April 6, 2023 - Russia's oil exports are facing challenges due to a struggling logistics network that is having difficulty keeping up with Russia’s daily exports of over 7 MMBbl of crude and products. Ships carrying fuel are experiencing delays off the coasts of Africa, Europe, and Latin America, while tankers are bouncing between Chinese ports without unloading.

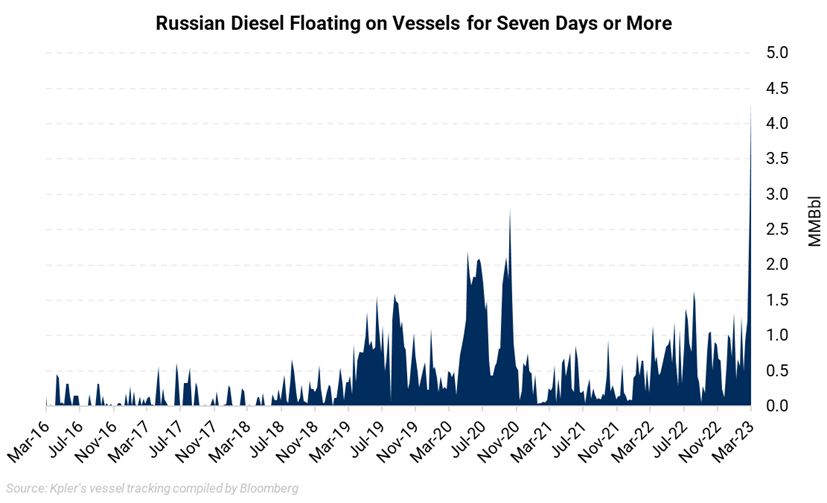

The chart above shows that the floating fuel volumes have soared to the highest since at least 2016. Although the fuel will eventually unload, the buildup highlights the challenges in finding new buyers for Russian fuel.

Crude exports from Russia to India and China rather than Europe have resulted in longer transit times. This surge in Russian oil on the water also signals that not every vessel leaving a Russian port has a willing buyer. Furthermore, a lack of vessels may arise later, as Russia’s "shadow fleet" vessels may take four months or more to pick up the next cargo if they get stuck, leading to potential disruptions in oil exports.

The increasing waiting time for cargo to find homes may lead to a bottleneck or lower exports and production in the future.

Additionally, S&P Global Commodities’ tanker tracking data indicates that there has been a surge in seaborne tanker switching of Russian crude and products since EU-G7 sanctions were imposed on Moscow's oil. Seaborne STS transfers of Russian crude and diesel reached a record high in February, with at least 22 MMBbl rerouted. This was a 3.8 MMBbl increase from January. However, the data indicates that the opaque practice of ship-to-ship transfers could be less about avoiding Western sanctions and more about Russia's need to sell its discounted oil to a dwindling number of potential buyers.

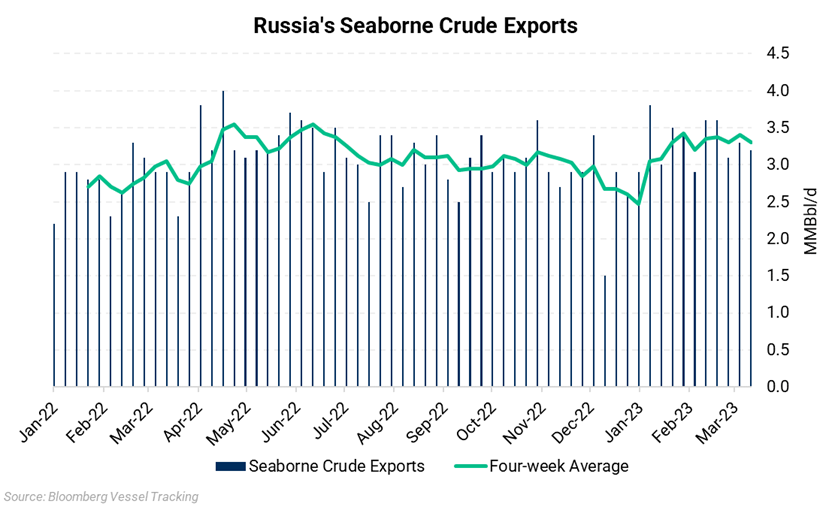

Furthermore, Russia announced it is going to extend its retaliatory 0.5 MMBbl/d production cut until the end of 2023. However, as shown in the chart below, Moscow’s seaborne crude exports hold above 3 MMBbl/d, and the voluntary production cut hasn’t yet shown in Russia’s crude exports to the global market.

Despite little evidence of Russia losing any supply after the EU-G7 price caps and sanctions, reports of its shadow fleet struggling to find new buyers could imply a risk of curtailing 0.5-1.0 MMBbl/d of supply this year.

Russia remains a bullish flag; AEGIS believes that Russia’s resilience to Western sanctions may keep prices neutral in 2023 if Russian crude exports remain steady. More supply shortfalls from Russia would be a bullish factor not currently incorporated into the price.