|

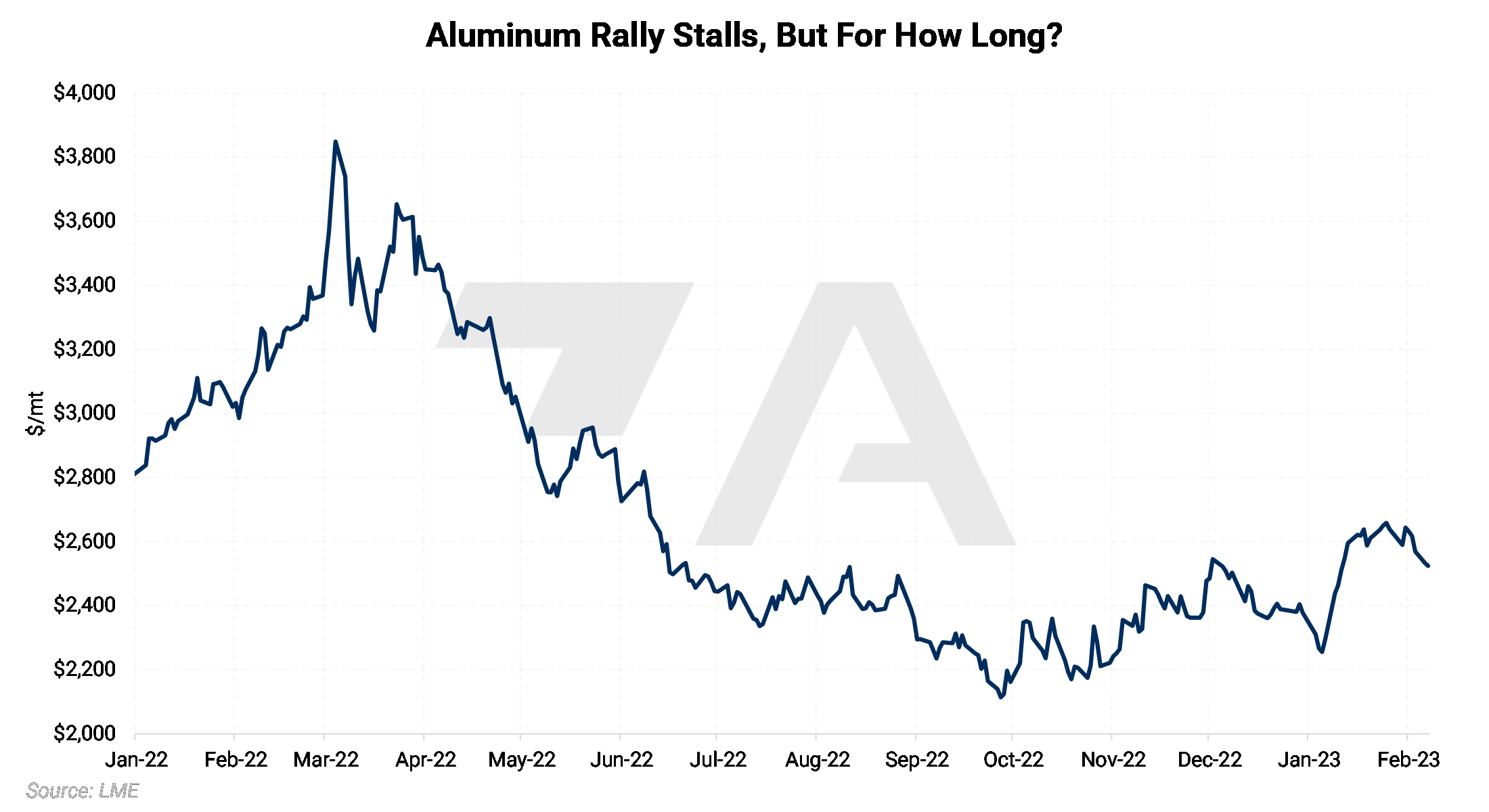

The LME Aluminum 3M Select contract last settled at $2,534.50/mt (2/7/2023 close). Prices have stumbled in early February, mainly due to a rising US Dollar. However, the market could recoup recent losses if the USD begins to weaken again. AEGIS also notes that Chinese (and perhaps global) demand likely needs to strengthen for prices to continue to rally. |

|

|

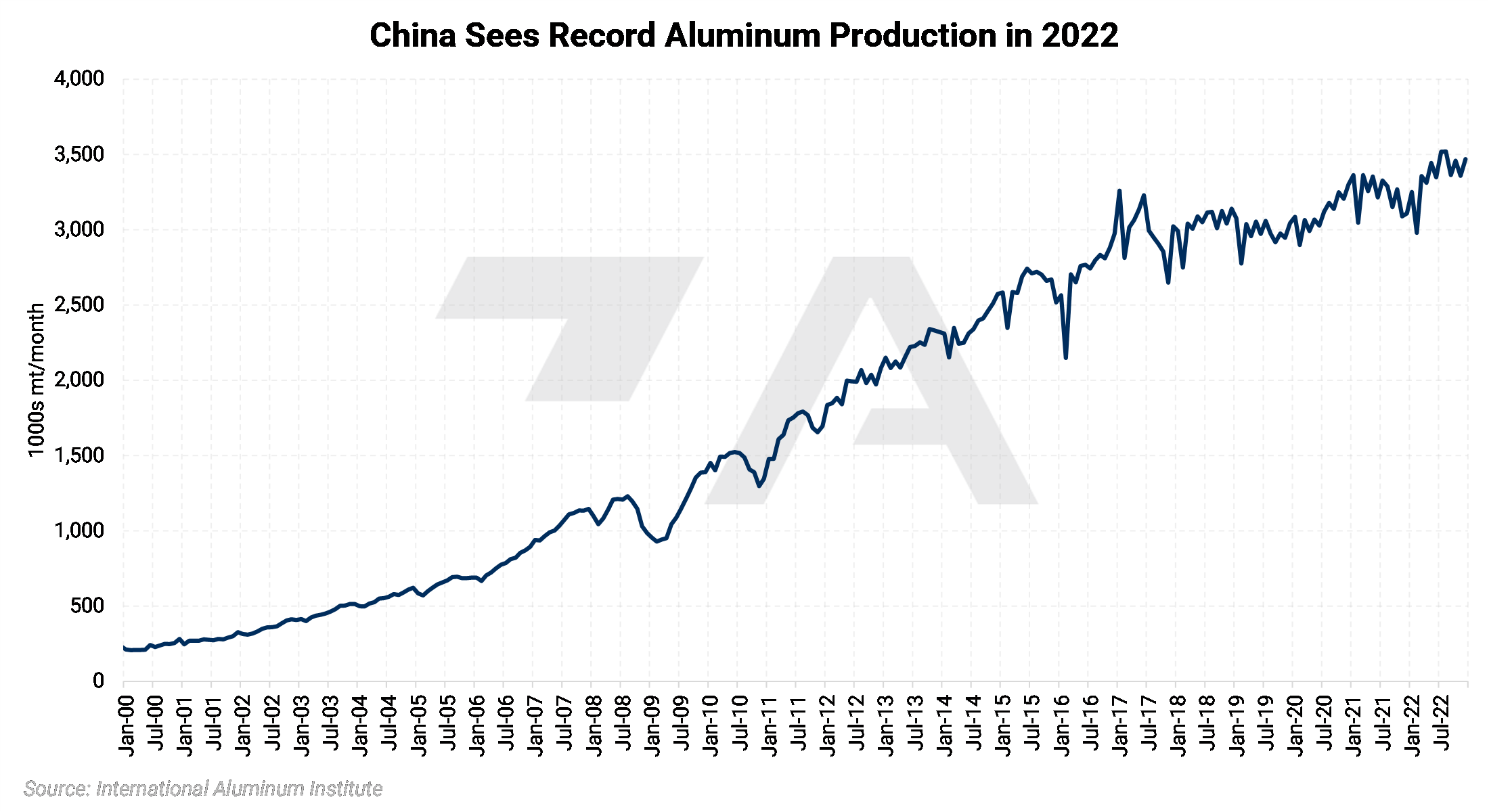

China’s aluminum production hit an all-time high of 40.21 million mt in 2022. Several analysts predict this will continue to grow over the next few years and ultimately reach the 45 million mt capacity cap. This capacity cap was set in 2017 as part of an effort to clamp down on emissions, as well as close illegal and older facilities. |

|

|

One area of China’s aluminum demand that is predicted to grow exponentially over the coming years is electric vehicle production. China produced a record 3.155 million pure electric cars last year, up over 70% compared to 2021. One analyst estimates that aluminum usage for EV production will hit 2.4 million mt by 2025, up 135% compared to 2022. |

|

|

|

Finally, Chinese aluminum exports are key to global prices. China exported a record 6.6 million mt of unwrought aluminum last year; however, exports could fall in the coming years. This is mainly because exports are usually price sensitive. For example, they normally export more as global prices rise, and this was true in the first half of 2022. However, as prices fell in 2H2022, exports also fell. Given that LME aluminum prices are approximately 35% off last year’s high, it is likely that China’s export window is closed. Also, they just doubled their export tariff to 30%, so that could keep a lid on exports too. |

|

|

|

Consumers can hedge aluminum in a variety of ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.