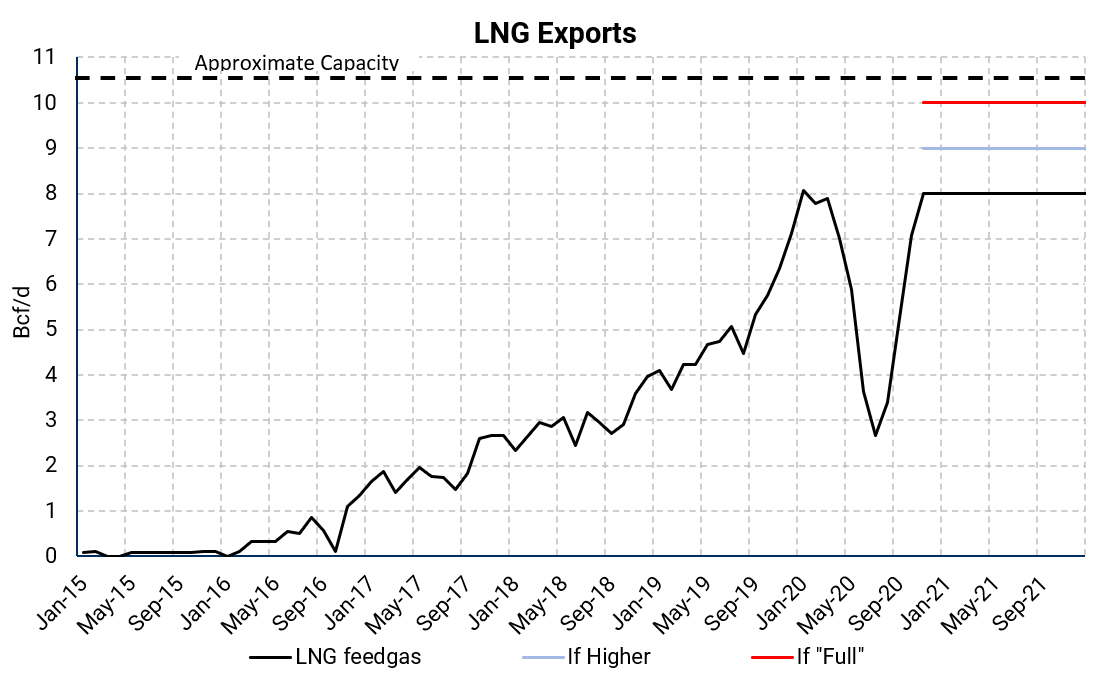

LNGOn October 29, LNG flows set a record-high of 9.6 Bcf/d, according to Bloomberg data. The recent move suggests that U.S. LNG exports are returning faster than the market anticipated. To account for this, we modeled LNG flows at 8 Bcf/d to remain conservative in our base case. Our mid and high case was run at 9 Bcf/d, and 10 Bcf/d. |  |

|

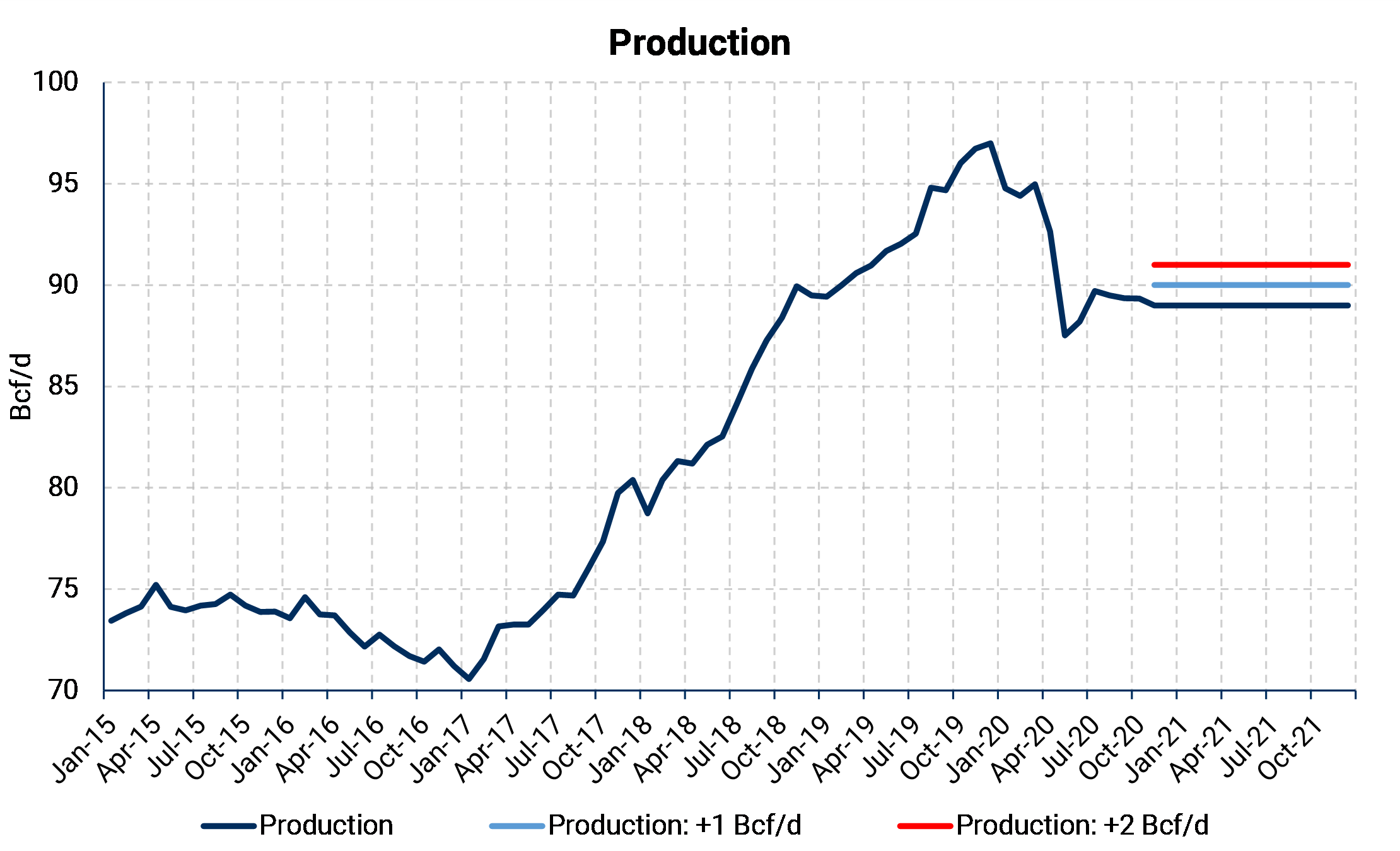

Production VariableThe second variable that was manipulated was production. We used 89 Bcf/d and held this number constant through the end of our forecast period for our base case. For our mid and high case, we used 90 Bcf/d and 91 Bcf/d. |

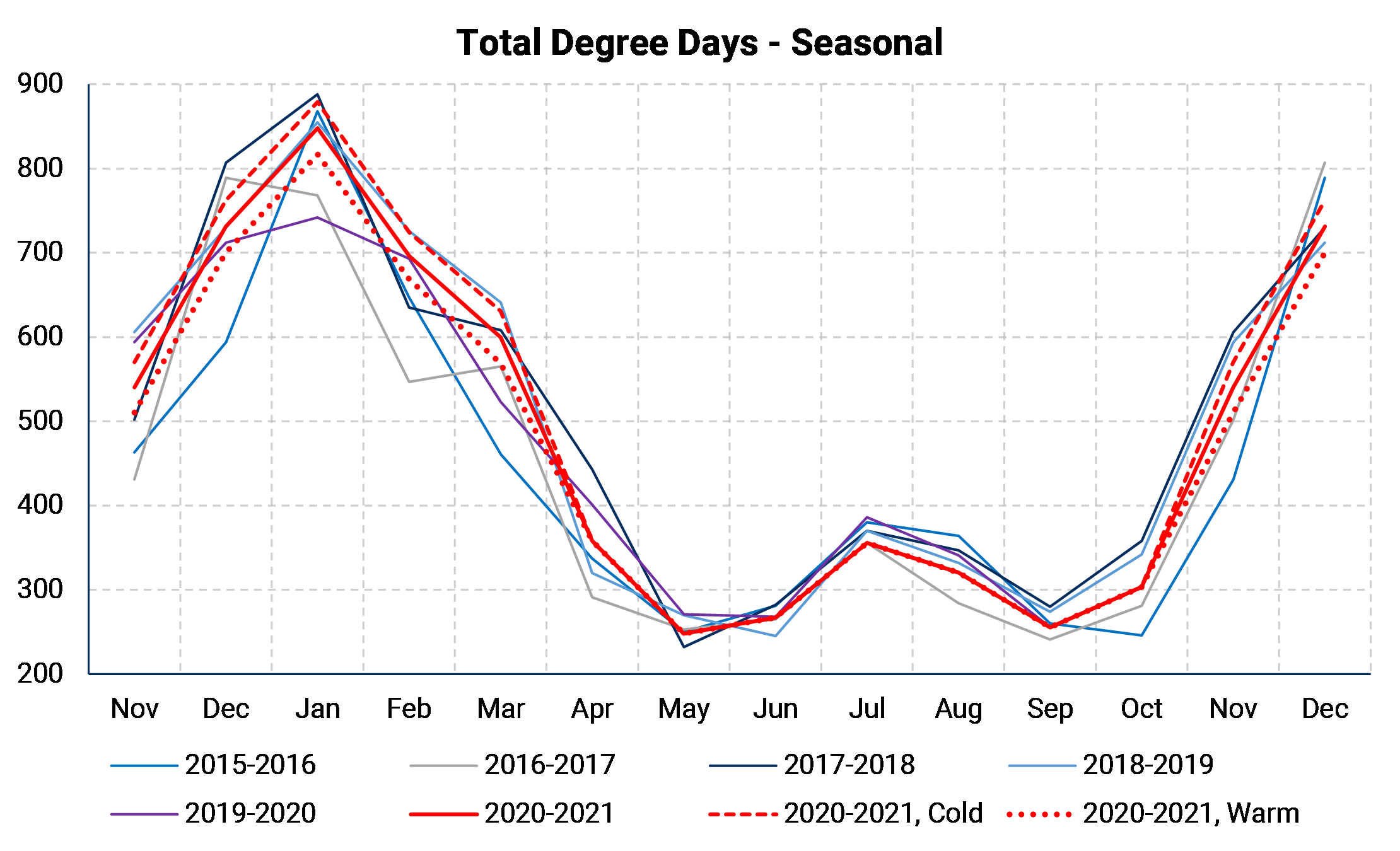

The last variable manipulated was weather, where we decided to use very conservative numbers given the climate drift observed over the last few years. Over the last five years, we have observed the 4th, 5th, 7th, 17th, and 63rd warmest winters on record (since 1885), which skewed our average base case. Over the last five years, the coldest winter was only "normal" using the 125-year standard. Our assumptions and use of only the past five years as "climate normal" cause our weather base case to be relatively warm, even in our "cold" case.

The base case (five-year average) was varied by 1° Fahrenheit to the upside and downside. This factor had the most considerable impact on the model's results, given that several demand variables are correlated with the weather, particularly during the winter season.

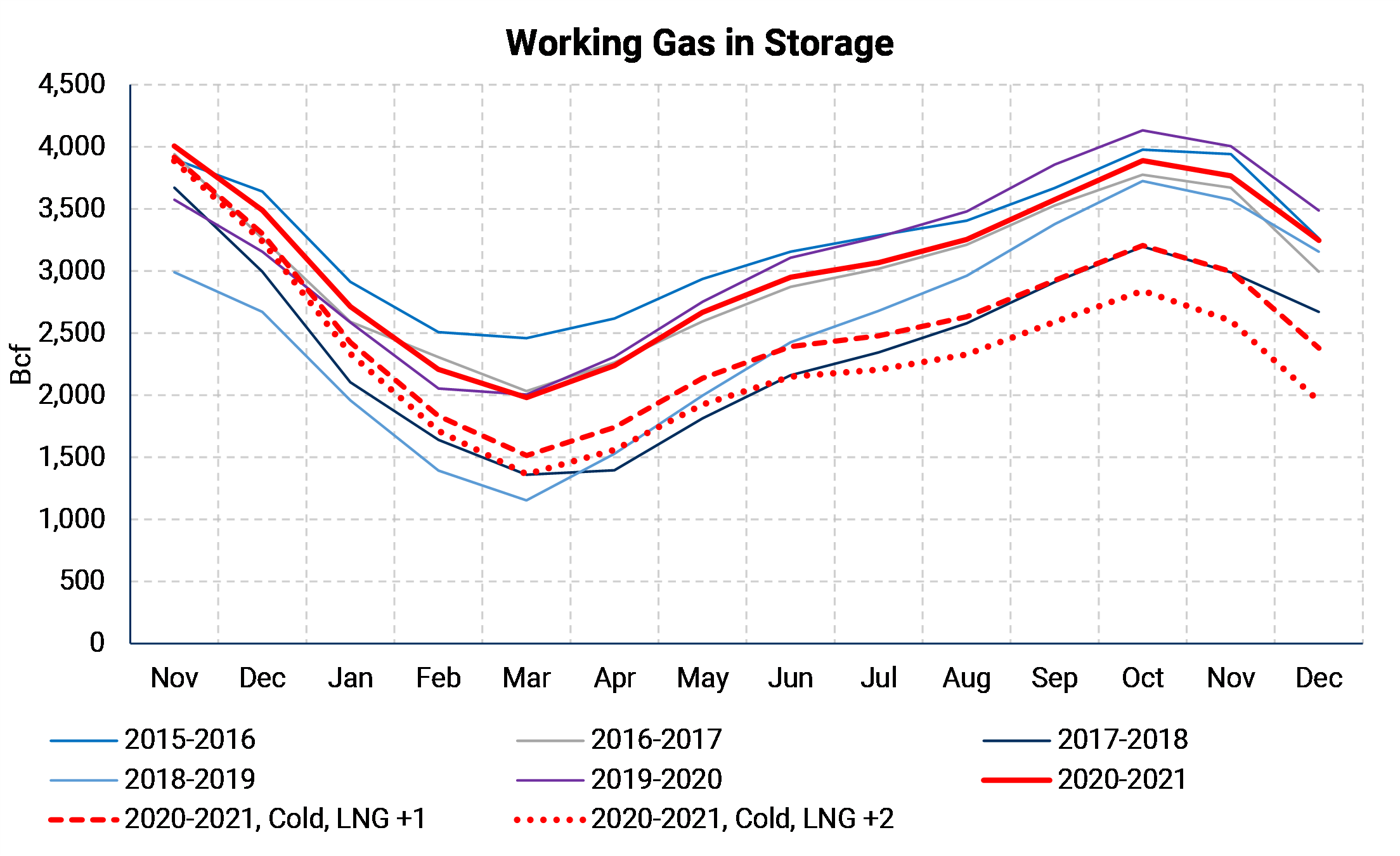

The chart shows how much an increase in LNG exports can flip the script for gas this winter. Assuming 9 Bcf/d of LNG feedgas rather than the 8 Bcf/d of our base case, we would end the winter season at 1,500 Bcf. That would give us one of the more bullish set-ups for summer in recent memory and signifies a very tight market for both this year and next. The red, dashed line describes this case.

If LNG exports were to run at near full capacity (10 Bcf/d), we could see an even tighter market, as shown by the red, dotted line. This LNG outcome is not far-fetched; daily LNG throughputs were near 9.5 Bcf/d in the last week.

This model is liable to change as more information becomes available. If one of our more bullish cases were to occur, it would likely come with a price increase, which would incentivize more production to be brought online, less power-generation consumption, a drop in LNG exports in 2021, etc.... If you have any questions about our assumptions, please feel free to reach out to view@aegis-hedging.com.