|

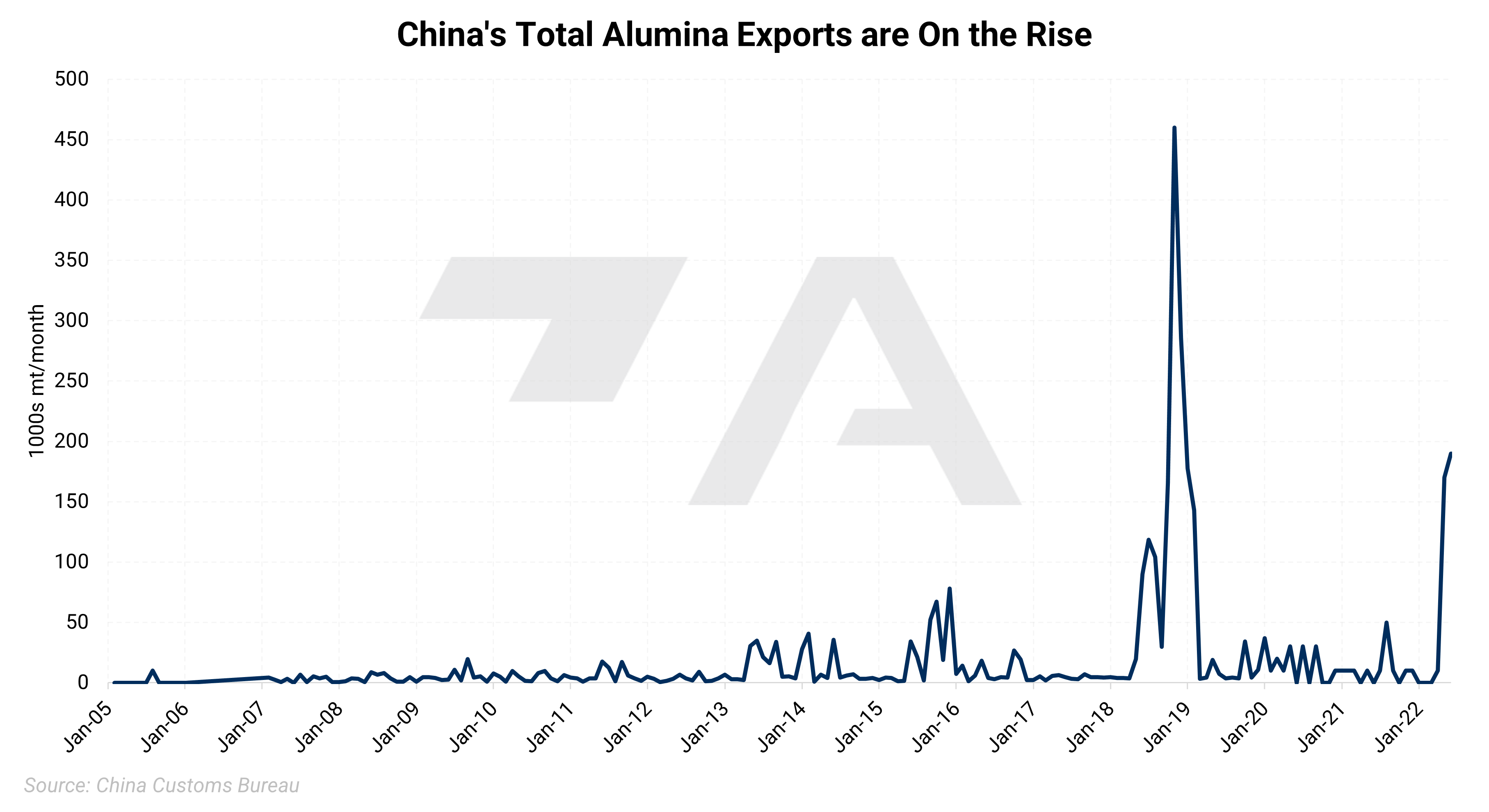

China normally exports little alumina to Russia, as they only shipped 1,747 mt to them in 2021. However, logistical issues and sanctions from the Russia-Ukraine conflict have forced Rusal to seek out Chinese alumina. These alumina imports have helped Russia’s aluminum producer, Rusal, to keep aluminum production flowing. China's total monthly alumina shipments rarely eclipse 10,000 mt. However, exports have increased dramatically in 2022. This increase in shipments coincides with the start of the Russia-Ukraine conflict, as nearly all of the recent shipments are going to Russia. |

|

|

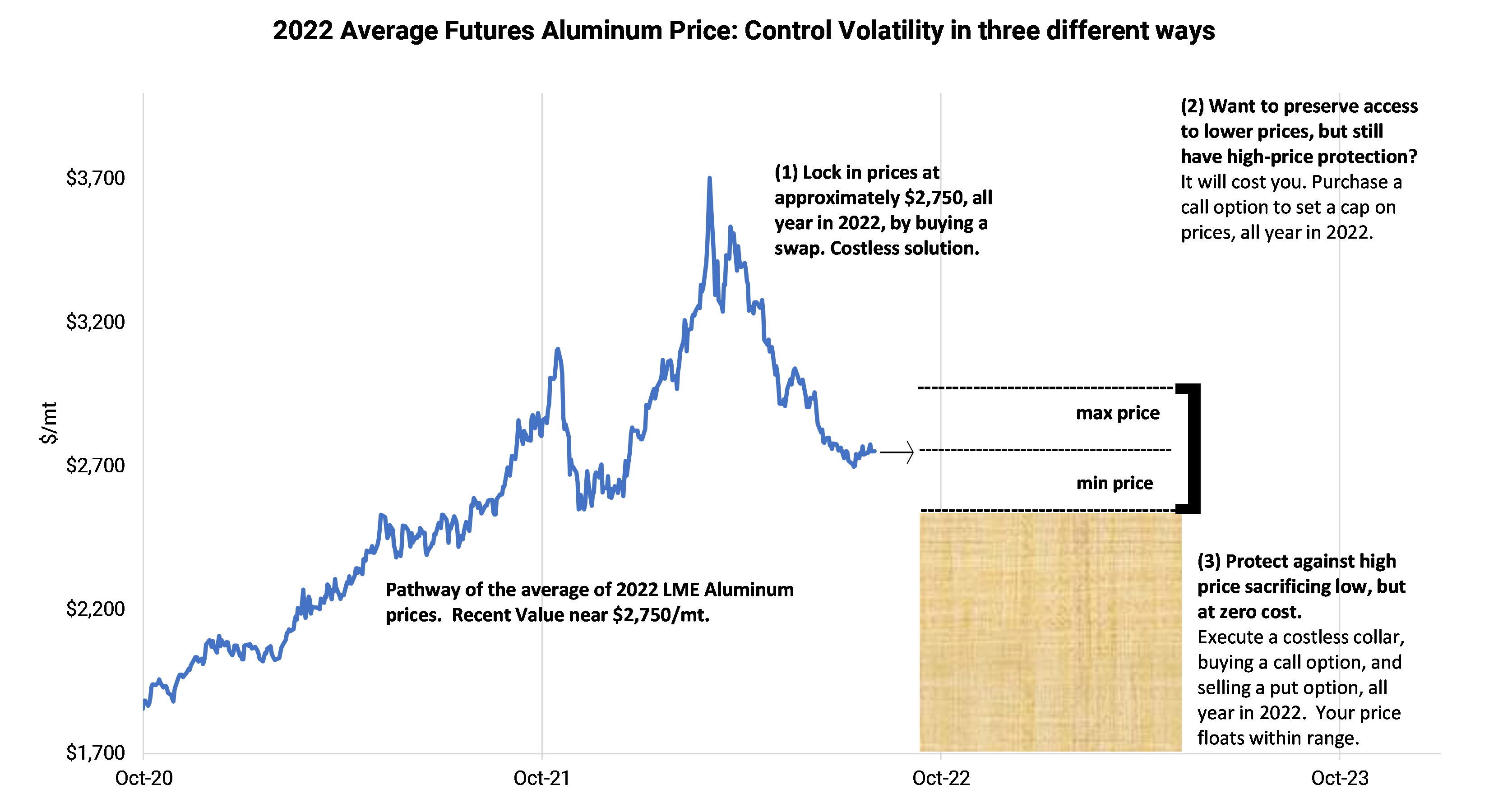

Aluminum prices at the LME are down nearly 13.6% in 2022 (8:00 AM CST 8/2/2022). End-users might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for an end user, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.