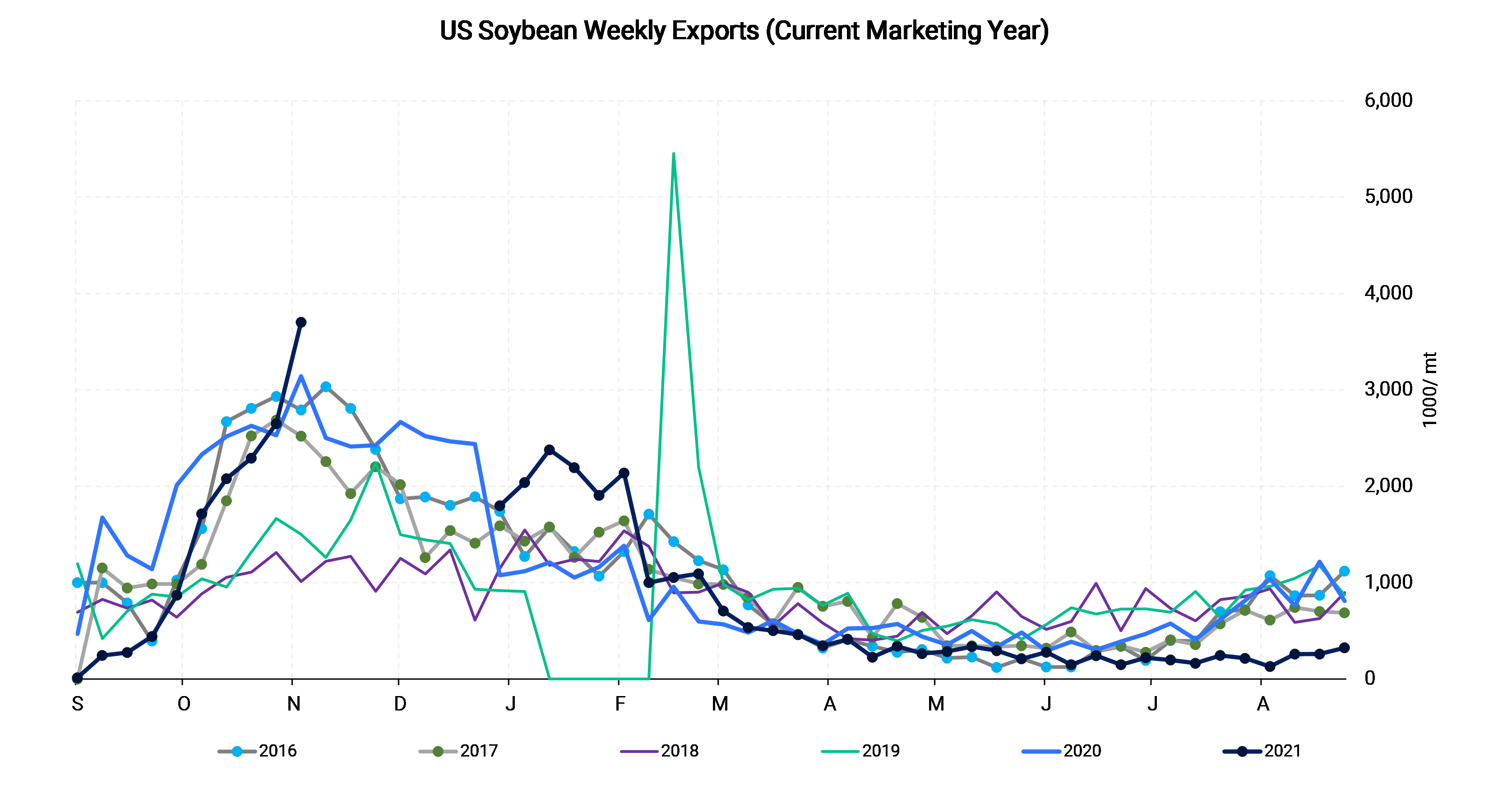

Harvest season (when farmers gather crops from fields) is nearing completion. USDA announcements of weekly soybean exports tend to spike as we harvest in the fall season.

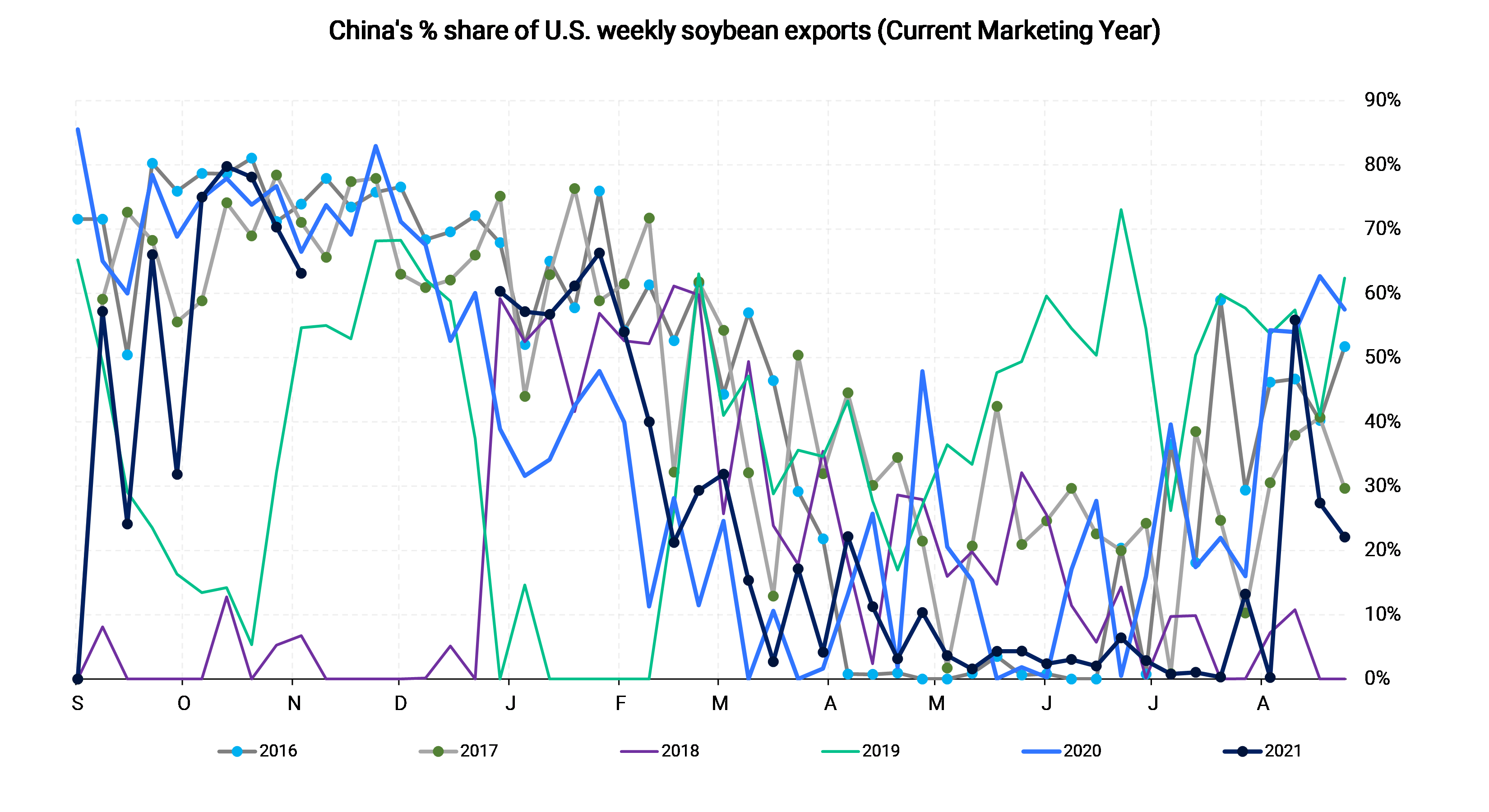

| Weekly soybean exports announcements have skyrocketed since early September, largely due to demand from China. Historically, China's portion can peak at 70% to 80% of total exports for a given week during harvest season. True to form, China's take of soybean exports were nearly 80% for the week ended October 14. |

|

However, the buying frenzy did not end there. For the week ended November 4, current marketing year soybean exports totaled 3701.7 thousand mt, a record for that marketing week.

|

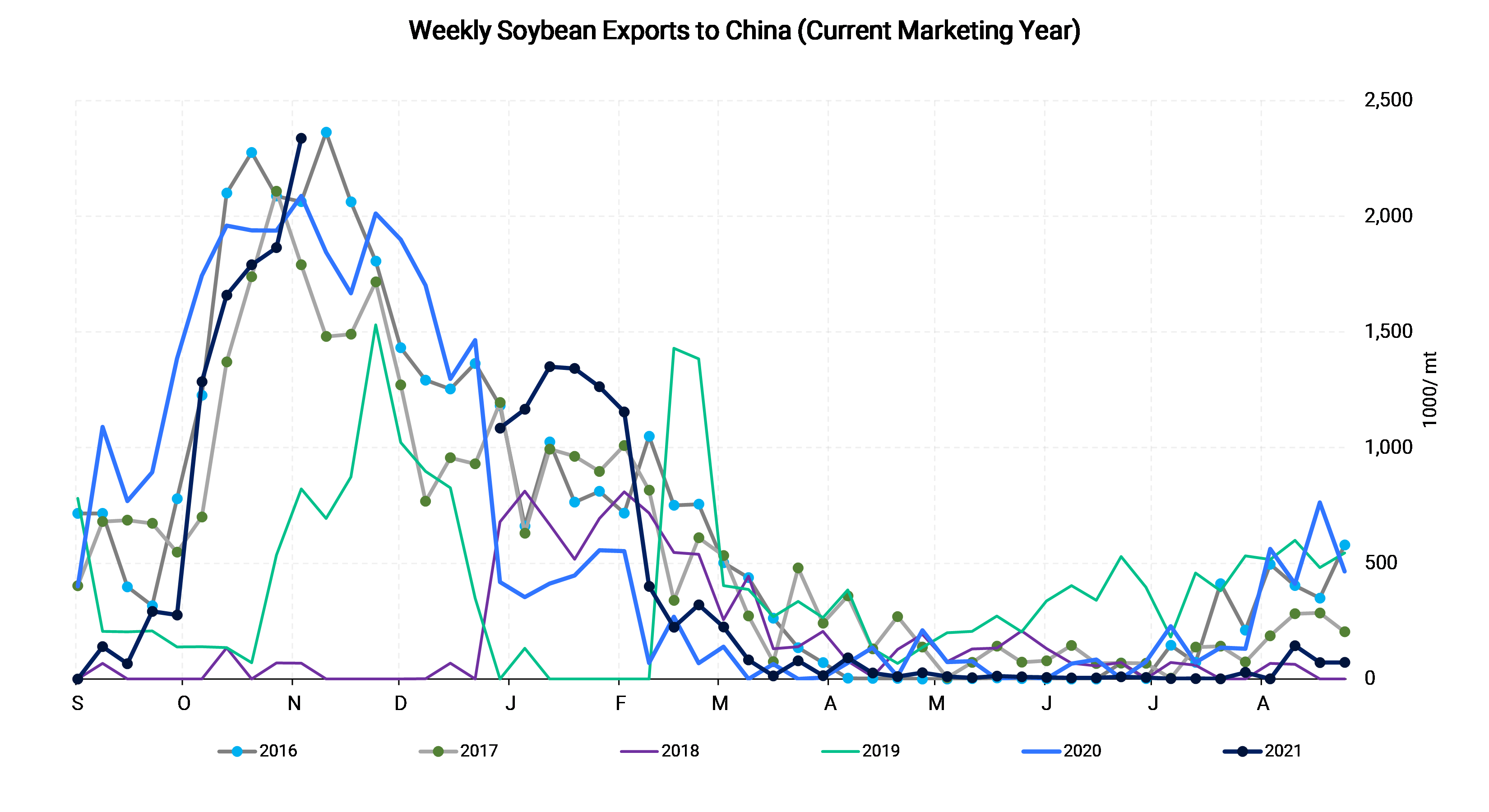

| China's portion for the week ended totaled 2337.7 thousand mt, nearly matching the November record set in 2016 |

|

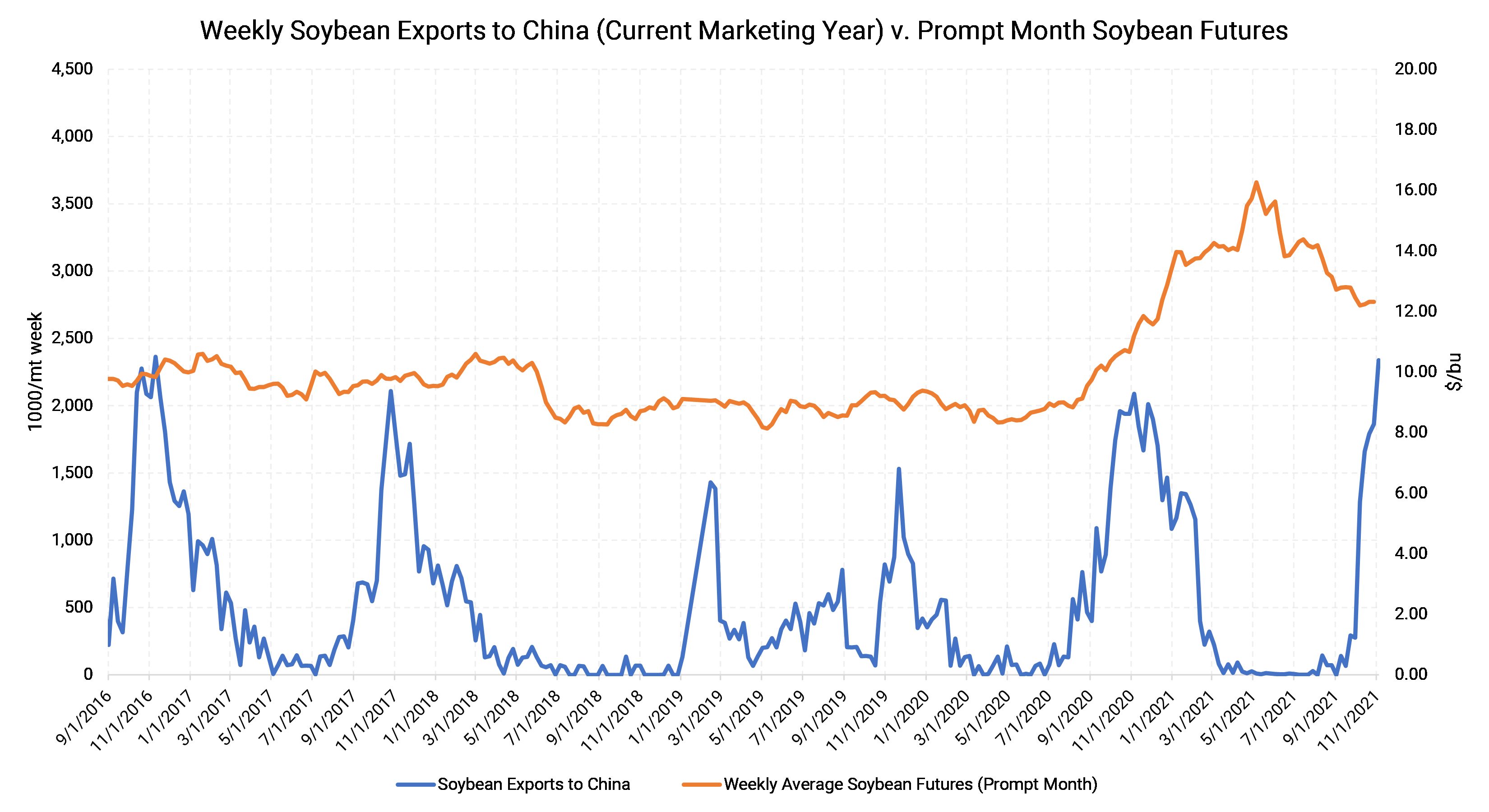

It is interesting to note that weekly exports to China (and therefore overall Chinese demand) are rarely correlated to soybean prices. Chinese demand for our soybeans is largely driven by two factors. First, China's large hog herd is large consumer of soybean meal. Secondly, the Chinese diet has evolved to include vegetable oils over the past several decades. The Chinese seem to be one of the most proactive buyers, positioning themselves at or near the front of the line when we harvest in the fall. However, exports tend to dropoff mere weeks after harvest is completed. Thus, exports to China for the current marketing year may be peaking.

Hedging soybeans other ag products can be done in a variety ways that matches your exposure and risk. Please contact AEGIS for specific strategies that fit your operations.