The latest outlook from NOAA predicts an 85% chance of an above-average hurricane season, with 17-25 named storms and 4-7 major hurricanes. Driven by record high ocean temperatures and more favorable wind conditions from a weaker El Nino pattern. If any major storms do make their way into the Gulf of Mexico and threaten the US, there could be sizeable impacts on natural gas markets. While hurricanes were a bullish factor in the past, they now pose a bearish price risk.

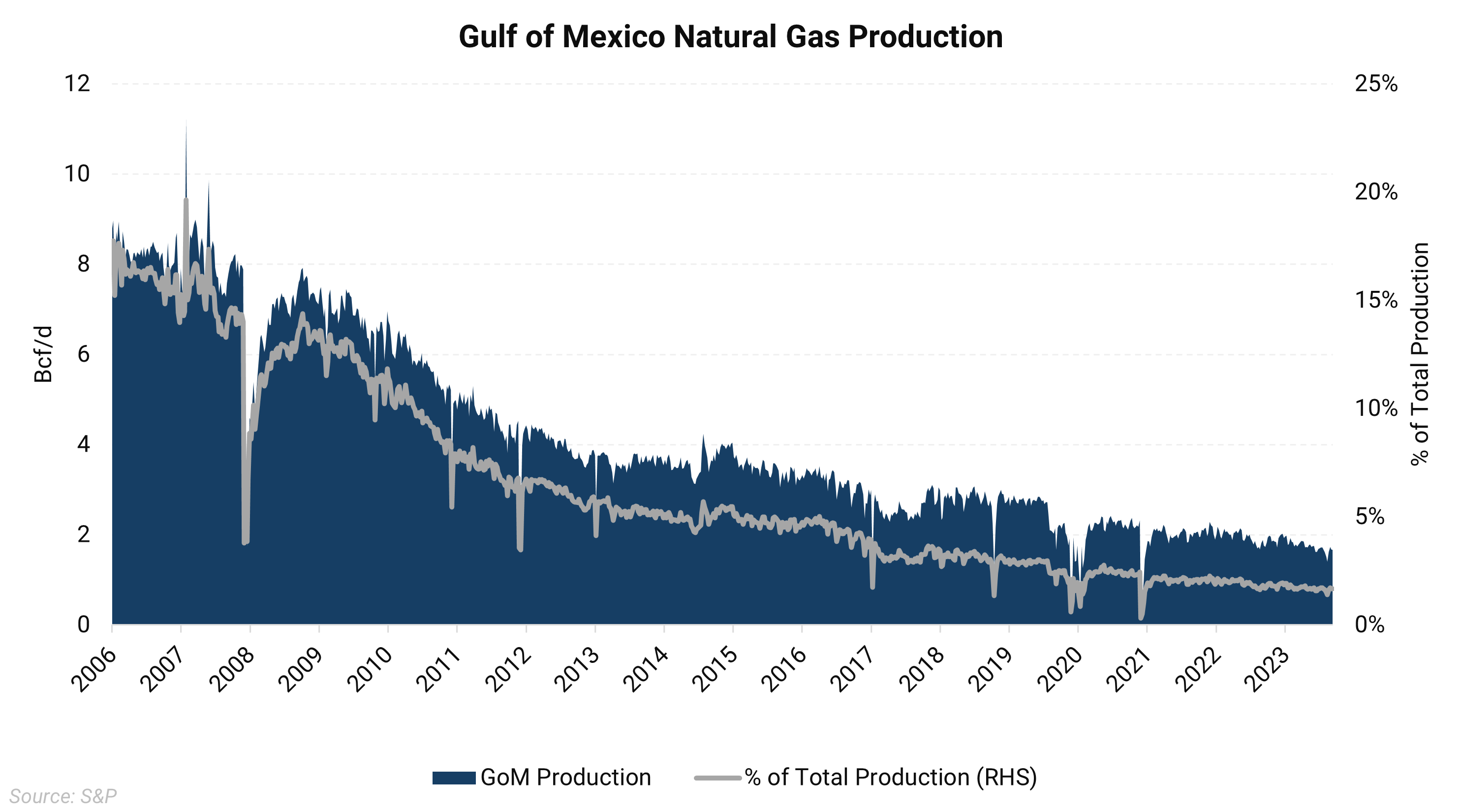

The Gulf of Mexico used to be the source of a large percentage of US gas production, but it has declined over the past decade. With the Gulf now responsible for about 2% of total US production, any large storm would have a limited temporary effect on US supply-demand balances. Meanwhile, gas demand from the Southern US has grown sharply.

There have been consistent increases in power and industrial gas demand along the US Gulf Coast, exacerbated by gas now holding a higher share of the power mix. Due to this increase in power demand, the Southeast region is the largest gas-consuming region of the Lower 48 during the summer months. Storms can often dampen power demand by reducing temperatures and potentially damaging power plants and transmission lines. LNG exports are another major source of demand along the Gulf Coast that is at risk from storms.

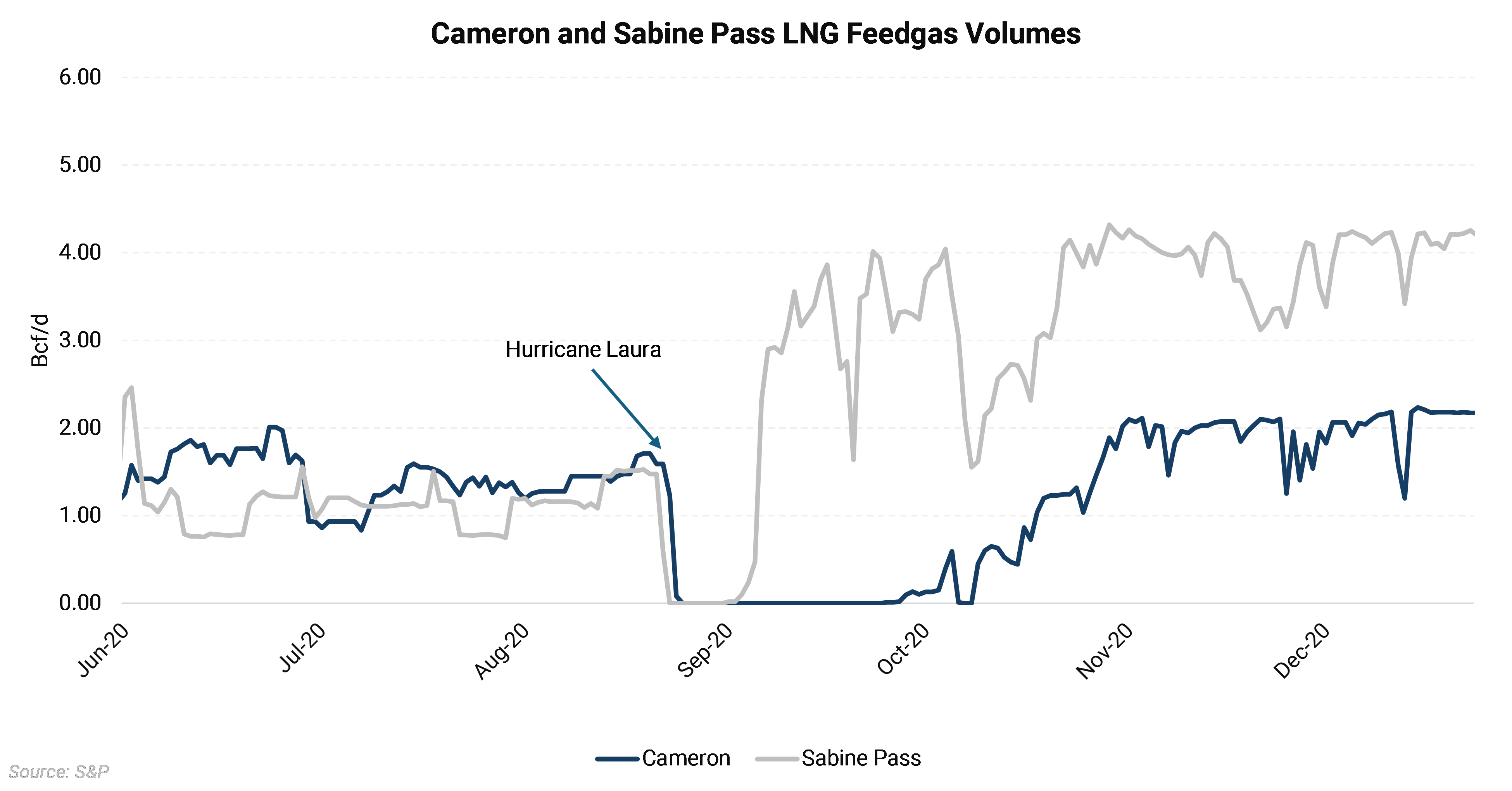

Over the past ten years, LNG exports have surged as several new facilities have entered service, most of which are located along the Gulf Coast. While the federal government requires LNG export facilities to withstand winds of up to 150 MPH, the main risks to exports have historically come from power outages. Several facilities have on-site power generation, which has proven more resilient, but Cameron LNG and Freeport LNG are both powered by the electrical grid. Any damage to transmission lines could lead to a sustained outage while repairs occur.

Following Hurricane Laura in 2020, Cameron LNG saw significantly reduced feedgas flows for several months. As shown in the chart above, the feedgas levels of Cameron LNG and Sabine Pass LNG suffered an outage following Hurricane Laura in 2020. However, the grid-powered Cameron LNG sustained a much longer outage, not returning to full capacity until November.

If NOAA's outlook pans out and any large storms do move into the Gulf of Mexico, it could present a bearish risk for natural gas prices this summer. Power outages, cooler temperatures, and risks to LNG facilities all stand to reduce gas demand in the largest gas-consuming region of the US at this time of year. In addition to impacts on Henry Hub, regional basis markets may see outsized effects. For example during previous outages at Freeport LNG, the substantial drop in local demand led to weaker pricing in Houston Ship Channel gas basis.