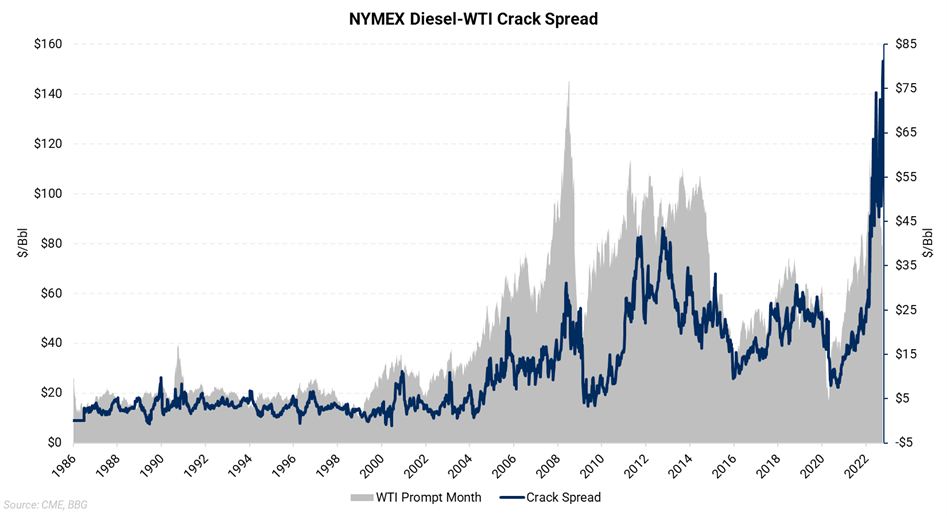

October 12, 2022 - U.S. refining margins surged to an all-time high on Wednesday. The chart above shows the diesel crack spread and the weekly average price of WTI crude oil. A crack spread is a simple difference in price between a refinery’s input and output products (WTI Crude and NY Harbor ULSD in this case), after converting to dollars per barrel. Cracks can also be described as the gross margin in refining a gallon of crude into a gallon of gasoline or diesel. When the product price rises faster than the crude oil price, the crack widens or gets larger.

A high crack spread could also indicate that the production capacity for a product is less than the market demands. The result is that consumers bid diesel higher as they compete for limited quantities of fuel. Diesel then becomes more profitable as the price of diesel is moving away from the price of crude oil.

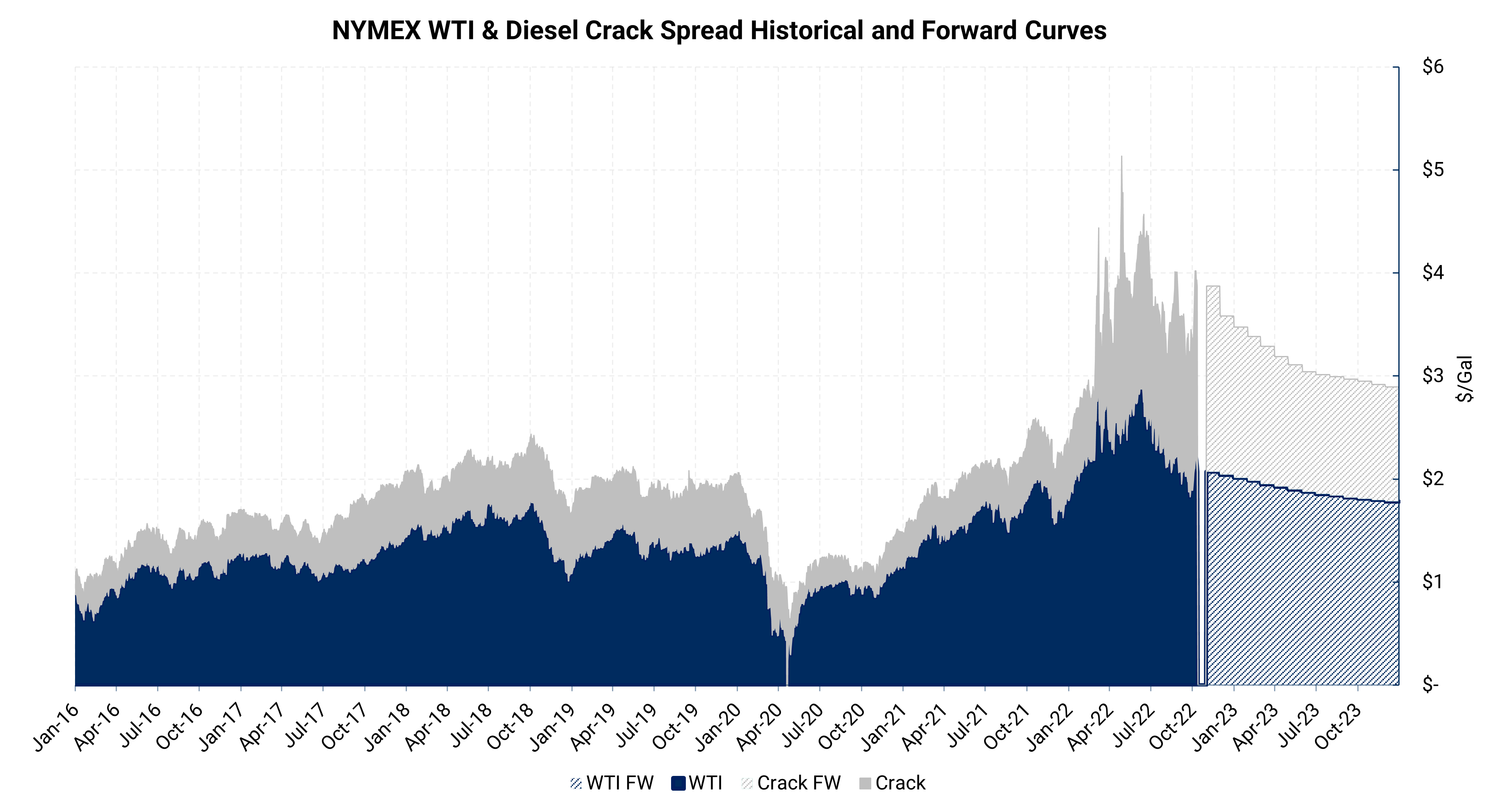

Meanwhile, the recent strength in oil prices is accentuating the price of diesel. The chart below shows historical and forward diesel prices in $/gal. The blue area shows the price of WTI in terms of $/Gal, while the grey area stands in for the "crack," (Diesel price minus WTI Crude price), and the sum of the two gives you the cost of diesel in $/Gal. It is evident that the sharp increase in oil prices has caused diesel prices to rise quickly.

Diesel prices are also surging in the U.S. and Europe ahead of winter, when there may be higher demand than usual. Because of extremely high natural gas prices in Europe, large amounts of diesel-like products may be consumed to generate power. The IEA, in its September monthly report, said it expects widespread switching from gas to oil for heating purposes, saying it will average 0.700 MMBbl/d from October 2022 to March 2023 - double 2021’s levels.

Refinery outages and seasonal maintenance could be one of the major drivers behind the current price rally. Three refineries in Washington state and California had planned maintenance, while another experienced an unplanned outage in September. A fire at the BP-Husky refinery (0.151 MMBbl/d) in Toledo, OH, on September 20 forced the closure of the plant. BP also looks to be having difficulty getting a gasoline-making fluid catalytic cracking (FCC) unit back online at its massive 0.435 MMBbl/d Whiting, Indiana, refinery due to a fire in August.

Refineries on the U.S. West Coast are currently undergoing planned maintenance, with Phillips 66 and Valero temporarily shutting down their Anacortes, WA, and Benicia, CA, plants. However, problems at a number of refineries in the Los Angeles area led several refiners to shut down some units for unplanned maintenance.

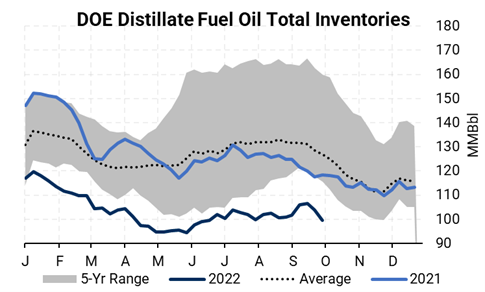

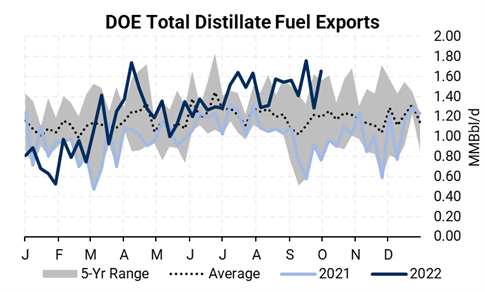

Diesel stocks can support the market when demand is high, or supply falters. However, the charts below show the seasonal levels of total distillate inventories and exports in the United States. Stockpiles in the U.S. are very low. Europe’s are arguably dangerously low ahead of winter, considering its current energy crisis.

|

|

The inventory shortage may further support diesel refining margins and prices. Distillate fuel inventories in the U.S. are 21% below the five-year average for this time of year. Meanwhile, exports continue to be high as refiners attempt to address global shortages brought on by the pandemic's quick recovery, and the disruptions caused by Russia's invasion of Ukraine.