current oil forward prices would likely have led to production growth in the past. This year is different for a few reasons. Energy equity prices are no longer being rewarded for showing output growth. It may be that capital restraints, both internally and externally, are pushing producers to focus on other metrics.

Data and analysis provider Enverus comes to the same conclusion using a combination of guidance and economic models. The focus to not grow into higher prices should leave U.S. oil production relatively unchanged from the current level of 11.5 MMBbl/d, in their view.

If U.S. production is perceived to be tame, it could have global market implications right away. Depending on the recovery timeline for demand, the world could be in a position where additional U.S. production is needed to help balance the global S&D. This is a bullish scenario but one that needs to be watched. It's a phenomenon not lost on OPEC+'s reasoning in its own output plans, we expect.

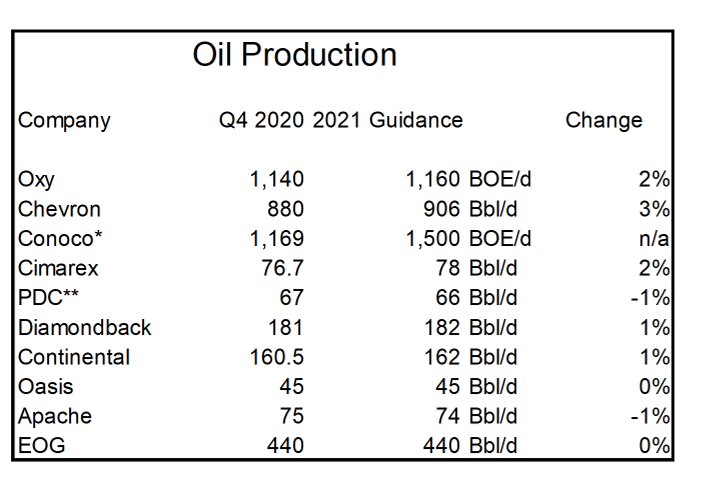

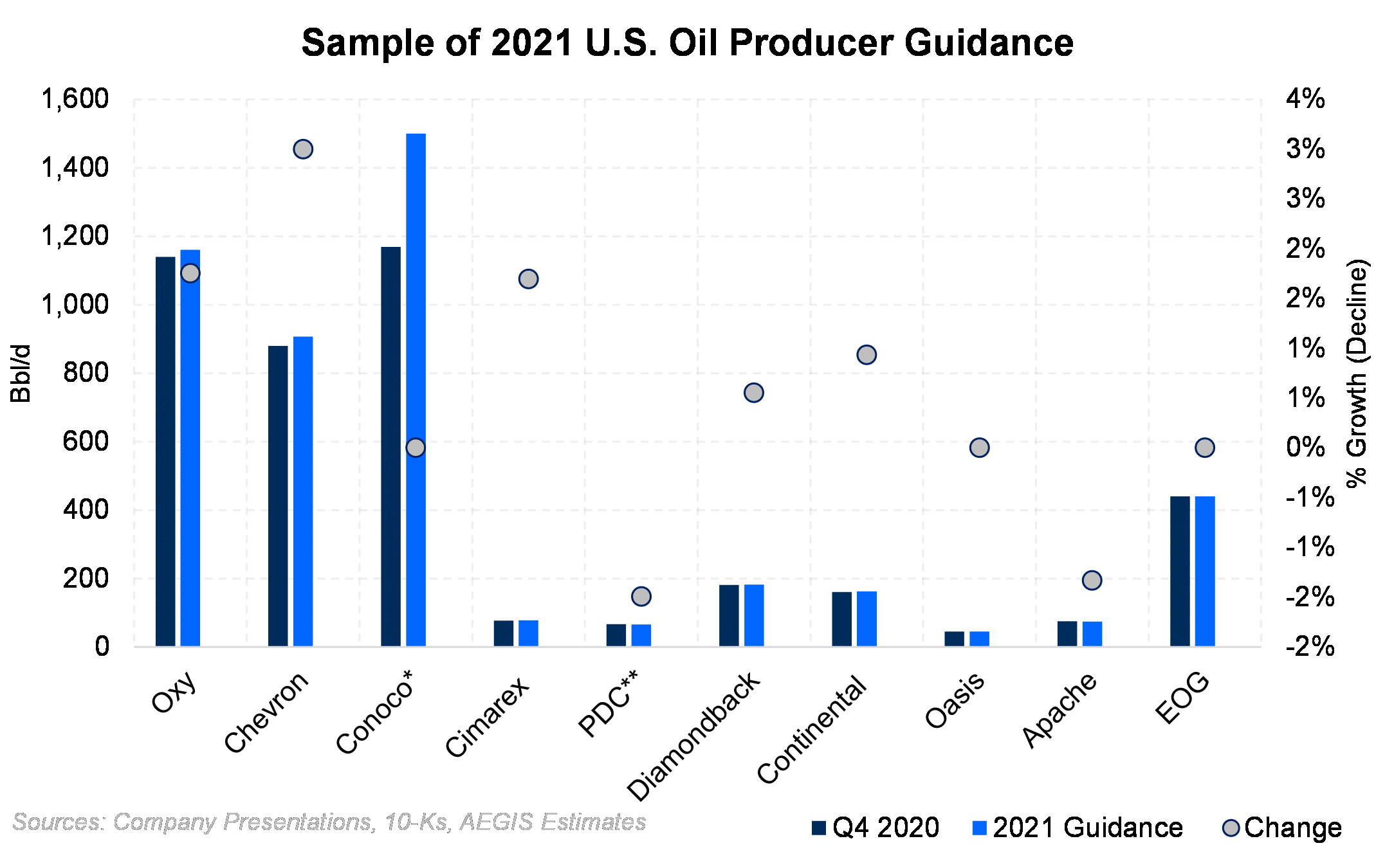

A sample of public company announcements is shown below. At least for now, oil-dominated U.S. producers are focusing on keeping production level to either their 2020 mid-point or their 4Q2020 exit rate.

|  |

AEGIS notes that while many public company earnings calls are showing flat production in 2021, smaller private companies may not be in the same situation. We manage hedge programs for over 280 entities that run the gamut from large, public to small operators with only a few hundred barrels per day of production. In general, what we are hearing from our private-company clients is that some are looking to increase activity and grow production at current prices. En masse, this could cause a material move in output. It is possible that while public companies are listening to shareholder concerns about growing production, smaller E&Ps are looking to take advantage of the move higher in oil prices and grow.