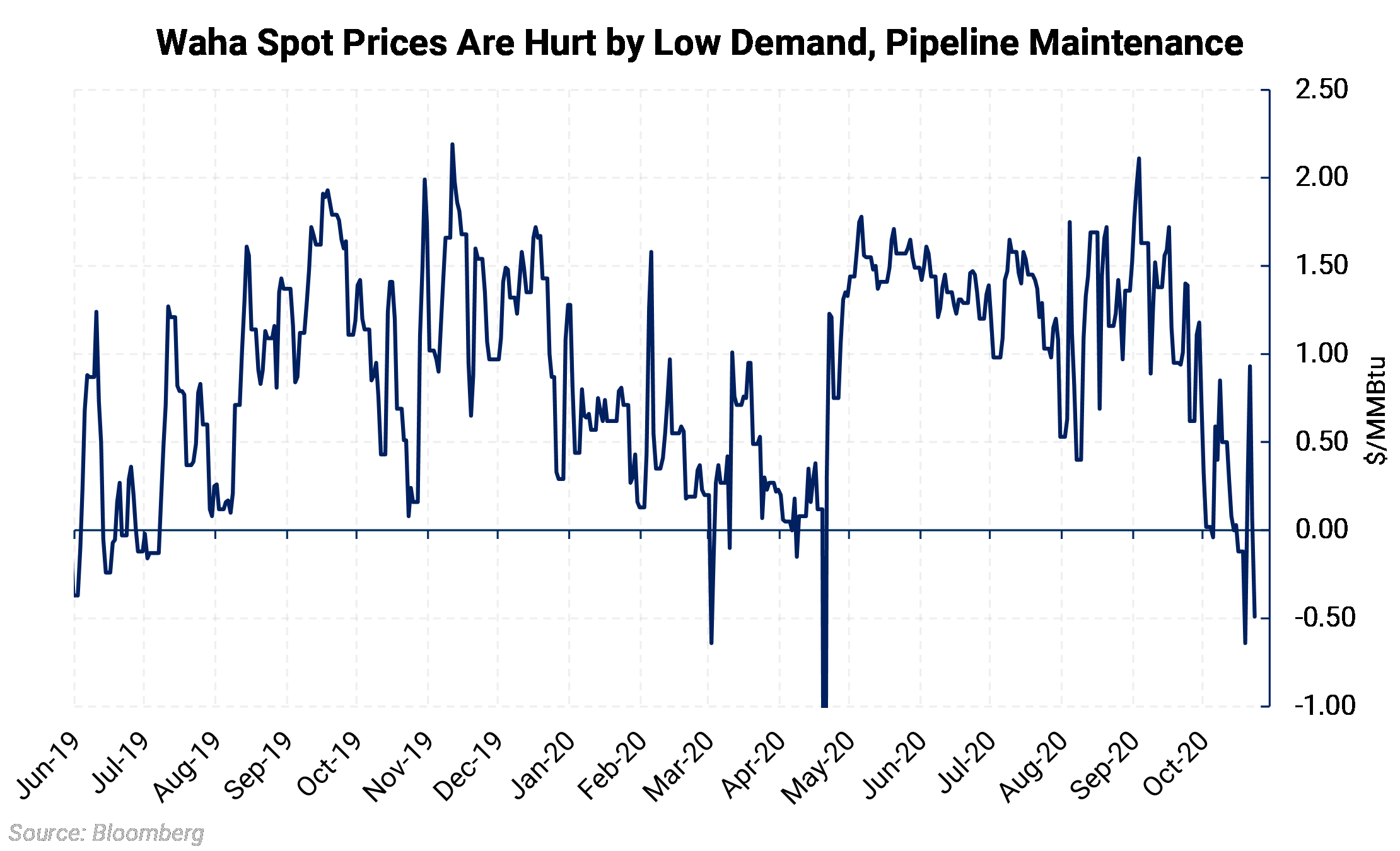

The reasons behind the cash-price weakness is an old story: insufficient pipeline space in times of low Texas demand. But this time, an outage on El Paso pipeline going west to southern California is making it worse. Gas on that corridor usually runs at 2 Bcf/d; lately, it's been just over 1.6 Bcf/d.

The reasons behind the cash-price weakness is an old story: insufficient pipeline space in times of low Texas demand. But this time, an outage on El Paso pipeline going west to southern California is making it worse. Gas on that corridor usually runs at 2 Bcf/d; lately, it's been just over 1.6 Bcf/d.

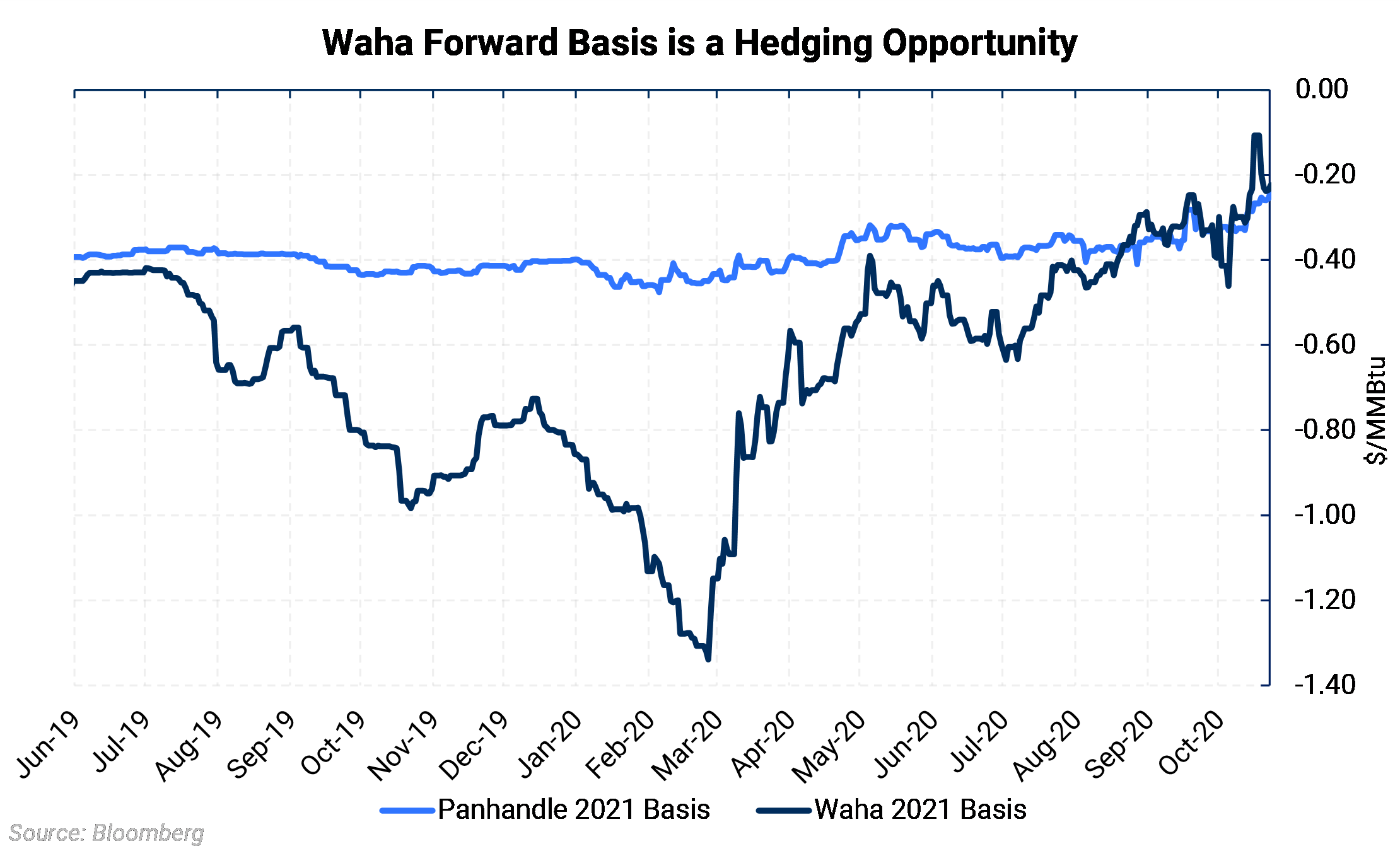

Meanwhile, the forward-looking story for that same Waha pricing point could not be more different. Cal 2021 Waha basis (difference from Henry Hub) is only -$0.22/MMBtu. It has been improving during the same time span during which cash prices have suffered — up from its low of -$0.46 on October 5. The improvements are most easily explained by floundering oil prices and a new pipeline arriving soon.

The improvements are most easily explained by floundering oil prices and a new pipeline arriving soon.

First, oil prices hovering in the low $40s does not imply much growth in oil production or in the associated gas that would come with it. Lower supply means better basis pricing.

But this week Kinder Morgan said its 2 Bcf/d Permian Highway pipeline is 97% complete and is on schedule to be in place by early 2021. That capacity helps Waha prices better connect to Texas Gulf Coast markers like Houston Ship Channel. Further, it reduces the need for Waha gas to try to force itself north into Oklahoma and compete with in the Midcontinent.