In late 2020, Jet-fuel prices violently broke their languid stay at near $1.00/gallon to approach $1.40, and underlying oil prices have been lively.

In early 2020, lack of demand for Jet and low oil prices had conspired to hold the Jet curve at a very low level. Several recent developments pushed Jet out of the slump. COVID-19 vaccines started the trend. A weakening U.S. dollar, falling while fiscal stimulus packages were passed, has boosted many commodity prices.

Most recently, Saudi Arabia announced surprise 1 million barrels per day of additional supply cuts. Add all these up, and both fundamentals and trade flows are encouaraging higher refined products prices.

Still, a flat Jet curve, where late 2022 Jet prices are almost the same as spot rates, allows the Jet consumer to lock-in low prices for multiple years.

Below we discuss some of the elements that are contributing to Jet prices.

|

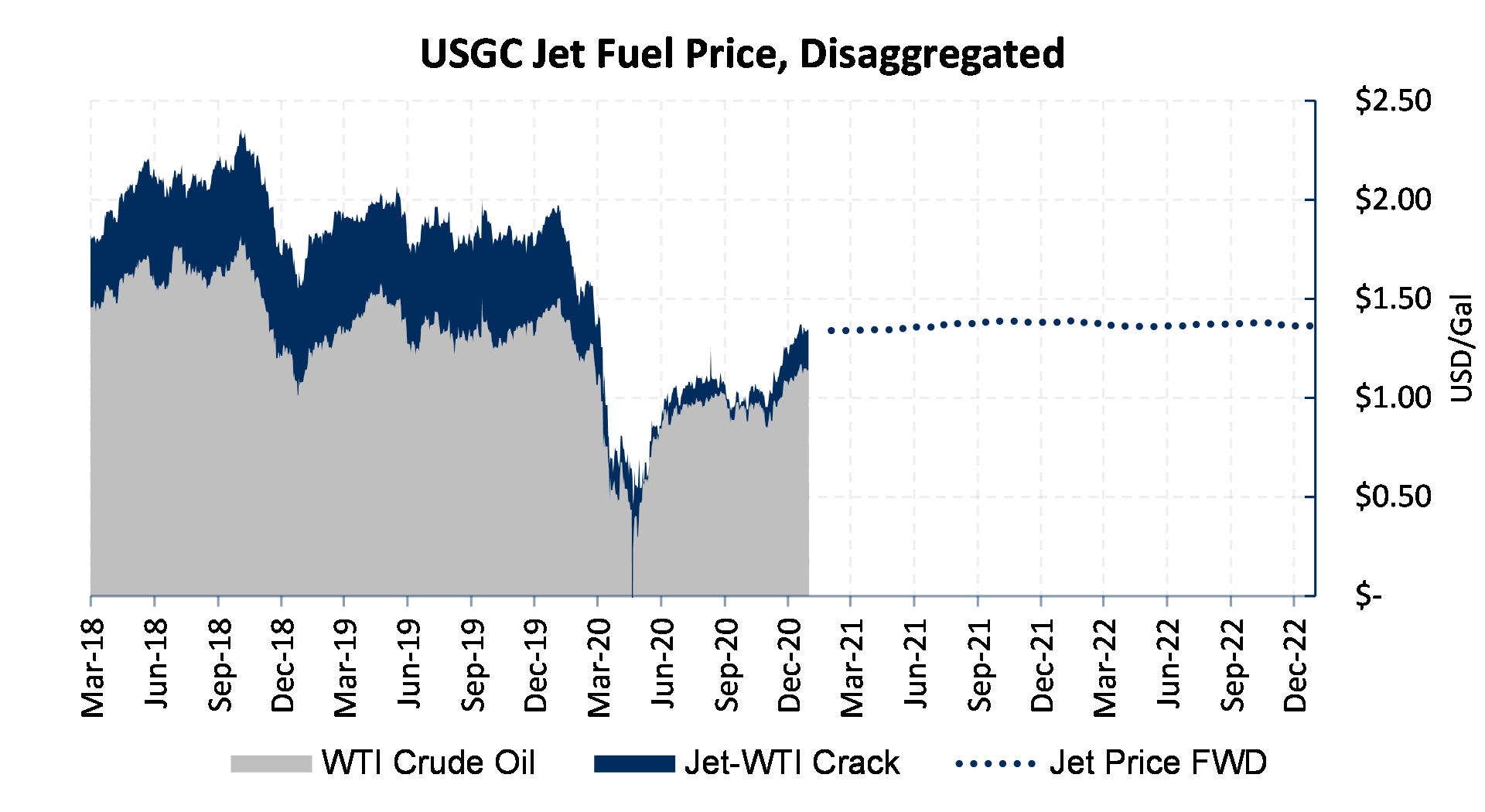

Jet price can be simply disaggregated into two major components: the cost of crude oil to a refinery, and the gross margin -- or Jet "crack" -- the refinery can capture. Added together, these two elements are exactly the price of Jet. As oil prices (Nymex WTI) have reached to the low $50s, Jet prices have floated on top of WTI, moving higher with the tide. Refining margins have expanded modestly, but it is an important trend. As global demand for petroleum rises, the Jet crack would likely expand, increasing Jet prices. AEGIS holds a view that oil prices have a chance to escalate in late 2021. Consumers of Jet should consider buying swaps all across this curve, especially beginning in 3Q2021. Near-term hedges can mitigate the rally and preserve some downside price exposure; consider consumer collars. |

|

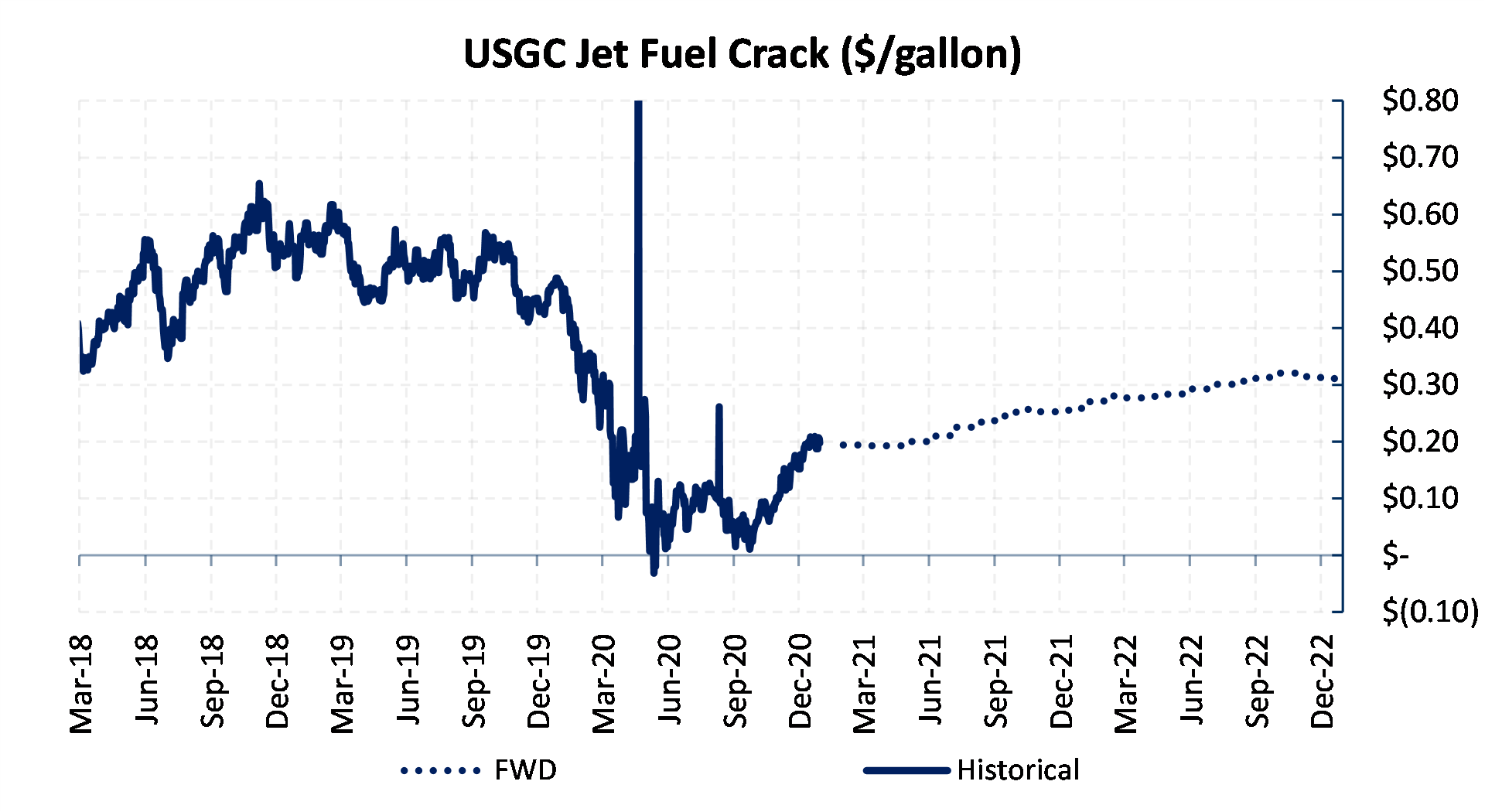

Despite a recent improvement in near-term refinery margins, Jet cracks are still low. In summer 2020, refineries had avoided making Jet, preferring to regrade their yields and produce more diesel. That practice is likely now being questioned, and more Jet supply could be produced. However, it seems prices are reflecting the need for more Jet supply. We would not expect refineries to overshoot and suddenly send the Jet crack back toward zero. |

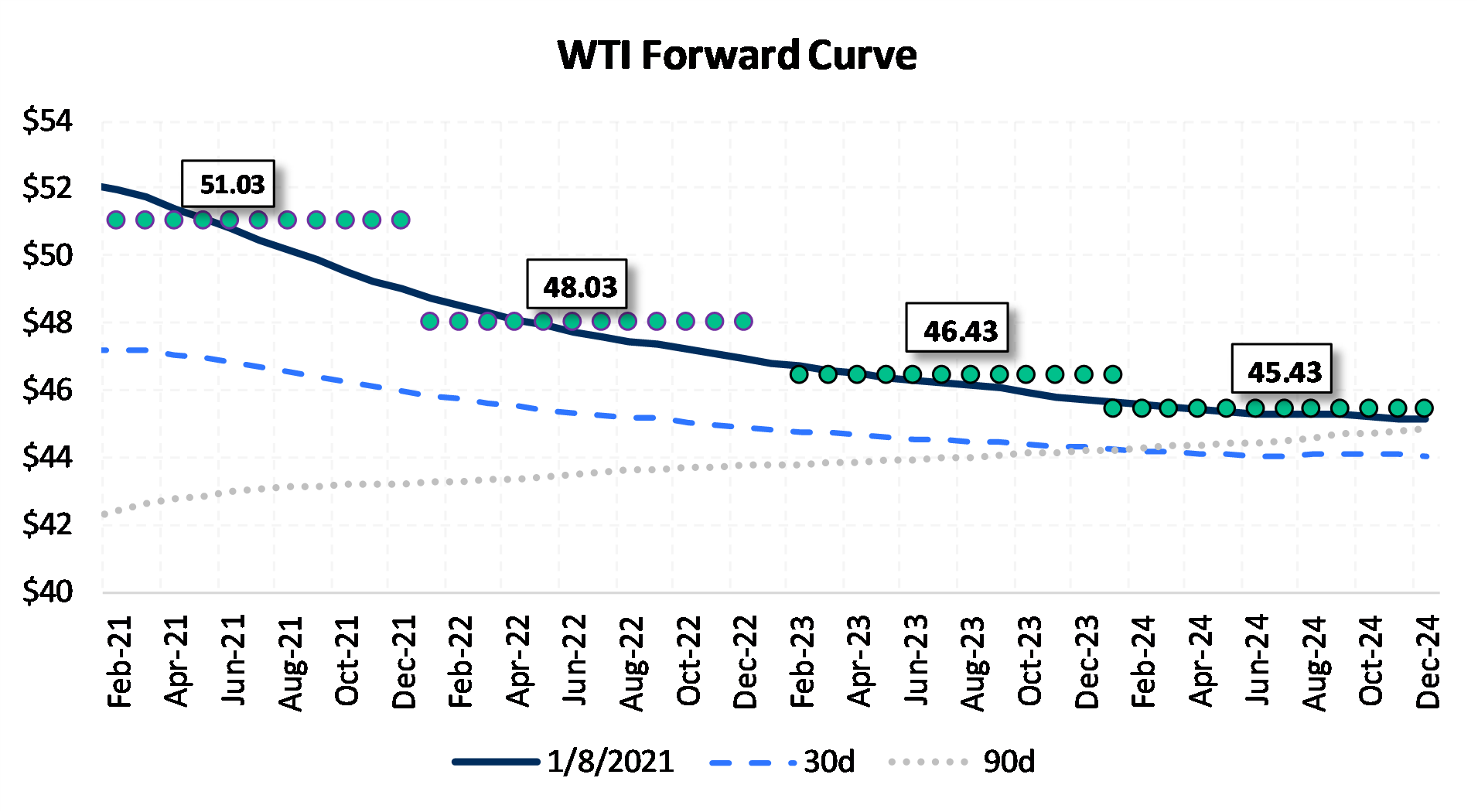

| Oil prices have improved greatly in the last several months. The curve is slightly backwardated (downward sloping). This is important for Jet if later WTI tenors settle higher, closer to values at the front of the curve.

By 2022, AEGIS sees risk of oil prices moving higher to encourage more production in the U.S. Therefore, Jet consumers need to be very wary of price increases in 2022. For many consumers with predictable purchase volumes, using swaps to aggressively lock-in Jet prices beginning in late 2021 tenors is our base recommendation. |

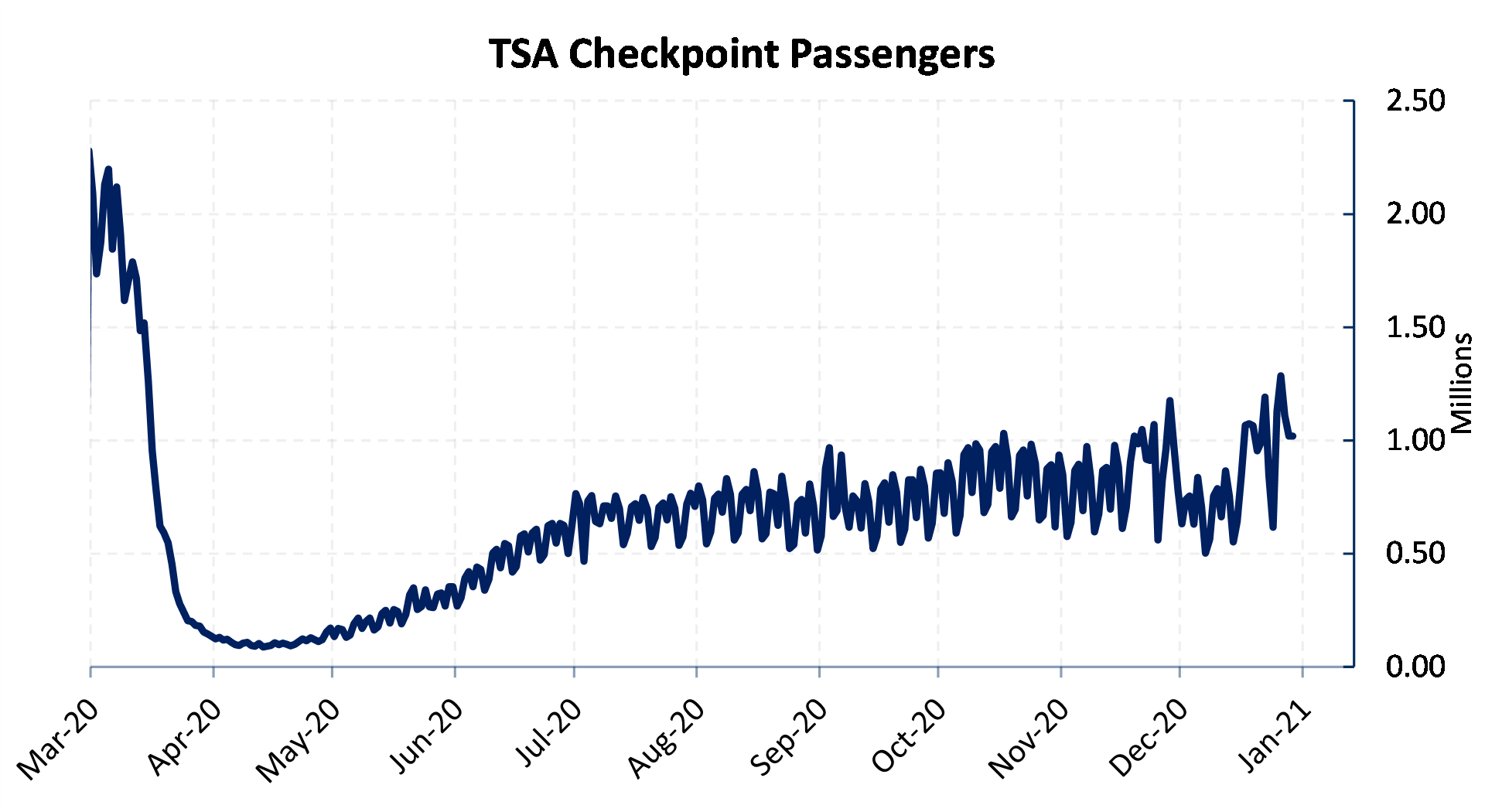

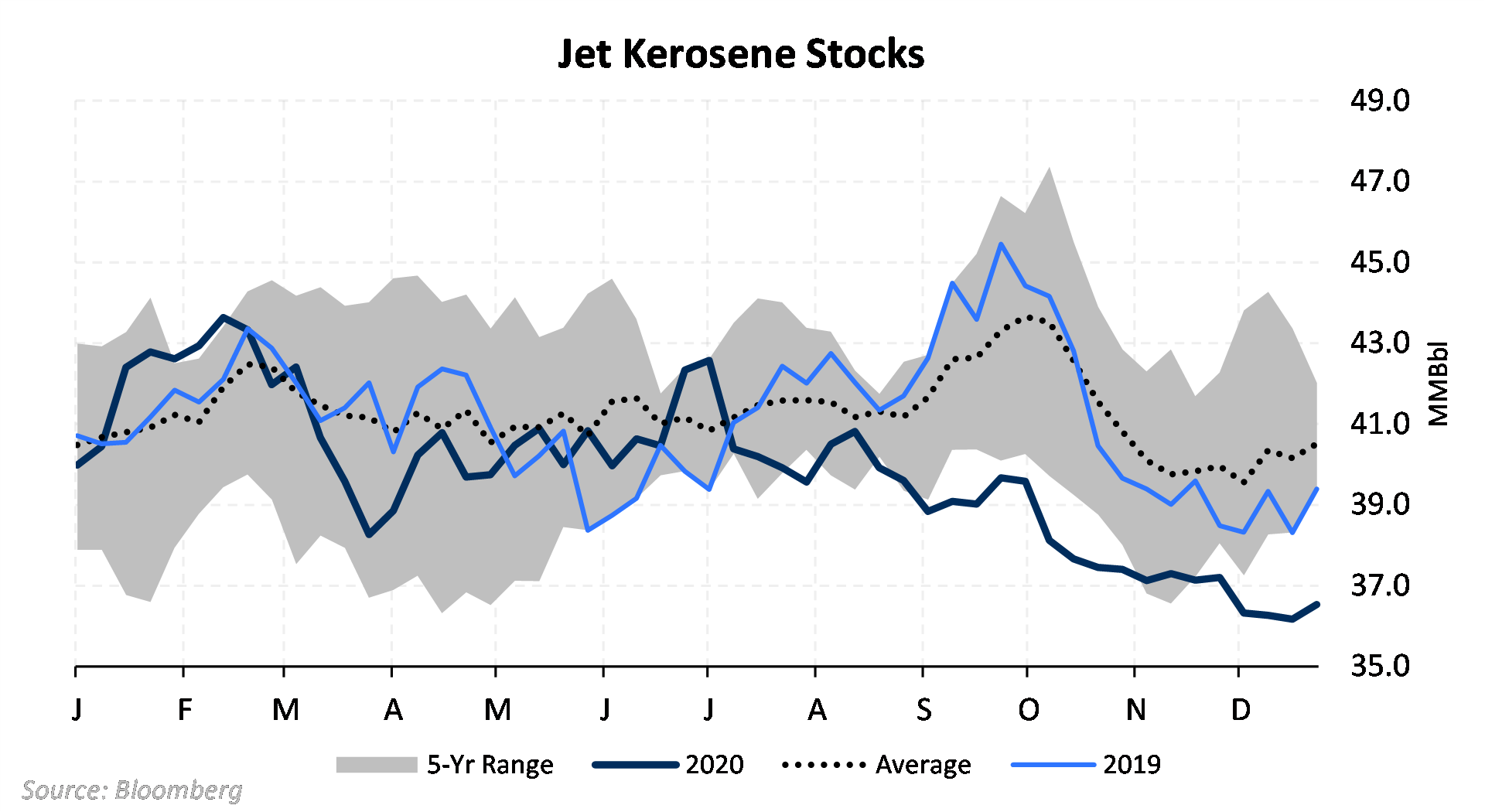

| The Jet crack is likely to widen if demand for the fuel rises. In the U.S., passenger flights are still carrying much fewer people than a year ago. However, holiday travel and the arrival of some vaccines has boosted passenger air travel. |

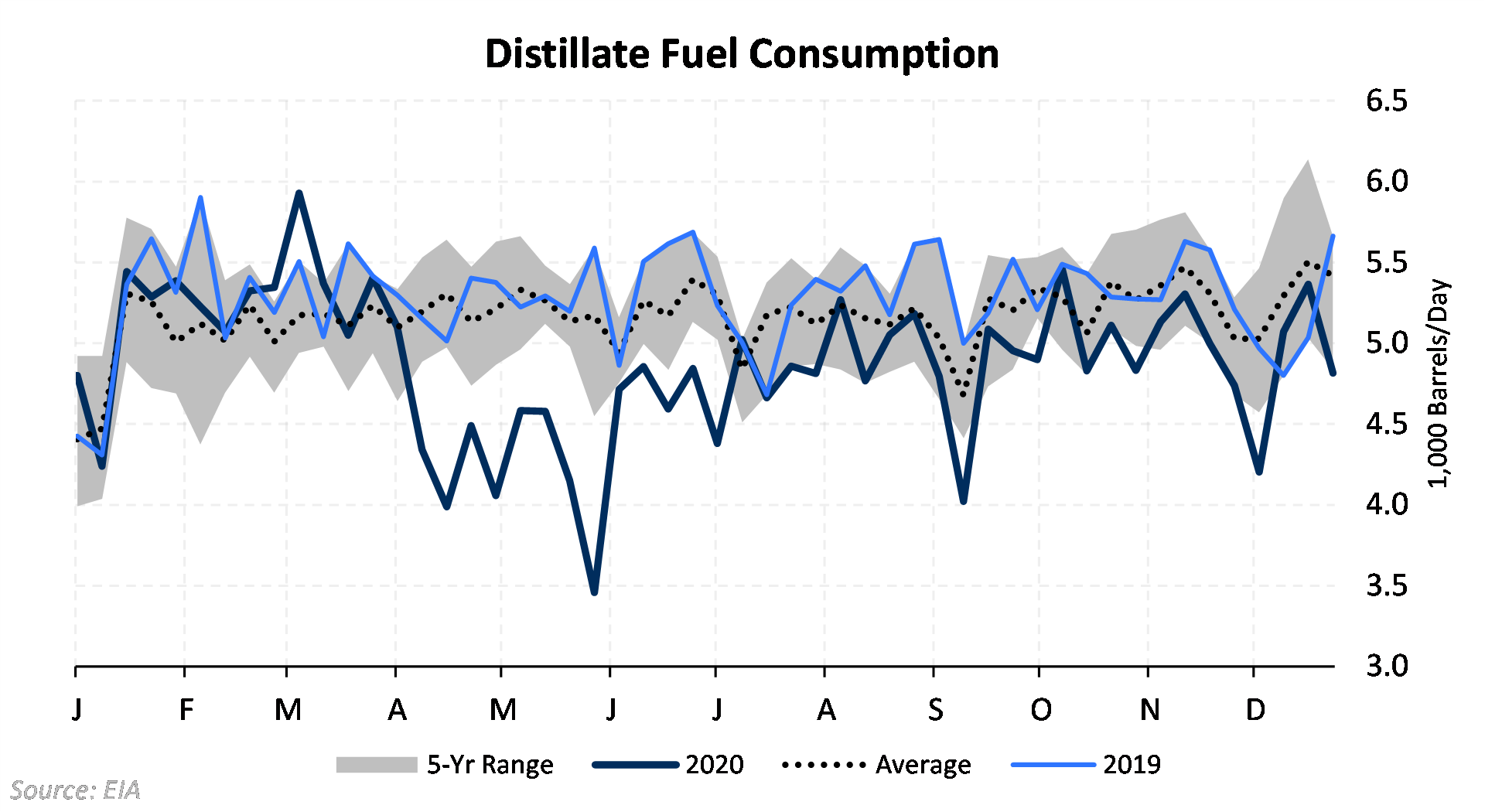

| Demand for all distillates (think diesel) has mostly returned, although it remains at the low end of the historical range. Trucking, logistics, and passenger vehicles have shown some demand recovery. This has persisted through December, even with renewed social-distancing and "lockdown" measures in place. |

|

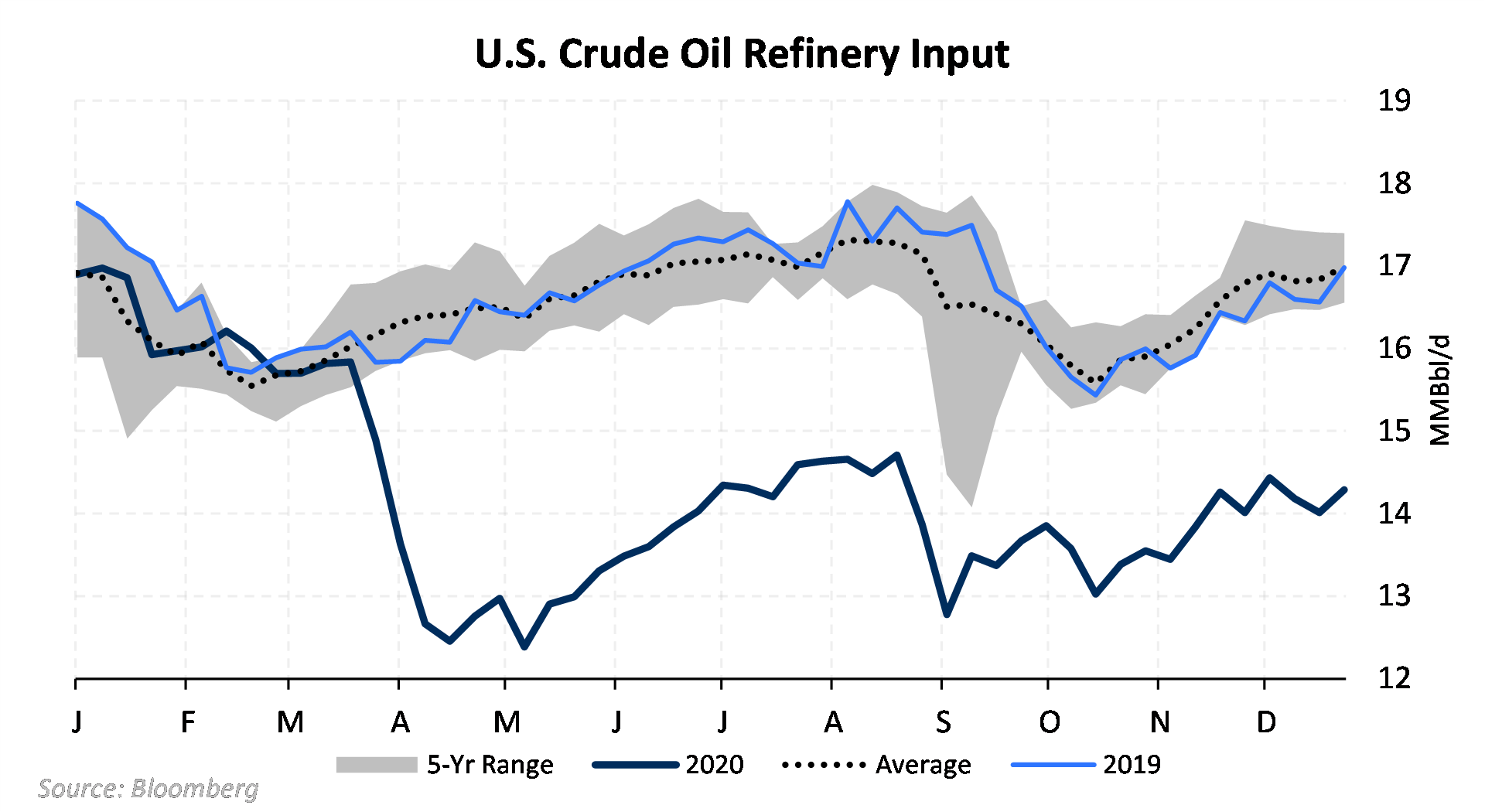

Much less refined products, of all types, are being made now than a year ago, despite some recovery form the lows in April and May 2020. A lack of demand for fuels has held down refining margins. |

|

Stocks of Jet fuel have plummeted to multi-year lows, despite low demand. This is because refiners chose to avoid making Jet. Now, as a result, Jet refining margins have slightly expanded. When Jet demand returns, prices will need to rise to encourage refiners to make more Jet. |

|

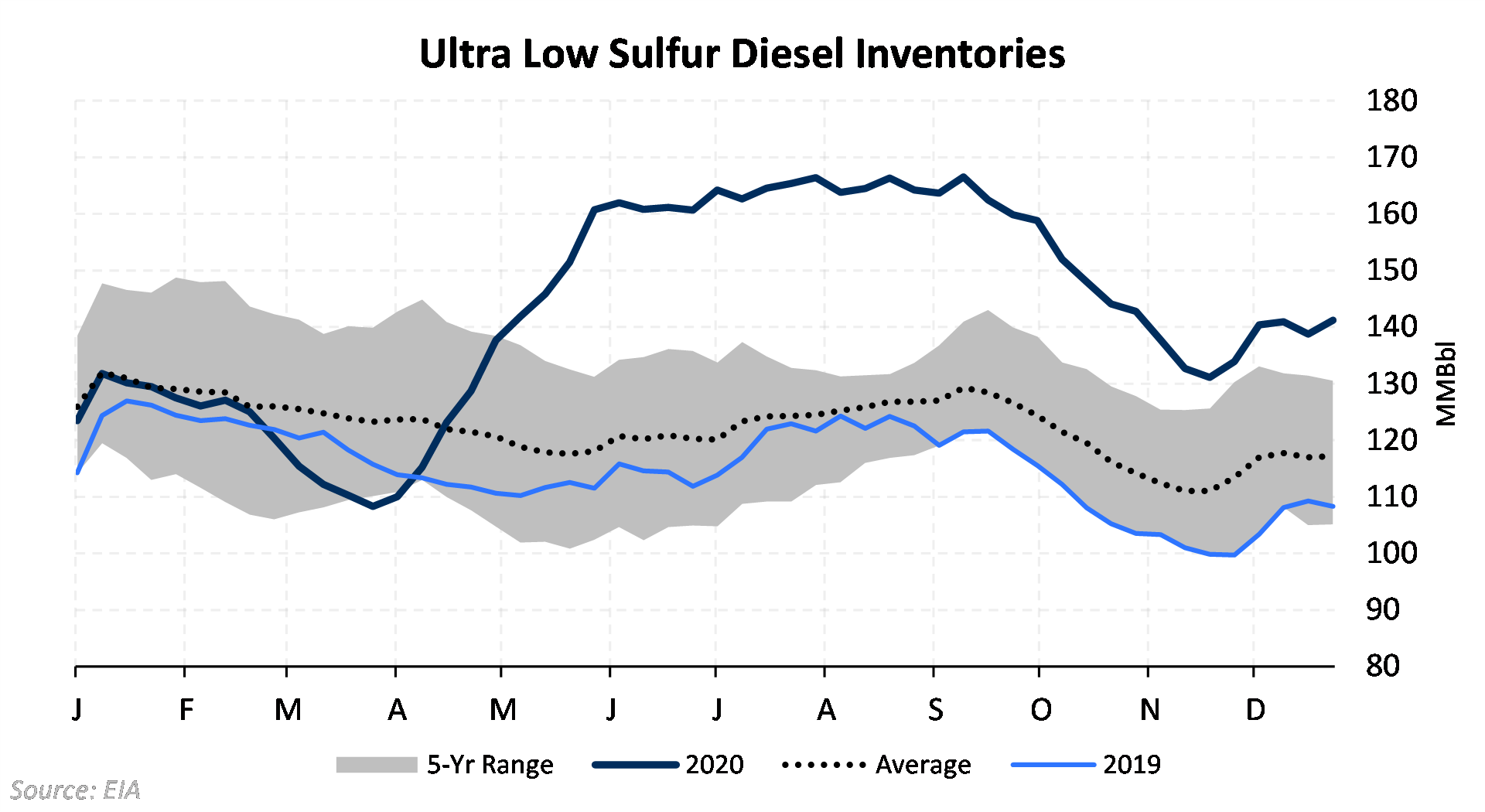

Diesel-like fuel inventories had risen quickly earlier this year, but now have been worked off to a reasonable level. A so-far mild winter has not helped heating oil (the same spec as ULSD) consumption. |

|

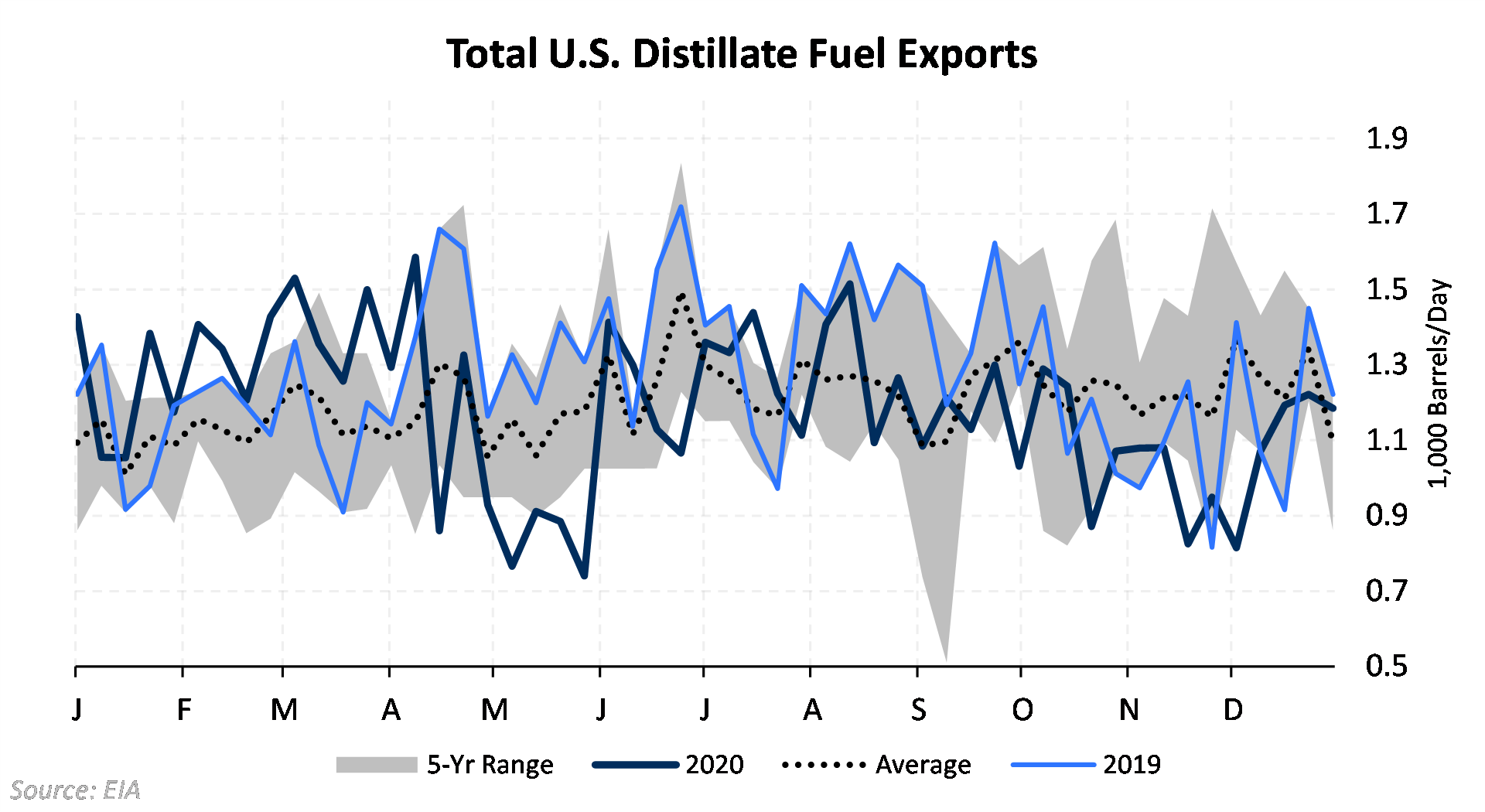

The U.S. is a net supplier to the world for distillate fuels, namely diesel or gasoil. Early in this winter, Europe had been redirecting cargoes back to the U.S., but exports have rebounded to within the typical range. |