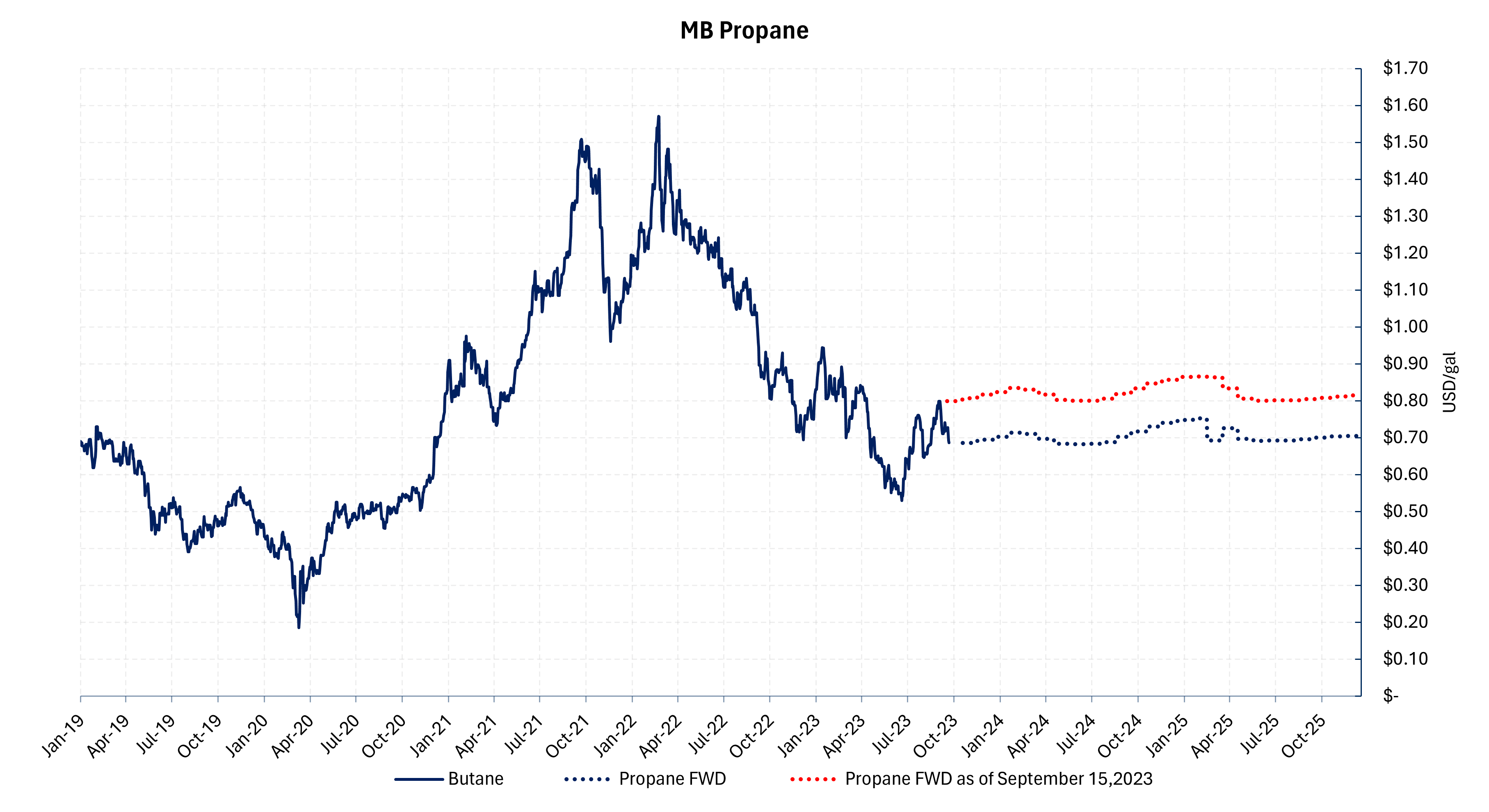

Mont Belvieu propane prices have fallen to 68.5c/gal as of October 5, 11c/gal lower than in mid-September. The quick fall in propane prices can be attributed to the faltering rally in crude oil prices as propane trades at a relative value to oil. The chart below shows that the propane curve was pulled lower rather than only nearby contracts.

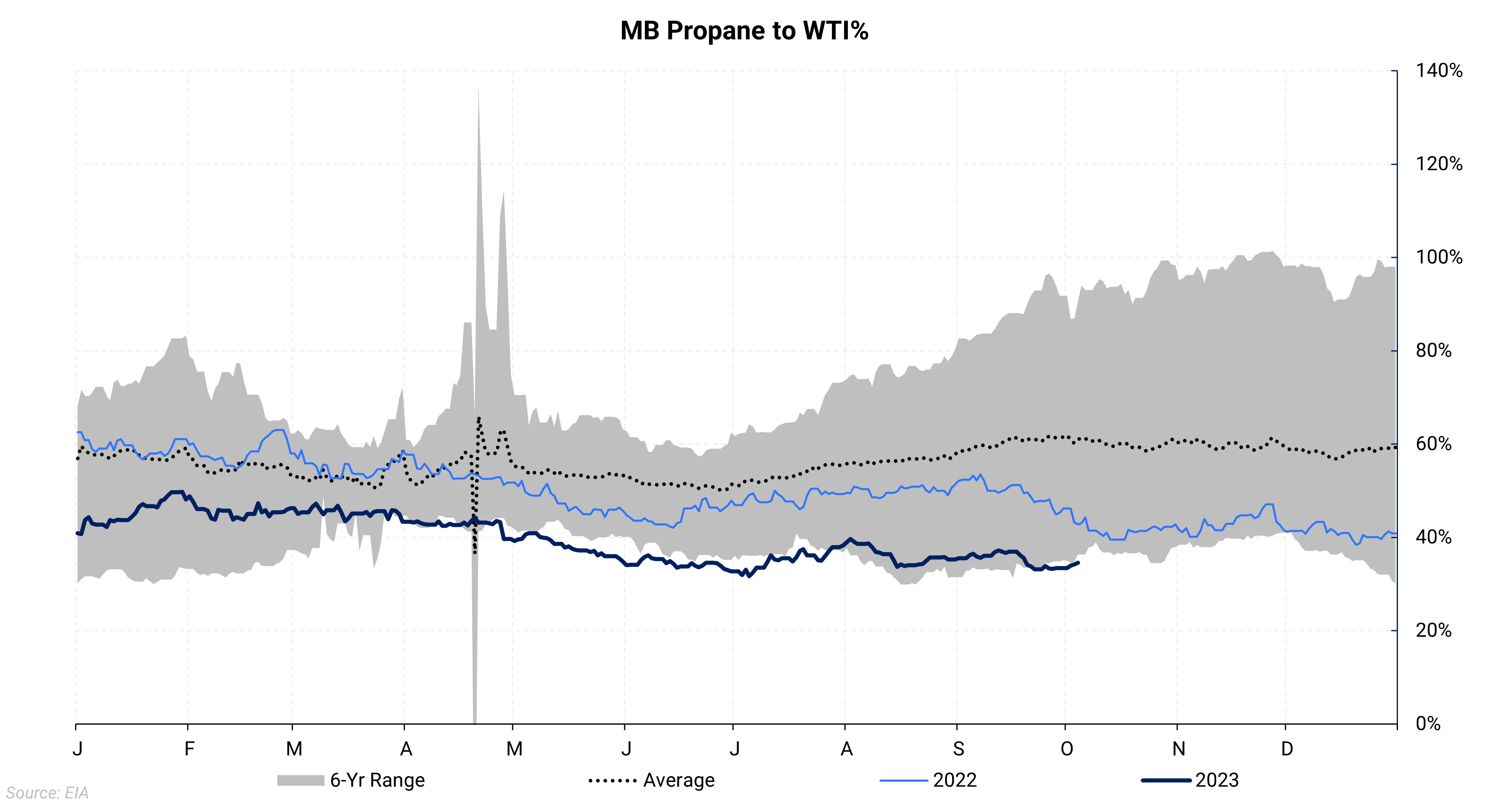

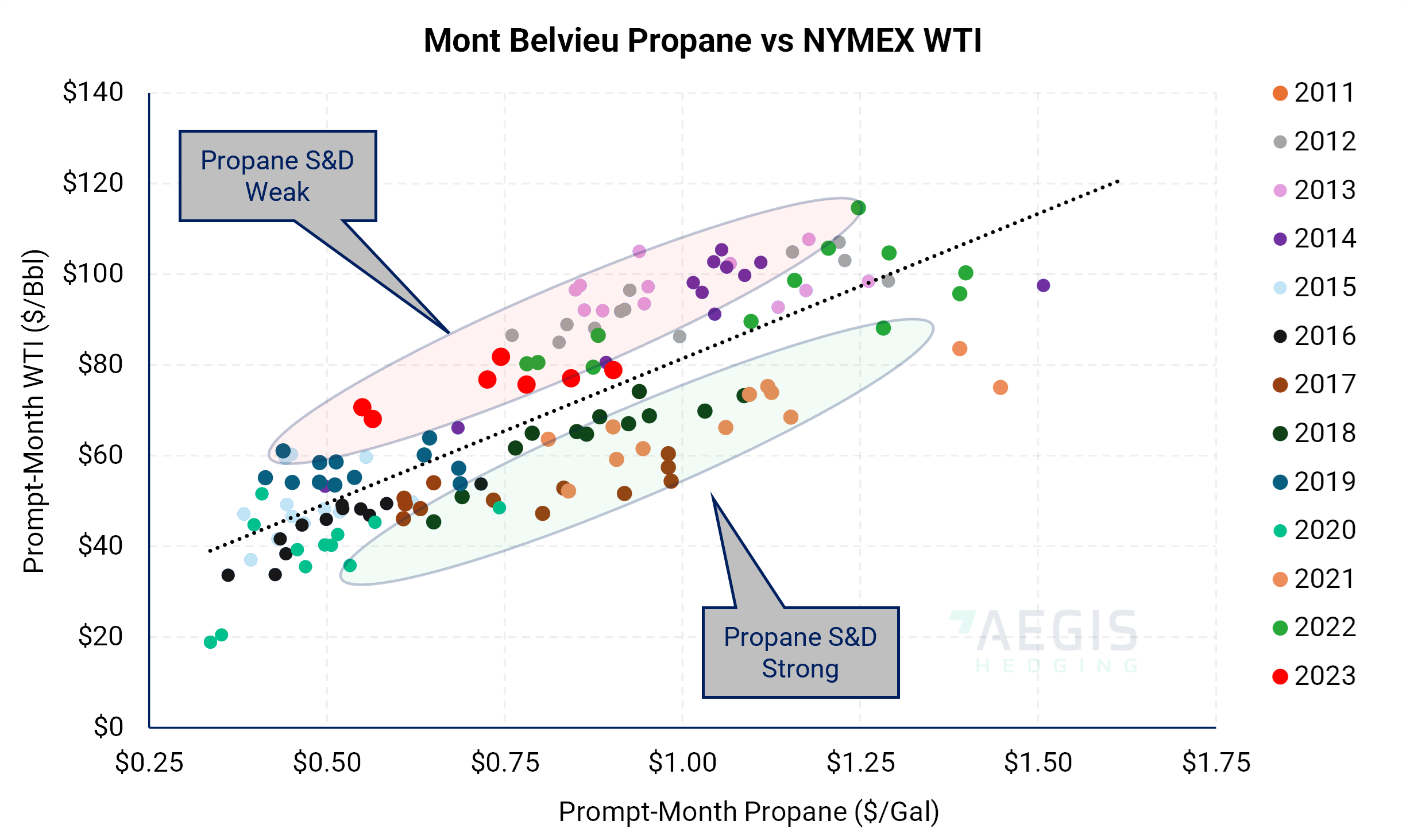

Relative to WTI, propane has been exceptionally weak since April of this year. The chart below shows how relatively undervalued relative to crude oil propane has been, near the bottom of the six-year band in terms of percentage to oil. In August, propane edged slightly higher versus oil to just under 40% relative value.

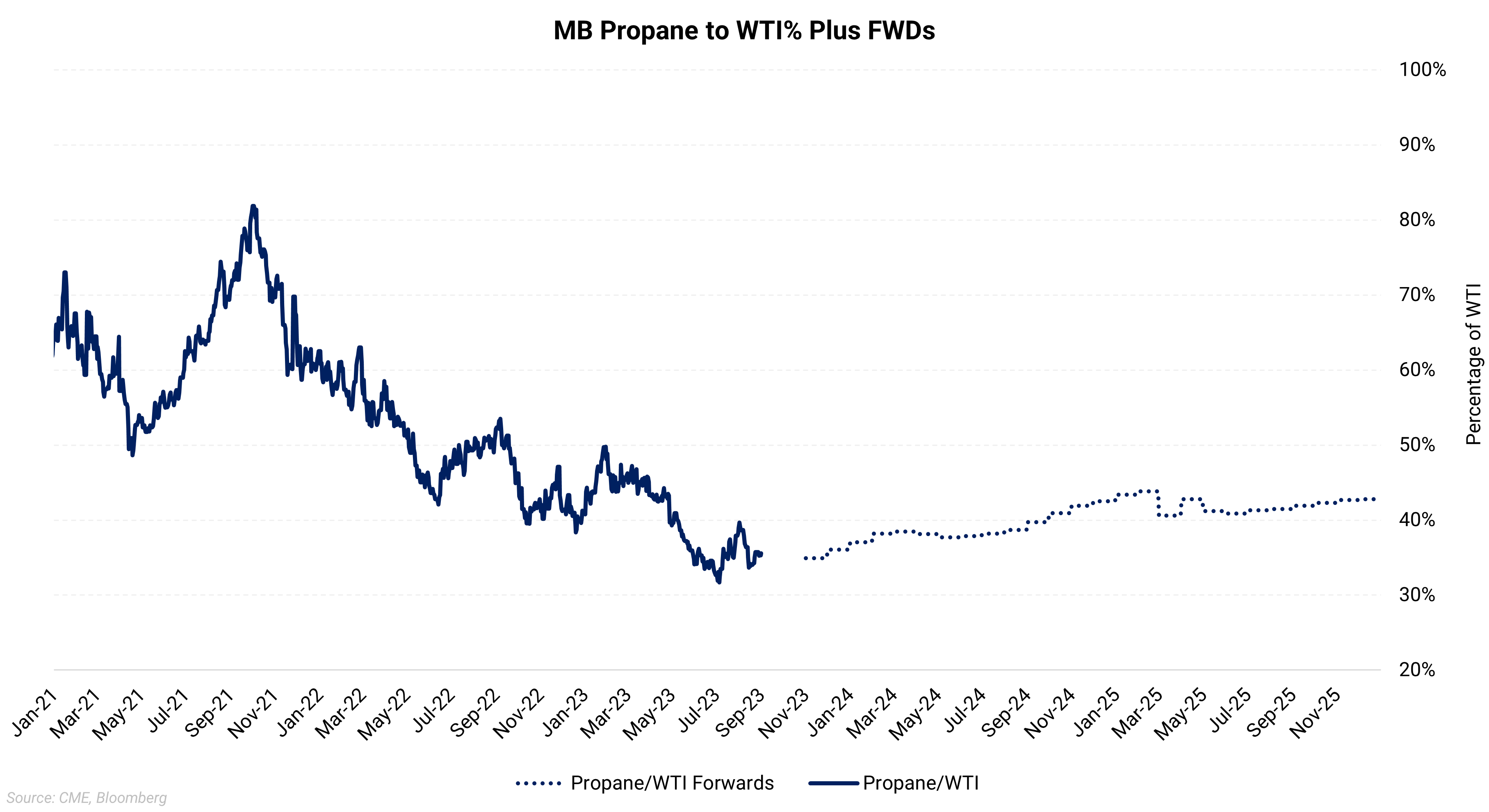

Looking into the future, we notice that propane’s relative value to WTI improves. The chart below builds upon the previous chart by comparing propane’s forward and WTI’s forward curves. The increase in propane’s relative value in future months highlights the weakness in propane in the prompt month. All things being equal, propane prices should rise relative to WTI as time progresses.

Bottom line (10/05/2023): Propane prices should climb if WTI rises as propane’s relative value is already historically seasonally weak. Similarly, propane prices could increase even if WTI moves sideways and propane’s supply and demand turn more bullish (not our base case).

We see more upside potential in crude oil prices for the fourth quarter of 2023. Therefore, propane prices are likely to increase along with crude.

Propane Fundamentals

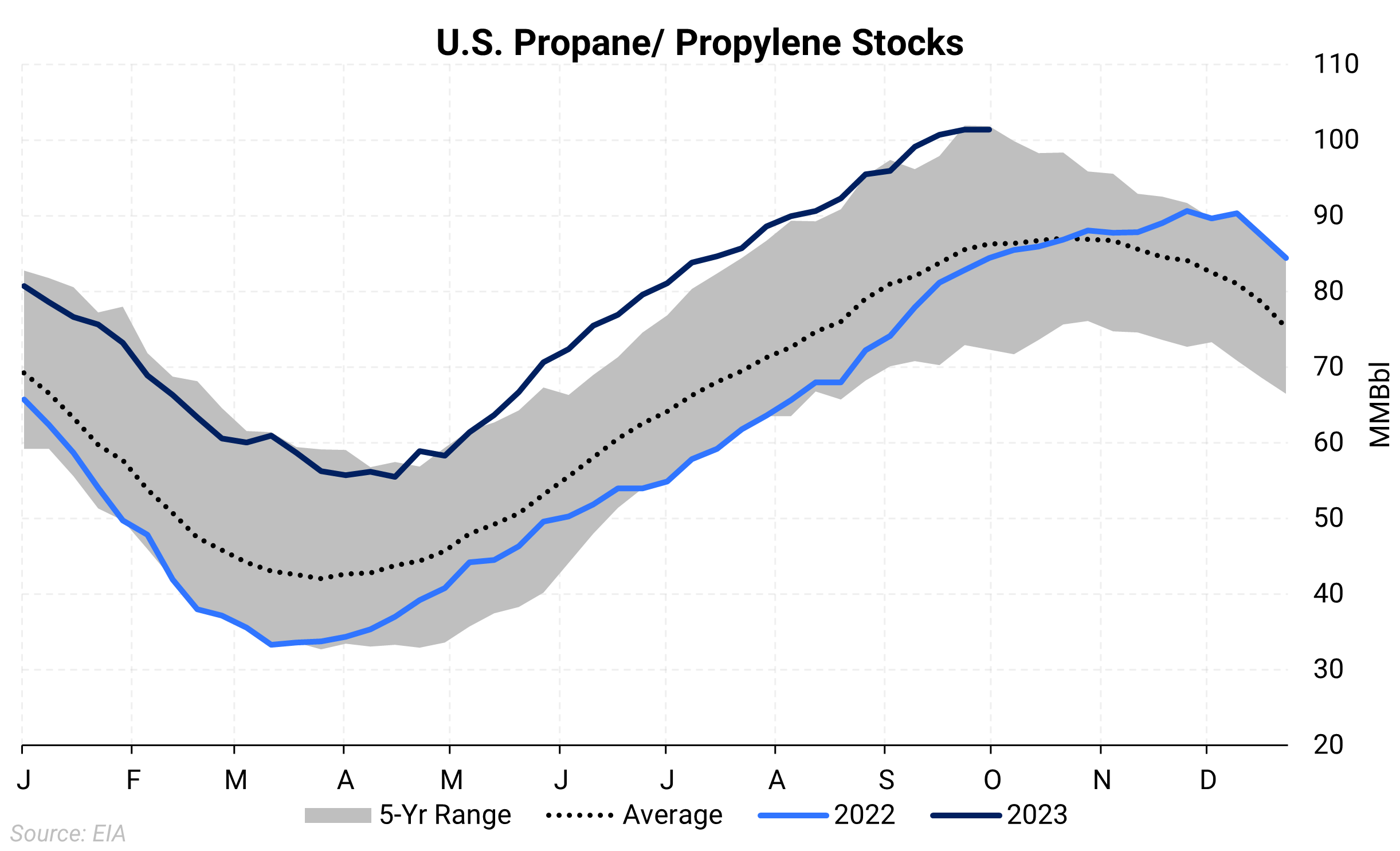

| Propane inventories have remained elevated since late 2022. |  |

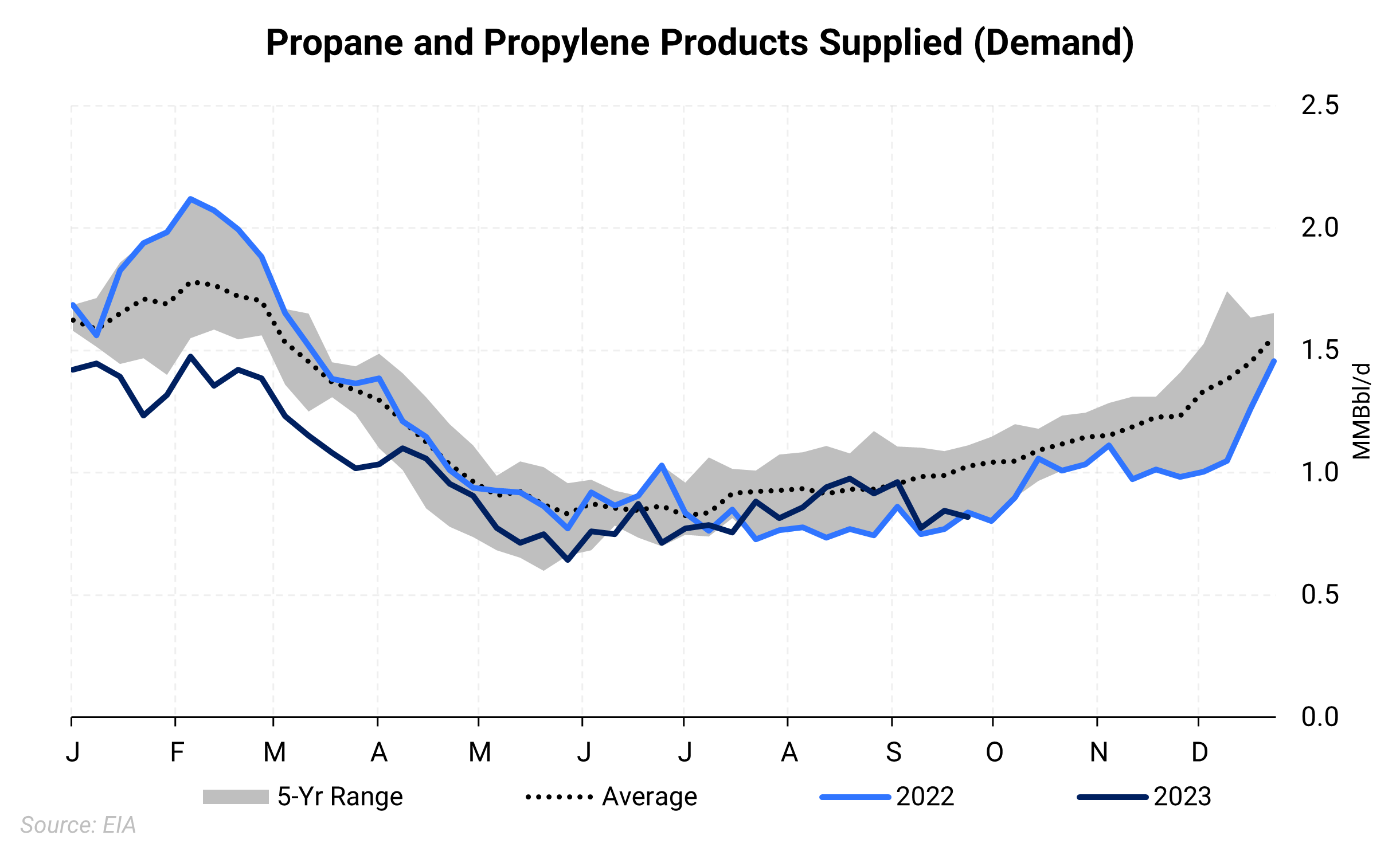

| Implied demand for domestic US propane has been below average this summer. Demand was particularly weak in Q1 as warm weather dominated the Lower 48, hurting space heating consumption. |  |

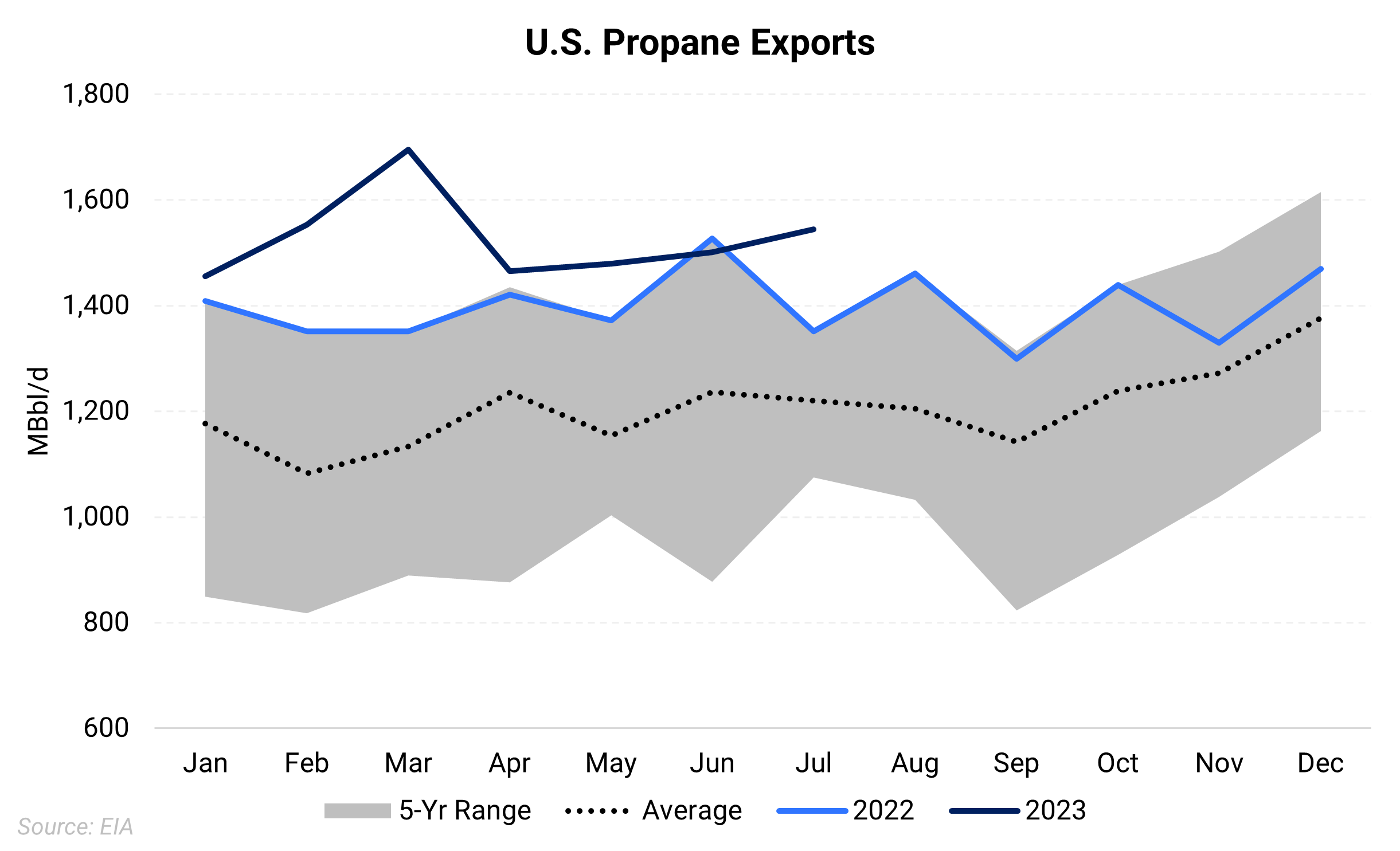

| Propane exports have been robust, clearing the excess supply that otherwise would enter the already well-supplied salt caverns. |  |

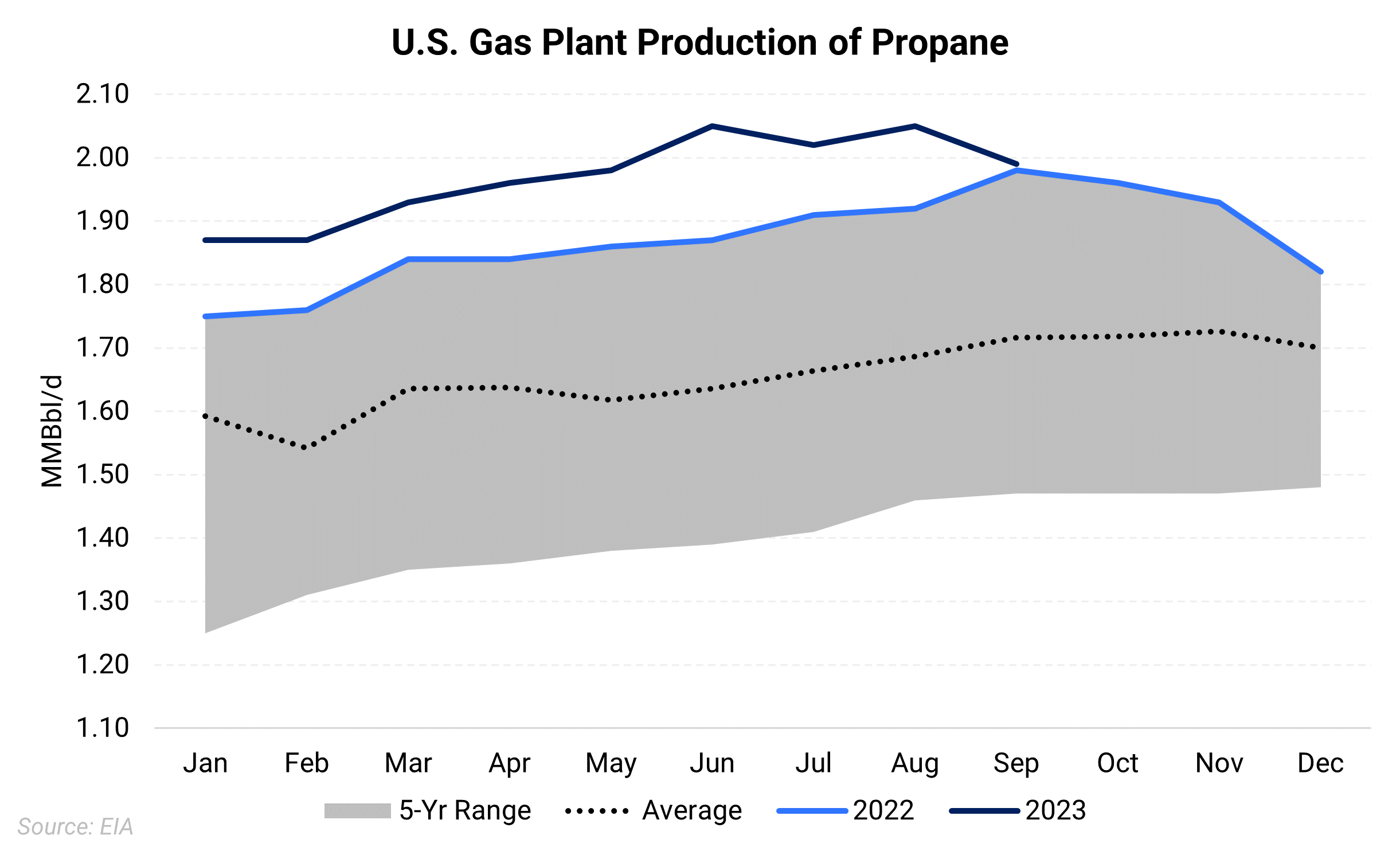

| Production has been on a steady rise year-to-date. Growing gas processing, primarily out of the Permian, is expected to push supply higher through 2023. Furthermore, Enterprise recently started their new fractionator at Mont Belvieu, allowing y-grade to be converted to purity product. |  |

| The chart on the right helps identify periods when propane was weak or strong relative to WTI. On the x-axis is the price of propane, and on the y-axis is the price of WTI. Year-to-date (red dots), propane has been weak relative to WTI, represented by marks above the average trend line. Propane was relatively strong and undersupplied in the U.S. in 2021 (light orange), trading at a higher percentage to WTI than most years in the graph. |  |

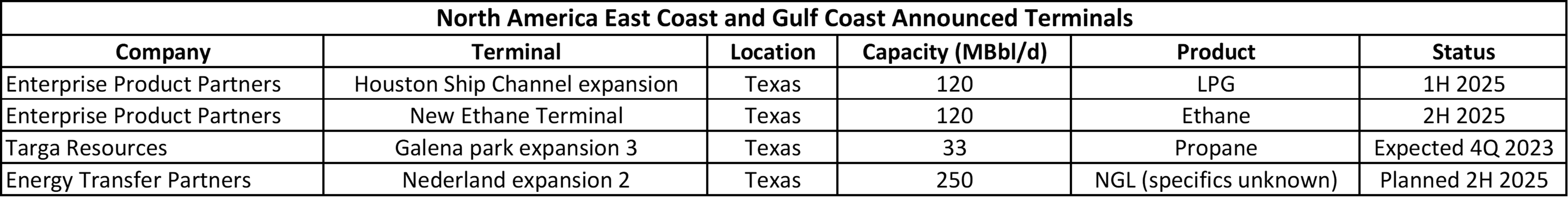

Recent Infrastructure Announcements

LPG exporters are bullish with their export views and are adding more capacity for the product to flow.

Furthermore, propane exports are supported by demand from Asia. Propane arbs to Asia widened in August as Asia propane prices rose. Propane prices in Asia and Europe increased by 18.8% and 9.5%, respectively, while Mont Belvieu prices fell by 5.6%. The increase in global propane prices offset Mont Belvieu prices – widening the arbs.