During the day Thursday, reporters were saying an OPEC+ committee was recommending a new set of production increases to raise output by 2 MMBbl/d between August and December. Simultaneously, the committee recommended extending the framework of supply cuts to December of 2022 from its current expiration date of April 2022.

The market interpreted the news very positively. The potential deal would make much more certain the pace of production increases, and the supply growth is slower than what OPEC and other groups are expecting out of demand growth this year.

However, the United Arab Emirates delegation ended all the fun. Reports came out that UAE would reject the deal unless some demands were met. The effect is that they want to increase their own production by 700 MBbl/d over and above any OPEC+ plans. When the meeting ended on Friday, no deal had been struck, and the group planned to reconvene on the 5th.

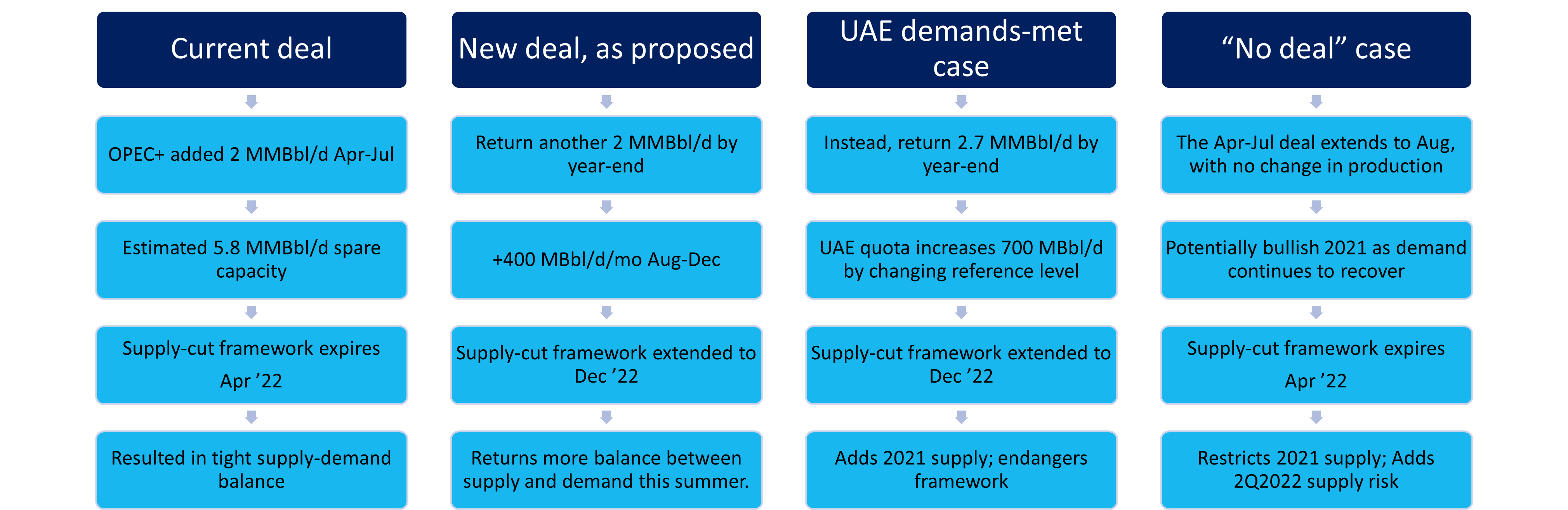

Below, we outline some possible ramifications of several scenarios.

One main conclusion is that this changes the late-2022 supply-demand balance in only one way, in our estimation. It could bring some extra production from UAE. Otherwise, there is still a risk that OPEC supply would be exhausted by the end of the year next year, creating a potential very bullish scenario.

The effects of a deal-or-no-deal discussion are mostly short term, with effects through mid-2022.

If OPEC+ can’t reach a new deal, then supply may not keep up with demand this summer and the market would wrestle with greater undersupply. That is generally bullish.

However, if no deal is ever reached to extend the framework, then all OPEC’s spare capacity could arrive in April or May next year when the framework expires.

If UAE gets its way, then supply is gradually increased, but with an extra (up to) 700 MBbl/d kicker. It’s short-term bearish, especially if Iran’s production capacity can start to return this year, too.

But there are longer-term effects as well. If UAE's capacity has permanently increased, then it may take longer for demand growth to catch up with productiion capacity.

Last, we shouldn’t discount some of the behavioral effects of UAE’s demands. If OPEC+ acquiesces, what would stop other countries from demanding the same deal UAE got? Lack of consistency among the members seems like risking the entire framework itself. Such a breakdown could accelerate production additions, perhaps in advance of the April 2022 deal expiration.