Demand Recovery

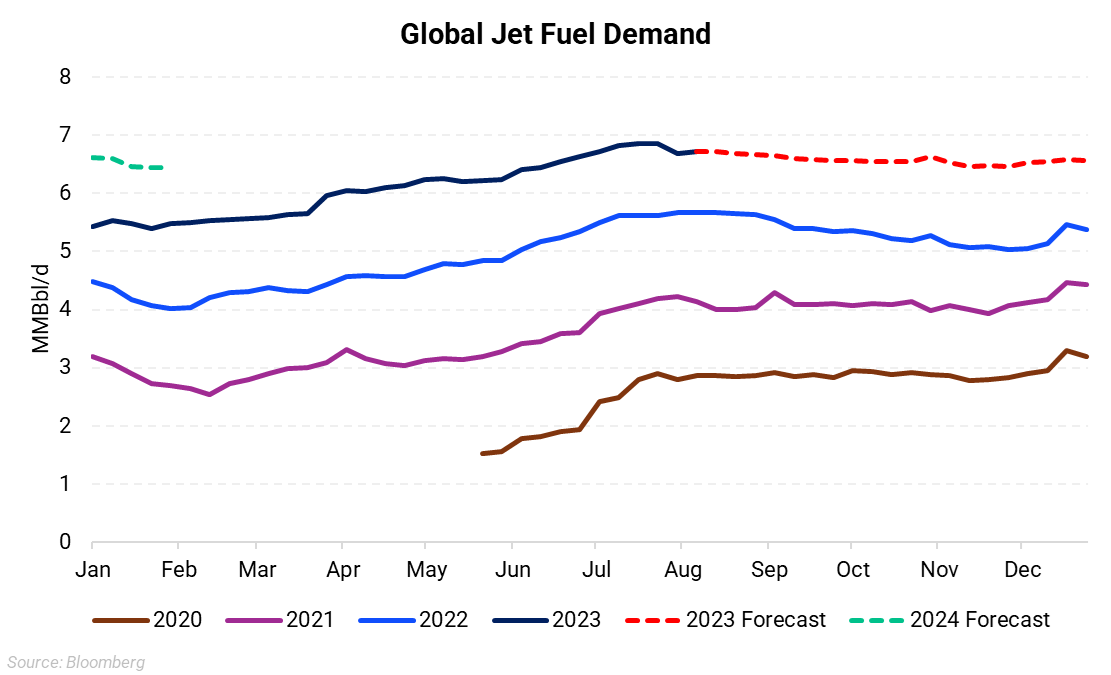

The first half of 2023 has been promising for the aviation sector. Jet fuel consumption soared to an average of 5.9 MMBbl/d from January to June, a 30% increase from 2022. Much of this surge was fueled by the reopening of global travel channels and China's economic recovery. If the momentum persists, jet fuel consumption could hit a record-high 6.6 MMBbl/d in the second half of 2023, according to data compiled by Bloomberg. However, this growth could slow if jet fuel prices continue to rise.

The Price Hurdle

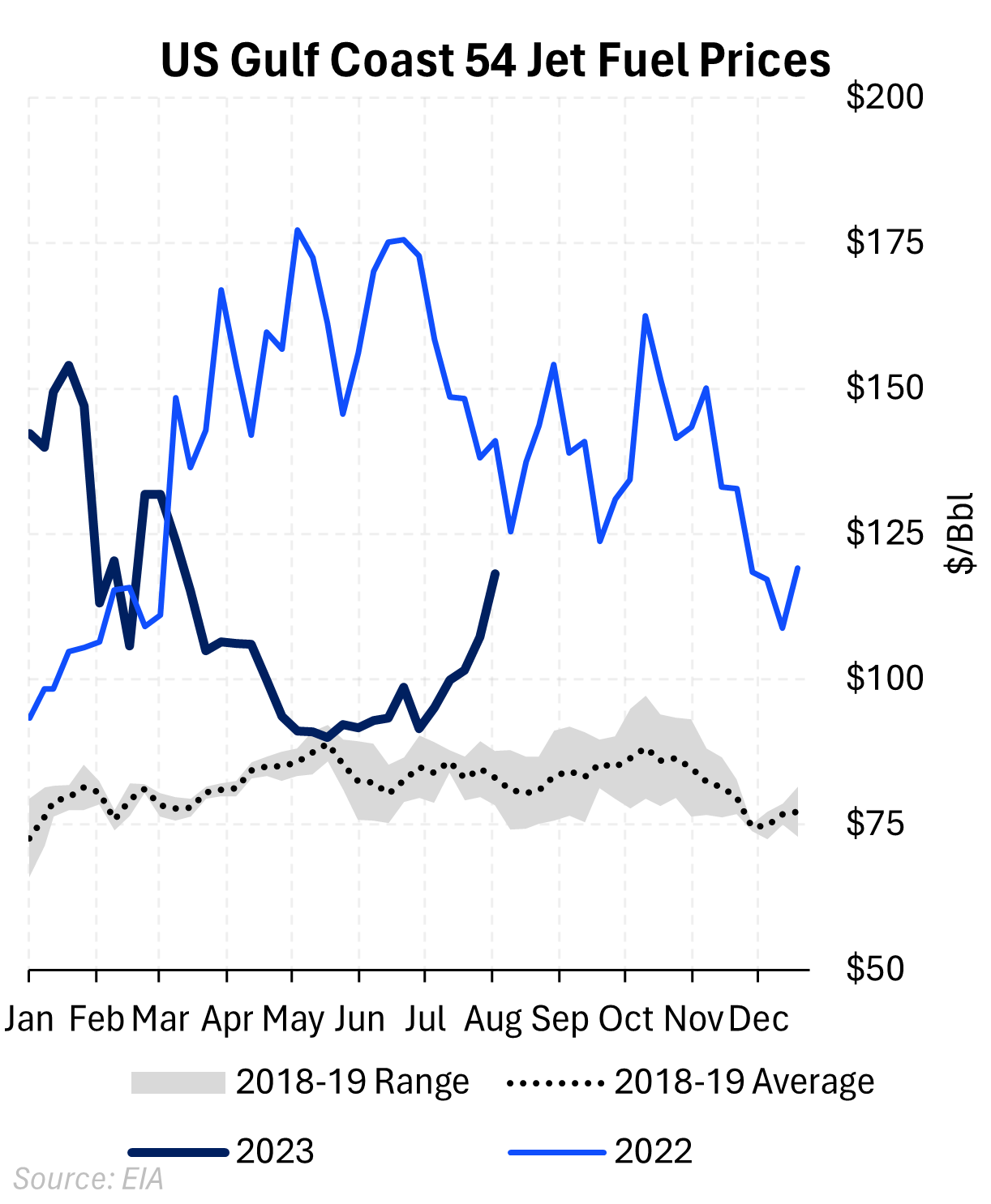

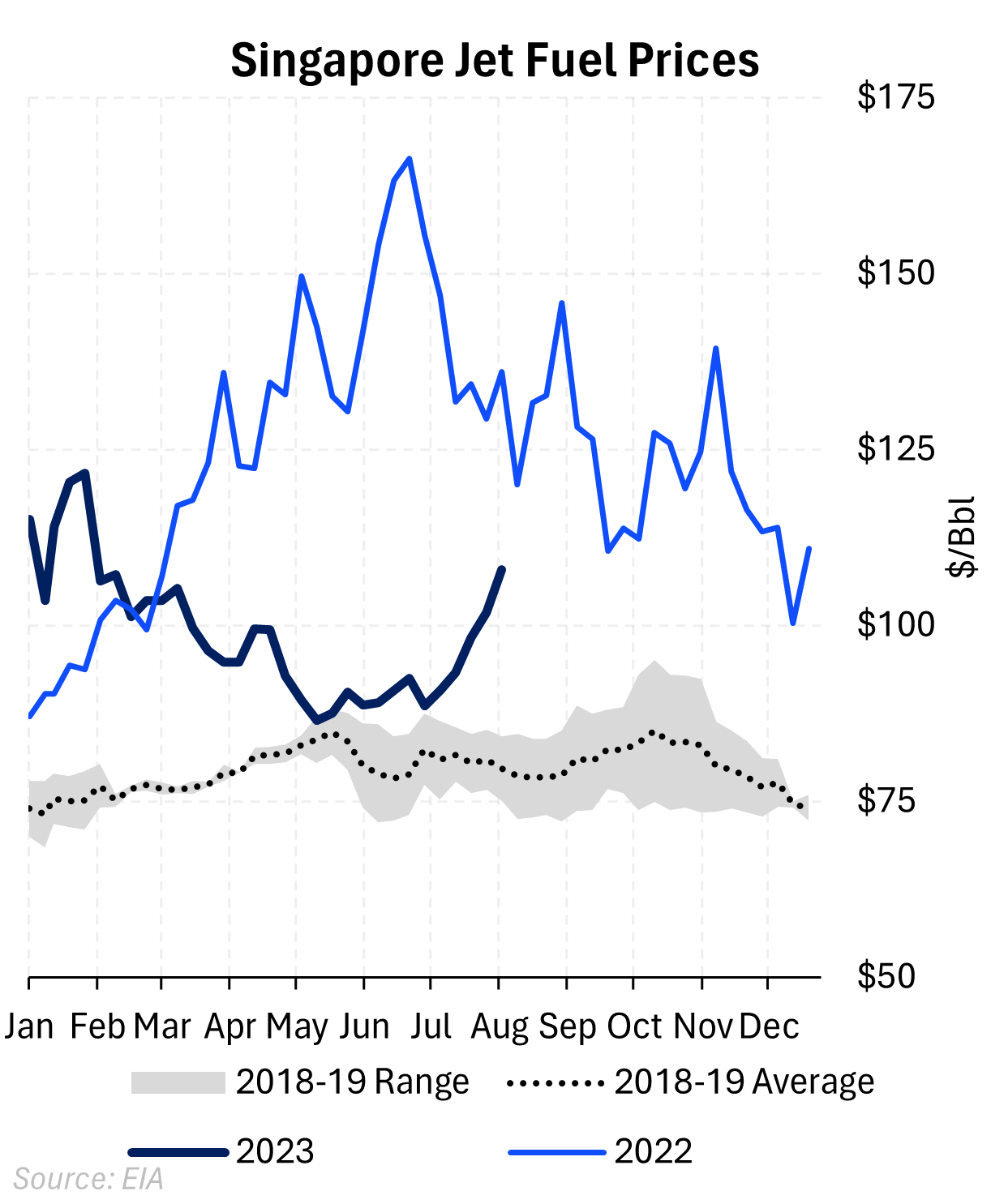

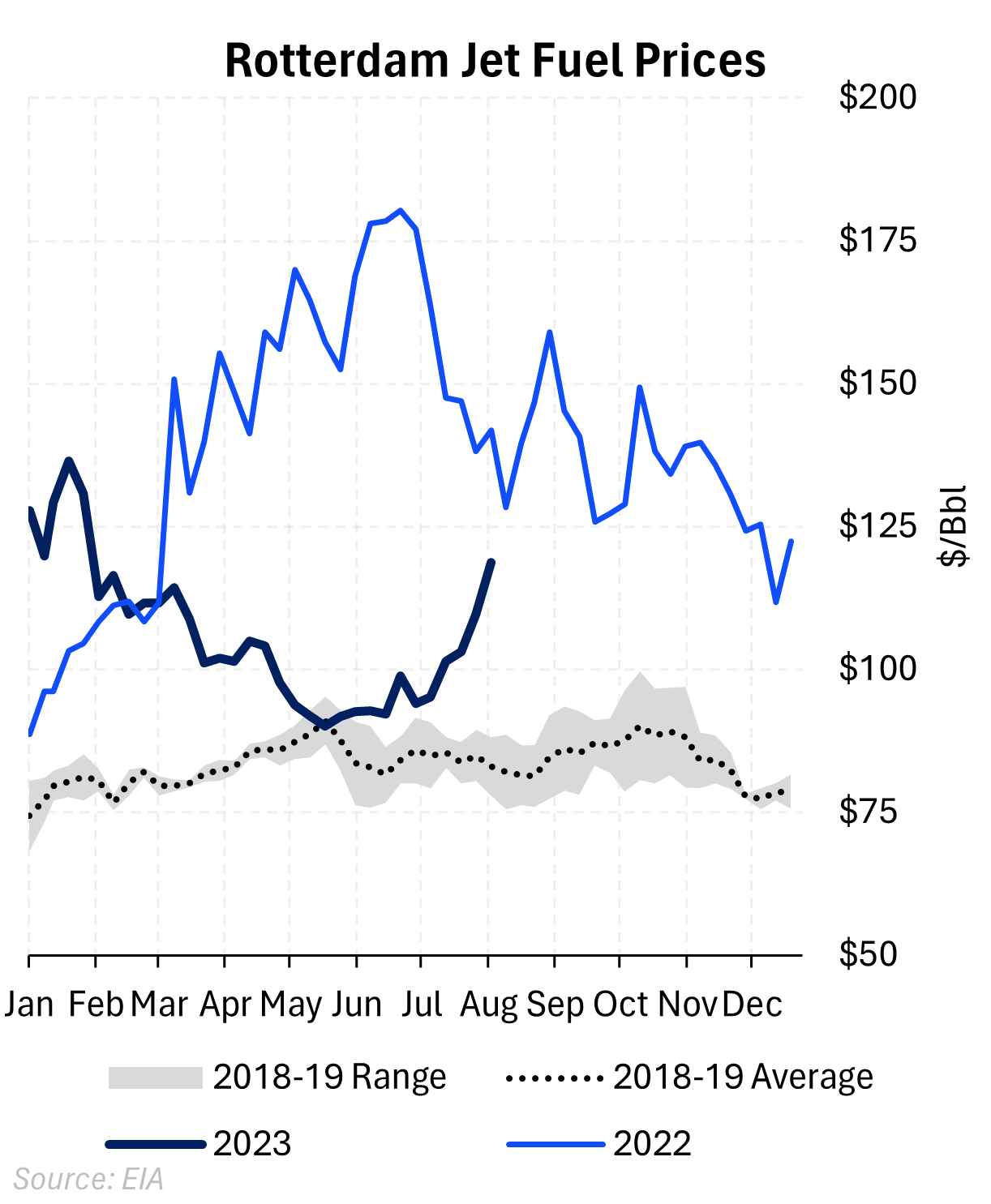

Accompanying this demand growth is a key concern: escalating jet fuel prices. In July alone, major markets like the US Gulf Coast, Rotterdam, and Singapore saw prices soaring by $17-$24/Bbl. Furthermore, in 2022, these escalating prices acted as a significant roadblock to the industry's complete recovery.

|

|

|

Airlines benefitted from low jet fuel costs during the second quarter due to range-bound crude pricing. But with crude markets tightening, this is set to change. Even if refinery margins begin to decrease, rising crude prices could underpin jet prices.

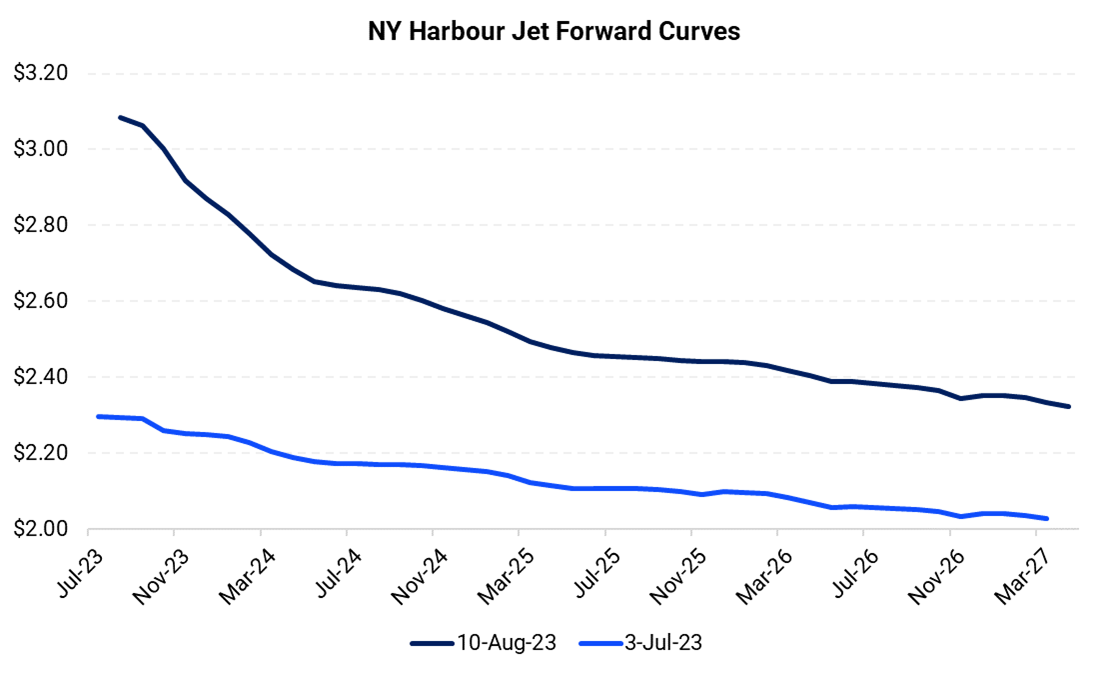

The forward curves for jet fuel and other refined products are in backwardation, indicating a tightening supply environment. As the chart below shows, a comparison of the New York Harbor jet fuel forward curve from July 3 to August 10 shows a 77c or a 33.6% increase for the September contract within a month.

The Factors at Play

Several factors are influencing this price surge:

The Implications

High jet fuel prices have direct repercussions on airlines' bottom lines. Fuel typically constitutes 20% to 30% of their operational expenses. If the current price trend persists, airlines might be compelled to pass on the costs to consumers, which could, in turn, affect the forecasted demand growth.

What Lies Ahead?

The upcoming hurricane and refinery maintenance season in the US can add more volatility to the jet fuel market.

However, the longevity of the current price rally hinges on underlying crude prices. Even if the above-mentioned factors don’t materialize completely, AEGIS is bullish on crude prices on the back of tightening supplies in 2H2023 and an expectation of outsized withdrawals from storage. Strong crude prices could essentially lift the whole crude-complex pricing. And the demand growth expected in the jet market could take a hit if prices continue to rise.