In light of the Silicon Valley Bank (SVB) collapse and recent banking issues and concerns, AEGIS would like to explain what your counterparty risk looks like and encourage you to diversify that risk, if you have not already.

What risks do you have with your trading counterparties?

There are two credit-related ones to consider:

Credit/Default Risk

Is the risk of principal or financial reward loss from the borrower’s failure or inability to repay an obligation or meet contractual obligations

|

Counterparty Risk

Is the risk to each party of a contract that the counterparty will not live up to its contractual obligations

|

AEGIS’s concern is that our clients are confident that gains on hedge positions would be paid. Counterparty risk always exists, but it can be mitigated.

Most businesses have a quantifiable credit risk, but banks’ are calculated very different than are yours or ours. Banks almost always have a credit rating assigned to them, by agencies like Moody’s, Fitch, or S&P. These ratings are estimates of how likely a bank is to default within a given time period.

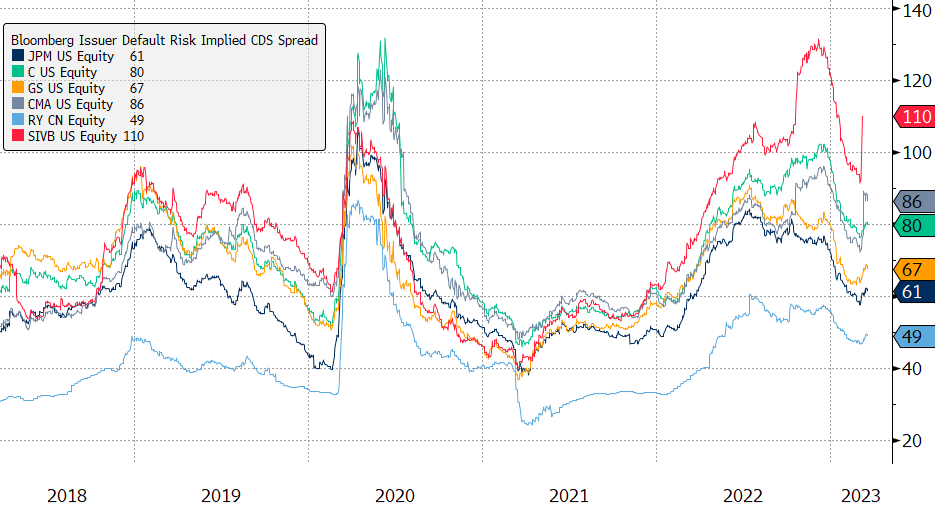

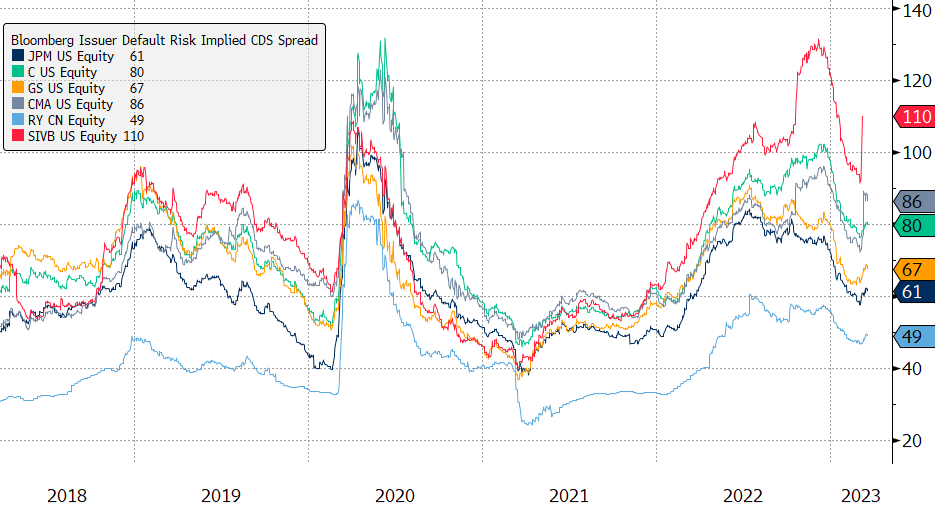

There are also market-based measures of risk, based on how credit derivatives are traded. Products like “credit default swaps” are actively traded and can be used to find the implied chance that a counterparty would default on its debt instruments. That debt-default estimate can serve as a proxy for the counterparty risk you face as a hedger.

Sample of Bank Implied 5-yr Credit Default Swap (CDS)

Source: Bloomberg as of March 21

We all can agree and probably know that we would avoid a bank with a “junk” rating. However, even banks with “A3”, which was SVB’s credit rating on March 8th, 2023, (assigned by Moody’s), have shown that they are subject to potential default. Banks that offer hedges are typically quite safe, but not all are banks, and not all counterparties are alike.

In fact, some counterparties are not banks at all, and do not conform to all the regulations that US banks are required to satisfy.

The risk of your counterparty’s defaulting is very low, but not 0%. We should follow the classic rule of thumb when handling our counterparty risk:

*Assemble a diversified portfolio by having more than one or two counterparties.

Having more than one or two counterparties spreads your risk based on diversification, avoiding concentration risk. Further, multiple counterparties will introduce competition – a potent advantage irrespective of a counterparty’s credit risk.

If you have not seen it, there are two ways on the AEGIS platform to measure counterparty risk. First, the proportion or share of each counterparty in your hedge portfolio is displayed on your AEGIS dashboard. Second, we use the credit ratings of each counterparty to create an (optional) “discounted” mark-to-market report, that incorporates an estimate of default risk.