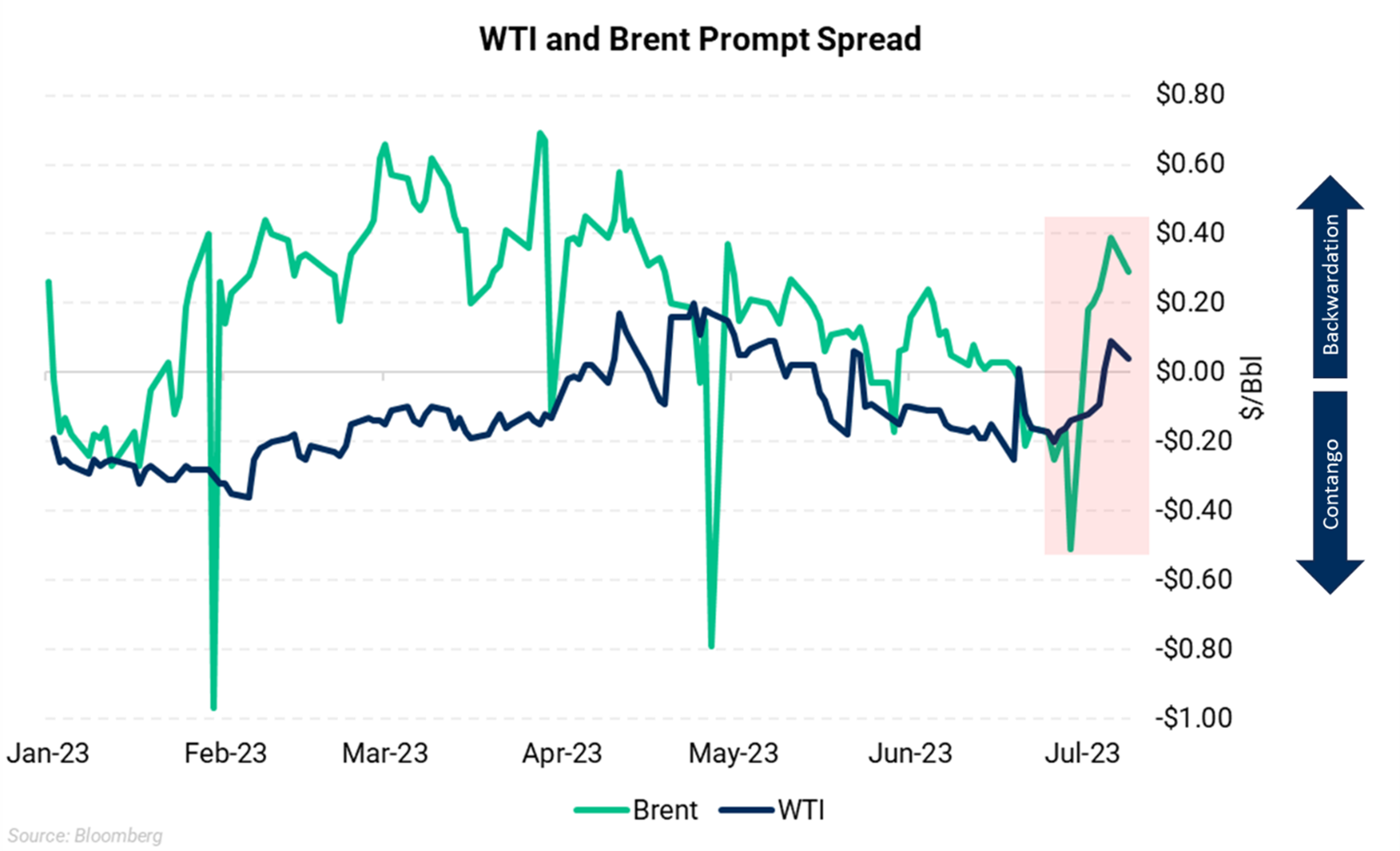

The WTI crude market has shifted into backwardation for the first time since May, signaling tighter supply. Prompt WTI is trading higher than in later months, with the prompt spread (M1-M2) at +21c/Bbl on Wednesday - the strongest backwardation for the prompt spread since November.

A backwardated (downward-sloping) curve reflects the high demand for immediate oil supply than what is expected in the future. It encourages traders to sell oil out of storage to take advantage of higher prompt prices. Refiners are also incentivized to draw down inventories when the curve is in backwardation.

Recent production cuts announced by Saudi Arabia (1 MMBbl/d) and Russia (0.5 MMBbl/d) aim to limit crude supplies through August. The cartel also extended its previous cuts until the end of 2024. This helps support the backwardated curve structure by reducing available supply. Bullish time spreads in both WTI and Brent reflect expectations of tightness as buyers snap up available barrels.

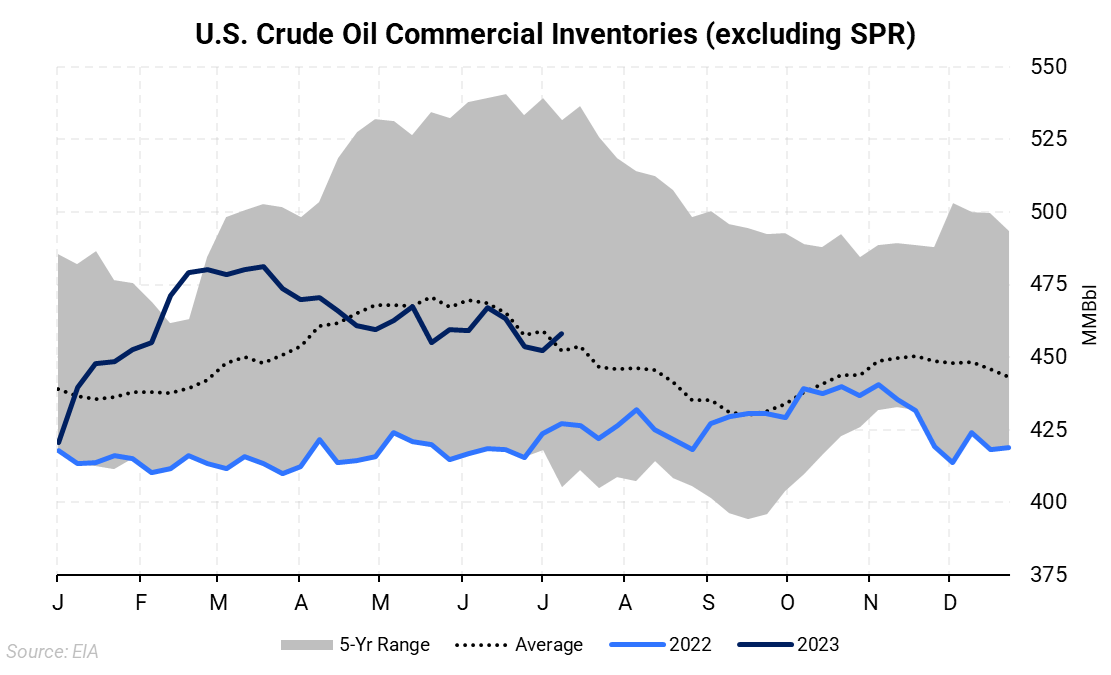

The OPEC+ cuts have removed some downside risks and provided price support. They could counter slower expected economic growth and oil consumption in China and Western nations. The cuts aim to tighten the market by reversing the inventory buildup seen this year, as OECD stocks rose 66 MMBbl through May.

Some analysts see the backwardation as a catalyst for global inventories to decline in the second half, with U.S. stocks already at the lowest since February.

The EIA reported a 5.9 MMBbl build in U.S. crude inventories for the week ending July 7. However, stocks had fallen for the three weeks prior to it. Total inventories are 458.1 MMBbl, only about 1% above the 5-year average.

Seasonally, inventories should be continuing drawdowns, and if inventories aren't falling as implied, it may signal weaker-than-expected demand. However, the recent inventory drawdowns indicate physically tightening crude supplies in the U.S. market.

AEGIS analysis of OPEC data shows a projected 2.6 MMBbl/d supply/demand imbalance in 2H2023, with Chinese demand recovery accounting for nearly 70% (IEA). And, as OPEC+ production cuts manifest in the physical market and China's demand rebounds, further tightening is expected in 2H2023. This could lead to outsized inventory drawdowns to balance the ensuing supply deficit. The combination of declining stocks and prompt backwardation implies that crude fundamentals may be turning more bullish.