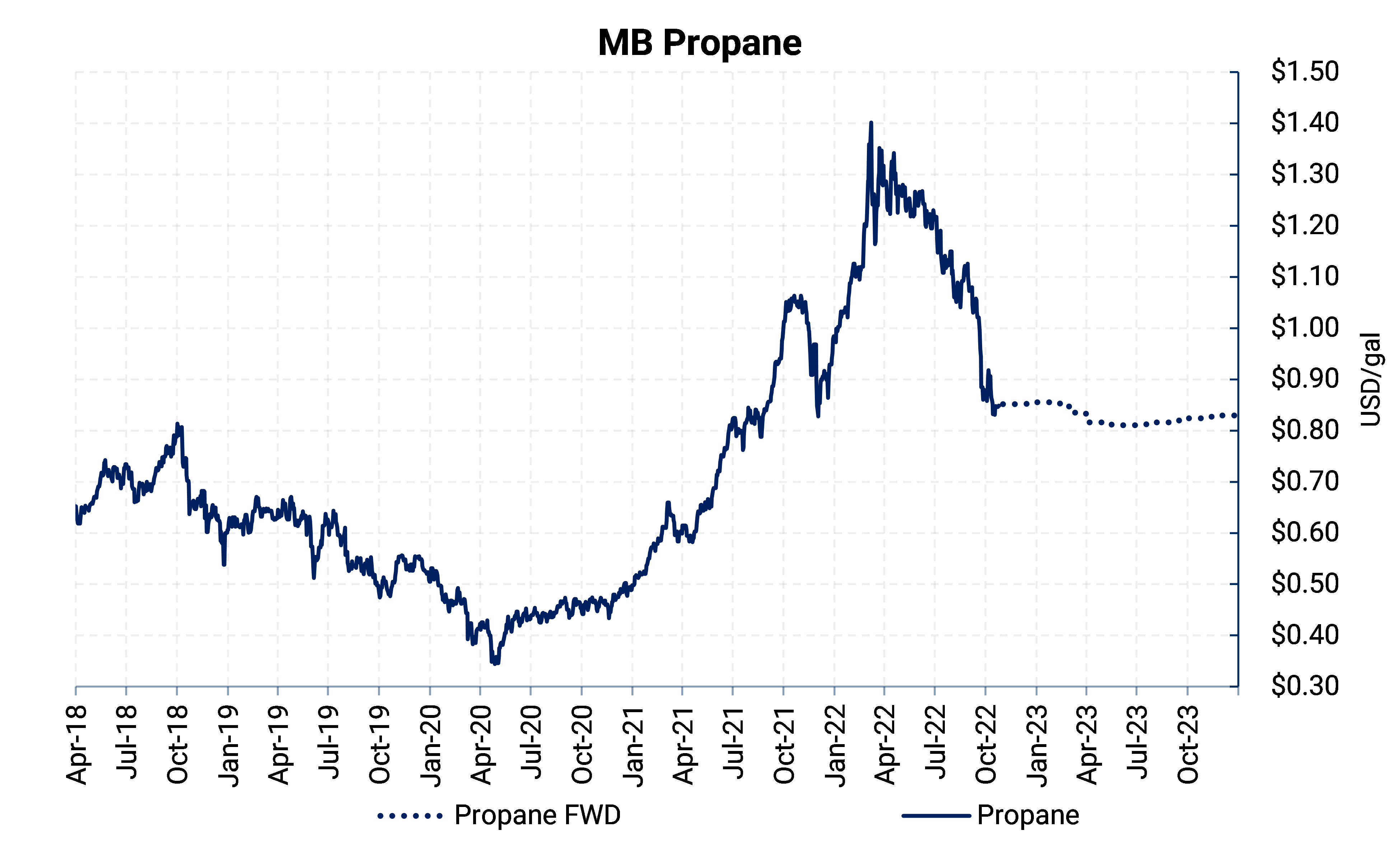

Propane’s Relationship to WTI

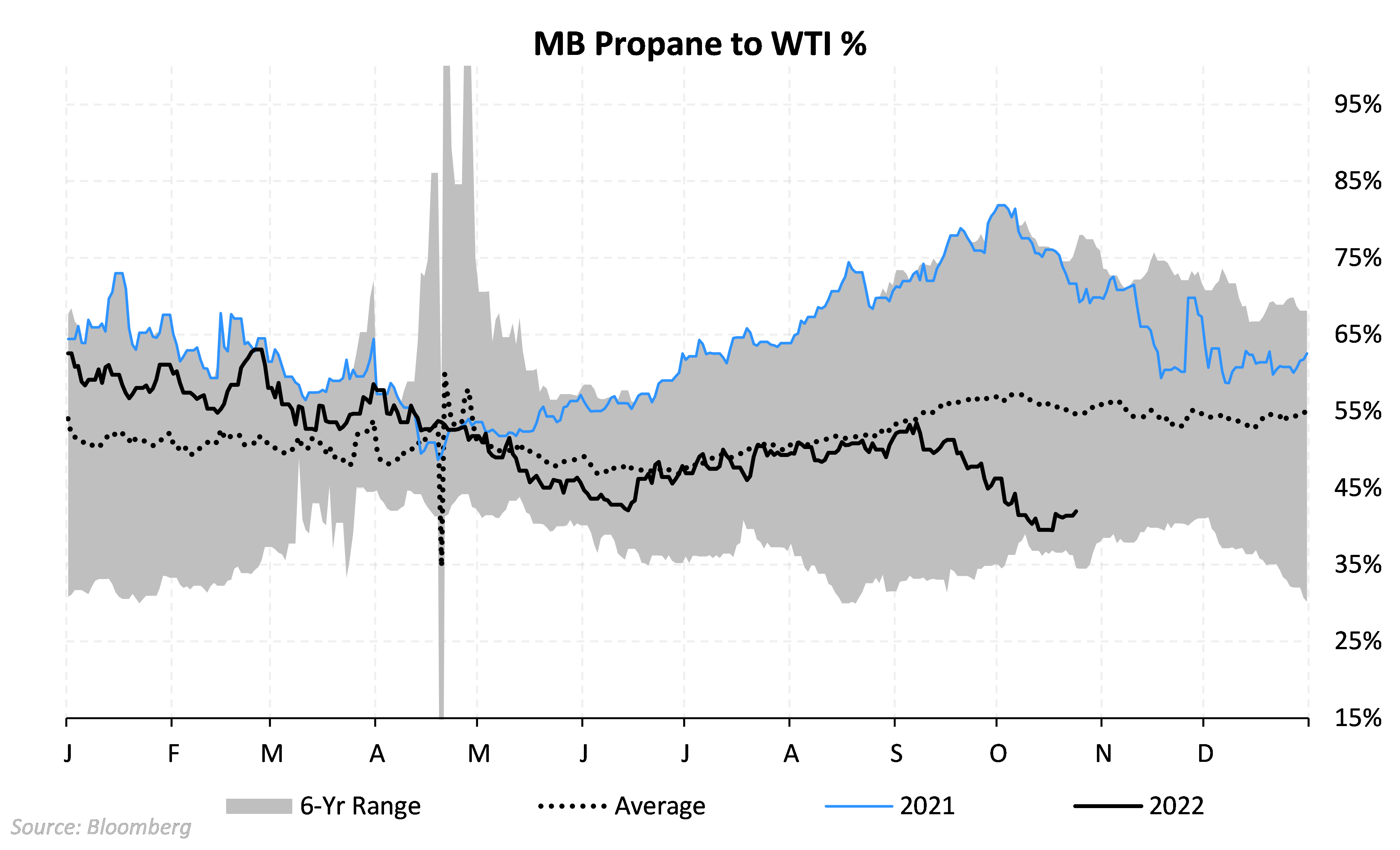

In the past five years, a barrel of propane (42 gallons) has averaged between 50-55% of the price of WTI. Propane’s relative value to crude oil will generally rise when propane stocks are low or supply is tight. The price ratio usually decreases if propane is oversupplied.

The chart below shows the history of how propane trades relative to WTI. Recently, propane has dislocated from oil. Propane’s month-ahead price has fallen to 40% of month-ahead WTI, a breakdown from 53% in early September.

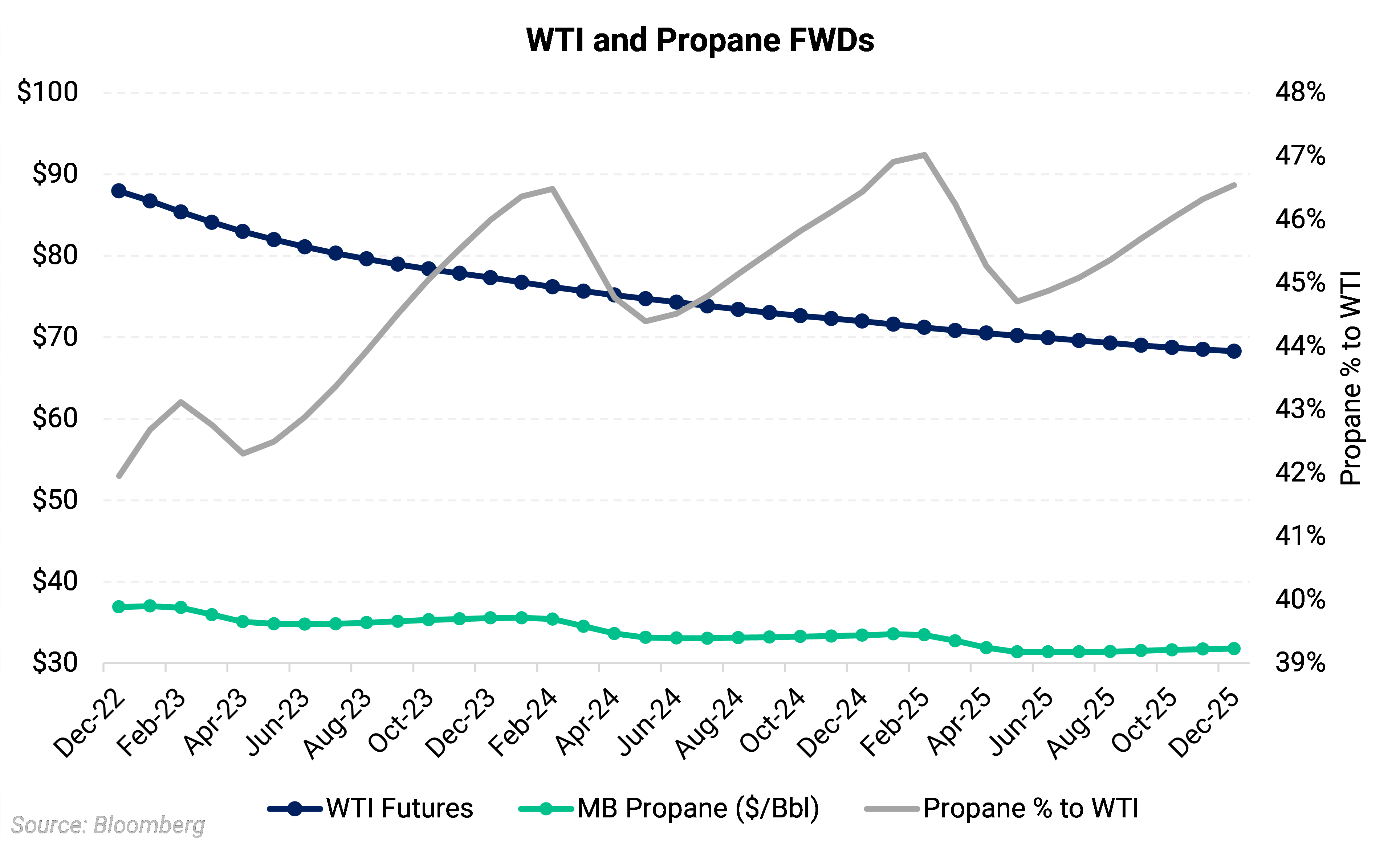

Most of the propane price weakness is in the front, or near-term, part of the curve. In the chart below, propane’s relative value to WTI rises farther down the forward curve. This is due to near-term weakness in propane’s supply-demand dynamics.

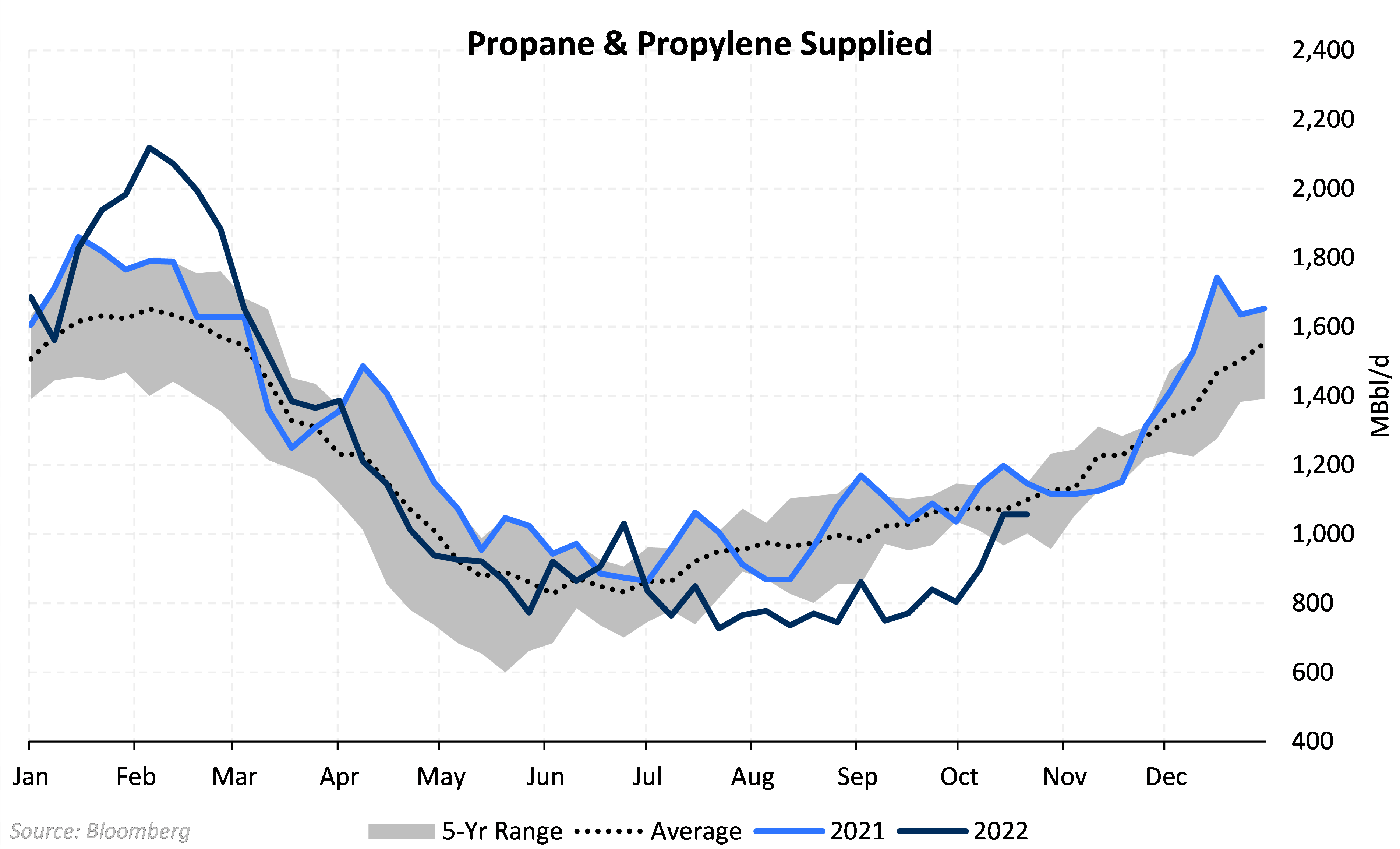

Petchem Demand Erased?

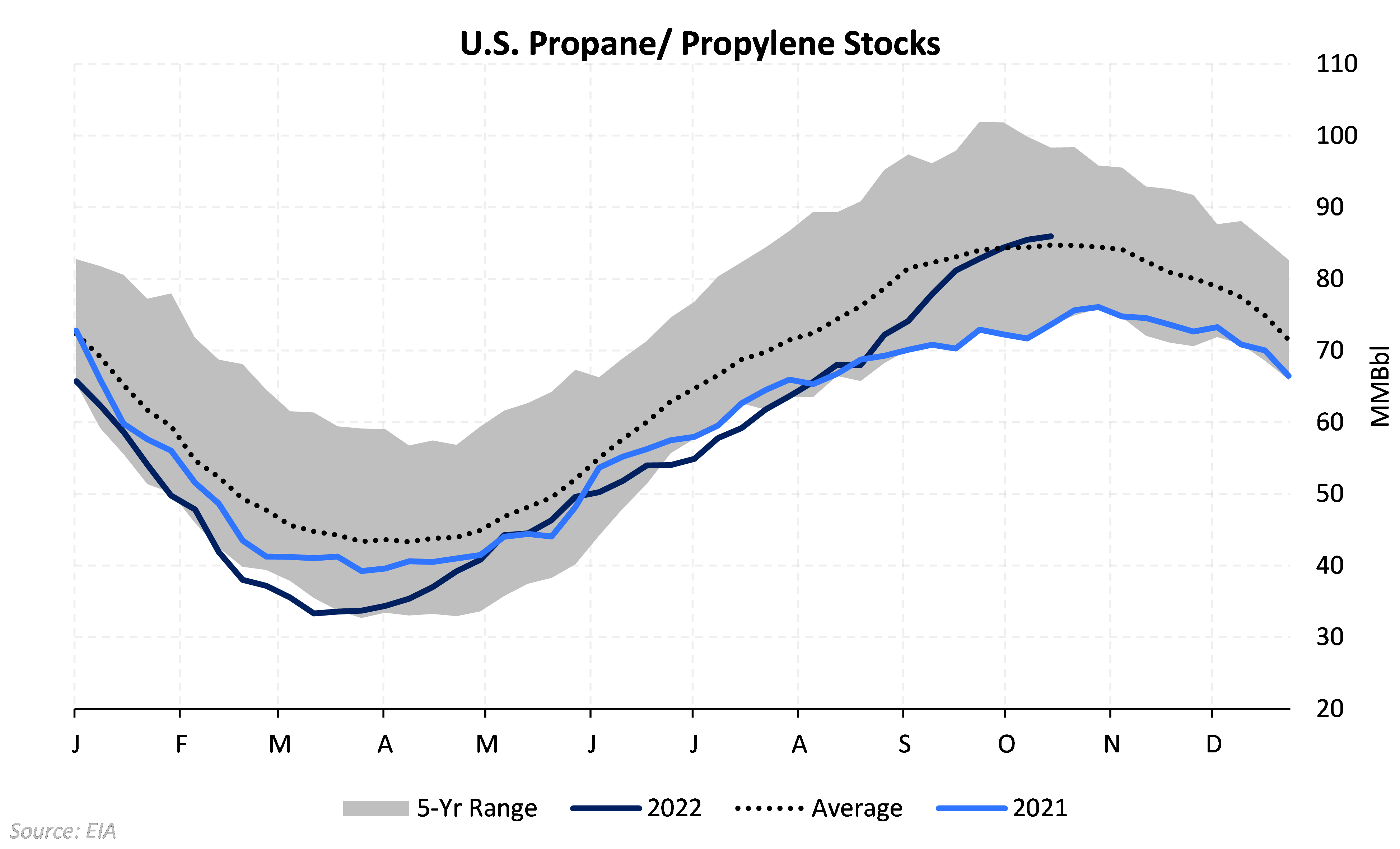

So why is propane weak when compared to oil? Since July, the EIA has reported that propane and propylene “products supplied” (a proxy for U.S. propane consumption), suddenly dropped to much lower than the five-year average for the same time period.

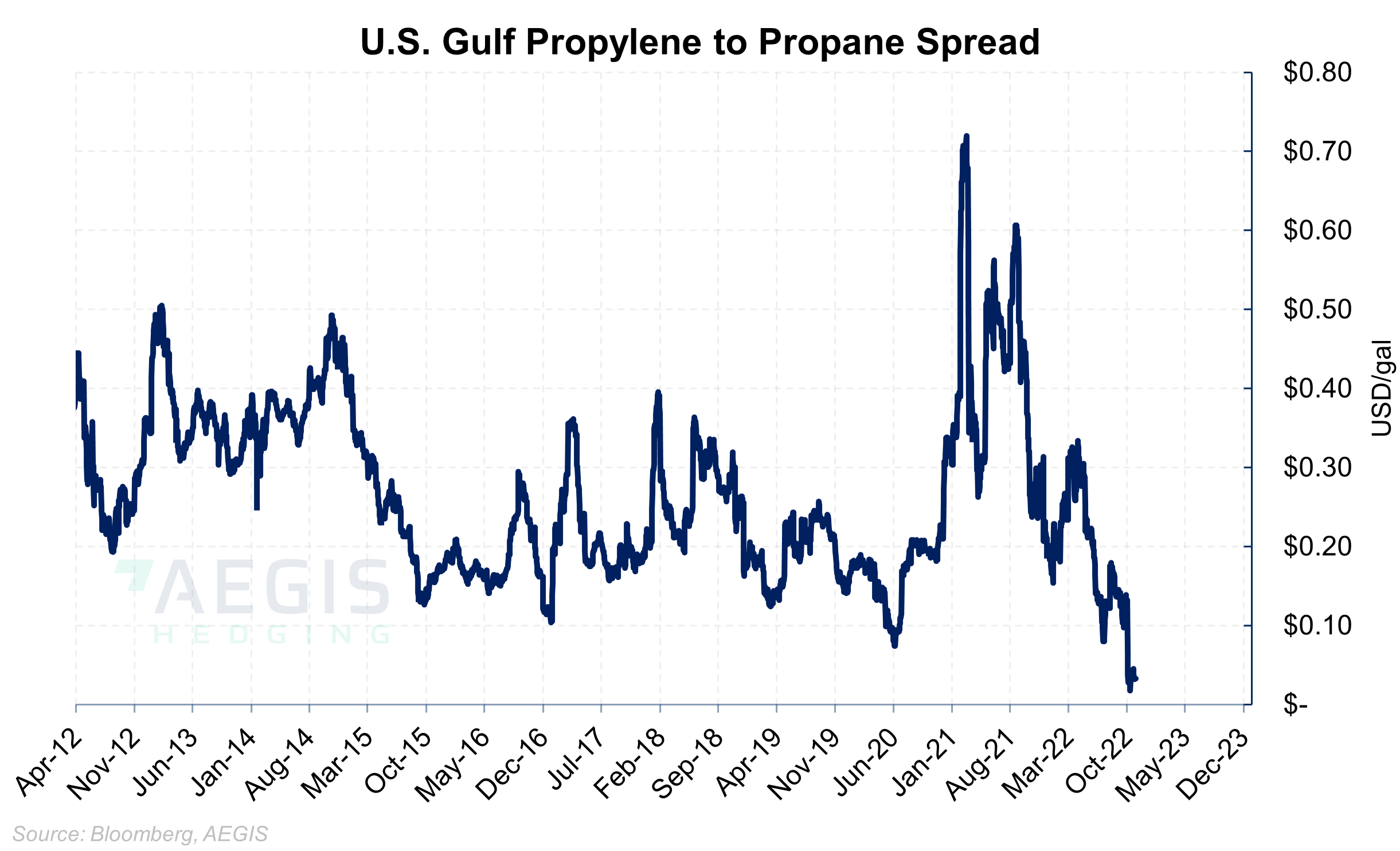

One possible explanation is a loss of petrochemical demand for propane. The propylene-to-propane price spread offers evidence. A component of domestic propane demand is its usage as a feedstock in propane dehydrogenation (PDH) plants. PDH plants consume propane and convert it to propylene, which is used mainly to produce polypropylene plastics. U.S. PDH plants account for about 125 MBbl/d of propane demand, making the relationship between polymer-grade propylene (PGP) and propane important – if the spread is too narrow, a PDH plant cannot make money**. The chart below shows a rapid decrease in the Gulf propylene-to-propane spread since March, moving to near $0 in October.

Index converts propane to cents per gallon (C3/4.2), then (PGP-1.2*C3)

Inventories on the Rise

Propane production has steadily increased this year, mostly due to increased activity in the Permian. The additional supply can’t alone explain the sharp rise in propane stocks since August. The reduction in implied propane demand over the same time period looks to be the more likely cause of fast-growing inventories.

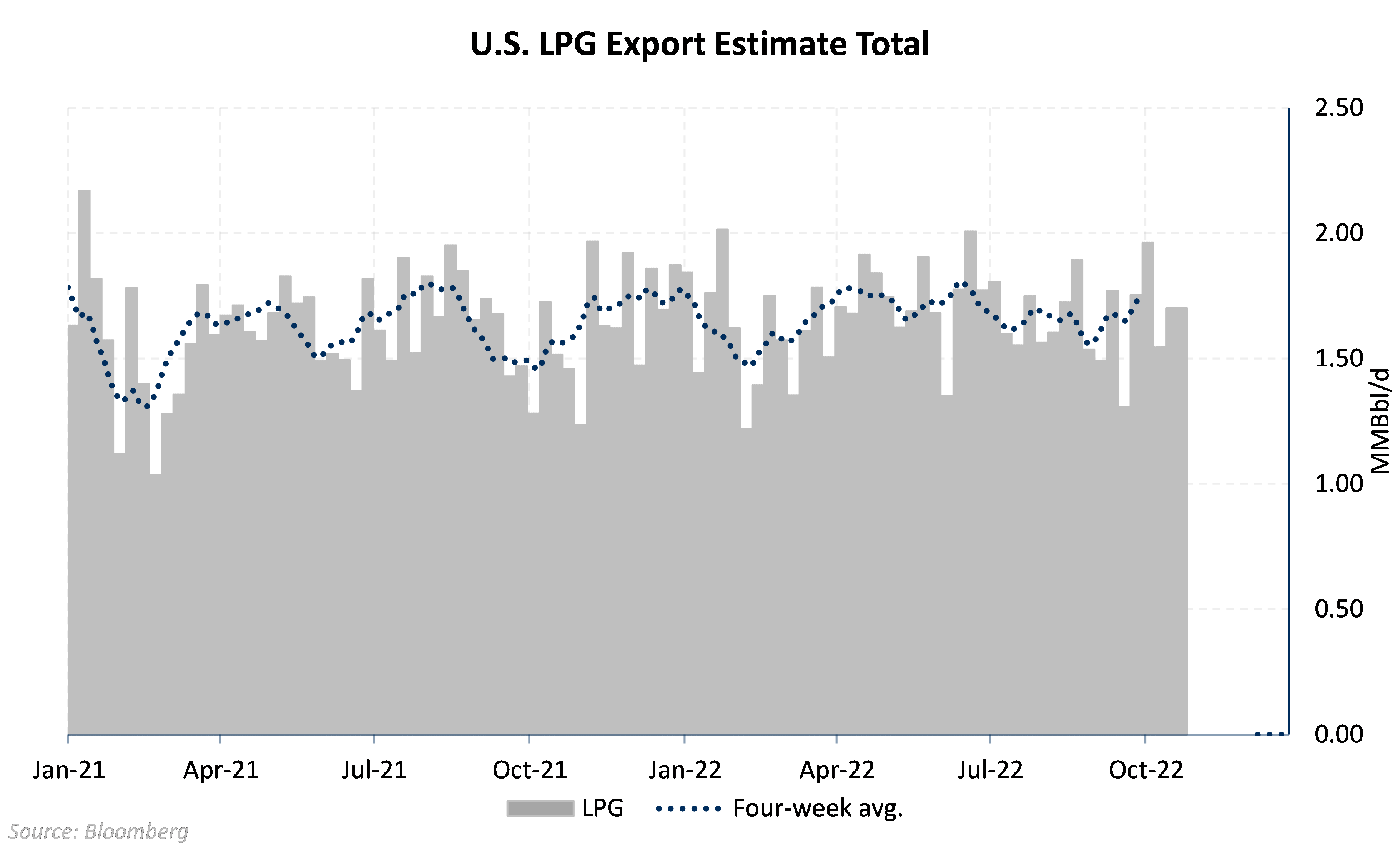

Data suggest domestic demand must be the culprit. Production increases? Not high enough. Reduced propane exports could be part of the equation, but LPG exports have not wavered much in the past eight months. The chart below shows LPG exports, which include butane, have averaged about 1.75 MMBbl/d since April.

Conclusion

Future propane prices will continue to be heavily influenced by the direction of crude oil. Additionally, propane’s own supply-demand dynamics face headwinds. Seasonal propane demand will start to pick up as winter approaches and space heating increases. Combining the fact that propane already trades at a relatively low percentage to WTI, propane likely has more upside than downside this winter. After this winter, propane will have an uphill battle to find fundamental support on its own. If the current propane supply-demand weakness persists, the 2023 strip could realize lower. Now may be the prudent time to discuss adding downside protection for propane for next year.