|

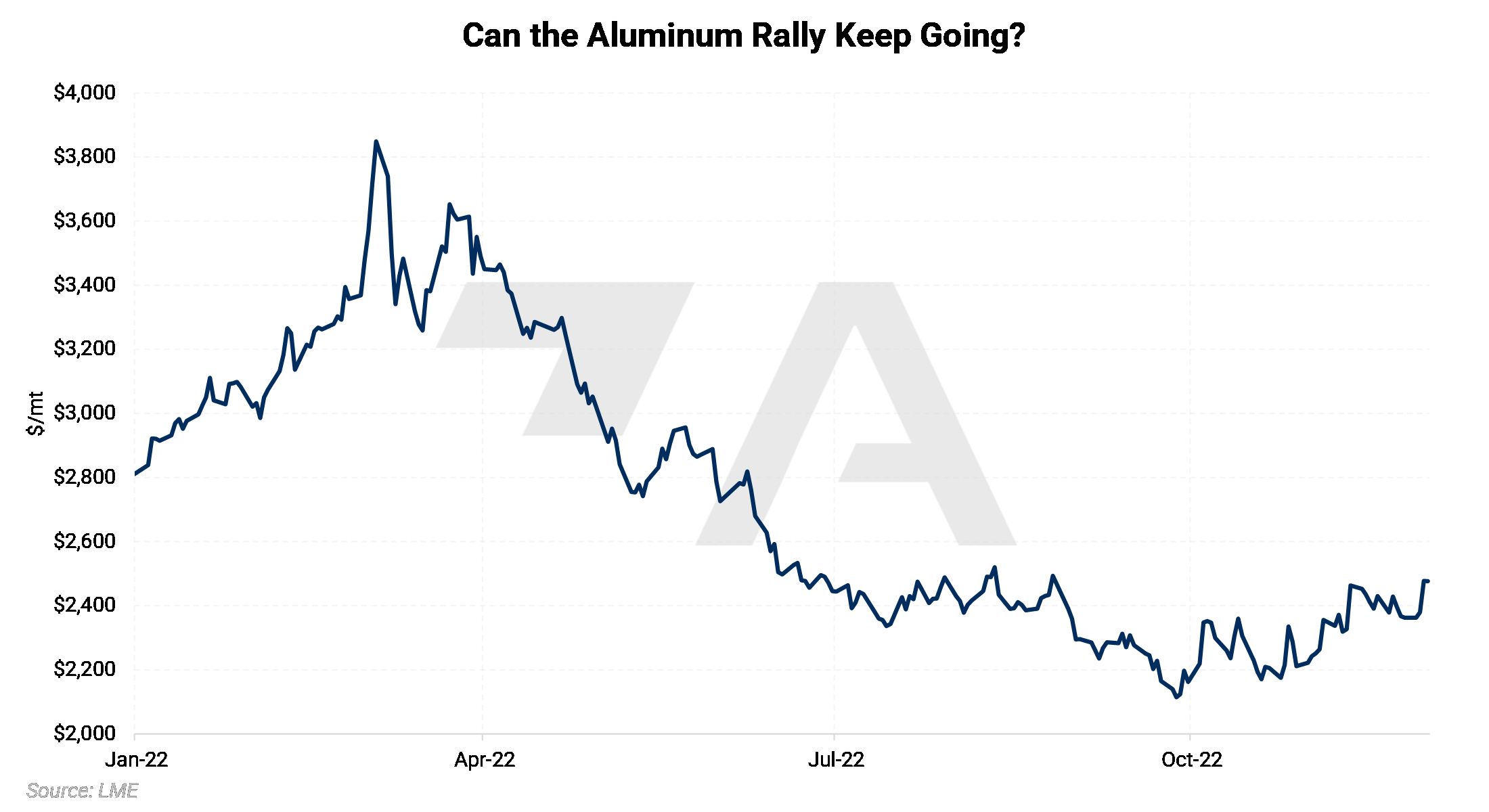

Aluminum prices surged about 12% in November. We would like to point out that the recent uptick in prices could be tied to China’s COVID and economic policies. Earlier this week, Chinese government officials stated they will “speed up” COVID vaccinations for the elderly, leading some to speculate that the government could start easing some COVID policies. Also, this week, in an attempt to boost its faltering real-estate sector, Chinese authorities relaxed financing restrictions on property developers. Last week Friday, to increase the country’s money supply, China’s central bank lowered the reserve requirement ratio (RRR) on domestic banks. The RRR is the percentage of funds that a bank must hold in reserve and not lend out. (As of November 30, 2022, close) |

|

|

Perhaps the most important recent aluminum news came from the LME. After much debate, the LME will not ban Russian metal from being traded and delivered to exchange warehouses, the exchange stated on November 11. They will not impose limits on how much Russian metal may be delivered to or stored in exchange warehouses. According to the LME, many end-users have already contracted to buy Russian metal next year. Moreover, no Russian metal producers have been sanctioned, therefore the exchange believes it “should not take or impose any moral judgments on the broader market." The LME later stated that it will “remain responsive to any sanctions or tariffs imposed by governments and will communicate with the market should those arise.” The statements were taken from the exchange’s response to the discussion paper on Russian metals launched in early October. The motivation for the discussion paper stems from Russia’s ongoing conflict with Ukraine. (Source: Reuters, LME) Traders have long worried that allowing significant volumes of Russian aluminum onto the exchange could be bearish for prices. As of December 1, warehouse stocks now total 499,150 mt, a nearly 50% increase since early October. However, LME aluminum prices are up nearly 15% during that time. Thus, it appears that traders have shrugged off the recent increase in warehouse stocks. Moreover, it appears that concerns over increasing LME stocks have taken a “backseat” to the news from China. However, AEGIS notes that if traders continue to deliver large volumes to the LME, aluminum prices could fall not because of a change in the supply-demand balance, but because of increased selling interest in the exchange-traded product. |

|

|

|

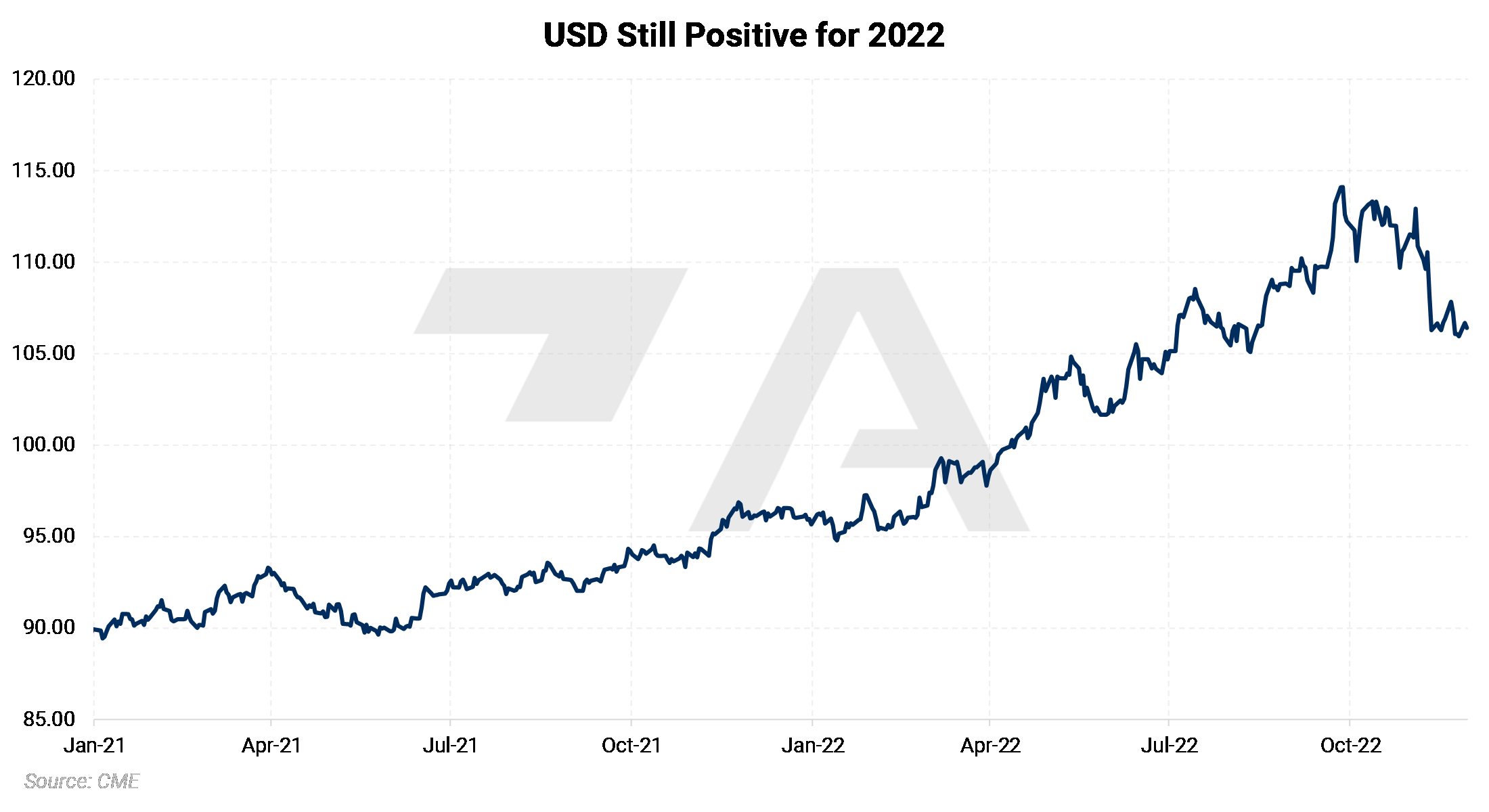

Another important factor that we should consider is the US Dollar and its potential impact on LME aluminum prices. In times of economic uncertainty, we usually see a flight to safe-haven assets such as the USD. Due to the inverse relationship between the DXY and dollar-denominated commodities, we would expect to see aluminum prices fall while the USD goes up. Conversely, aluminum should rise if the USD drops. This has largely been the case in 2022. Since early October, the USD has trended down while aluminum has rallied. That said, the USD is still up about 11% for the year. Will aluminum go higher if the USD remains pressured? |

|

|

Although there has been little supply news lately, we feel it’s important to review how much European production has been curtailed in recent months. By our calculations, approximately 1.16 million mt, or roughly 26% of Europe’s annual smelter capacity has gone offline in the past year due to unprofitability. Although electricity prices throughout Europe have improved in recent months, there have been no major announcements of any some European smelters ramping up production. |

|

|

|

Are you an aluminum end-user looking to hedge your future needs? Consumers can hedge aluminum in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.