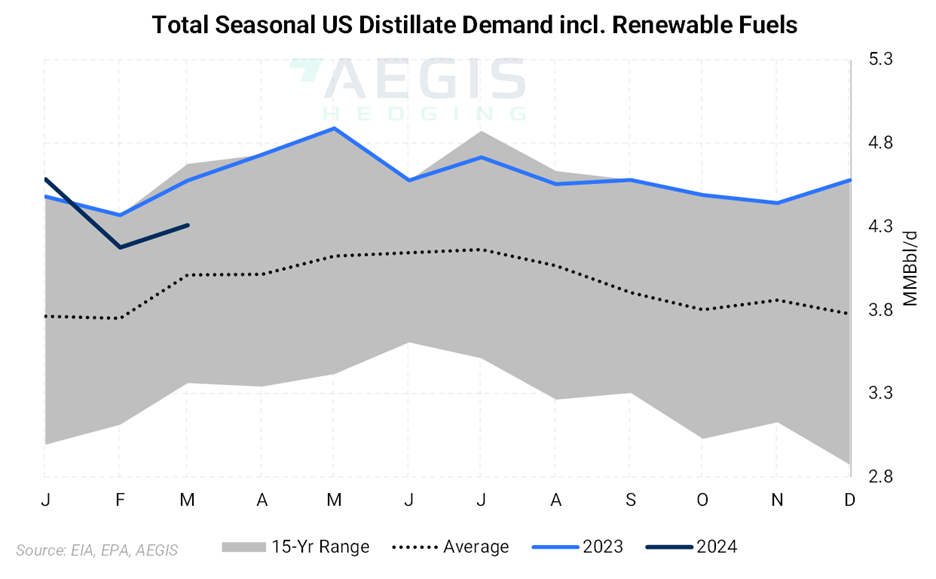

US distillate demand is far from the seasonal 25-year lows implied by data from the Energy Information Agency, a bearish warning indicator which has stoked macroeconomic fears among energy traders and economists alike.

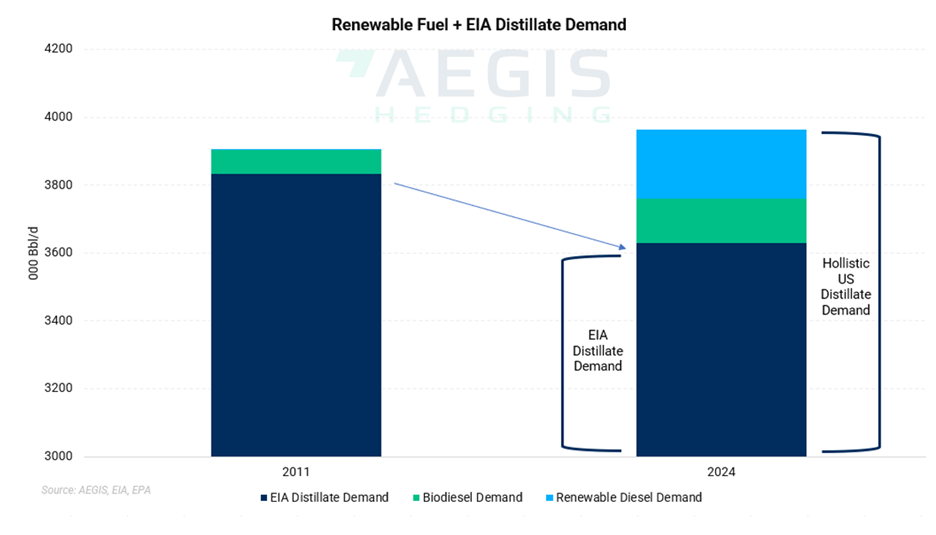

Rising adoption of renewable fuels like biodiesel and renewable diesel has displaced material amounts of petroleum-derived diesel over the course of the last decade.

Renewable fuels now account for more than 7% of the US diesel pool—enough to distort the true pull on fuels from critical sectors of the economy like manufacturing, freight, and agriculture.

We are witnessing the energy addition, not the energy transition referred to by so many pundits and policymakers. The US economy is simply consuming more fuel from a wider variety of sources.

While policymakers aim to promote the adoption of certain technologies and fuels over others, the world’s insatiable demand for energy should determine winners and losers, leaving a framework of alternative energy sources to meet this need.

Renewable diesel in particular has undergone revolutionary growth over the past three years and new projects are set to come online in the second half of 2024 and into 2025 stoked by large federal incentives from regulations such as the Inflation Reduction Act; the largest clean energy bill in history.

Renewable diesel accounted for just 0.07% of the US distillate pool in 2011. The drop in fuel which is nearly identical to conventional ultra-low sulfur diesel now accounts for more than 4% of US diesel demand, with the vast majority of this consumed in California, where state incentives combine with federal credits to provide the highest returns to producers.

Biodiesel now makes up 2.7% of the diesel pool, up from 1.6% in 2011. Combined the renewable fuels accounted for roughly 7.2% of total US distillate demand in recent weeks.

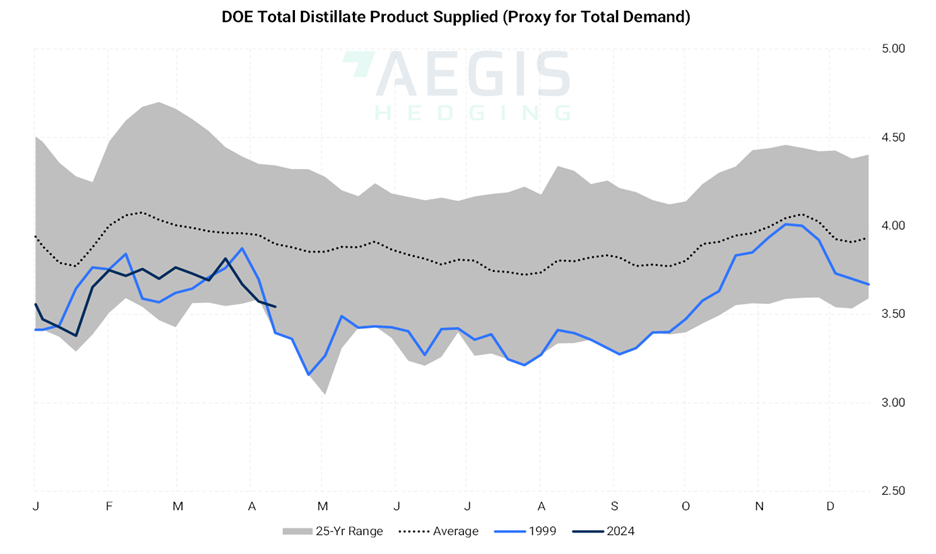

As shown below, US petroleum-derived distillate demand did reach the lowest level in a quarter century last week, according to EIA data. EIA distillate demand accounts for both on-road and off-road diesel as well as locomotive fuel and fuel oils used for heating and power generation.

When accounting for renewable diesel and biodiesel demand we find US diesel demand is running nearly 780,000 Bbl/d higher than 1999 levels and is 425,000 Bbl/d, or 11% above the 15-year average.

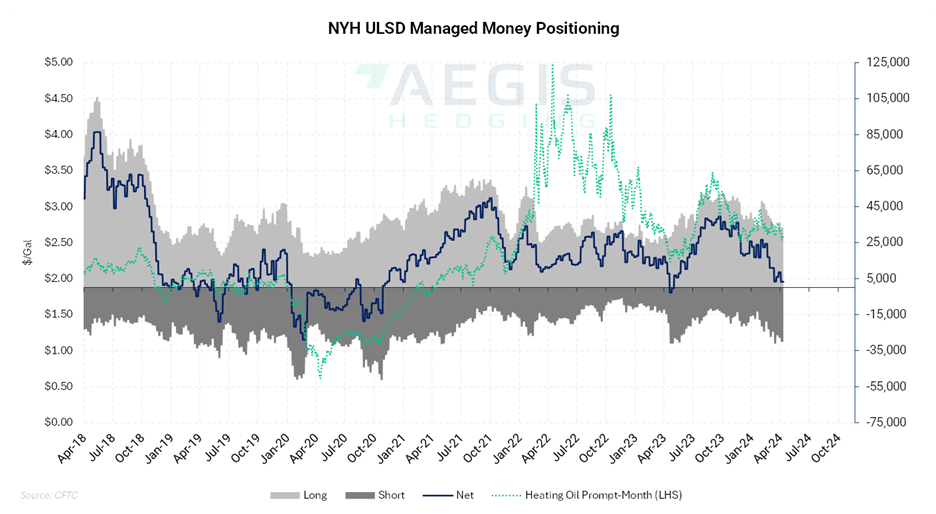

Flagging distillate demand and broader economic concerns has led to an increase in shorts in managed money positioning. The category of managed money is often synonymously used as speculator interest. Yet a more holistic view of the demand equation may indicate managed money is overdone to the downside.

When accounting for renewable fuels, US distillate demand is running off the highs of 2022 and 2023. Yet these were exceptional years when severe global trade flow disruptions and a lack of spare refining capacity drove diesel cracks to over $70/Bbl. Diesel crack spreads at the US Gulf coast have retreated to under $22/Bbl, levels that are in line with the 10-year average.

Far from sounding alarm bells, US diesel markets have just returned to earth. The great energy addition is a space to watch for those exposed to fuel price risk. For this, AEGIS has premier insights from veteran industry experts. Learn more: Stay on top of key renewable fuels & environmental market developments (aegis-hedging.com)