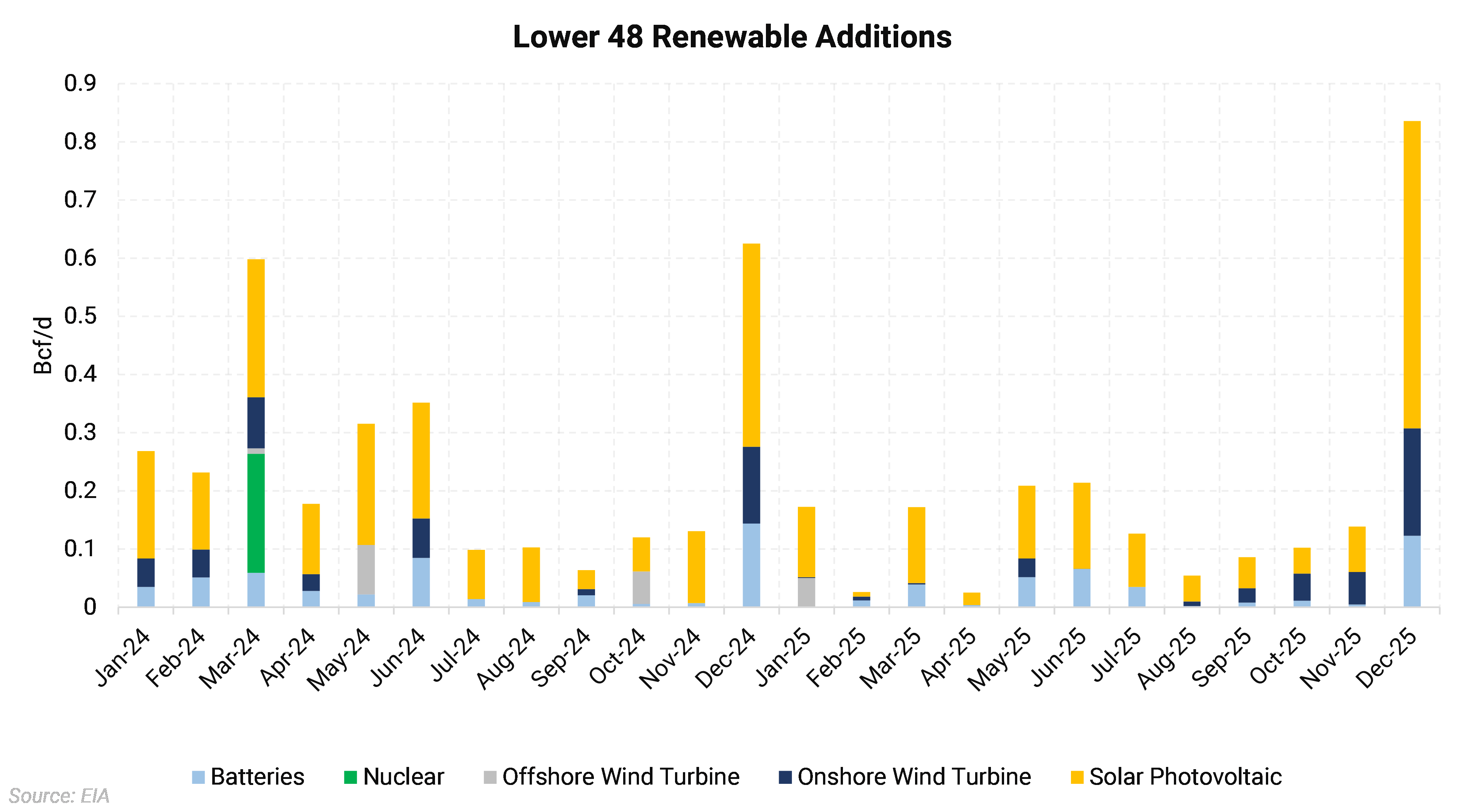

The power sector will continue to add renewables at a swift pace in 2024 and 2025, just as it has done for the past few years. These additions will directly compete with natural gas in the power mix and reduce overall power sector gas demand. Renewable encroachment occurs across the country, but some regions will add considerable amounts of ”green” energy, such as ERCOT, MISO, PJM, and CAISO. The retirement of coal plants will offset some of this, but the pace of coal retirements is set to slow considerably in 2024 before increasing again in 2025.

When adjusting the incoming renewables for their capacity factors and then converting from Gigawatts to Bcf/d, we can estimate the amount of gas demand that could be displaced. Due to the variability of resources such as wind and solar, there will be instances when the displacement is much smaller, but on average, there should still be a sizable reduction in gas demand. An example of this is observed in the CASIO system (most of California), where solar generates a large amount of daytime electricity, but gas-fired power and electricity imports are needed in the evening and nighttime hours.

In total, about 3.08 Bcf/d of gas demand could be displaced by the end of this year, with another 2.16 Bcf/d by the end of 2025. Utility-scale solar will be most of the renewables entering service over the next two years, displacing about 3.2 Bcf/d. Onshore and offshore wind will be the second largest source of gas demand erosion at 0.99 Bcf/d and battery storage at 0.83 Bcf/d. It is important to note that many of the incoming renewables are slated to enter service in December 2024 and 2025; this can often lead to these projects being pushed into the following year.

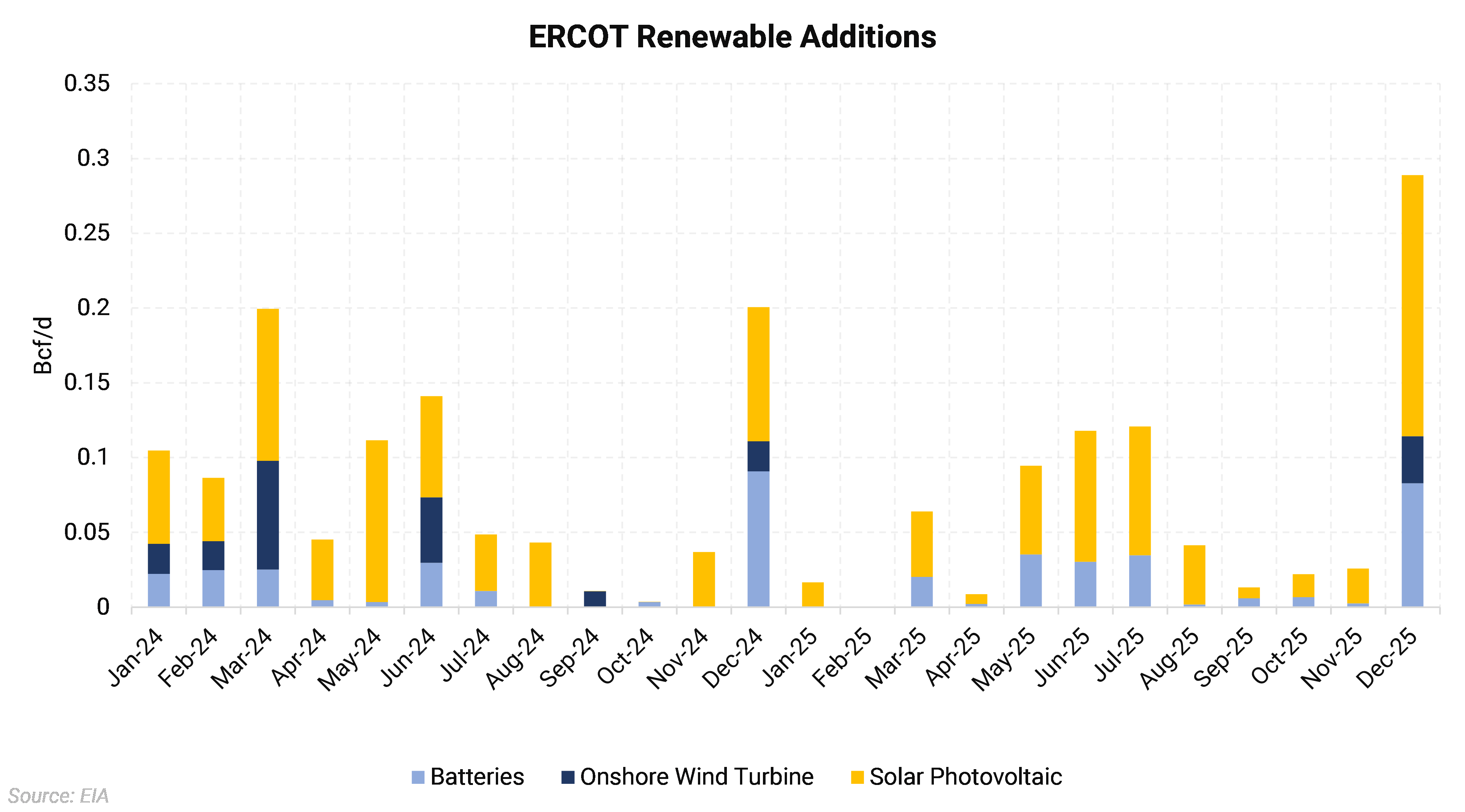

Every grid is adding more renewables, but ERCOT is by far the most aggressive about adding new capacity. Over the next two years, ERCOT will add 18 GW compared to 5 GW in MISO and 4 GW in PJM, the second and third largest region for renewable growth. Adjusting for capacity factors and converting to Bcf/d equates to about 1.85 Bcf/d of potentially lost gas demand over the next two years. In 2023, Texas averaged 5.33 Bcf/d in year-round power sector gas demand and a summer average of 6.8 Bcf/d. A loss of 1.85 Bcf/d could expose Waha and Houston Ship Channel to deeper periods of price weakness when gas is needed less by the power sector, such as during periods of strong performance from wind and solar.

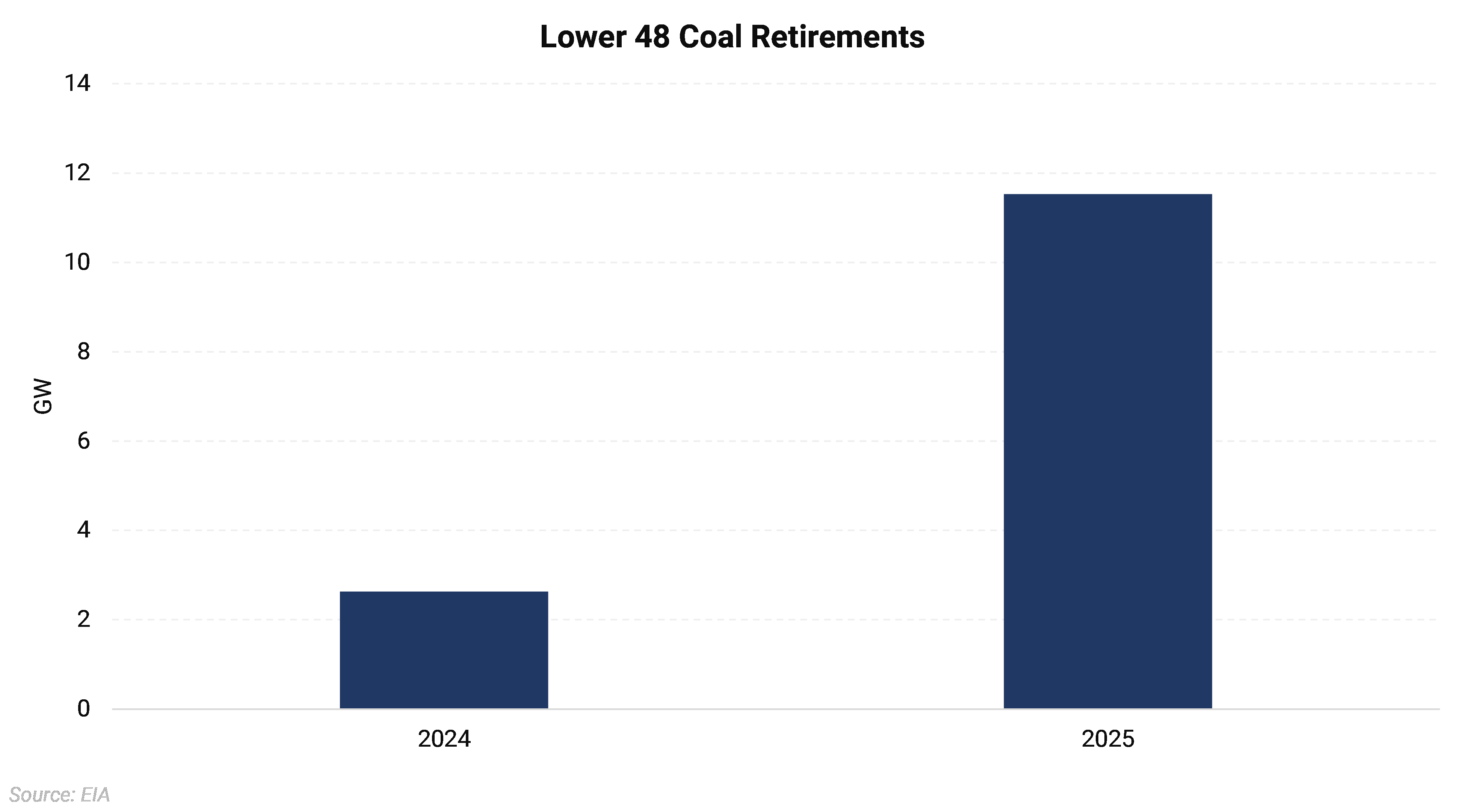

Coal retirements have offset much of the new growth in renewables over the past few years, but they are set to slow to only 2 GW in 2024 before picking up again in 2025. In addition, by the time a coal plant retires, it has often been derated significantly from its nameplate capacity. Most retirements planned for the next two years will be in the Midwest, with 7.72 GW planned to retire in MISO alone.

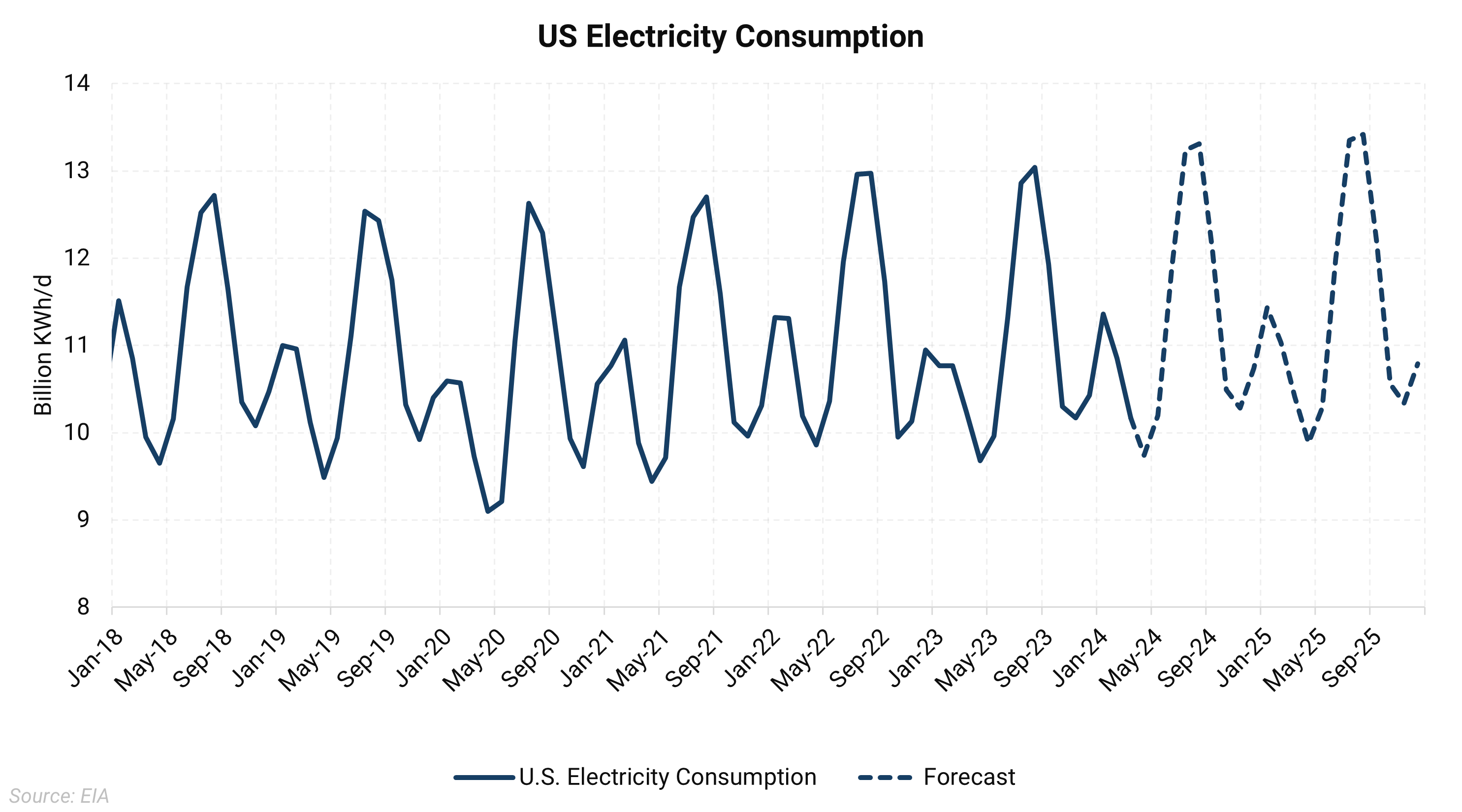

Another important factor when looking at changes to the power stack over the next few years is the growth in overall power demand or load. US electricity consumption is expected to make new highs in 2024 and 2025 and will continue to grow over the next decade. Growth from industrial facilities, data centers, and electrification should keep the need for electricity generation high and potentially offset some of the gas power displacement.

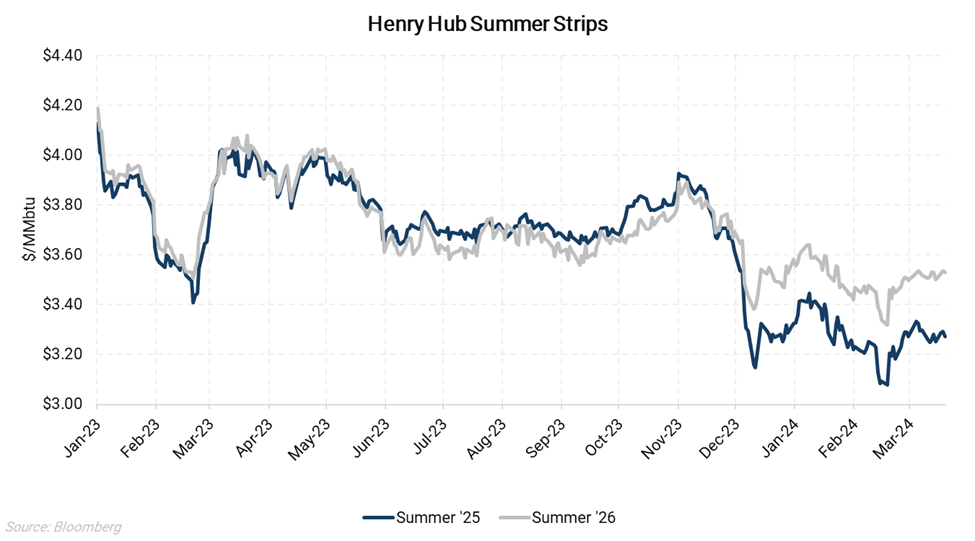

This loss of demand could lead to weaker Henry Hub prices in the shoulder months but could also increase volatility during months of stronger demand, especially in the summer. Due to the uncertain nature of intermittent assets such as wind, there can be large swings in expected gas demand from one day to the next. This may also lead to the spread between shoulder-month contracts and higher-demand months remaining wide into the future.