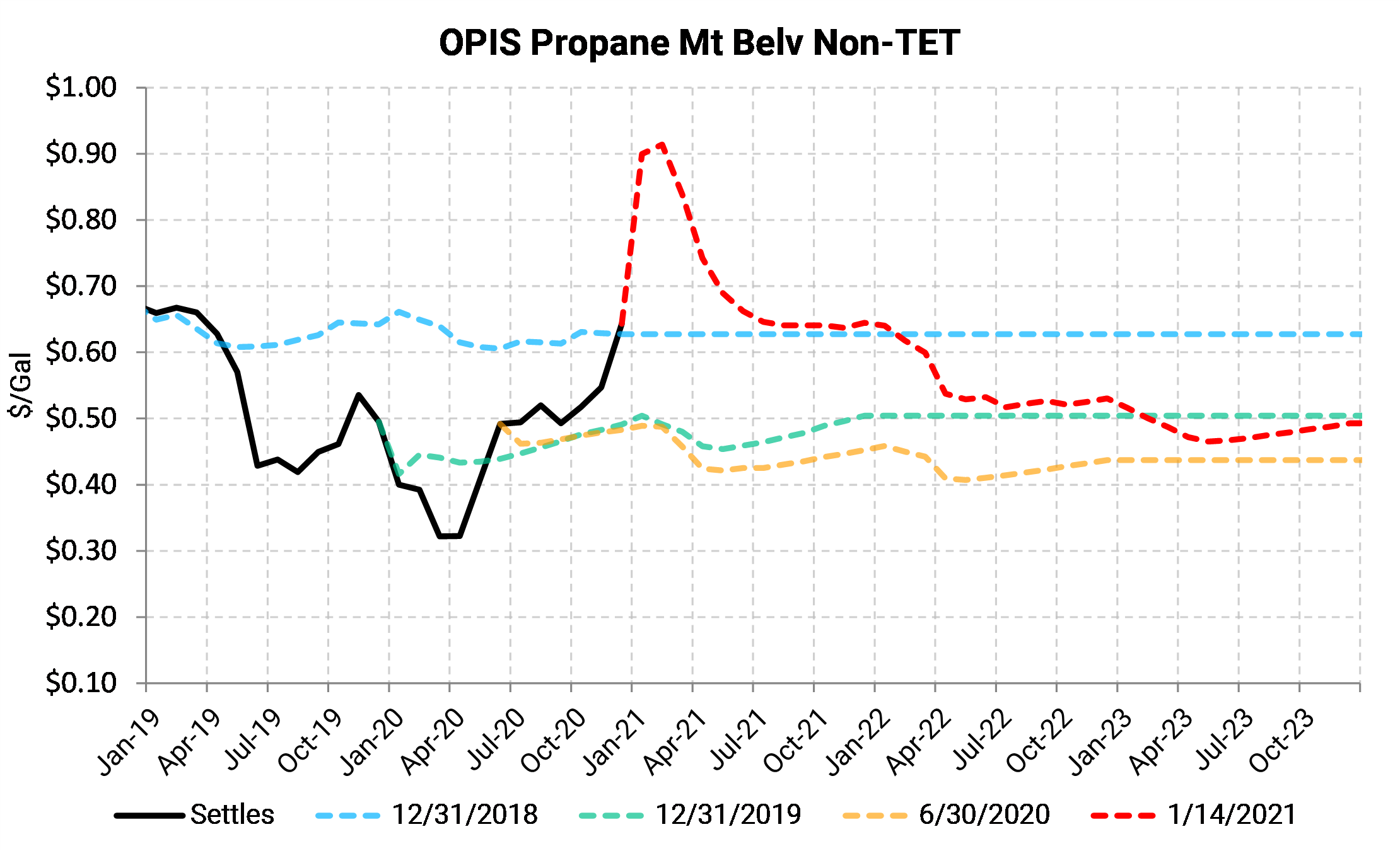

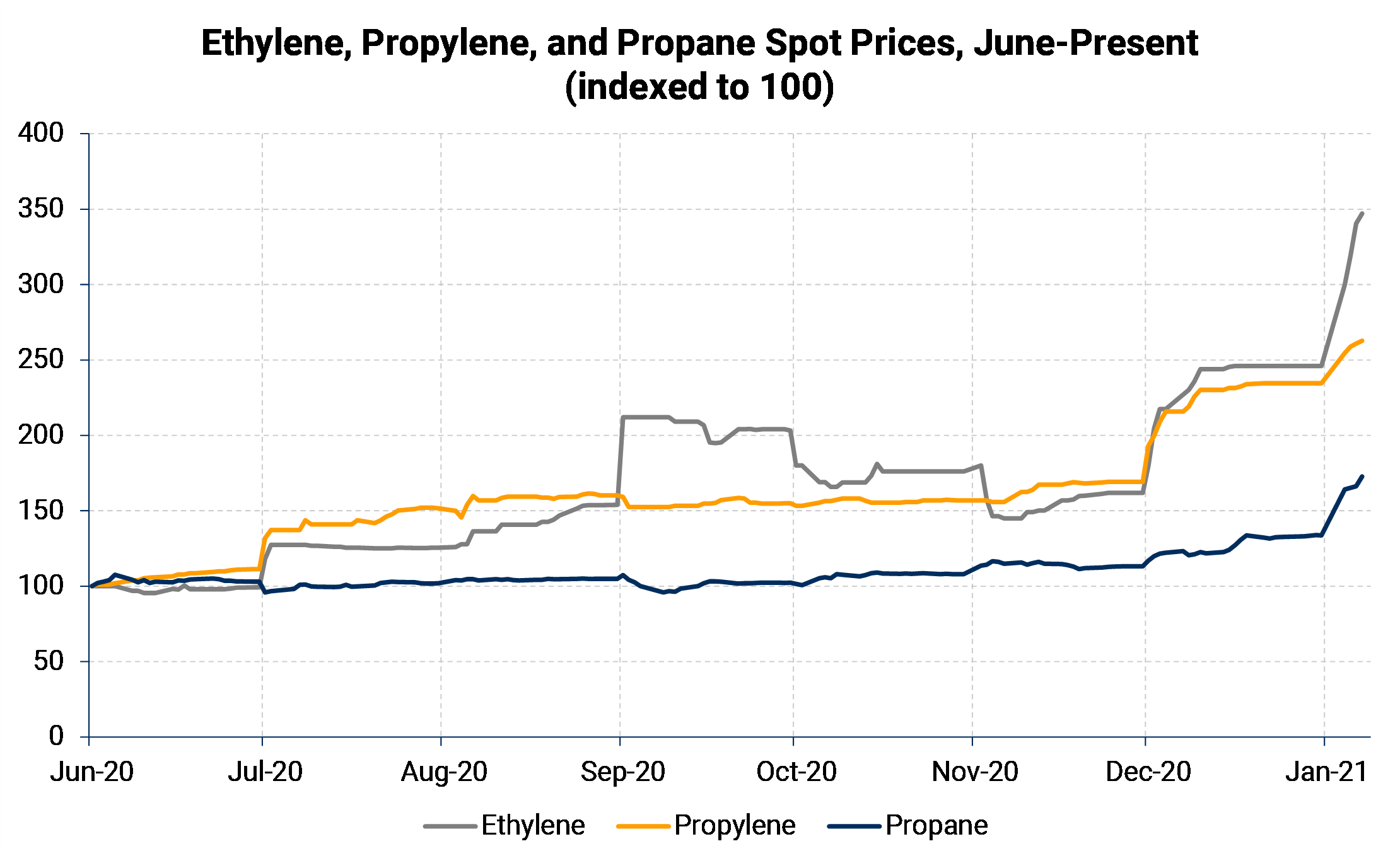

Producers can lock in the strength in propane prices but should stick to the front of the curve.Propane prices haven't suffered the warm-winter blues like natural gas. They have rallied strongly, and with good fundamental reason. The rally in propane accelerated this week on account of new export capacity at Energy Transfer's Nederland, TX terminal. Spot propane traded above $0.90/gal.

The forward curve is up, too; Bal 2021 propane has rallied nearly 60% since the summer to $0.70/gal. AEGIS thinks producers should sell a portion of their hedgeable volumes into the strength and incrementally hedge Bal 2021 propane. Producers should leave room to hedge more at potentially higher prices.

While the forward curve is up, near-term hedges make more sense than longer-dated ones. Producers should be less aggressive in hedging longer-dated tenors due to a strongly backwardated (downward sloping) forward curve.

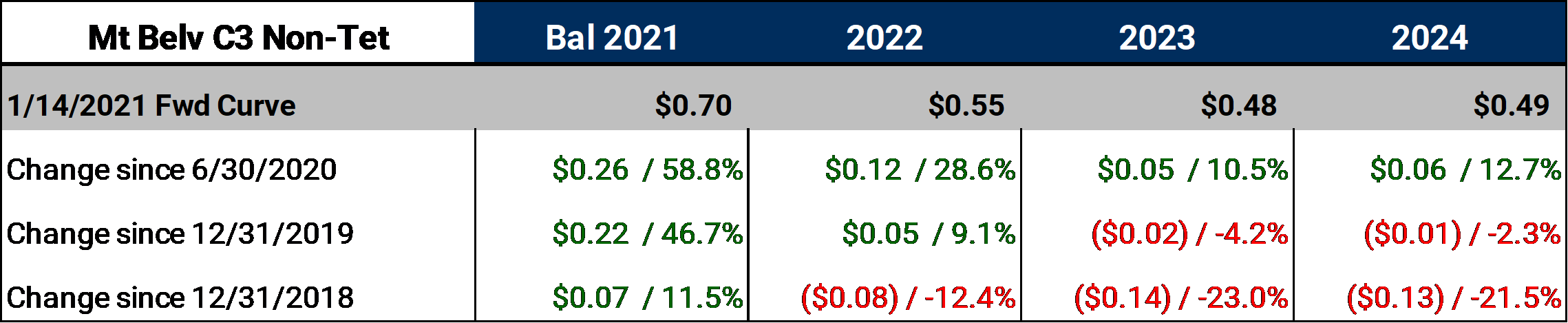

Why have propane prices been strong this winter? The biggest factor is increased exports, which took a large step up this week to reach record highs.

Why have propane prices been strong this winter? The biggest factor is increased exports, which took a large step up this week to reach record highs.

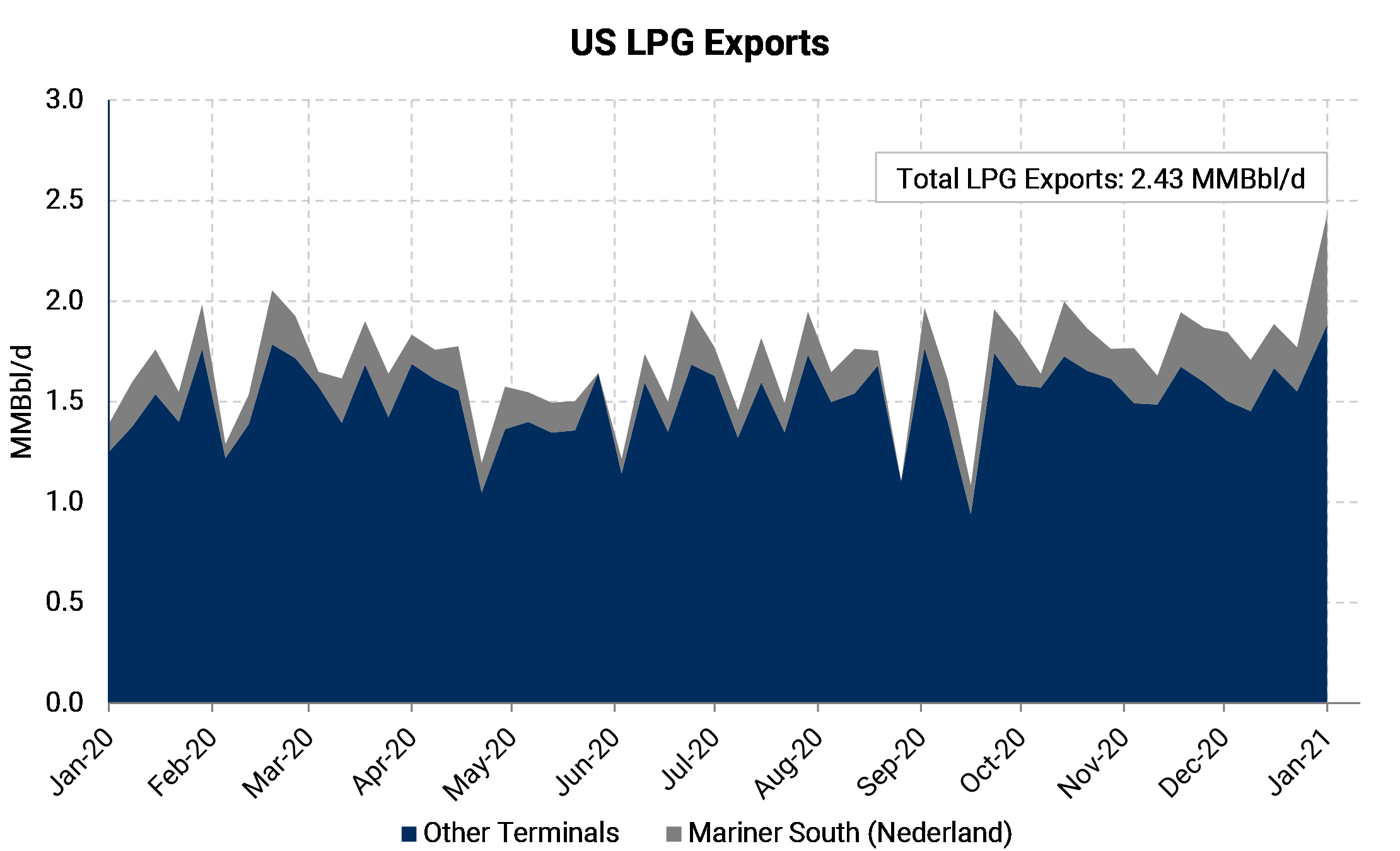

Energy Transfer's 235 MBbl/d dock expansion at Nederland is apparently online. This week, BNEF reported a massive increase in exports out of Nederland, bringing total exports out of the facility to 551 MMBbl/d! This is a step change for U.S. LPG exports, and a significant development for the U.S. propane supply-demand balance. Exports are the biggest story, but not the whole story. Rising petchem prices are another factor helping propane prices. Ethylene and propylene prices have rallied, putting upward pressure on NGL feedstock prices in the process. Although less ethylene is made from cracking propane and butane than from ethane, rising ethylene prices lift all these feedstocks' prices. It raises the price "ceiling" that comes from petchem manufacturing economics.

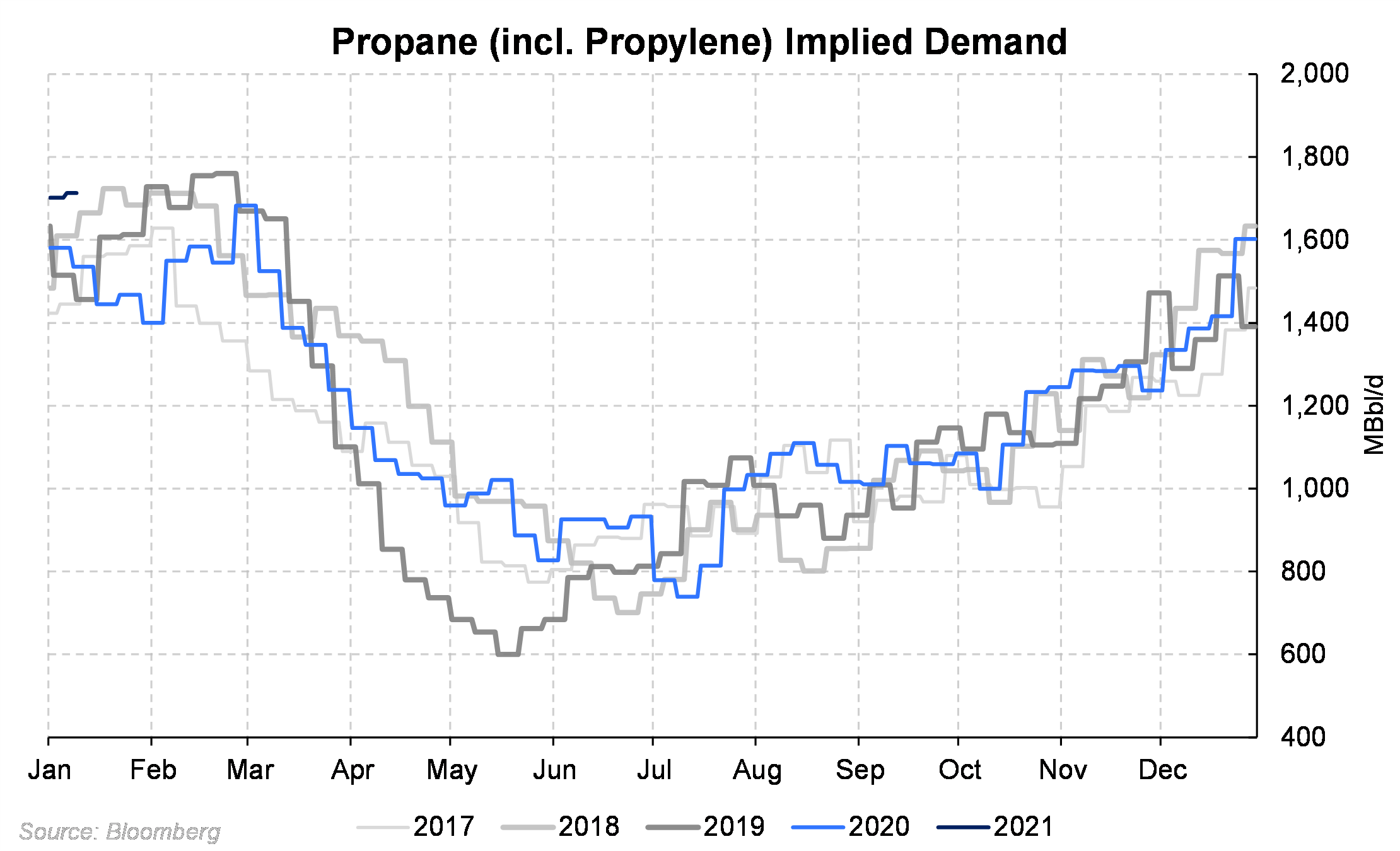

Exports are the biggest story, but not the whole story. Rising petchem prices are another factor helping propane prices. Ethylene and propylene prices have rallied, putting upward pressure on NGL feedstock prices in the process. Although less ethylene is made from cracking propane and butane than from ethane, rising ethylene prices lift all these feedstocks' prices. It raises the price "ceiling" that comes from petchem manufacturing economics. What about weather demand? Propane consumption for heating is concentrated in the winter, and in the East and Midwest parts of the U.S. It is this winter weather that typically draws down inventories. Even though eastern-U.S. temperatures have been exceptionally mild this winter, domestic propane demand has held up surprisingly well.

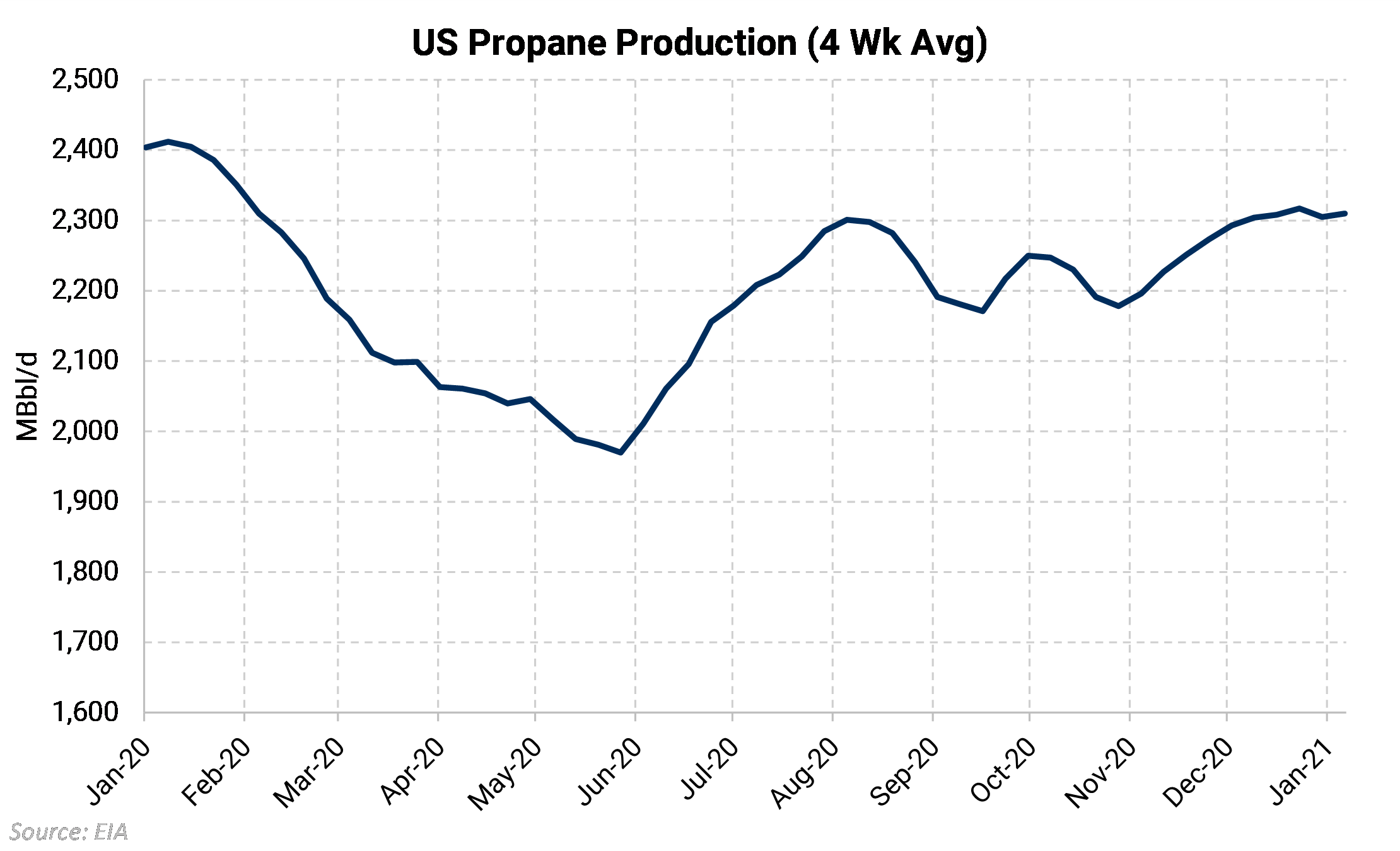

What about weather demand? Propane consumption for heating is concentrated in the winter, and in the East and Midwest parts of the U.S. It is this winter weather that typically draws down inventories. Even though eastern-U.S. temperatures have been exceptionally mild this winter, domestic propane demand has held up surprisingly well. What about the supply side? U.S. propane production is flat, as E&Ps have scaled back drilling plans. It appears unlikely that U.S. shale producers (in aggregate) will be able to materially increase production in 2021 given price and capital constraints.

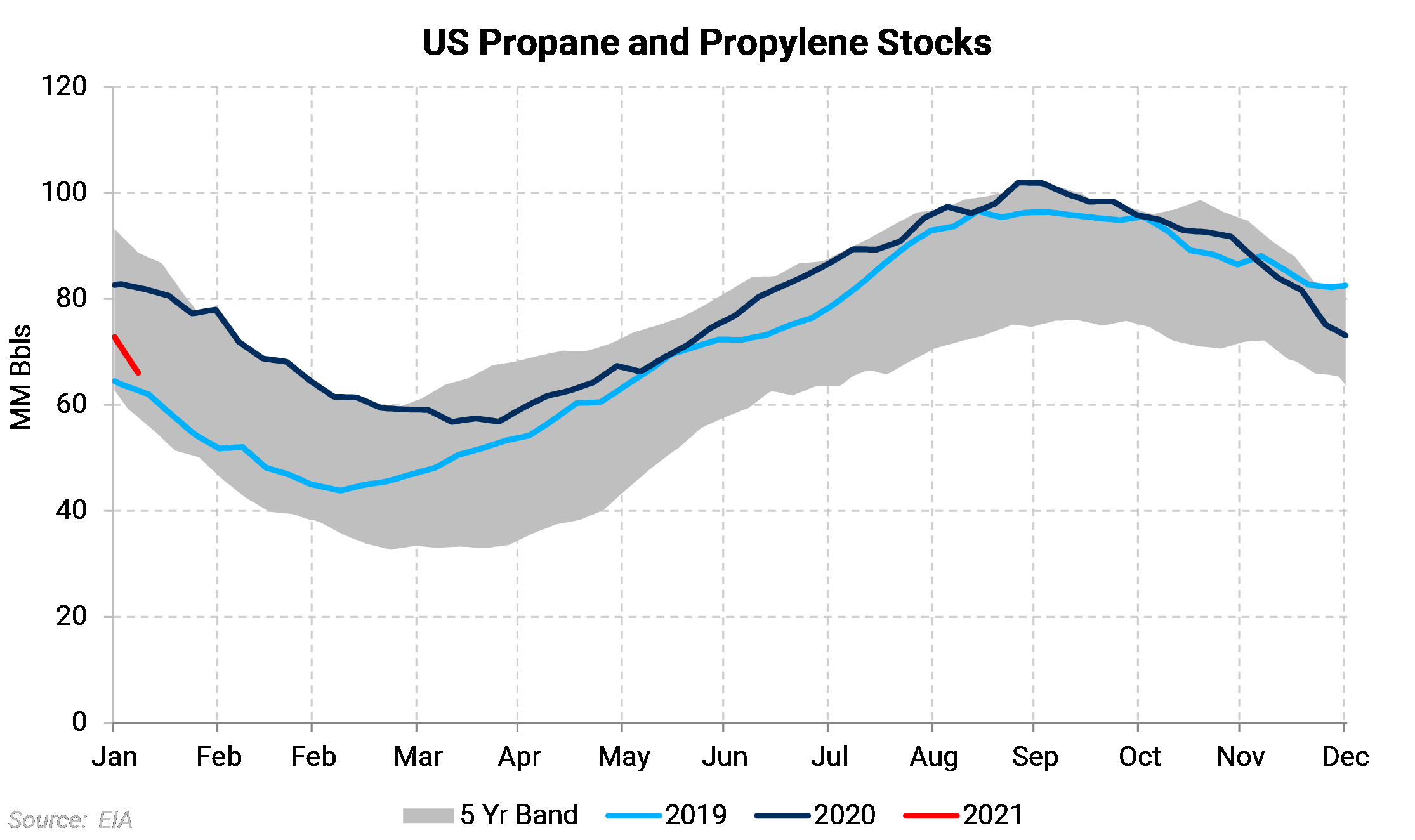

What about the supply side? U.S. propane production is flat, as E&Ps have scaled back drilling plans. It appears unlikely that U.S. shale producers (in aggregate) will be able to materially increase production in 2021 given price and capital constraints. Add up rising exports, flat domestic demand, and flat production, and you have (dramatically) falling inventories. Not only are we approaching the low end of the five-year band in stocks, we are doing so at a rapid pace.

Add up rising exports, flat domestic demand, and flat production, and you have (dramatically) falling inventories. Not only are we approaching the low end of the five-year band in stocks, we are doing so at a rapid pace. Structurally, the rise in propane prices this winter is largely justified on fundamentals, best evidenced by declining stocks.

Structurally, the rise in propane prices this winter is largely justified on fundamentals, best evidenced by declining stocks.

Will propane prices continue to move higher? That is pretty likely in the near term. Fundamentals are strong;exports are soaring, and production is flat. However, once winter is over, it is expected that overseas prices for propane will fall significantly. It remains to be seen where overseas prices settle out in the shoulder months, and what effect that will have on U.S. prices.

For producers, it's a good idea to lock in prices on the back of the strong rally we've had for a portion of their hedgeable propane for Bal 2021.

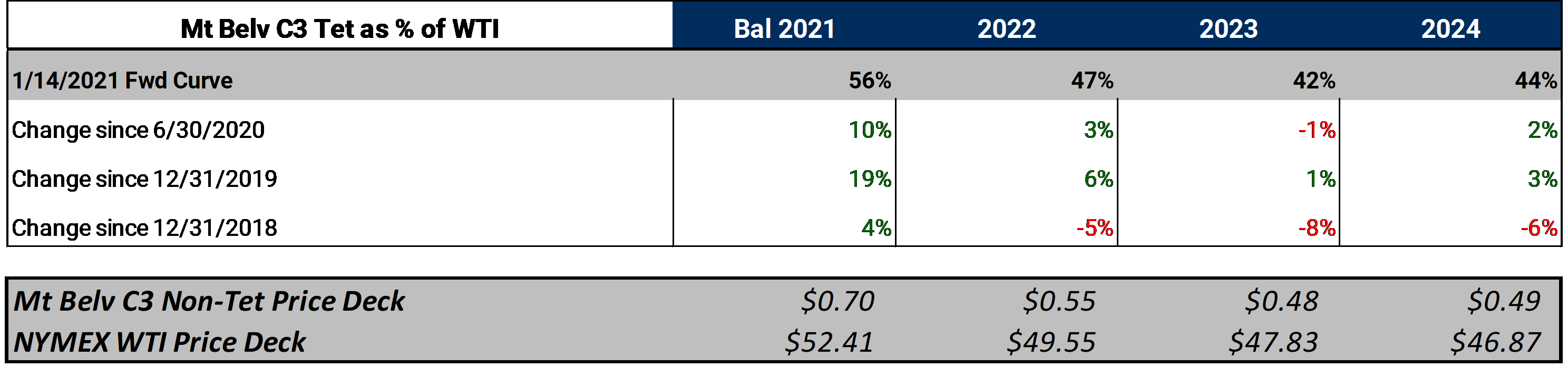

Producers should leave room to hedge more at potentially higher prices as the impact of a large step up in exports at Nederland this week is digested by the market. Regarding tenors, AEGIS believes producers should stick to hedging only the front of the curve, where propane is once again trading at reasonable valuations relative to crude. Bal 2021 propane is currently trading at 56% of WTI, back in-line with historical norms.

Regarding tenors, AEGIS believes producers should stick to hedging only the front of the curve, where propane is once again trading at reasonable valuations relative to crude. Bal 2021 propane is currently trading at 56% of WTI, back in-line with historical norms.

Beyond 2021, propane still trades below 50% of WTI. Propane's forward curve seems too backwardated to warrant locking in prices now for 2022 and 2023, debt-service considerations aside.