Market: Natural Gas

Hedge: Sell Call Spread (Roll Down Existing Call Strikes)

Tenor: Nov24-Mar25

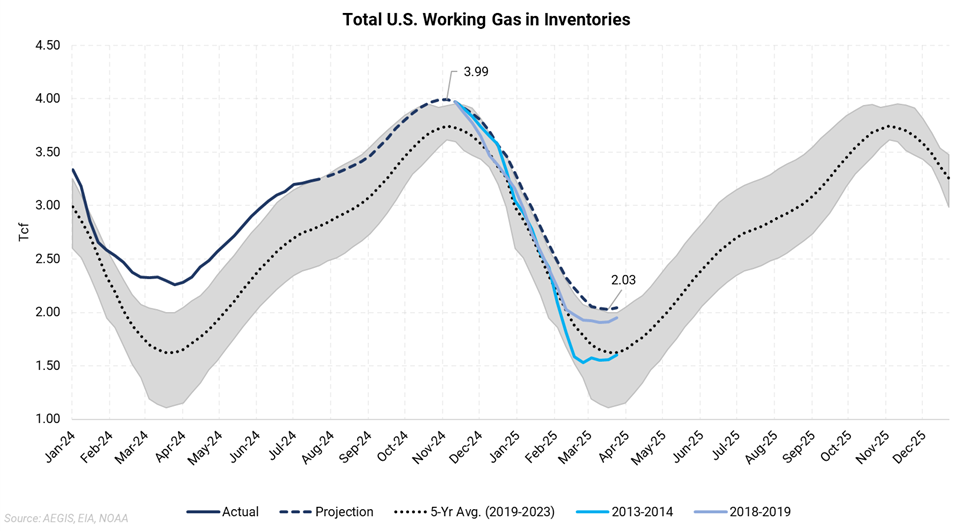

AEGIS recommends a closer examination of the call strikes on your costless collars. As we head into the winter months, our outlook on Natural Gas remains bearish. Storage levels are currently trending near the top of the 5-year range, which may limit any significant price increases for the Winter '24 tenor. Even with above-average heating demand or exceptionally cold weather (as depicted by the blue line in the chart below), the likelihood of prices exceeding and sustaining levels near $5.00 appears fundamentally unlikely. In fact, the options market is implying only a 19% chance of natural gas expiring at $5/MMbtu for the average winter strip. The peak winter January contract only holds a 26% chance of settling at $5/MMbtu as implied by the options market.

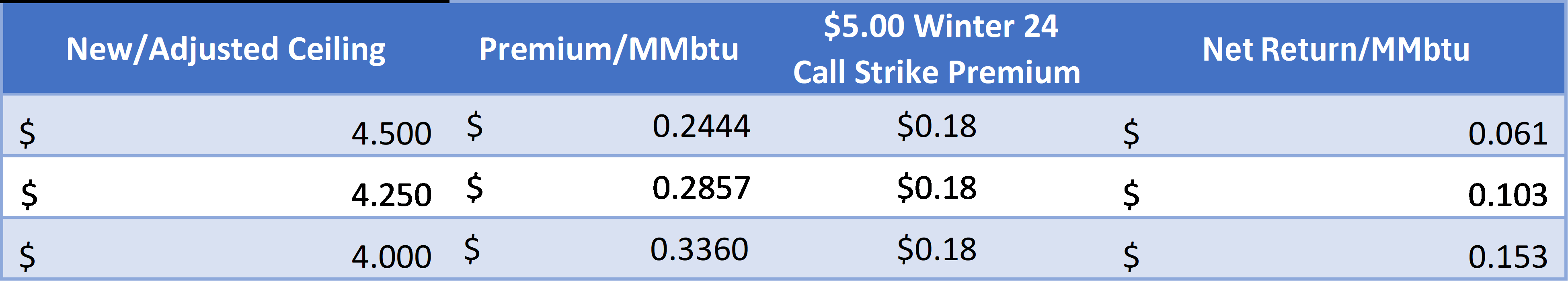

Rolling down your call strikes currently set at $5.00 or higher to a range between $4.00 and $4.50 would look like this. This adjustment applies only to those with associated put strikes set below $4.00. Keep in mind, the example below represents a $5.00 call strike. Higher call strikes will be cheaper to buy back, potentially providing a larger return.