Natural gas sure had its sexy back for a minute after the one-two Hurricane punch at the beginning of September, but NYMEX Henry Hub is coming back out of the stratosphere across the board this week. Whether the fall in price is due to the slow-but-continuing recovery of production in the Gulf after the storms, headlines around manufacturing slowdowns on account of high gas prices, or just a product of the overall market selloff, winter is still in the high $4 range. Concerns over sufficient US inventories if a cold snap materializes this winter plus domestic supply concerns in Europe and Asia this winter are still ever present.

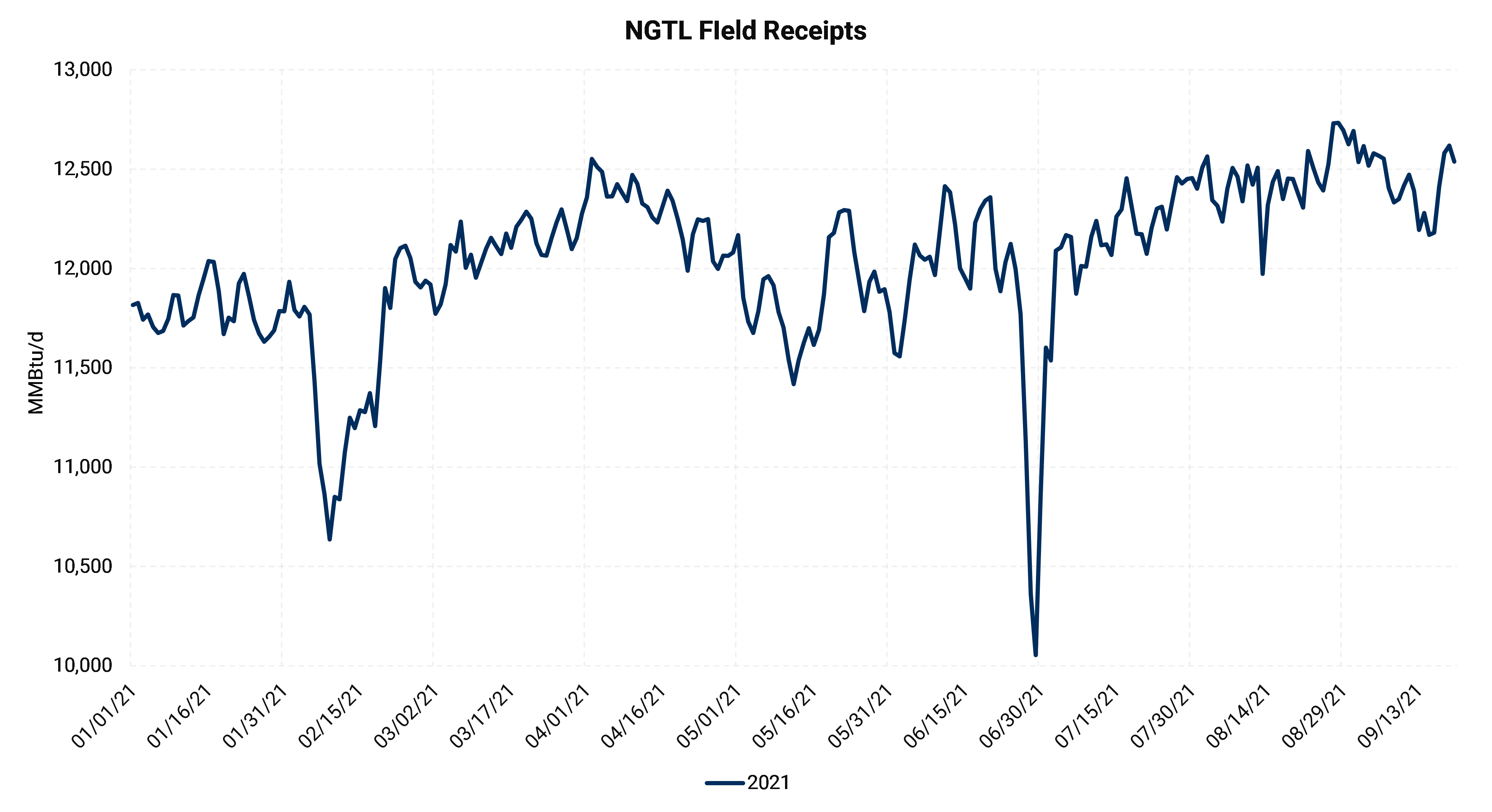

All of the headaches gas producers have endured over the past few years with respect to maintenance and expansions has actually improved the system somewhat and we aren’t paying for our gas to go away when a compressor station goes offline – at least we hope.

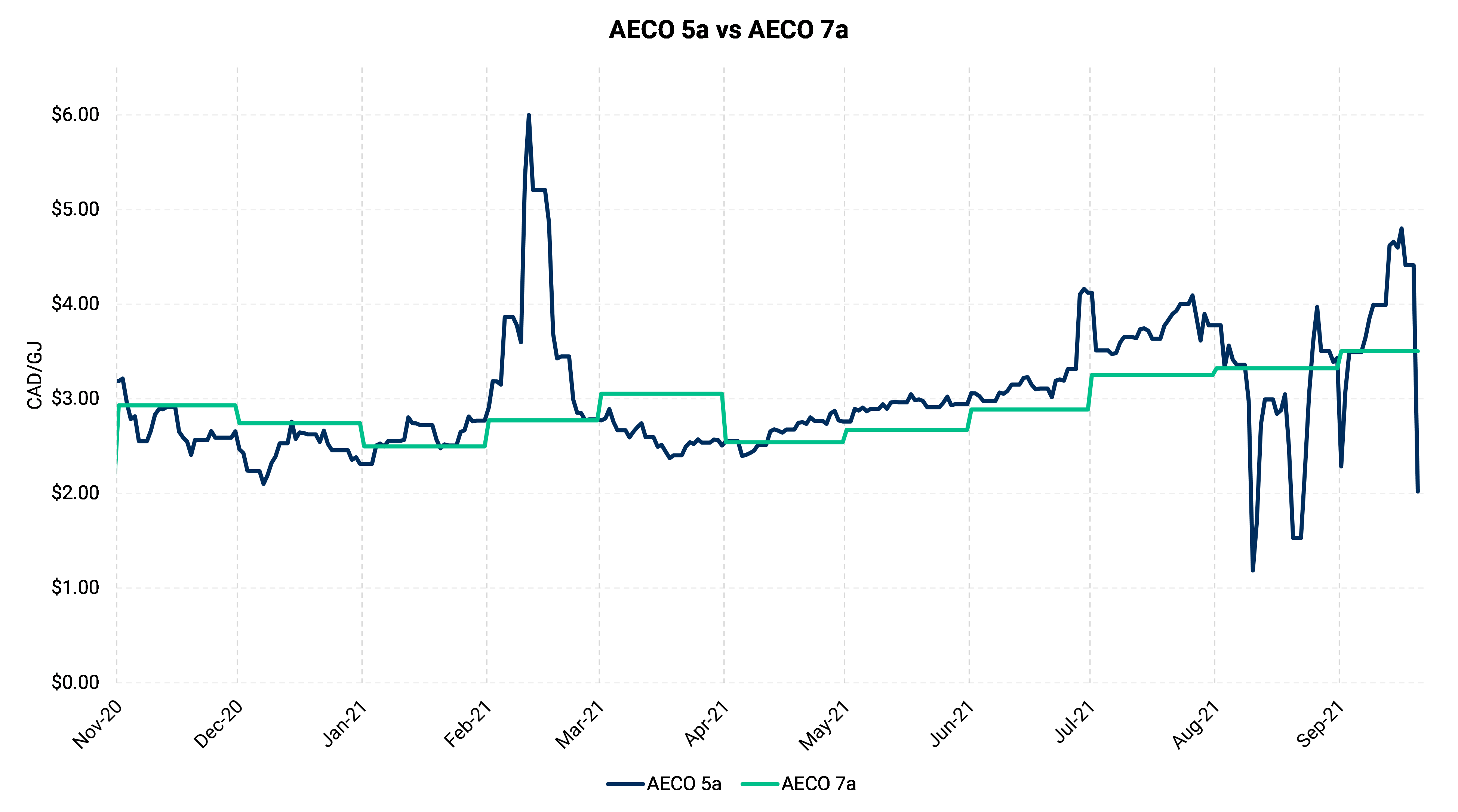

By all accounts, AECO has enjoyed some of the highest prices in years. Cash prices were remarkably good and uneventful for most of the summer, but with August came a heavy maintenance schedule and we are back to seeing huge swings in day gas.

Source: ICE, NGX

Source: ICE, NGX

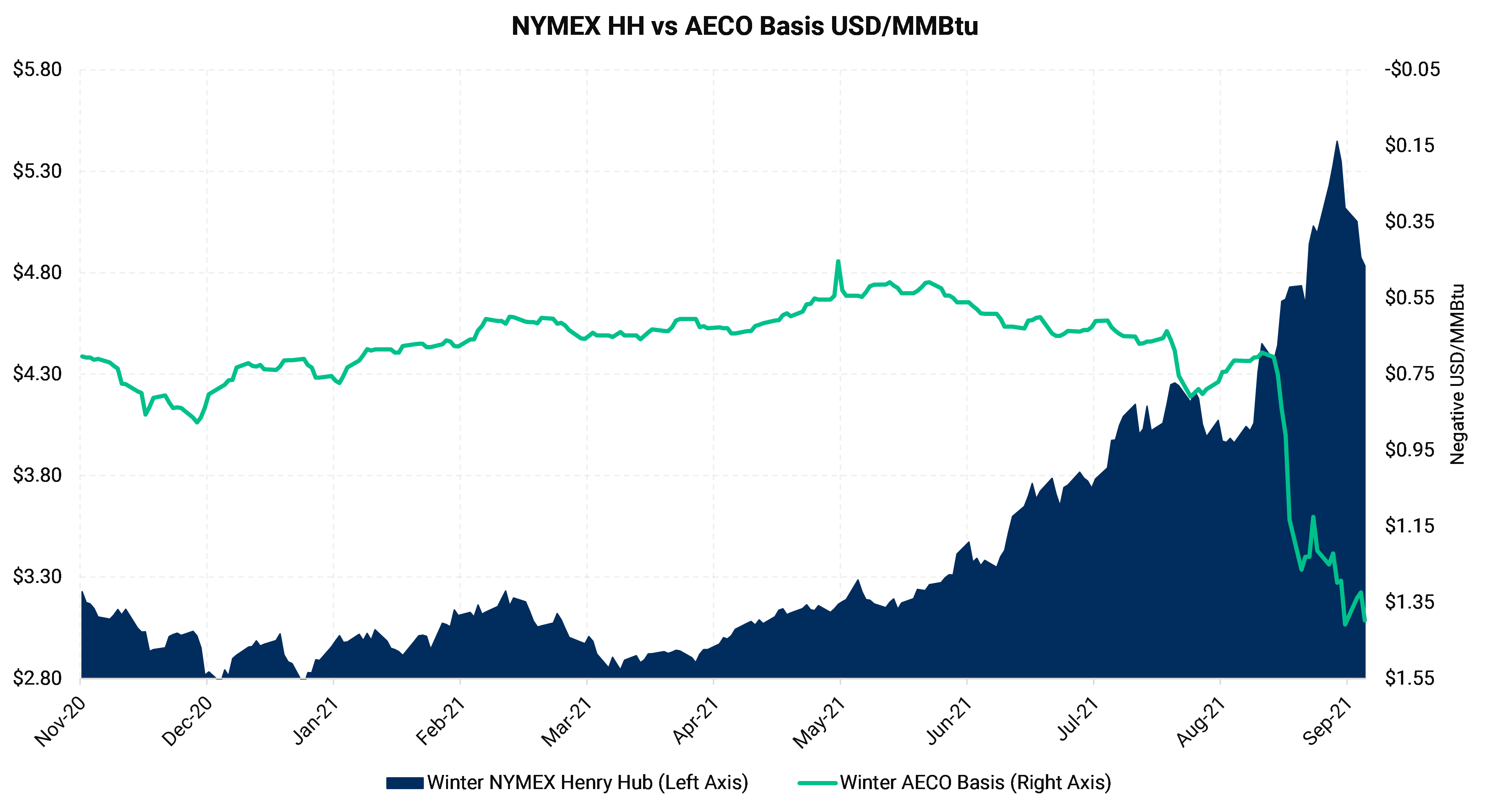

The forward strips have kept producers happy as well, but are we keeping pace with the overall rising tide in gas prices? We compared the move in AECO with the moves in nearby basins as well as overall NYMEX Henry Hub and, while we don’t want to be Debbie Downer, AECO is asleep at the wheel.

Source: ICE, NGX

Source: ICE, NGX

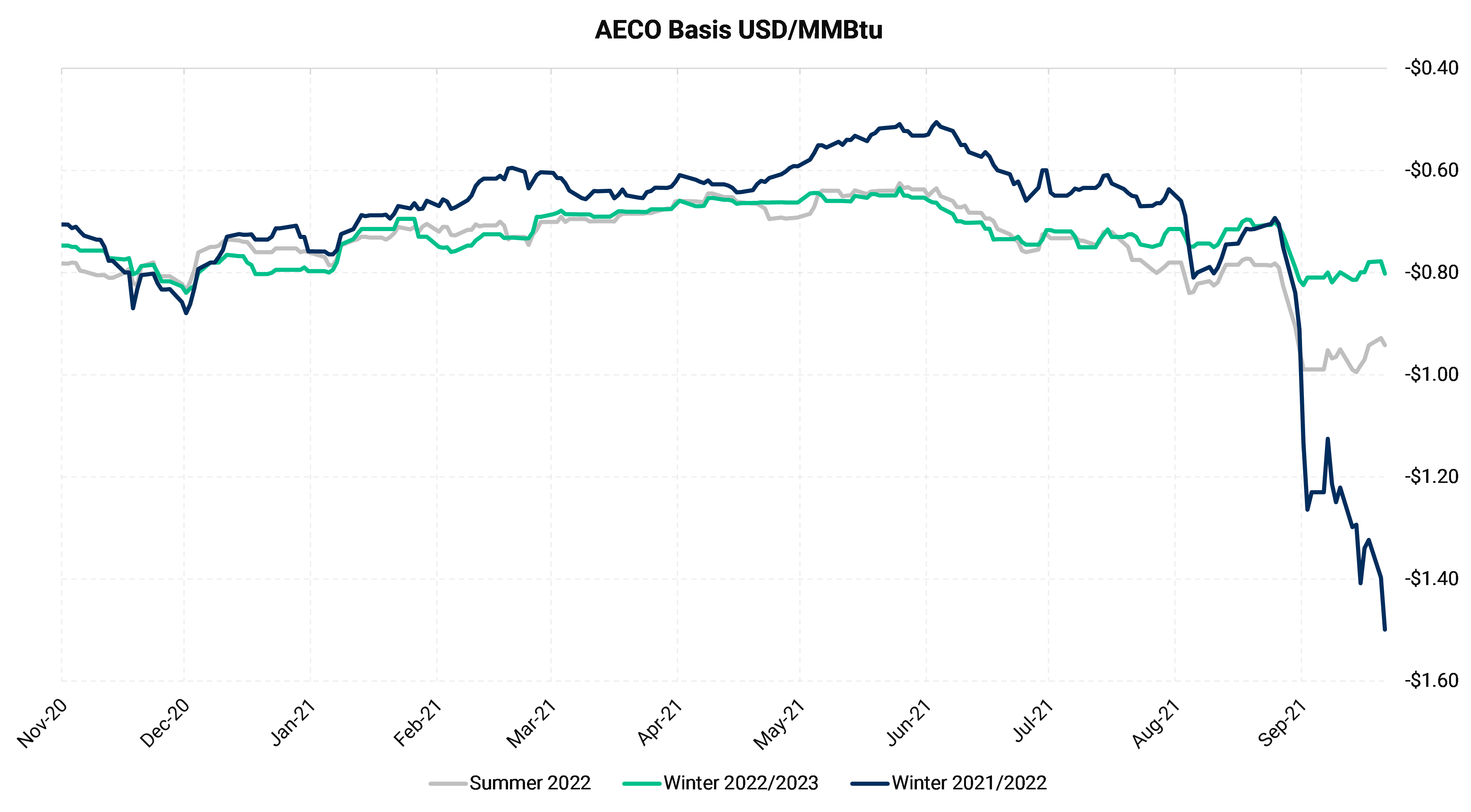

At the highs, winter NYMEX HH moved higher by nearly $1.50 while AECO basis widened $0.70 USD/MMBtu. Widening basis as NYMEX moves higher is expected, but winter NYMEX has now fallen by $0.70 over the past week, yet AECO basis continues to move wider.

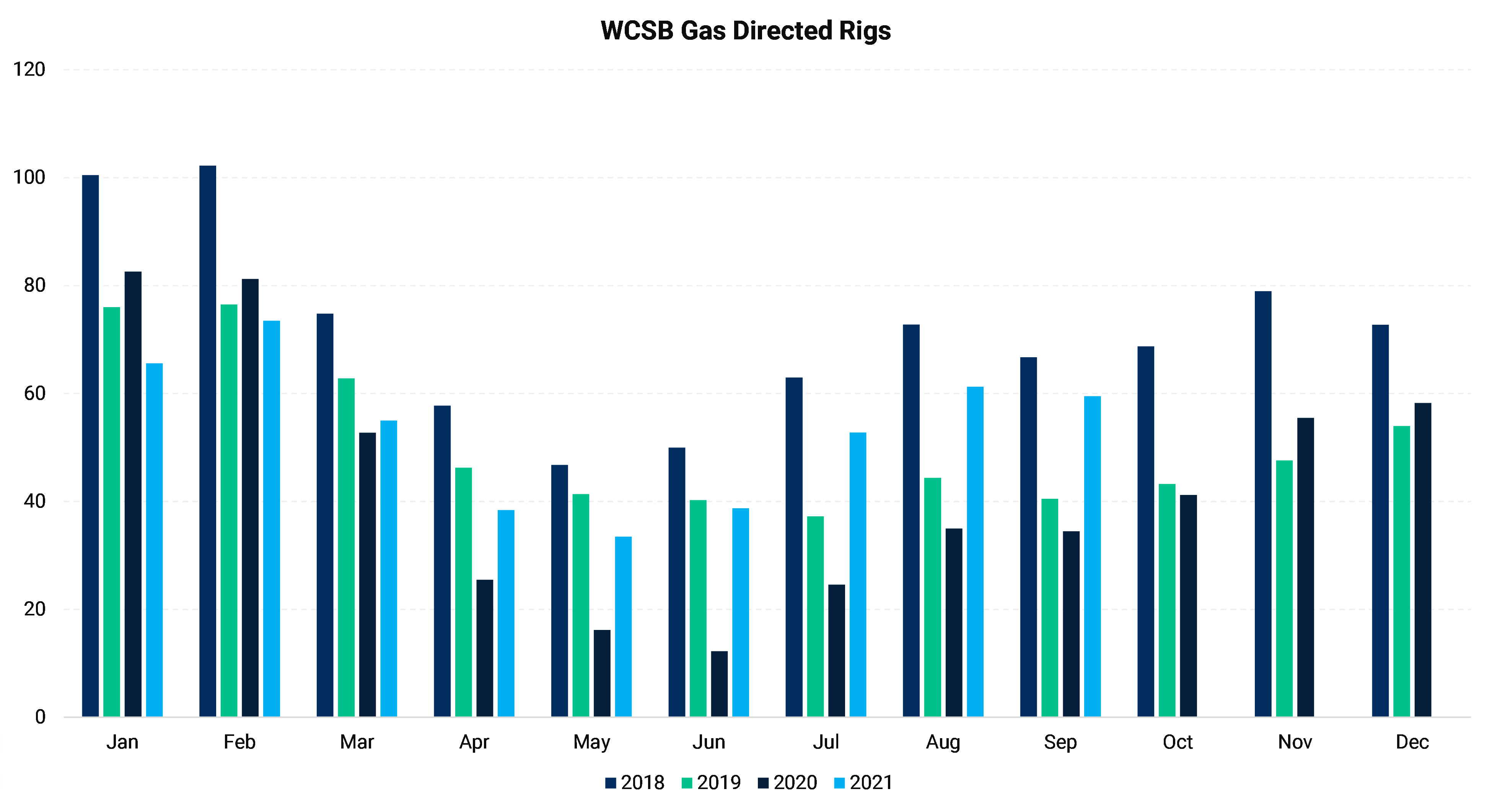

The ability of molecules to find their way to demand markets within and outside of the WCSB is markedly improved over recent years, but the price action recently shows that we aren’t out of the woods yet. Supply is noticeably higher as producers can’t resist increasing output in one of the best pricing environments we have seen in many years. Rig counts are also creeping higher, and increased capital spending announcements indicate the supply growth will continue.

|

|

| Source: COEC | Source: TC Energy |

As we have observed time and time again, AECO basis can disconnect from North American and intra-basin gas fundamentals and be instead based on factors that are somewhat hard to pinpoint, leading to "maintenance programs" as the easy answer. While maintenance is certainly part of the equation, the subtle but material move higher in supply as we head into a period of decreased demand is likely what has moved the Winter 21/22 basis strip wider. Looking into Summer 2022 and on into Winter 2022/2023, the path of AECO basis is similar, but the magnitude of the moves is comparatively muted.

Source: ICE, NGX

Source: ICE, NGX

While producers can't complain about the overall price we have seen this summer in Canada, AECO still suffers from tremendous basis risk that holds us back from completely participating in the upward trend of natural gas. The TC Energy NGTL 2021 Expansion project won't be entirely completed until sometime in 2Q 2022 according to their posted timeline. This means that we might have another year of egress restrictions while supply continues to grow. This is grandma's age-old recipe for basis volatility.