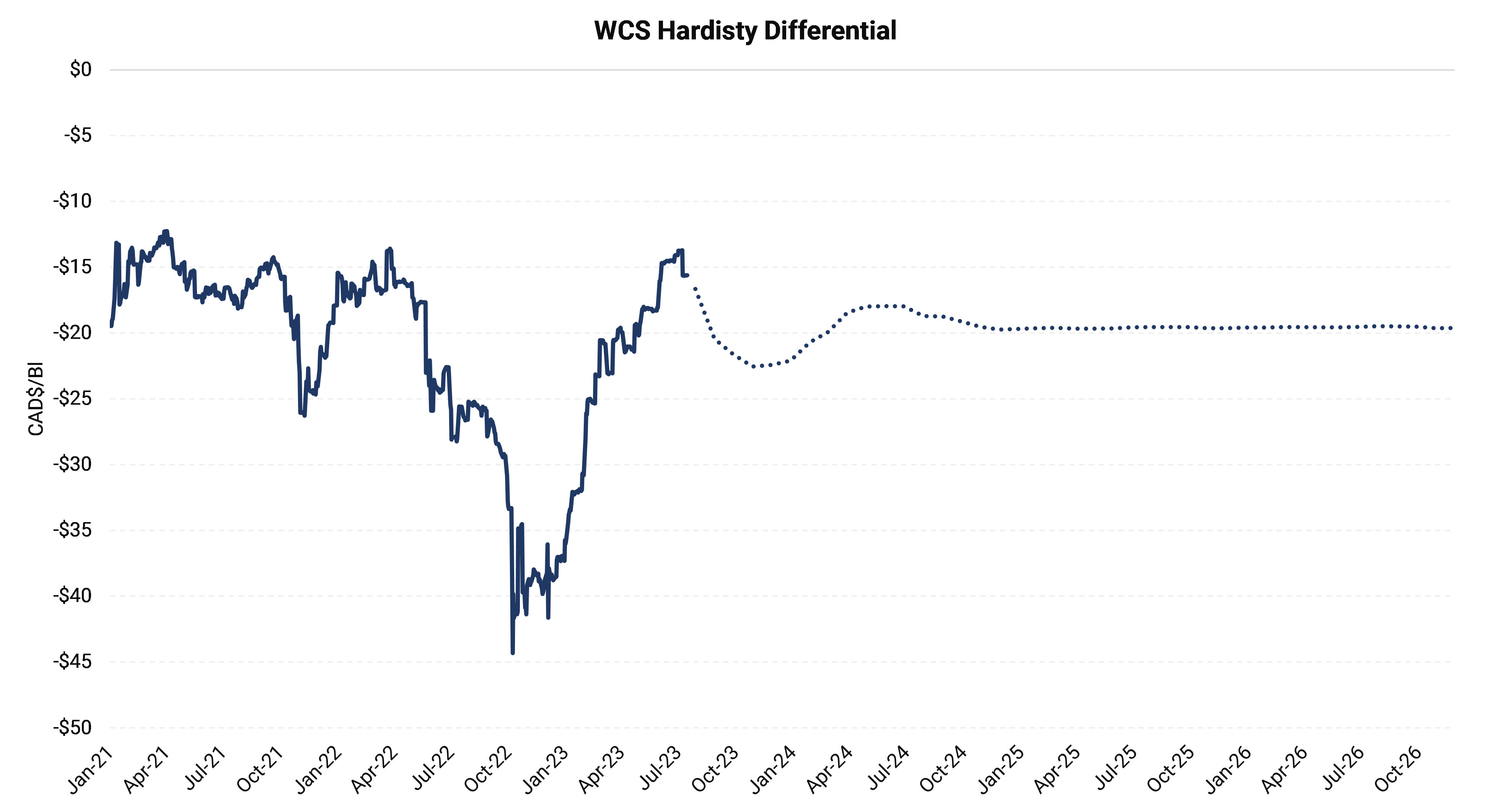

After multiple years of delays and billions of dollars more than was originally budgeted, the Transmountain Pipeline Expansion is nearly finished. How will this linchpin logistics infrastructure impact crude differentials? The WCS diff has steadily climbed to its current level of C$-15.61 and traded as high as C$-13.71 in early July, the highest level seen in over a year. Additional egress capacity should be a bullish factor going forward, but the forward curve is not pricing in any strength in diffs in 2024.

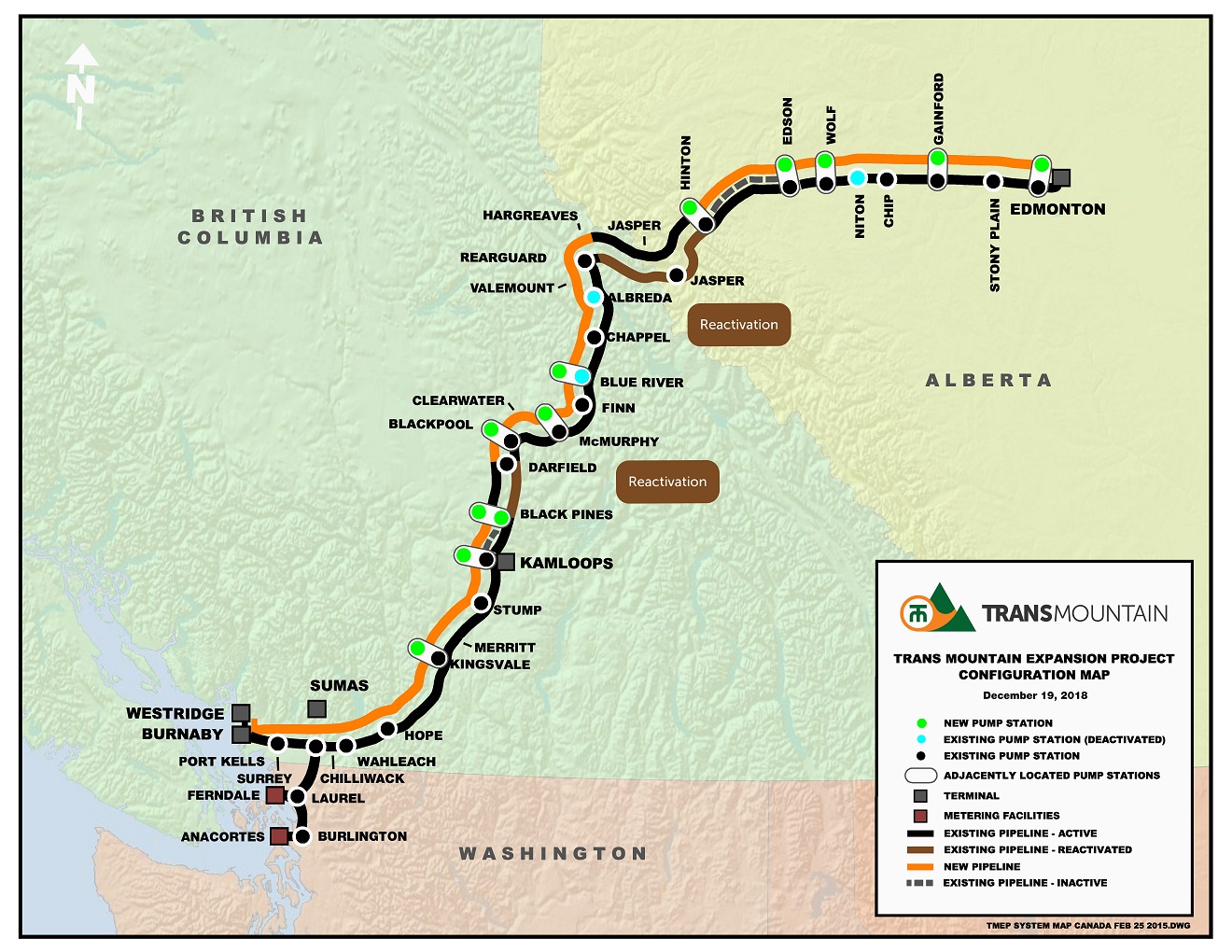

Originally slated to enter service in 2019 with a price tag of C$7.4 billion, the expansion is now expected to come online five years later and at a cost of more than C$30 billion. The original pipeline in service since 1953 currently transports about 300 Mb/d of light crude, heavy crude, and refined products from Edmonton to Vancouver and Washington State. The expansion will triple the available capacity to 890 Mb/d.

While the original pipeline carries predominately light crude, the new line is expected to transport mostly heavier grades of crude. According to the most recent available data from the Canadian Energy Regulator, the pipeline shipped 62 Mb/d of heavy crude, 232 Mb/d of light crude, and 31 Mb/d of refined products in March. While some of the crude delivered on the pipeline is consumed domestically at Parkland’s Burnaby refinery in Vancouver or exported at the Westridge Marine Terminal, about half of the volumes are directed south into the Puget Sound Pipeline, which delivers crude to refineries in Washington state.

The expansion was intended to bring Canadian crude to Asian markets, but most of the oil will likely end up on the US west coast, specifically California. Refineries in Washington state run lighter grades of crude, while refineries in southern California are tooled to run heavier sour crudes. But with no pipeline access to California, most volumes will be delivered by tanker or barge. Exports to Asia will probably increase, but the Vancouver to Asia route is not common, leading to higher freight rates. In addition, Asian markets have been relatively well supplied by Russian oil, which has been shunned by Western buyers following the invasion of Ukraine. An expansion of the Westridge Marine terminal will increase the total number of Aframax vessel loadings from five per month to 34 per month. Shippers could also opt to use smaller Panamax vessels or barges.

On the matter of pipeline utilization, Transmountain is unlikely to be the first choice of shippers or even the second choice. In June, the government-owned pipeline filed its proposed tolls, much to the chagrin of shippers. At a cost of C$11-12/Bl, Transmountain would be, by far, the most expensive pipeline shipping option in Canada, only slightly below the cost of rail. Current tolls for shipping heavy oil from Edmonton to Westridge on Transmountain are only C$4.29/Bl. For reference, the cost of shipping the same grade from Hardisty to Cushing on the Keystone pipeline is C$3.44, and the cost of shipping on the Enbridge Mainline from Edmonton to the international border near Gretna, Manitoba is C$7.76/Bl.

Even at more than twice the current toll rate, Transmountain will still be a cheaper option than rail shipping. However, US imports of Canadian crude by rail hit a 10-year low in April, the most recently available data. Rail exports generally rise during times of heavy apportionment, peaking at 12.5 million barrels in 2019 but falling to only 952k barrels in April. This would imply that pipelines out of western Canada are not particularly constrained relative to recent history, and tightness seen in oil differentials supports this.

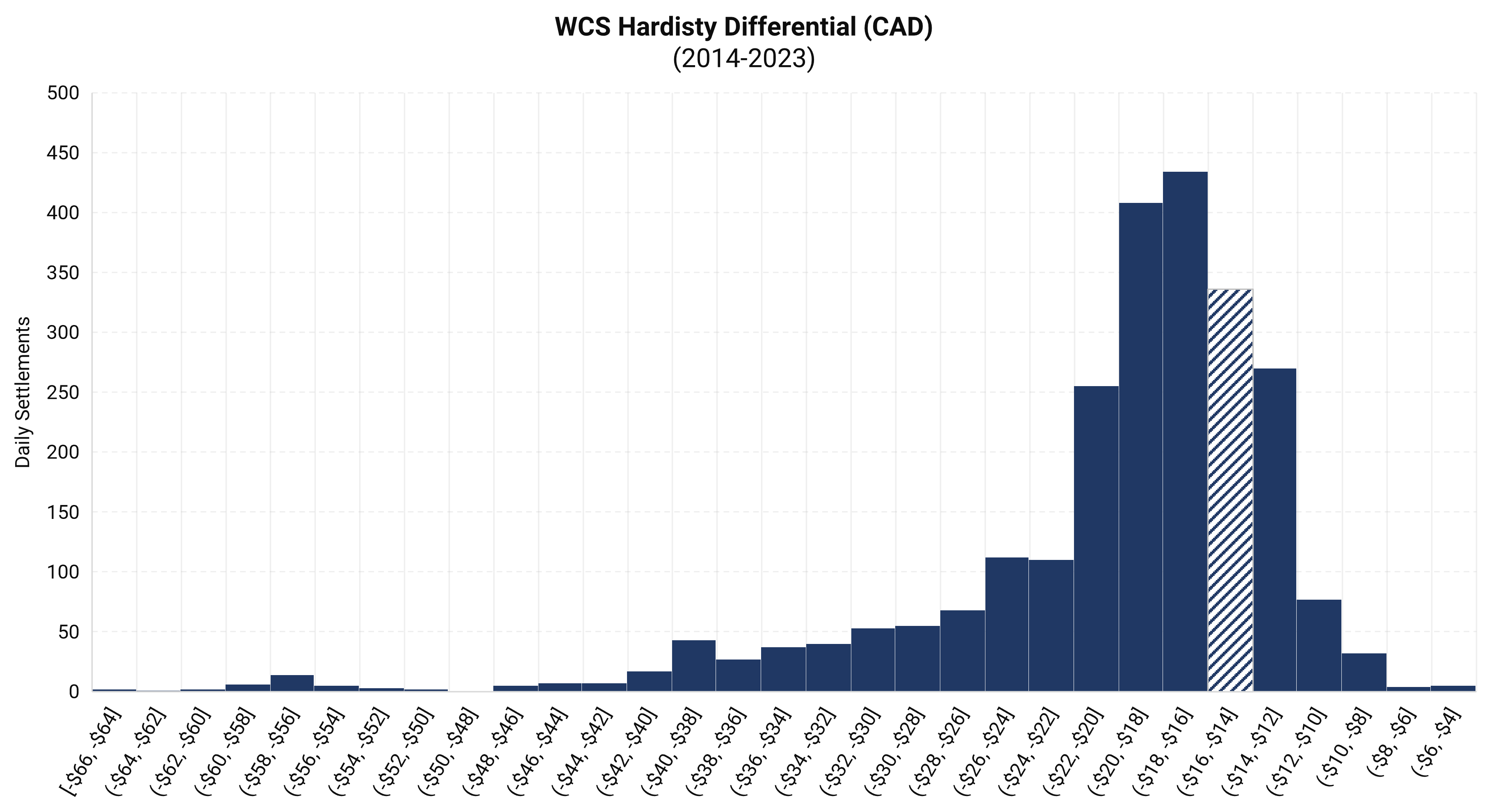

Even with enough egress for Canada’s current production, WCS differentials have some room for growth. At C$-15.63, WCS differentials are higher than historical averages but could potentially strengthen from here by as much as C$10/Bl. The chart above shows the number of daily settlements for prompt-month WCS Hardisty in various price ranges, starting in January 2014. The shaded bar representing the current range prices are currently trading in. However, despite additional egress being a bullish factor for differentials, the risk of a delayed start could force market participants to reevaluate egress and shipping options, sending prices lower again.