AEGIS went for a walk yesterday, and we can confirm: There are still trees outside. Why is lumber pricing like there is a shortage? |

|

|

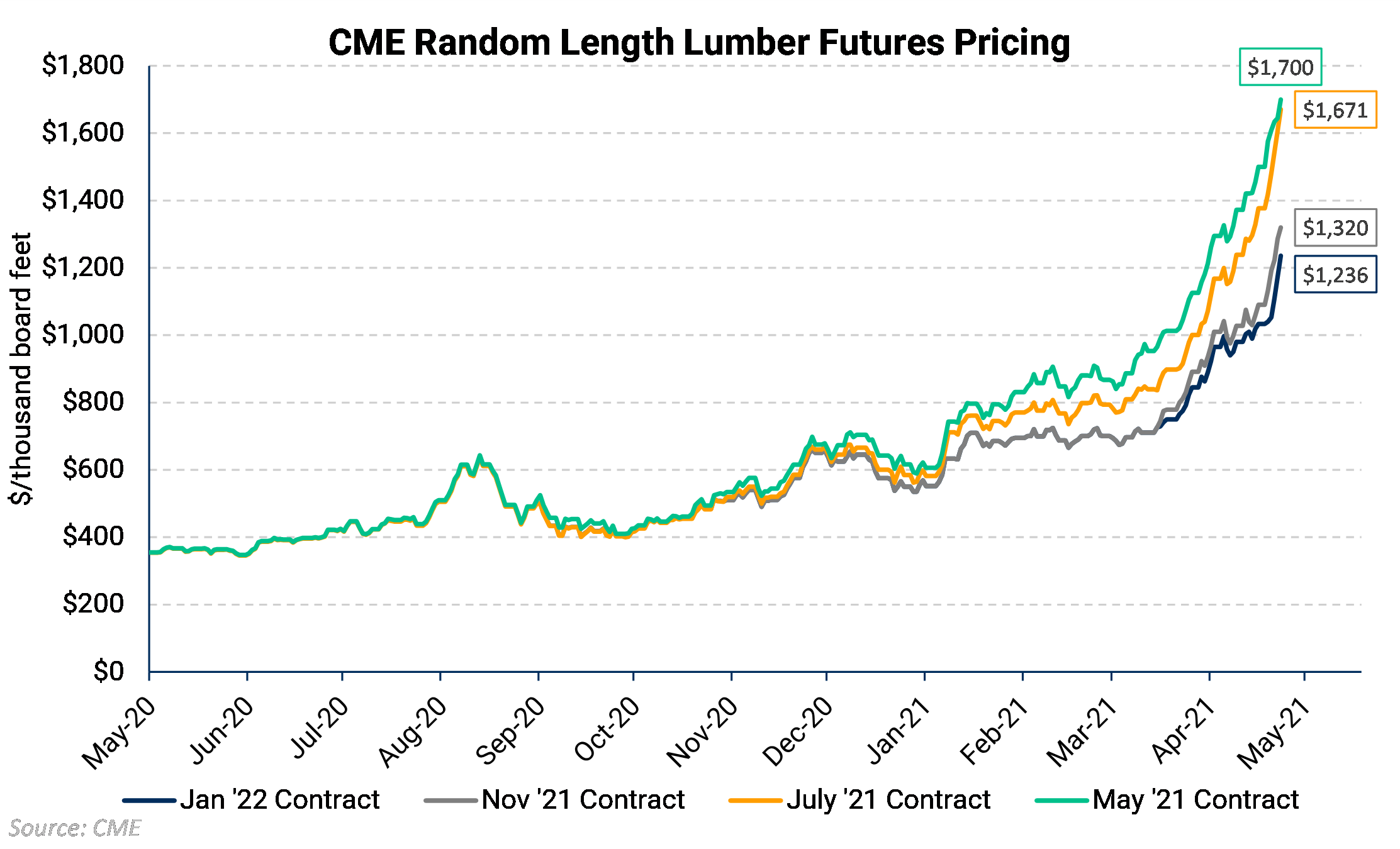

(May 7, 2021) Lumber futures (see chart above) have tripled in just six months. The price of random lengths for May delivery settled at $1,645/Mbf (thousand board feet) on May 6. Six months ago? Just over $500/Mbf. The rise in price is due to a surge in demand, but with limited milling capacity. While supply of trees is not under threat, the industry’s capacity to make boards and other wood products is close to maxed out. How does a builder control costs when lumber prices appear to be marching ever-higher? There are possibilities, but it is a good-news/bad-news situation. You can move some bad-news items into the good-news items if you are careful. First, lumber prices are hedgeable, meaning that there exists a fairly liquid forward market, and there are counterparties (usually banks) that will offer financial swaps and options. |

|

|

Good News and Tactics |

|

Perhaps the one mercy in lumber prices’ rise is the shape of the forward curve. The chart above shows that near-term prices are much higher than just a few months in the future. May was recently at $1,645, but November transactions were closer to $1,300. This downward-sloping forward curve is called “backwardation,” and it’s a consumer’s friend. A consumer can hedge future prices much lower than current prices. For example, if a consumer hedged half their November consumption, the market price could rise to over $2,000/Mbf, while the hedger would still be protected at near the current, May 2021 price. |

Bad News and Mitigation |

|

Unfortunately, the lumber market suffers two challenges for the hedger. First, liquidity in the CME futures is poor. Open interest is one way to measure the liquidity – it is the number of net contracts that have been bought and sold. Therefore, open interest can show how active trading is. Lumber futures have very little open interest and trading activity past six months, and most liquidity is concentrated in the next two months. Therefore, it is difficult to hedge into the cheapest part of the curve. Second, we meet few buyers of lumber who buy boards at an exchange price, such as the CME Random Lengths. There are other more popular indices, at which many buy and sell lumber. However, most do not have much forward liquidity. |

|

|

There are ways to mitigate this problem, but it requires individual study. Here is a quick checklist to decide if hedging your lumber costs is worthwhile: |

|

1. Rising lumber prices are reducing margins. Costs cannot be passed down to the customer, or; Rising lumber prices reduce your competitiveness. 2. Amount of purchases is known, at least in a known range (minimum or maximum expected). 3. Your purchases are made on a published index. If you answer “yes,” then there are ways to hedge your exposure, but it is going to require some careful study. AEGIS statistical methods and our hedging software platform can establish a strategy and oversight system to make it work. |

|

|