Wildfires in Western Canada have led to evacuations of populated areas and a significant amount of oil and natural gas production being shut in. As of Wednesday morning, rain and cooler weather have limited the spread of the fires. However, weather forecasts indicate a return to warmer, drier conditions this weekend. Alberta’s wildfire status dashboard indicates 74 active fires, 20 of which are classified as “out of control.”

Natural Gas

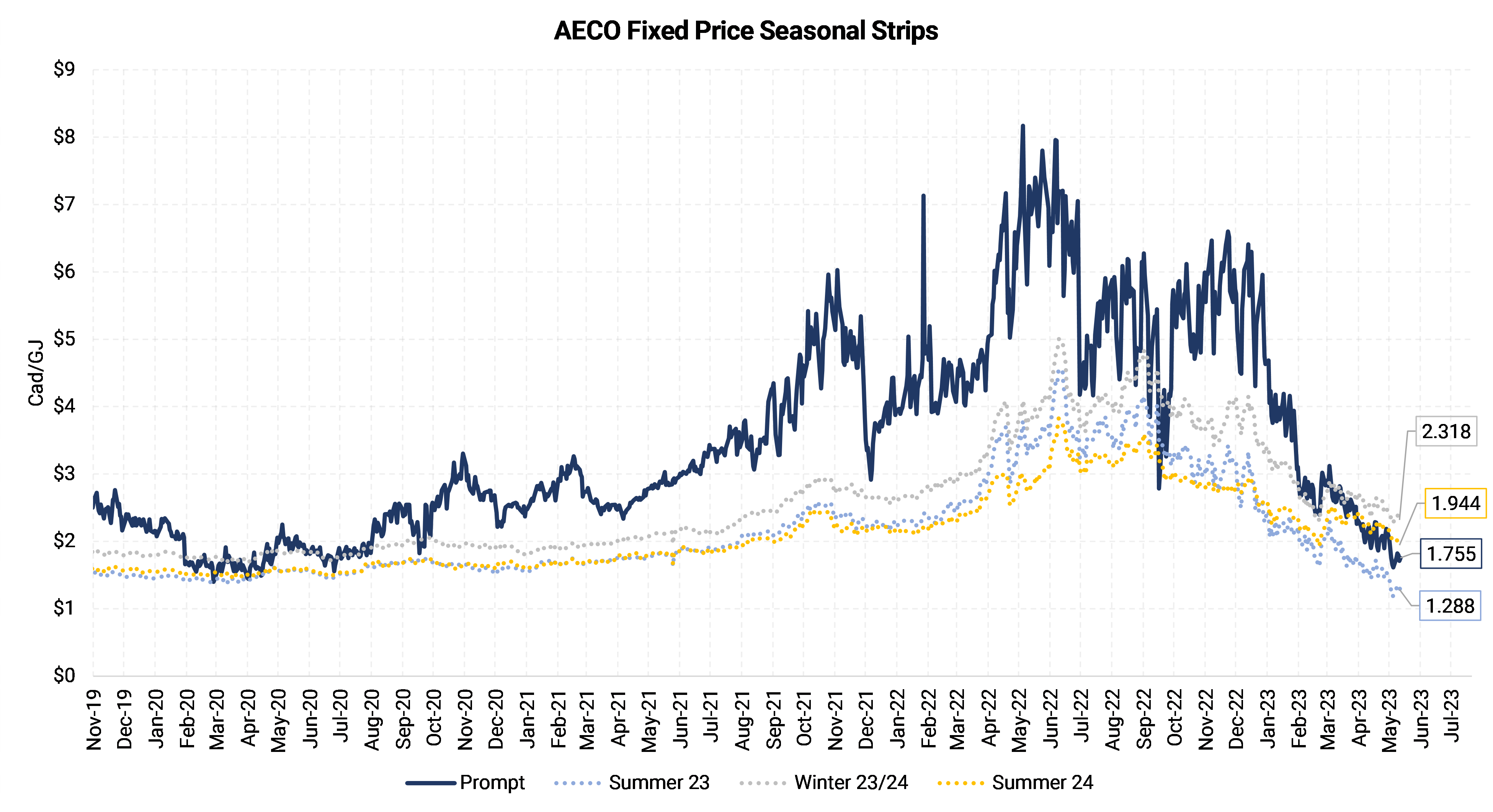

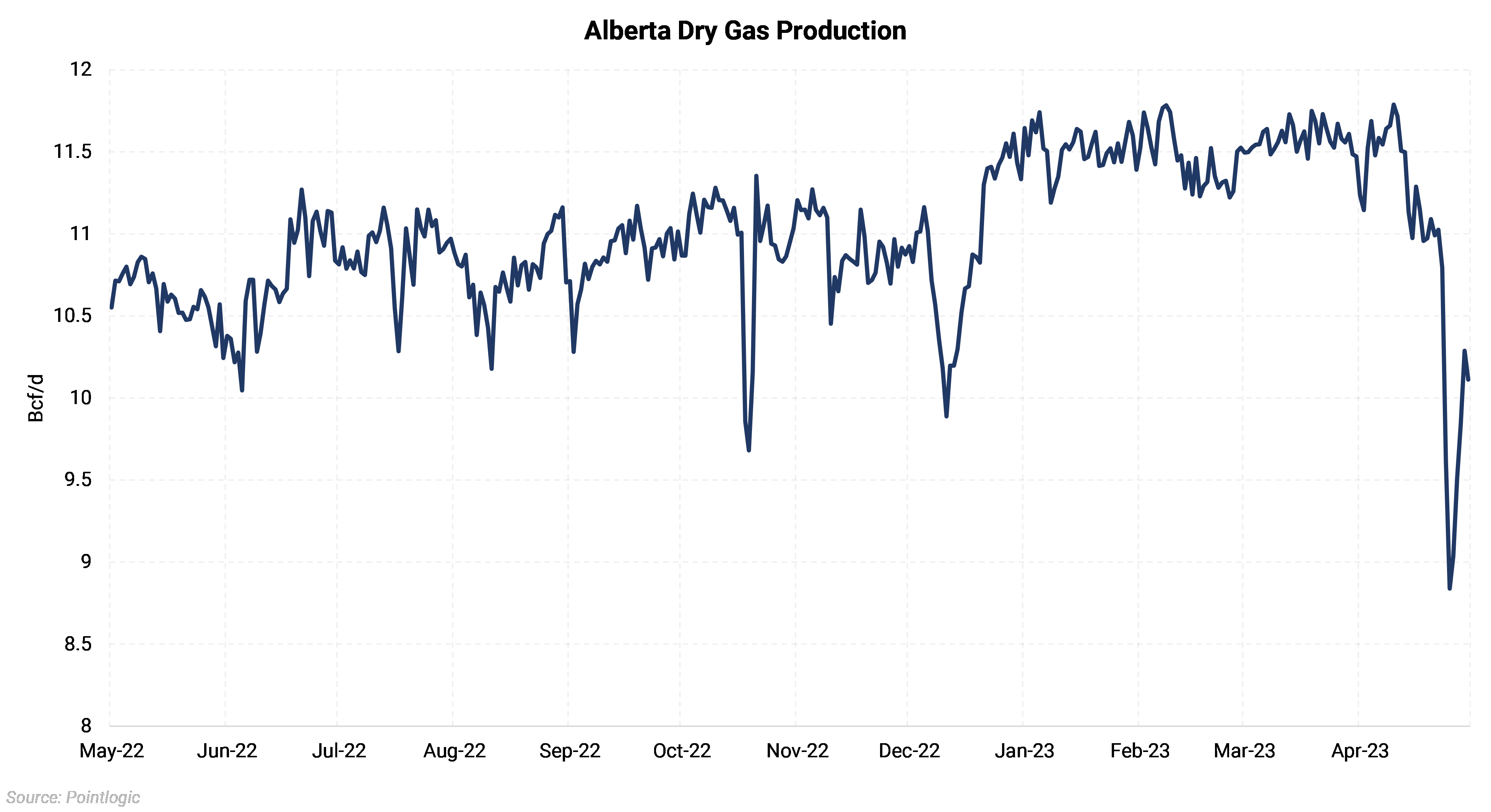

Gas production in Alberta fell 3-Bcf/d to 8.84-Bcf/d at the start of the week but has since improved to about 10.1-Bcf/d. Several gas producers have had to shut in as several areas were evacuated. In addition, two gas processing plants operated by Pembina Pipeline Corp were shut, resulting in a loss of 443 MMcf/d of processing capacity. TC Energy halted two compressor stations on its NGTL pipeline system as well. Production volumes should continue to improve unless forecasts of drier conditions over the next few days lead to difficulties in extinguishing the fires. Prompt month AECO fixed price has improved by 10c from $1.61/GJ last Friday to $1.76/GJ today, while the Summer ’23 strip has gained 11c and the Winter ’23-’24 strip rose by 3c.

Oil

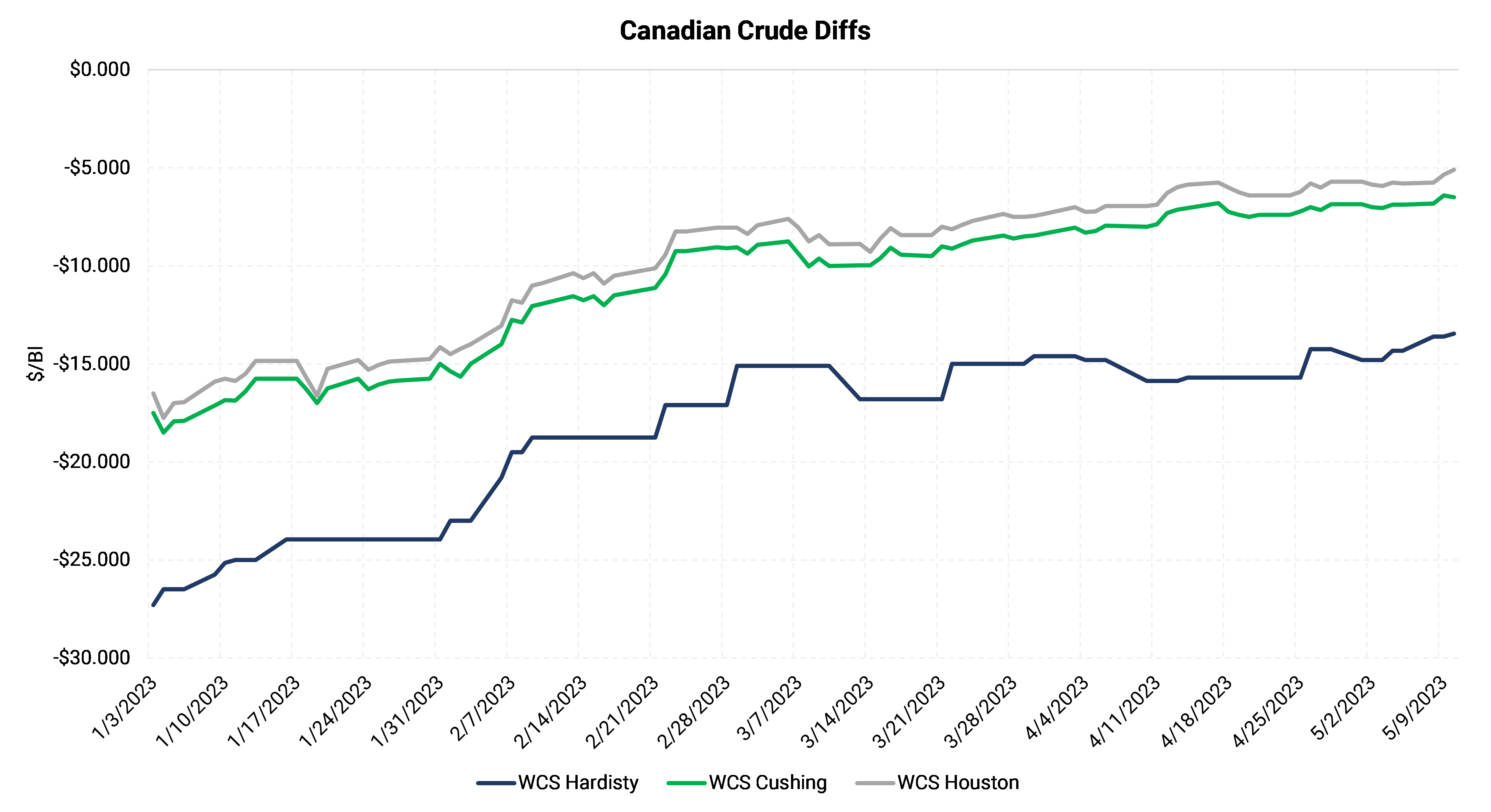

According to Argus, about 350,000 barrels of oil production have been shut in due to wildfires. While a significant amount of Canada’s conventional crude production has been affected, oil sands mining operations have been mostly unaffected by the fires. Western Canadian Select diffs have been improving throughout 2023. Since last Friday, the WCS diff priced in Alberta has improved by 9c, WCS Cushing gained 4c, and WCS Houston rallied 7c.

Production volumes are beginning to improve as the fires are brought under control. The rise in AECO prices across the curve this week presents an opportunity to hedge additional volumes, as this event should only have a short-term impact to market balances.