What is a voluntary carbon offset?

The market for voluntary carbon offsets has grown massively over the past several years, as governments and shareholders pressure companies to reduce their carbon emissions. While certain carbon emitters operating in some regions are required by governments to maintain emissions below a certain threshold by using compliance credits, others voluntarily choose to curb their emissions using carbon offsets. An offset is equivalent to one ton of CO2 and is created when an offset project developer proves to a carbon registry that their project is reducing carbon emissions in an approved method by their registry. That offset can then be sold to an entity that wants to retire the offset, thereby permanently removing it from supply and offsetting one ton of their CO2 emissions.

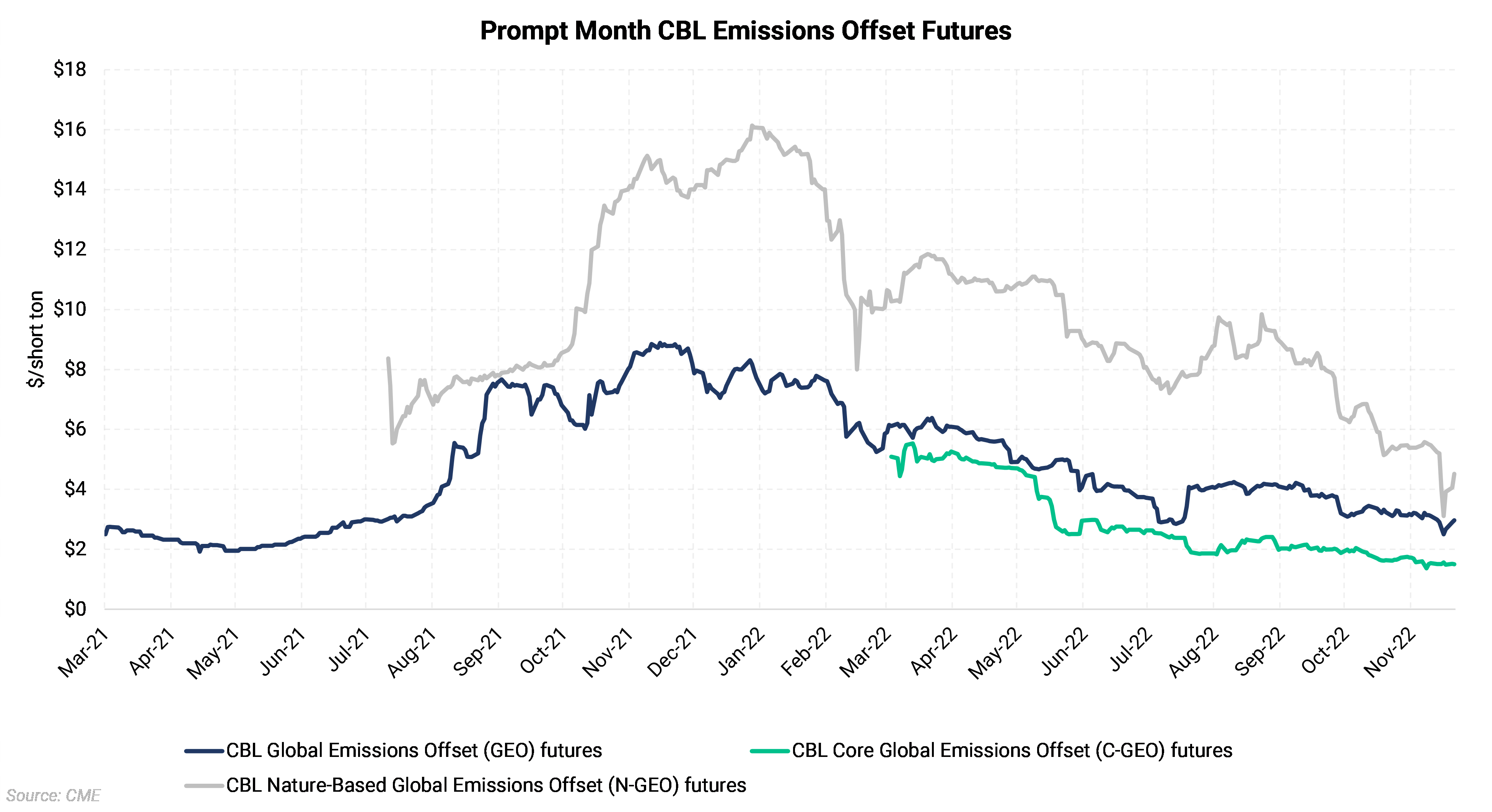

There are three voluntary carbon offset futures contracts that trade on the CME.

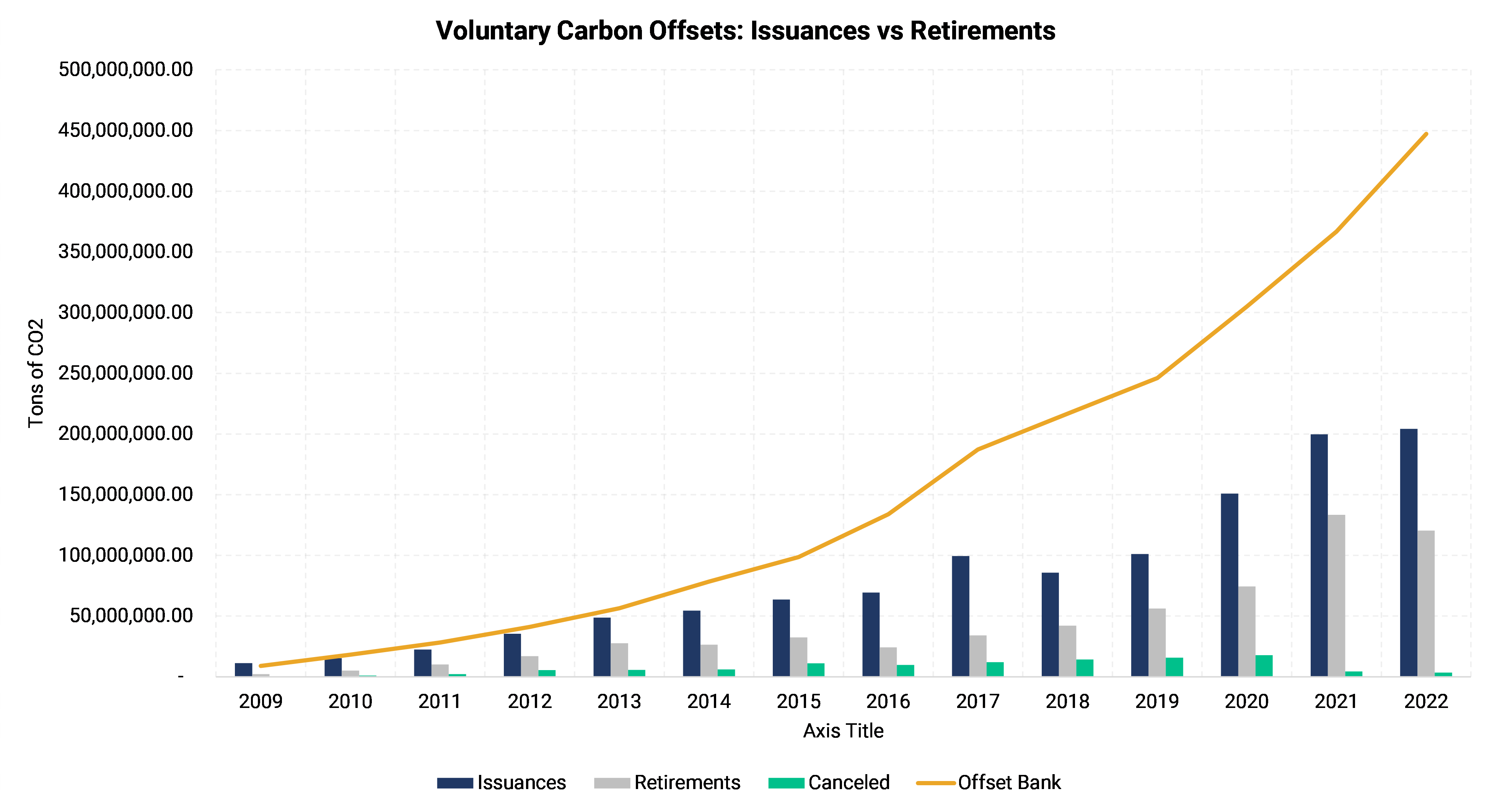

Charts above include offsets from Verra, ACR, and CAR

Credit issuances have consistently outpaced retirements leading to an oversupplied market.

While credit retirements have increased almost every year, issuances have also increased, and at a higher rate. This has led to a considerable ‘bank’ of credits building up, which has weighed on prices. The bank of offsets or the number of offsets available on the market is a measure of total supply. While retirements, or offsets that have been permanently extinguished, represent demand. Prices have softened considerably in 2022, with GEO contracts falling from $9 to $3, while the bank of offsets continued to increase, from 332 million to 455 million. More than twice as many offsets were created in 2021 than in 2020 which substantially increased the size of the offset bank.

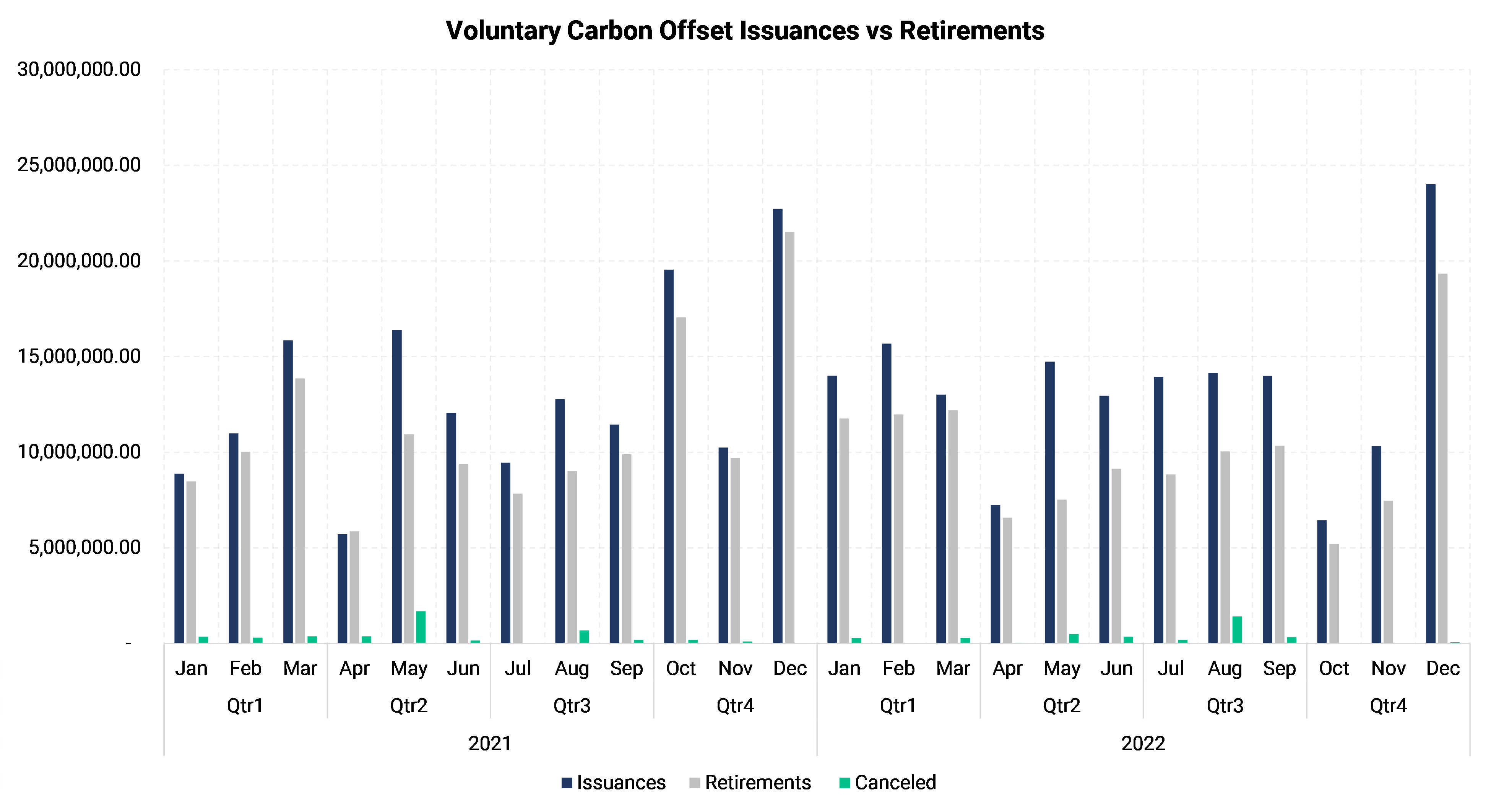

December has been the strongest month for both issuances and retirements.

In both 2022 and 2021, December was the month with the largest volume of both issuances and retirements, with most of the volume occurring in the final days of the month. In December 2022 about 20 million tons of offsets were retired, while 24 million offsets were issued, a new monthly record for issuances. This compares to 21 million retirements in December 2021 and 22 million issuances.

Chart above includes offsets from Verra, ACR, and CAR

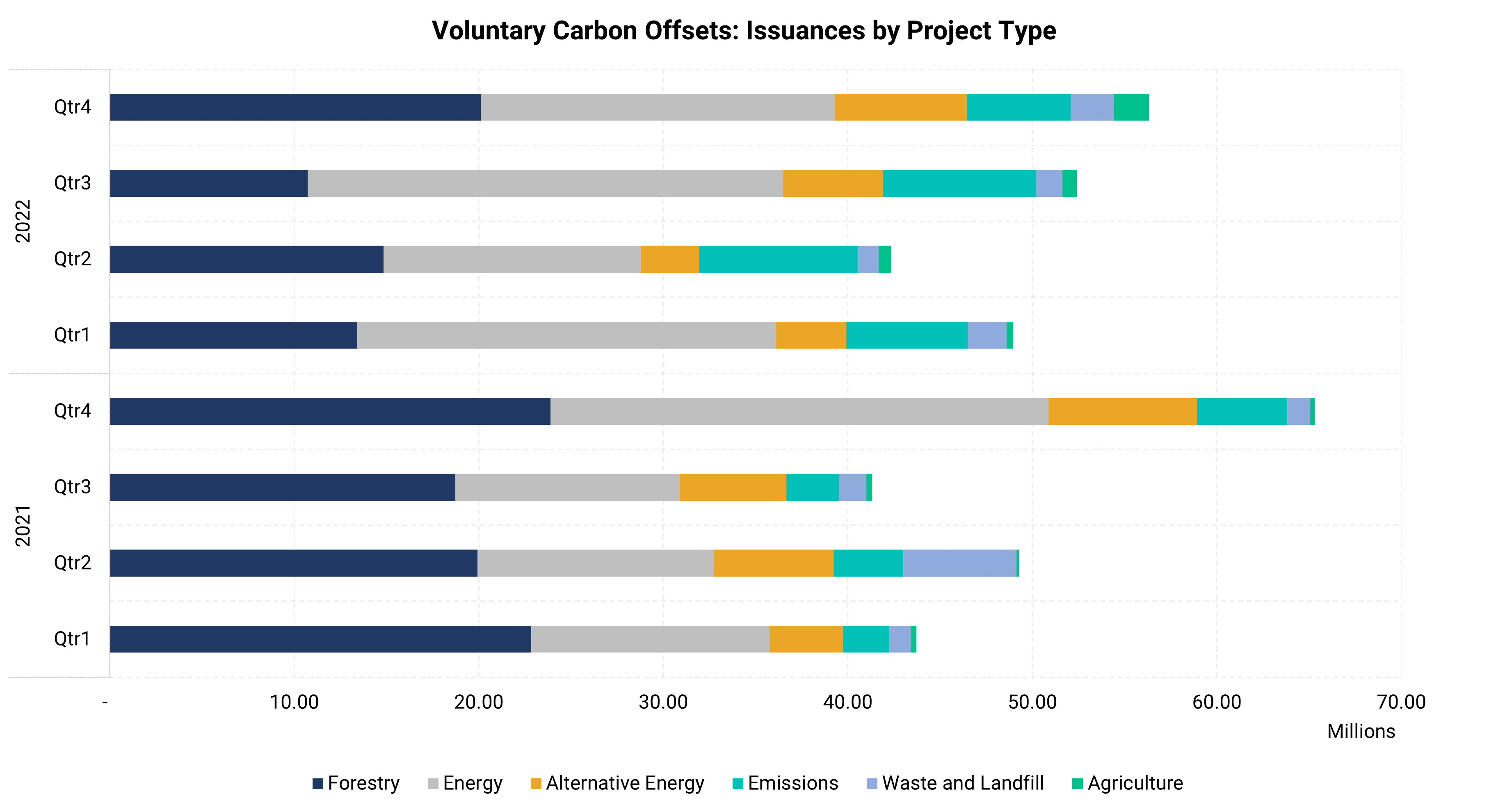

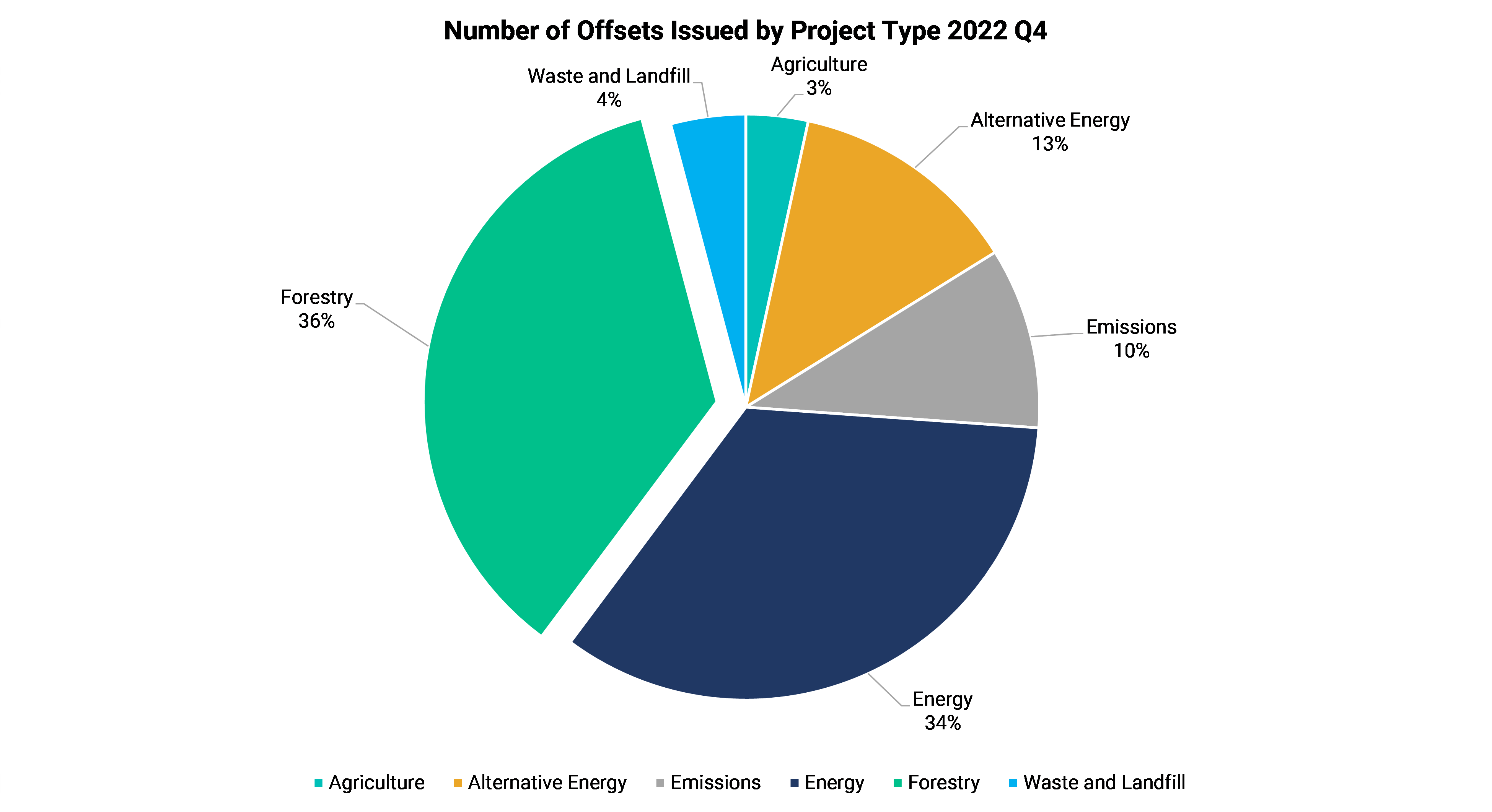

The bulk of offsets generated have been from forestry and Energy projects.

Forestry projects generally remove carbon through one of three methods, reforestation, avoided conversion, or improved forest management.

Energy Projects include operations such as carbon capture and sequestration, which capture carbon emissions and store them below ground, and energy efficiency projects, which reduce electrical demand through higher efficiency technologies.

Offsets from energy and forestry projects represented two-thirds of all offsets generated in the fourth quarter.

57 million offsets were created in the fourth quarter of 2022, with 34% of those coming from energy-based projects. 36% of offsets created in Q4 were from forestry projects, compared to Q3 in which 21% of offsets originated from forestry projects.