Most recent developments

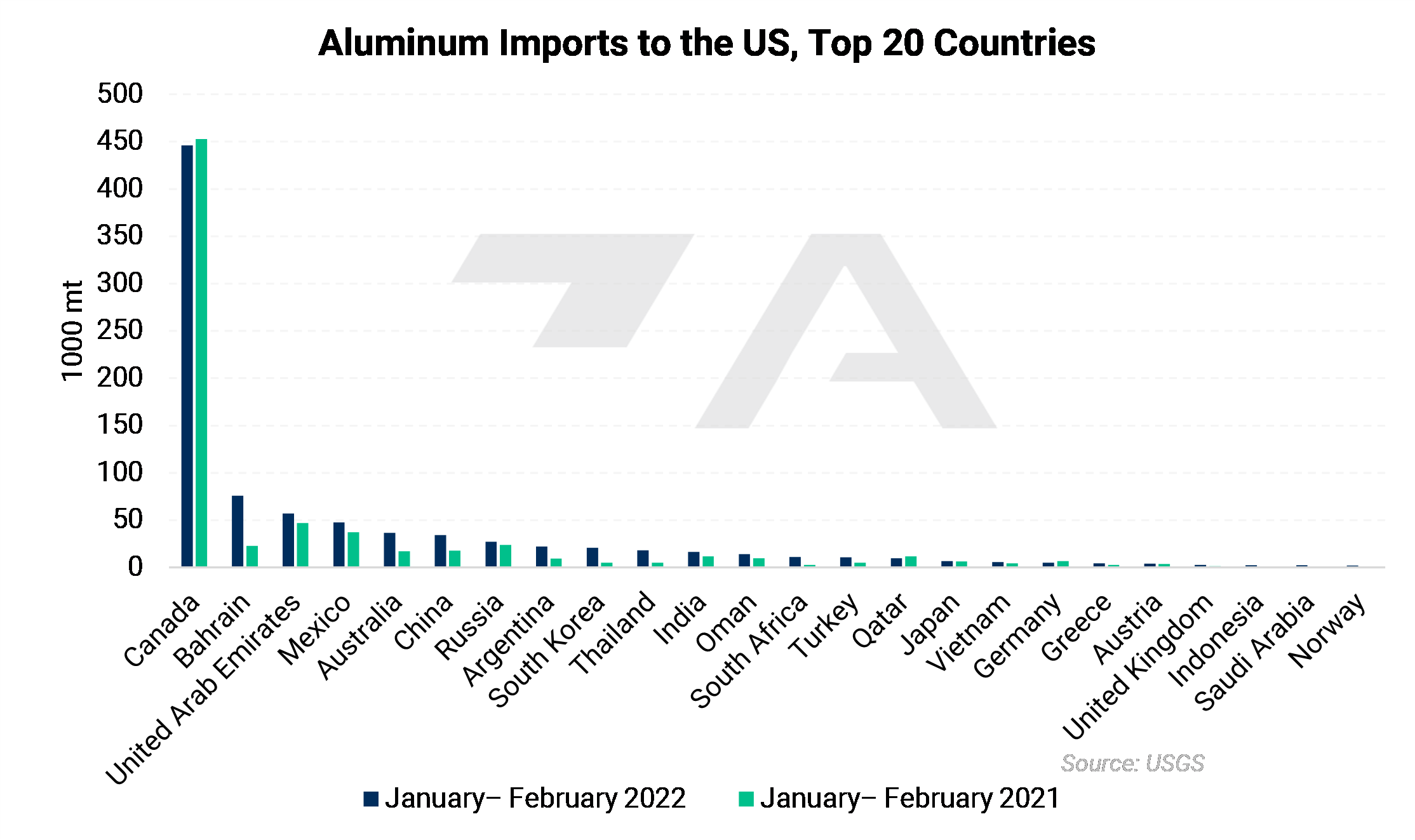

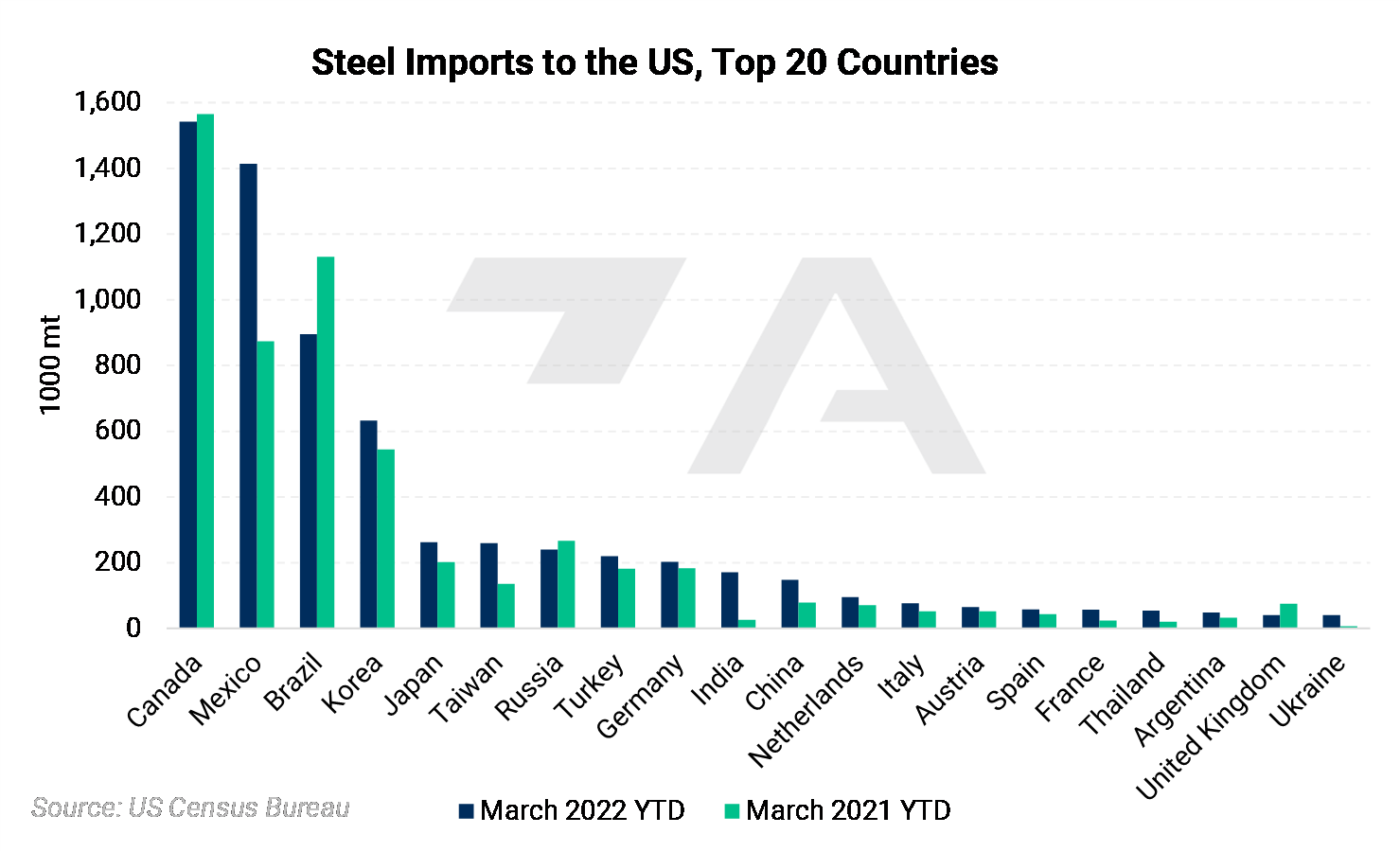

(5/11/2022) Public hearings on the economic impact of Section 232 import tariffs on steel and aluminum will begin in July 2022. The US International Trade Commission is seeking input from consumers and producers of those metals, which have been tariffed since 2018 by the Trump administration. Section 232 tariffs are at the discretion of the executive branch and are allowed for reasons of national security. Current tariffs are 25% on steel and 10% on aluminum. These tariffs were meant to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel and aluminum onto the US market. AEGIS notes the cost of the tariffs has supported Midwest Transaction Price (Aluminum) and US-based steel tariffs (e.g. CRU Hot Rolled Coil). Reducing or eliminating those tariffs would likely reduce costs and perhaps prices in the U.S. The ITC will release findings in 2023.

(2/11/2022) Earlier this week Bloomberg reported that the US will be ending the current 25% tariff on Japanese steel imports, but no date has been set. The current tariff was set in 2018 as part of the Section 232 tariffs that sought to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel onto the US market. At 732,157 mt, Japan was the sixth-largest source of steel imports into the US in 2020.

(12/13/21): The US has made steps to negotiate with Japan regarding the current import tariffs on Japanese-produced steel and aluminum. Last Friday, December 10, the US submitted a new proposal to the newly elected Prime Minister of Japan, Fumio Kishida. The current tariffs levels are 25% on steel and 10% aluminum and have been in place since 2018. The US is proposing a tariff-rate quota system in which volumes are taxed at different levels. Talks between the two nations are private, so specific details are unknown. According to government data, the US imports of Japanese steel fell from 1.73 million mt in 2017 (pre-tariffs) to 1.14 million mt in 2019.

(11/15/2021): On November 15, 2021, Japan’s Industry Minister stated that “Japan and the US have agreed to start discussions to solve the issue over US "section 232" tariffs on steel and aluminium imports.” However, another ministry official stated “Japan’s Trade Minister and US Commerce Secretary did not discuss any concrete measures to resolve the issue like that of EU-US agreement.”

(10/30/2021): At the G20 summit on October 30, the US agreed to end the Section 232 tariffs on EU-produced steel and aluminum. The previous tariffs were 25% on steel and 10% on aluminum. The new system will be based on a tariff quota ratio, and allow for a small, to-be-determined amount of metal to enter the US duty-free. A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff. Now 3.3 million mt of EU steel products in 54 categories can enter the US duty-free, anything above that amount is subject to 25% tariff. As for aluminum, 18 thousand mt of unwrought in two categories and 366 thousand of wrought in 14 categories can be imported duty free. The remaining for aluminum will be 10% as before.

(10/5/2021) Industry groups are disagreeing on the usefulness of Section 232 tariffs. Contrary to recent comments by other US aluminum industry organizations, the American Primary Aluminum Association (APAA) believes that the Section 232 tariffs should be continued. In a statement released October 5, the APAA suggests that a tariff-rate quota is a positive for the industry. A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff. Tariff-rate quotas had been floated as a replacement for tariffs in place since the Trump administration. The association believes that a tariff-rate quota is key to rebuilding the US aluminum industry.

(9/30/2021) US aluminum tariffs should be eliminated, not replaced with tariff-rate quotas, said the US Aluminum Association at its September 30 annual meeting. A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff. US aluminum industry professionals have been examining ways to resolve issues regarding the Section 232 tariffs. The association also suggests that the tariffs should be phased out over a three-year period.

(9/1/2021) The European Union (EU) is currently pushing for the US to end some Section 232 tariffs by the end of 2021. The EU hopes to convince US authorities to replace this tariff with a tariff-rate quota. (A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff.)

Brief history of 232 Tariffs on Steel & Aluminum Imports (since 2018)

The Section 232 tariffs on steel and aluminum imports were implemented on June 1, 2018 to combat the dumping of low-cost steel and aluminum on US markets. The tariffs are set at 25% for steel, and 10% for aluminum.

Tariffs on Canada were lifted in May 2019. However, after imports surged at the hinderance of American producers, tariffs were reinstated on Canada in August 2020.

Tariffs on Mexico were lifted in May 2019.

On February 8, 2020, tariffs were also implemented on certain steel and aluminum products. Please see the "Annex" links in the Important Links section below for complete lists of the affected steel and aluminum products. Currently tariffs apply to all countries except for Argentina, Australia and Mexico on aluminum derivatives and Argentina, Australia, Mexico and South Korea on steel derivatives.

3/22/2022: New U.S.-U.K. trade deal cuts tariffs on British steel, American motorcycles, bourbon

2/7/2022: Tai, Raimondo Statements on 232 Tariff Agreement with Japan

12/13/2021: Raw Steels MMI: Steel prices decline; more tariff negotiations

11/15/2021: U.S., Japan to Discuss Lifting Tariffs on Aluminum, Steel as China Ramps up Production

11/15/2021: Japan-US to resolve issue over US “section 232” tariffs on steel and aluminium imports

10/31/2021: US 232 EU Statement

10/30/2021: U.S., EU end Trump-era tariff war over steel and aluminum

10/30/2021: APAA Supports the Biden Administration's Tariff-Rate Quota Deal with the European Union

10/30/2021: USW Supports Interim Arrangement with EU on Section 232

10/24/2021: US Trade Rep Tai Hopeful Of Breaking Impasse With EU On Aluminium And Steel Tariffs

9/30/2021: US, EU aluminum industries pushing for tariff phase out, not quotas: panel

9/3/2021: 9EU expects US S232 tariffs to be replaced with quota

9/1/2021: US metals end-users ask Biden to drop steel tariffs amid record prices

8/19/2021: EU steel buyers fear higher prices subject to potential removal of US' Section 232 tariff

5/18/2021: Section 232 Investigations: Overview and Issues for Congress (Updated May 18, 2021)

8/6/2020: Statement on re-instating aluminum tariffs on Canada (August 2020)

2/8/2020: Annex I: Tariffs on Derivatives of Aluminum Articles

2/8/2020: Annex II: Tariffs on Derivatives of Steel Articles

5/17/2019: United States Announces Deal with Canada and Mexico to Lift Retaliatory Tariffs

5/18/2019: Statement on removal of tariffs on Mexico (May 2019)

3/18/2018: US Department of Commerce Section 232 page

3/8/2018: President Proclamation (March 8, 2018)

Links for Economic Data pertinent to Section 232 Tariffs (All sites below are updated monthly)

U.S. Imports for Consumption of Steel Products (FT900A)

FT900a: Preliminary U.S. Imports for Consumption of Steel Products Press Release Schedule

National Minerals Information Center: Aluminum Statistics and Information