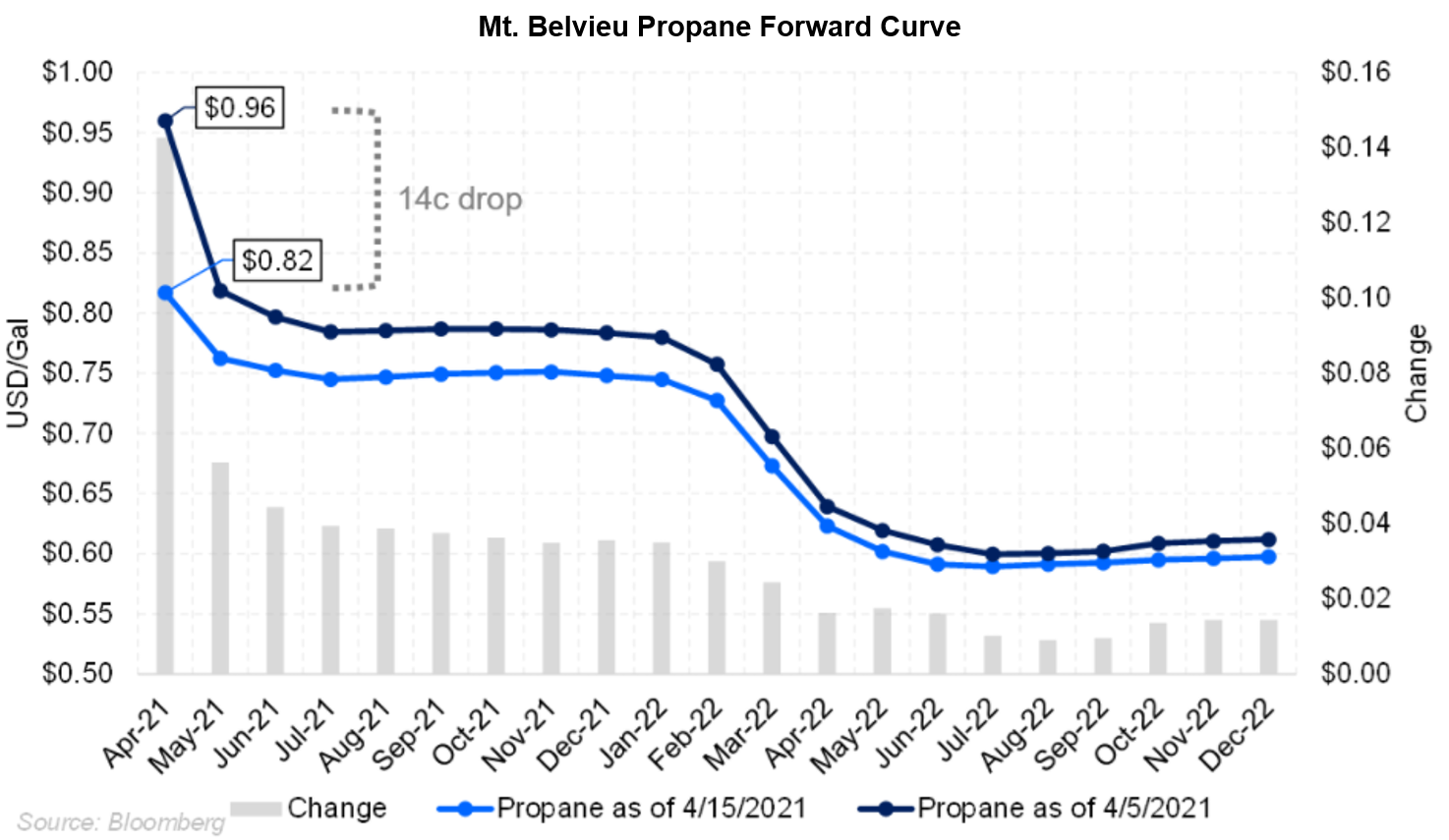

Prompt-month propane price has fallen from its highest level since late 2018. Mt. Belvieu propane gave up 14 c/gal between April 5 and April 15, marking the largest 10-day loss since May 2019.

Global supply of propane is expected to increase as OPEC+ unwinds some of its held-back oil output. Saudi Aramco set April propane at $560/mt, down from March , the first month-on-month fall after nine-straight months of increases. Meanwhile, Iranian LPG shipments have been rising, according to FACTS Global Energy (FGE).

Mt. Belvieu propane prices had been strong on the backs of low U.S. inventories and February's cold snap in Texas. Export capacity from the U.S. recently jumped following late 2020 additions from Targa (at Galena Park) and Energy Transfer's Nederland terminal. This brings total LPG export capacity in the region to more than 2 MMBbl/d.

|

Propane's drop can't be attributed to the crude oil price. NGLs are linked to crude oil in both supply and demand. These products' prices usually fluctuate with oil. However, we can see in the chart above that WTI has traded mostly flat lately, and propane's ratio to WTI dropped from 69% to 54% from April 5 to April 15. This shows that propane was weak on its own, rather than led lower by oil prices. |

An international cause is likely. Propane prices in Asia and Europe are indicator that Mt. Belvieu propane weakened because of additional Middle East supply. All three global benchmarks shown above (FEI, MB, NWE) fell at around the same time period in early April. The arbitrage between Asia and the US for propane has jumped between positive and negative or the past few weeks, according to Bloomberg BNEF data. |

|

Propane stocks in the U.S. have moved closer to the five-year average following the deep-freeze of February. |

A majority of US propane supply resides in PADD 3 on the Gulf Coast. Stocks on the coast were close to the lowest in the past five years this past winter — driven by strong exports to capture Asian demand. |

The recent pullback in propane is likely due to the expectation there will be additional global supply from OPEC.

Even as prices have relaxed, the propane forward curve is very flat through this winter. This discourages storage. We would expect winter tenors to increase in value with respect to summer. That, or storage may fill at a slow pace, setting up a scarcity situation for U.S. consumers.

A more reasonable outcome is that winter tenors rally as traders buying wintertime supply start bidding that part of the curve. Maybe then the curve will make some gains and give producers a chance to hedge propane at less of a discount in 2022.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.